Saudi Arabia Water Treatment Chemicals Market Expected to Reach USD 538 Million by 2033 - IMARC Group

Saudi Arabia Water Treatment Chemicals Market Statistics, Outlook and Regional Analysis 2025-2033

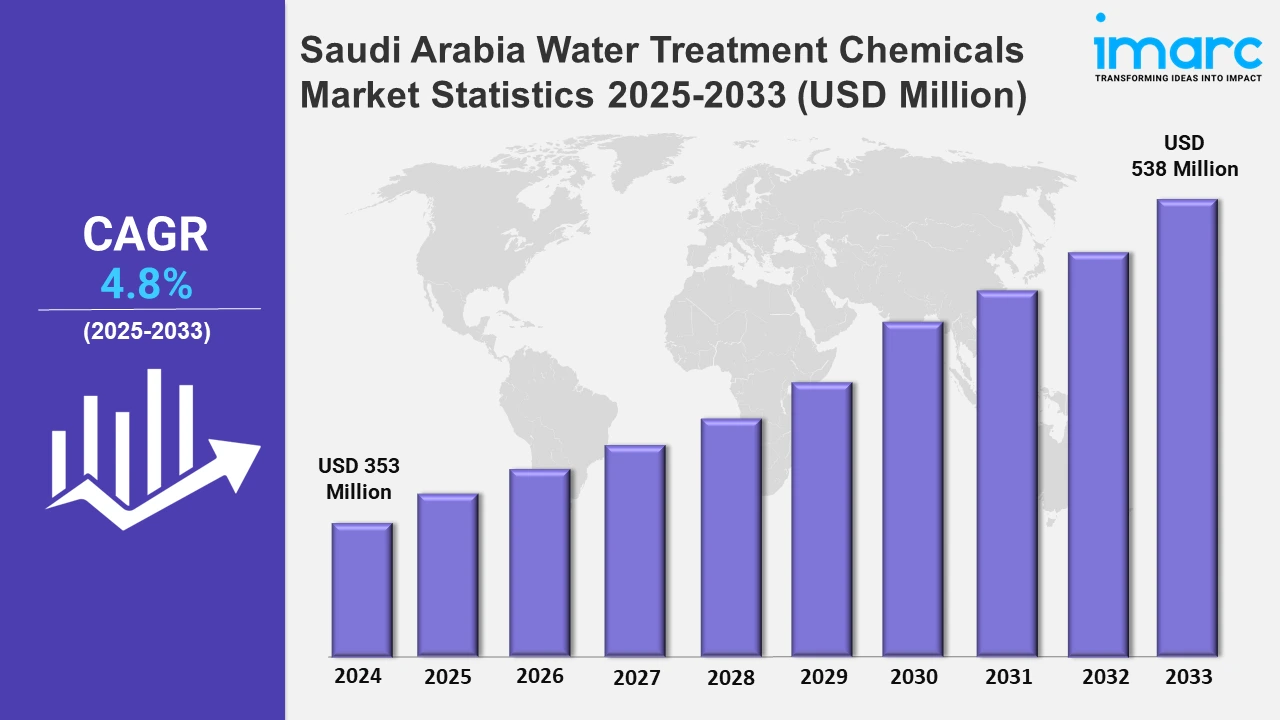

The Saudi Arabia water treatment chemicals market size was valued at USD 353 Million in 2024, and it is expected to reach USD 538 Million by 2033, exhibiting a growth rate (CAGR) of 4.8% from 2025 to 2033.

To get more information of this market, Request Sample

The Saudi Arabia water treatment chemicals market is witnessing robust growth driven by rapid urbanization, industrial expansion, and rising water scarcity concerns. For instance, according to the UN Habitat, urbanization in Saudi Arabia is projected to rise to 97.6% by 2030, with Riyadh, the capital, expected to reach a population of 8.2 million. Furthermore, increasing reliance on desalination, a critical water source for the nation, significantly boosts demand for chemicals like antiscalants and corrosion inhibitors. Additionally, the country's growing focus on wastewater treatment, propelled by stringent environmental regulations and sustainability goals, fuels the adoption of coagulants, flocculants, and disinfectants. Key industrial sectors such as oil and gas, petrochemicals, and power generation are pivotal in driving this market as they require effective water management solutions to optimize processes and meet compliance standards. The development of advanced infrastructure and large-scale public-private partnerships further strengthens market opportunities.

Emerging trends in the market include an inclination toward biodegradable and environmentally friendly water treatment chemicals, catering to the Saudi Arabia's Vision 2030 sustainability targets. The rapid deployment of cutting-edge technologies such as smart chemical dosing systems and automated water quality monitoring is significantly improving cost-efficiency as well as operational efficacy for wide range of end users. Moreover, heavy investments in research and development projects to develop customized and upgraded solutions are also substantially impacting the market dynamics, facilitating the industry to cater to the extensive water treatment challenges. In addition to this, the rapid proliferation of the industrial base in regions such as the Eastern Province and the increasing deployment of mega-projects are anticipated to further amplify the requirement for water treatment chemicals in the coming years. For instance, in November 2024, the Eastern Province Municipality announced the establishment of a 2.4 million sqm integrated industrial city in Dammam, alongside infrastructure development. With over 20,000 investment assets spanning 116 million sqm, the municipality aims to offer 5,000 investment opportunities by 2026, targeting over 90% utilization of its assets.

Saudi Arabia Water Treatment Chemicals Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Northern and Central Region Water Treatment Chemicals Market Trends:

The Northern and Central regions of Saudi Arabia significantly aid the expansion of the water treatment chemicals market primarily due to the steady increase in agricultural activities and robust presence of large-scale infrastructure ventures. Such areas focus on wastewater treatment and desalination to mitigate the water scarcity issue, fueling the need for disinfectants, coagulants, and corrosion inhibitors. In addition to this, municipal ventures and industrial hubs in cities such as Riyadh foster market expansion, aligning with the nation’s aim for sustainable water management.

Western Region Water Treatment Chemicals Market Trends:

The Western Region, home to key urban centers such as Mecca and Jeddah, plays a critical role in the water treatment chemicals industry. Some of the key sectors like hospitality and tourism, especially during the Hajj season, necessitate effective water treatment methods. In addition, the region’s dependency on wastewater recycling and seawater desalination plants boosts the requirement for biocides, scale inhibitors, and pH adjusters, guaranteeing safe and clean water supplies.

Eastern Region Water Treatment Chemicals Market Trends:

The Eastern Region, represented by its well-established oil and gas sector, significantly contributes to the demand for water treatment chemicals. Industrial operations, especially in petrochemical facilities, demand comprehensive water treatment for wastewater management, cooling, and refining. Moreover, the region’s magnifying emphasis on environmental sustainability and operational efficacy facilitates substantial utilization of demulsifiers, corrosion inhibitors, and antiscalants, fortifying its contribution to the overall market growth.

Southern Region Water Treatment Chemicals Market Trends:

The Southern Region's growing industrial activities and agricultural expansion drive the demand for water treatment chemicals. The region heavily relies on chemical solutions to enhance water quality for irrigation and ensure compliance with environmental standards. Additionally, the development of smaller-scale desalination projects and wastewater treatment facilities further stimulates the need for coagulants and flocculants, supporting sustainable water management in the area.

Top Companies Leading in the Saudi Arabia Water Treatment Chemicals Industry

The competitive landscape of Saudi Arabia's water treatment chemicals market is characterized by the presence of major global and regional players striving to address growing industrial and municipal water demands. Companies focus on innovation, offering advanced solutions for desalination, wastewater treatment, and industrial water reuse. Key players leverage strategic partnerships, expanding production capacities and introducing eco-friendly chemicals to comply with sustainability goals. The market is bolstered by government initiatives like Vision 2030, driving investments in water infrastructure and advanced treatment technologies. For instance, in February 2024, Nama Chemicals announced the commencement of a $19 million wastewater treatment project, following successful financing arrangements. Contracts valued at SAR 71.24 million have been awarded to Green Dimension Co. and Confident Engineering International. Implemented under a lease-to-own model, the project will manage wastewater from calcium chloride and epoxy resin production at Nama’s Jubail facility. Completion is anticipated by August 2025, with a two-month trial production phase to follow.

Saudi Arabia Water Treatment Chemicals Market Segmentation Coverage

- On the basis of the type, the market has been categorized into coagulants and flocculants, corrosion and scale inhibitors, biocides and disinfectants, pH adjusters and softeners, defoaming agents, and others. Coagulants and flocculants are essential for sedimentation processes, while corrosion and scale inhibitors protect pipelines and equipment. Biocides and disinfectants ensure microbial control, pH adjusters and softeners maintain optimal water quality, and defoaming agents effectively reduce foam formation, enhancing efficiency across applications in the Saudi Arabia water treatment chemicals market.

- Based on the end user, the market is classified into municipal, power, oil and gas, mining, chemical, food and beverage, pulp and paper, and others. Municipal applications focus on potable water and wastewater management, while the power sector emphasizes boiler water and cooling tower treatment. The oil and gas industry relies on chemicals for enhanced oil recovery and effluent control. Moreover, mining requires water clarification for various processes, and the chemical sector demands process water treatment. Furthermore, food and beverage prioritize hygiene, and pulp and paper enhance operational efficiency.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 353 Million |

| Market Forecast in 2033 | USD 538 Million |

| Market Growth Rate 2025-2033 | 4.8% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Coagulants and Flocculants, Corrosion and Scale Inhibitors, Biocides and Disinfectants, Ph Adjusters and Softeners, Defoaming Agents, Others |

| End Users Covered | Municipal, Power, Oil and Gas, Mining, Chemical, Food and Beverage, Pulp and Paper, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Water Treatment Chemicals Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)