Saudi Arabia Telecom Market Expected to Reach USD 22.7 Billion by 2033 - IMARC Group

Saudi Arabia Telecom Market Statistics, Outlook and Regional Analysis 2025-2033

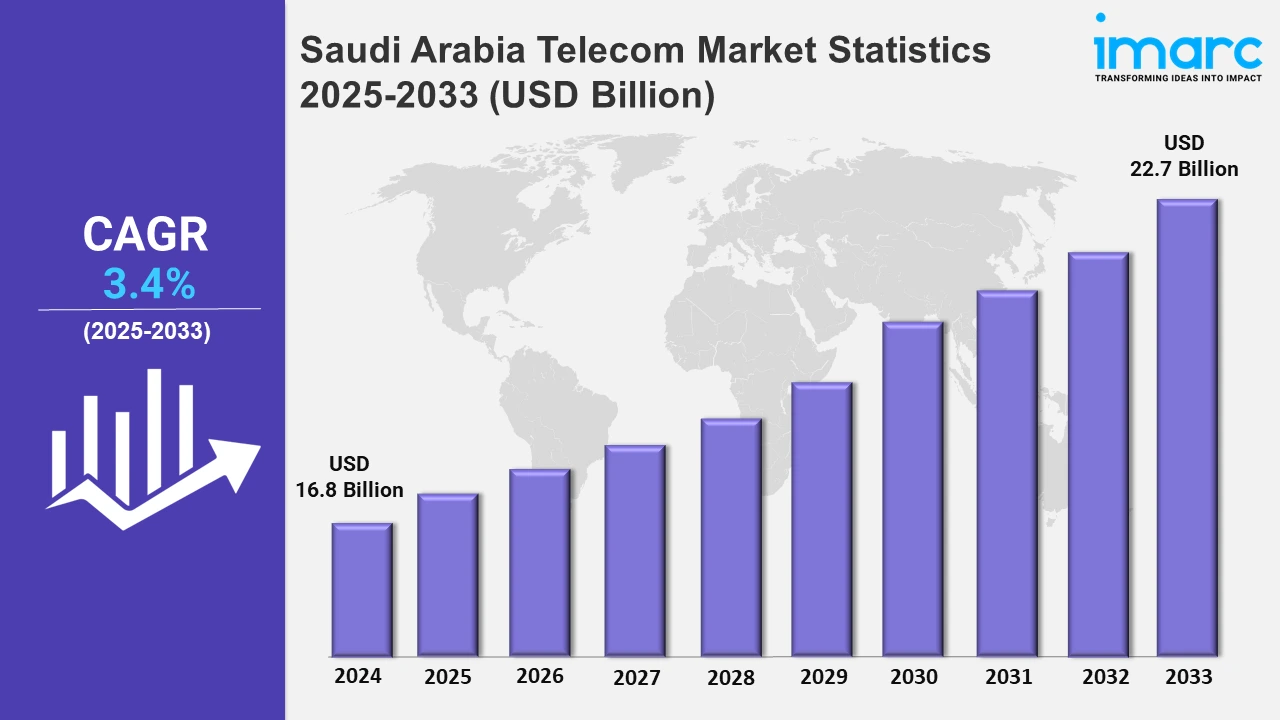

The Saudi Arabia telecom market size was valued at USD 16.8 Billion in 2024, and it is expected to reach USD 22.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.4% from 2025 to 2033.

To get more information on this market, Request Sample

Saudi Arabia's telecom market is being propelled by several key drivers, foremost among them being the rapid deployment of 5G technology. For instance, in November 2024, ACES and Radisys signed a Memorandum of Understanding (MoU) to co-develop 5G ORAN and small cell technologies supporting Saudi Vision 2030. This collaboration intends to establish a joint lab for ORAN testing and software development enhancing 5G infrastructure for local and international markets. The partnership emphasizes innovation in open telecom solutions boosting connectivity and efficiency in the telecommunications sector. The government’s Vision 2030 initiative emphasizes digital transformation fostering an environment ripe for technological advancements and increased connectivity. In line with this, rising mobile penetration and a young, tech-savvy population are fueling the demand for advanced mobile services and digital solutions. The expansion of Internet of Things (IoT) applications in sectors like healthcare and transportation, along with in smart cities is also significantly driving market growth.

Saudi Arabia’s telecom sector reflects a shift toward greater digital integration and enhanced consumer experiences. There is a notable increase in the adoption of cloud services and artificial intelligence (AI) to improve customer service and operational efficiency. For instance, in September 2024, Exotel, a leader in AI-driven customer engagement, launched Saudi Arabia's first local cloud for customer experience (CX) and AI solutions, aligning with the Kingdom's Vision 2030. The new platform Ameyo aims to empower enterprises and enhance operational efficiency. Competition among major telecom operators is intensifying leading to more competitive pricing and innovative service offerings. Regulatory frameworks are evolving to support cybersecurity and data privacy ensuring a secure digital ecosystem. Additionally, partnerships between telecom companies and global tech firms are expanding enabling the introduction of cutting-edge technologies and fostering a collaborative environment for future advancements. These trends collectively position Saudi Arabia as a dynamic and rapidly evolving telecom market in the Middle East.

Saudi Arabia Telecom Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Northern and Central Region Saudi Arabia Telecom Market Trends:

In Northern and Central Saudi Arabia key telecom trends include the rapid expansion of 5G networks enhancing connectivity and supporting smart city initiatives like Riyadh’s Vision 2030 projects. There is increased investment in infrastructure to improve coverage and reliability alongside the adoption of AI-driven customer services and the growth of digital and IoT applications to meet rising consumer demands.

Western Region Saudi Arabia Telecom Market Trends:

In Saudi Arabia’s Western Region, key telecom trends include accelerated 5G rollout enhancing connectivity in major cities like Jeddah and Mecca. There's a strong focus on smart city initiatives and IoT integration to support infrastructure and tourism especially during Hajj. Additionally, increased adoption of AI-driven customer services and digital transformation efforts are driving market growth and improving user experiences.

Eastern Region Saudi Arabia Telecom Market Trends:

In Saudi Arabia’s Eastern Region, key telecom trends include rapid 5G rollout and infrastructure enhancements supporting major oil and gas sectors. Smart city initiatives in cities like Dammam and Jubail drive demand for high-speed connectivity and IoT solutions. Additionally, increased digital transformation and enhanced cybersecurity measures are shaping the telecom landscape.

Southern Region Saudi Arabia Telecom Market Trends:

In Saudi Arabia’s Southern Region key telecom trends include the expansion of 5G networks to enhance connectivity in remote areas, significant investments in fiber optic infrastructure for faster internet speeds and the growth of digital services tailored to local industries such as oil and agriculture. Additionally, there is widespread adoption of IoT solutions and a strong emphasis on cybersecurity to safeguard data and ensure reliable communication.

Top Companies Leading in the Saudi Arabia Telecom Industry

Key market players in Saudi Arabia’s telecom sector are focusing on expanding 5G networks to enhance connectivity and support the nation’s digital transformation. They are heavily investing in advanced fiber optic infrastructure to deliver faster and more reliable internet services. For instance, in March 2024, Zain Saudi Arabia and Nokia signed a Memorandum of Understanding to enhance 5G network development in Saudi Arabia. This partnership focuses on integrating 4.5G Pro and 4.9G technologies to improve IoT connectivity and advance smart city projects. Additionally, these companies are developing innovative digital solutions, including IoT applications, cloud services, and AI-driven customer experiences. Strategic partnerships with global technology firms and a strong emphasis on cybersecurity are also prioritized to stay competitive and meet the evolving demands of the Saudi market.

Saudi Arabia Telecom Market Segmentation Coverage

- On the basis of the type, the market has been categorized into mobile, fixed-line, and broadband. The mobile segment in Saudi Arabia is advancing with widespread 5G deployment and increasing smartphone adoption to meet the consumer demand for high-speed connectivity. The fixed-line sector is enhancing fiber optic infrastructure to provide more reliable and faster internet services for both residential and commercial users. Broadband services are expanding to support the rising demand for high-speed internet driven by digital transformation and increased online activities across the kingdom.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 16.8 Billion |

| Market Forecast in 2033 | USD 22.7 Billion |

| Market Growth Rate 2025-2033 | 3.4% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mobile, Fixed-Line, Broadband |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Saudi Arabia Telecom Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)