Saudi Arabia Polypropylene Market Expected to Reach USD 1,684 Million by 2033 - IMARC Group

Saudi Arabia Polypropylene Market Statistics, Outlook, and Regional Analysis 2025-2033

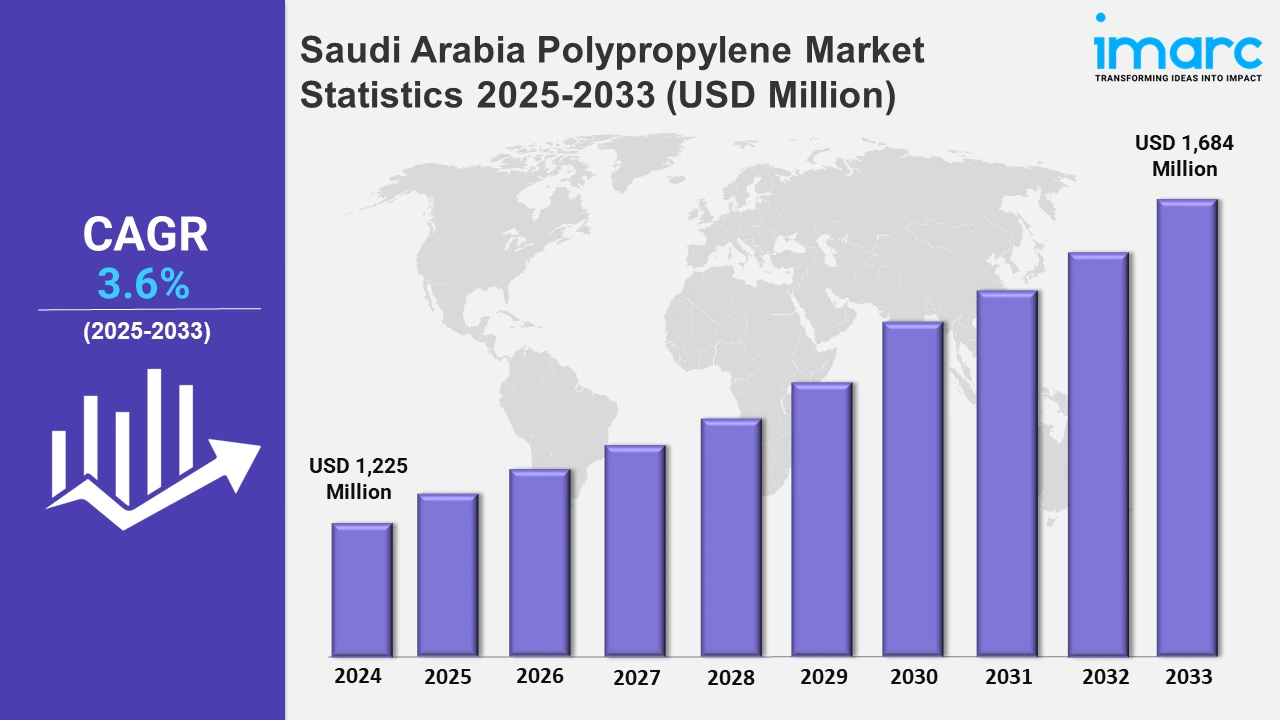

The Saudi Arabia polypropylene market size was valued at USD 1,225 Million in 2024, and it is expected to reach USD 1,684 Million by 2033, exhibiting a growth rate (CAGR) of 3.6% from 2025 to 2033.

To get more information of this market, Request Sample

The Saudi Arabia polypropylene market is experiencing steady growth, driven by its extensive applications across key industries and supported by the nation’s robust petrochemical infrastructure. For instance, as per industry reports, investments in Saudi Arabia's petrochemical industry are estimated to reach USD 600 billion by 2030. Additionally, in 2024, the production capacity of this industry has exceeded 118 million tons. Packaging remains one of the major end-user segments, fueled by increasing demand for lightweight, durable, and cost-effective materials in food, consumer goods, and industrial packaging. The construction industry also contributes significantly, leveraging polypropylene for applications such as piping, insulation, and geotextiles, driven by the government’s focus on infrastructural development under Vision 2030. Moreover, in the automotive sector, polypropylene’s lightweight properties align with industry trends toward fuel efficiency and sustainability, enhancing its adoption in vehicle components. Furthermore, the growing healthcare sector utilizes polypropylene for medical devices and packaging, owing to its chemical resistance and hygienic properties.

Emerging trends in sustainability and technological advancements are further shaping the polypropylene market in Saudi Arabia. The increasing emphasis on recyclable and eco-friendly materials has spurred innovations in polypropylene production, including bio-based and recycled variants. For instance, in November 2024, B!Pod announced a strategic partnership with SABIC, a Saudi Arabia-based chemical company, to utilize SABIC's ocean-bound plastic (OBP)-based polypropylene for container production. This transition from standard virgin polypropylene to OBP material represents a pivotal step toward enhancing sustainability and advancing the plastics industry's shift toward a circular economy. Furthermore, the integration of advanced polymer technologies is enhancing product performance, opening new avenues in high-value applications such as electrical and electronics. Regional demand disparities are narrowing, with industrial development spreading to less established areas, boosting polypropylene consumption. Furthermore, the proximity to raw materials, competitive production costs, and strategic location for exports position Saudi Arabia as a prominent player in the global polypropylene market.

Saudi Arabia Polypropylene Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Northern and Central Region Polypropylene Market Trends:

The Northern and Central regions of Saudi Arabia play a significant role in the polypropylene market, driven by robust demand from the packaging and automotive industries. These areas benefit from industrial growth and proximity to key infrastructure, enabling efficient distribution and consumption of polypropylene across diverse applications.

Western Region Polypropylene Market Trends:

The Western region, anchored by major cities like Jeddah and Mecca, contributes significantly to the Saudi polypropylene market. The growing construction activities, tourism-driven demand for packaging, and a strong manufacturing base in this region have led to increased consumption of polypropylene in various industries.

Eastern Region Polypropylene Market Trends:

The Eastern region, known for its petrochemical hubs, is pivotal to the Saudi polypropylene market. Home to extensive production facilities and export-oriented activities, this region drives polypropylene supply. In addition, the demand for polypropylene in the oil, gas, and industrial sectors enhances its strategic importance.

Southern Region Polypropylene Market Trends:

The Southern region's polypropylene market is growing steadily, fueled by construction and agricultural developments. Increased infrastructural projects and rising packaging needs in this area, combined with its proximity to neighboring countries, support the region's demand for polypropylene across end-user industries.

Top Companies Leading in the Saudi Arabia Polypropylene Industry

The competitive landscape of Saudi Arabia's polypropylene market is shaped by the presence of key domestic and international players leveraging the region's abundant petroleum resources and advanced production capabilities. Leading companies focus on cost-efficient manufacturing, innovative product development, and expanding downstream applications across automotive, packaging, and construction sectors. Government initiatives promoting industrial diversification and exports further enhance competition. Partnerships, technological advancements, and sustainability-focused solutions are central strategies, as companies aim to meet growing local and global demand effectively. For instance, in August 2024, Saudi Arabia’s Sahara International Petrochemical Company (Sipchem) has awarded $169 million in engineering, procurement, and construction (EPC) contracts to South Korea’s SGC eTEC Company and its subsidiary SGC Arabia for expanding propylene and polypropylene plants in Jubail. The project will increase production capacity by 72,000 tonnes for propylene and 150,000 tonnes for polypropylene, bringing the total capacities to 537,000 tonnes and 600,000 tonnes, respectively.

Saudi Arabia Polypropylene Market Segmentation Coverage

- On the basis of the type, the market has been categorized into homopolymer and copolymer. Each of these cater to distinct industrial applications. Homopolymers are witnessing robust growth primarily because of their excellent adaptability and strength, extensively utilized in automotive components, packaging, and textiles. Whereas, copolymers, providing exceptional impact endurance and improved flexibility, are rapidly being leveraged in specialized applications including consumer goods and various medical equipment.

- Based on the process, the market is classified into injection molding, blow molding, extrusion, and others. Injection molding pioneers in manufacturing high-precision, sophisticated components for consumer goods as well as automotive. Moreover, blow molding aids the production of durable, lightweight packaging, while extrusion propels need in piping and construction sector, employing polypropylene's cost-efficiency and versatility to address diverse industry demands.

- On the basis of the application, the market has been divided into film and sheet, fiber, raffia, and others. These segments are mainly driven by increasing need from textile, packaging, and construction sectors. Polypropylene’s exceptional attributes, including cost-efficiency, durability, and lightweight make it a preferable choice for manufacturing industrial fibers, films, and sheets, and raffia for geotextiles, ropes, and bags, catering to the nation’s escalating commercial and industrial demands.

- Based on the end user, the market is segregated into packaging, automotive, building and construction, medical, electrical and electronics, and others. In packaging, polypropylene’s cost-efficiency and robustness make it an ideal material for resilient and flexible solutions. The automotive industry utilizes it typically for its lightweight attributes to improve fuel efficiency, while construction and building segment profit from its strength in insulation and piping applications. In addition, medical and electrical sectors leverage polypropylene for its insulating abilities and chemical resistance.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1,225 Million |

| Market Forecast in 2033 | USD 1,684 Million |

| Market Growth Rate 2025-2033 | 3.6% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Homopolymer, Copolymer |

| Processes Covered | Injection Molding, Blow Molding, Extrusion, Others |

| Applications Covered | Film and Sheet, Fiber, Raffia, Others |

| End Users Covered | Packaging, Automotive, Building and Construction, Medical, Electrical and Electronics, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Polypropylene Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)