Saudi Arabia Plastics Market Expected to Reach USD 7.8 Billion by 2033 - IMARC Group

Saudi Arabia Plastics Market Statistics, Outlook and Regional Analysis 2025-2033

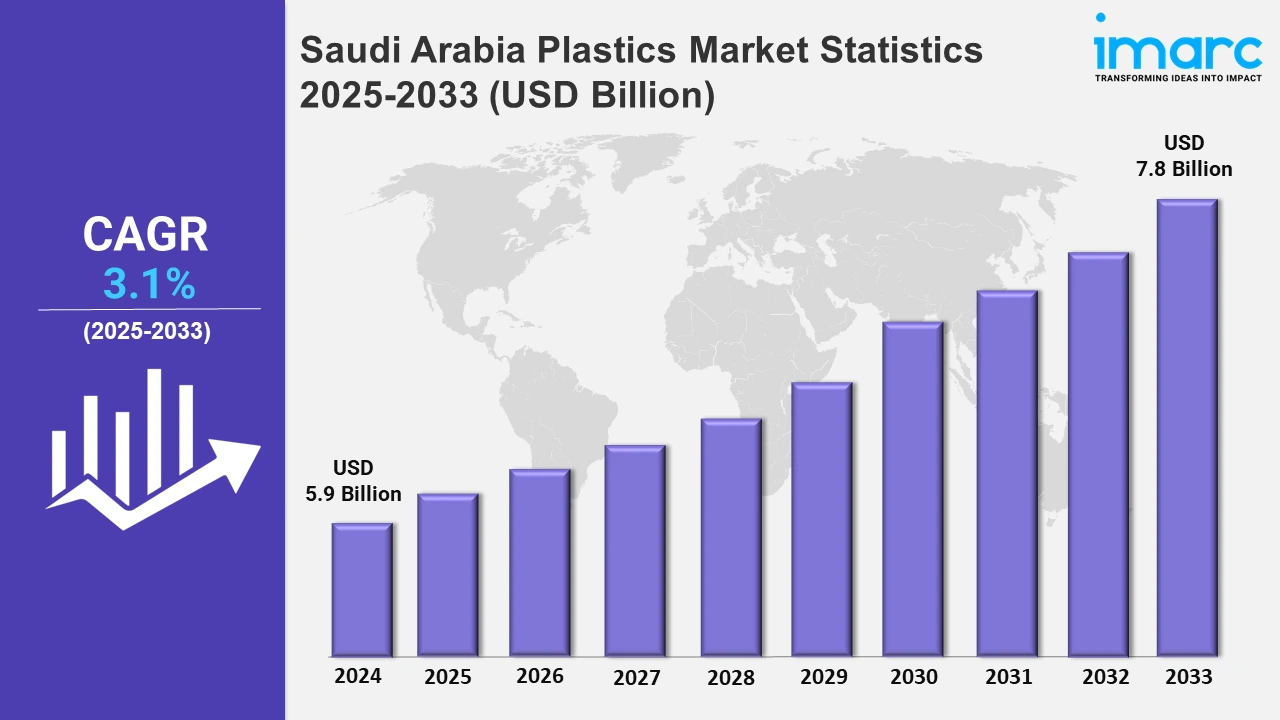

The Saudi Arabia plastics market size was valued at USD 5.9 Billion in 2024, and it is expected to reach USD 7.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.1% from 2025 to 2033.

To get more information on this market, Request Sample

Saudi Arabia's plastics business is being reshaped by an emphasis on sustainable waste management. Collaborative initiatives include improving recycling and traceability while also supporting environmentally friendly practices in critical industries such as cement. This move advances environmental objectives and strengthens the market's sustainable development ambitions. For example, in July 2024, MVW Lechtenberg Projektentwicklungs- and Beteiligungsgesellschaft GmbH, the leading consulting firm specializing in alternative fuels for the cement and related industries, in collaboration with Empower, a leading provider of innovative traceability solutions, announced the launch of a transformative plastic waste management project in the Kingdom of Saudi Arabia.

Moreover, Saudi Arabia is strengthening its position in the global recycling business by expanding exports of recycled PET flakes. This step demonstrates the country's dedication to sustainable practices while also growing its presence in the international market for eco-friendly and recycled products. For instance, in August 2024, Saudi Investment Recycling Co., a subsidiary of the Kingdom’s Public Investment Fund, expanded its export of recycled polyethylene terephthalate (PET) flakes to the U.K., following earlier successful shipments to Spain. The first shipment of heat-washed and recycled flakes has reached a major U.K. PET bottle manufacturer. The Saudi Arabia plastics industry is expanding due to rising demand in the building and packaging industries. With initiatives such as NEOM and the Red Sea Project under Vision 2030, the demand for long-lasting, lightweight, and cost-effective plastics is increasing. Plastic pipes, insulation, and fittings are used in infrastructure projects to increase durability and cost-effectiveness. Furthermore, packaging requirements for food, drinks, and consumer products are driving demand due to its practical and protective properties. For instance, the increase in food packaging in Jeddah and Riyadh, which is driven by expanding urbanization and a thriving retail sector, exemplifies this trend. Companies such as SABIC continue to develop sustainable plastic solutions to meet environmental aims. The emphasis on following industry standards and responding to customer demands for eco-friendly products is projected to drive growth in this rapidly changing market.

Saudi Arabia Plastics Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Northern and Central Region Plastics Trends:

In the Northern and Central Region, growth in the construction sector is fueling plastic demand for pipes and insulating materials, aided by megaprojects such as NEOM. The rising usage of plastics in urban infrastructure is driving market growth, which aligns with Vision 2030's development objectives.

Western Region Plastics Trends:

The tourist boom, as demonstrated by initiatives, such as the Red Sea Project, is increasing demand for plastics in packaging and consumer items in the Western Region. Hotels and retail establishments use long-lasting and low-cost plastics for a variety of purposes, expanding their market presence.

Eastern Region Plastics Trends:

Industrial growth in oil and gas centers, including Jubail, is driving up the usage of advanced polymers for chemical storage and transportation solutions. These sectors demand extremely strong and corrosion-resistant polymers for safe and efficient operations, which supports the Eastern Region’s market growth.

Southern Region Plastics Trends:

Agriculture is a major business, which drives the demand for plastics in greenhouses and irrigation systems. For example, farmers in Jizan are increasingly adopting polyethylene films to protect crops, improving water efficiency and production. This initiative encourages sustainable farming techniques, making agriculture a major source of plastic use in the Southern Region.

Top Companies Leading in the Saudi Arabia Plastics Industry

Some of the leading Saudi Arabia plastics market companies have been mentioned in the report.

Saudi Arabia Plastics Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into polyethylene, polypropylene, polyvinyl chloride, and others. Polyethylene is popular because of its versatility in packaging and construction, but polypropylene is recognized for its durability in automotive and textile applications. Polyvinyl chloride is widely used in pipe and cable insulation, which drives market expansion.

- Based on the application, the market is categorized into injection molding, blow molding, roto molding, compression molding, casting, thermoforming, extrusion, calendering, and others. Injection molding is a technique for producing intricate plastic parts efficiently. Blow molding creates hollow containers, such as bottles. Roto molding creates massive and hollow items via spinning molds. Compression molding is a process that uses heat and pressure to form plastic. Casting involves pouring liquid plastic into molds. Thermoforming transforms sheets into the required shapes. Extrusion involves pushing molten plastic through dies to create profiles, whereas calendering produces thin and flat sheets.

- On the basis of the end user, the market has been divided into packaging, automotive, infrastructure and construction, consumer goods, and others. Packaging plays a crucial role due to its critical function in food and commodities storage, whereas the automotive industry uses plastics for lightweight and long-lasting components. Infrastructure and construction benefit from strong plastic pipes and panels, while consumer goods rely on plastics for adaptable and everyday products.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 5.9 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Market Growth Rate (2025-2033) | 3.1% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Polyethylene, Polypropylene, Polyvinyl Chloride, Others |

| Applications Covered | Injection Molding, Blow Molding, Roto Molding, Compression Molding, Casting, Thermoforming, Extrusion, Calendering, Others |

| End Users Covered | Packaging, Automotive, Infrastructure and Construction, Consumer Goods, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)