Saudi Arabia Online Grocery Market Expected to Reach USD 5,925.7 Million by 2033 - IMARC Group

Saudi Arabia Online Grocery Market Statistics, Outlook and Regional Analysis 2025-2033

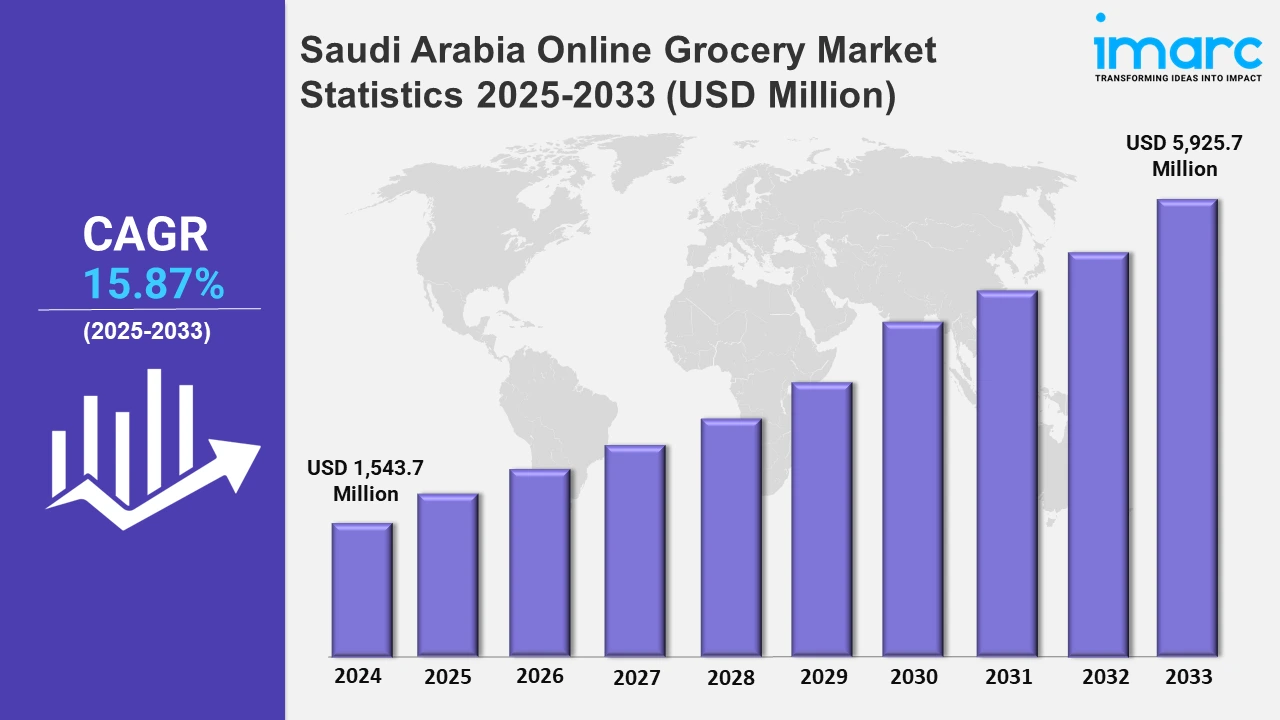

The Saudi Arabia online grocery market size was valued at USD 1,543.7 Million in 2024, and it is expected to reach USD 5,925.7 Million by 2033, exhibiting a growth rate (CAGR) of 15.87% from 2025 to 2033.

To get more information on the this market, Request Sample

International food delivery platforms continue to expand into Saudi Arabia in search of development prospects in growing markets. Companies are focusing on the Kingdom's growing demand for online food services, which is being driven by increasing mobile penetration, urbanization, and altering customer demands for convenience and speed. For example, in September 2024, Chinese food delivery giant Meituan launched its Keeta app in Saudi Arabia, starting in Al-Kharj, with plans to expand to Riyadh. The move marks Meituan's international push as it seeks growth amid increased competition and a slowing economy in China.

Moreover, Saudi Arabia's e-commerce sector is rapidly expanding, spurred by government measures to promote innovation, attract investment, and encourage small enterprises. With increased digital penetration, internet retail is emerging as a crucial engine of economic growth, improving customer convenience, and altering conventional buying habits. For instance, in September 2024, as per a government report, e-commerce in Saudi Arabia’s retail sector is likely to double between 2020 and 2025, with annual compound growth of 15% a year. The growth in e-commerce is aligned with the Saudi government's efforts to attract venture capital and promote small businesses. With encouragement from the Saudi E-Commerce Council, the e-commerce sector is expected to exceed USD 13.2 Billion by 2025. Furthermore, the Saudi Arabia online grocery market is quickly expanding across many locations, with merchants attempting to match the rising demand for convenience and variety. Consumers in the Northern and Central Regions are increasingly purchasing food through web-based platforms, owing to urbanization and greater internet access. For example, Riyadh-based online grocery retailers such as "Carrefour KSA" provide same-day delivery on a wide range of items, from fresh fruit to pantry staples. App-based platforms are becoming increasingly popular in the Western Region, with services such as "Tamimi Markets" allowing users in Jeddah to purchase groceries while on the move. Meanwhile, the Eastern Region has shifted to subscription models, with customers in cities such as Dammam receiving weekly delivery of necessary commodities. Finally, the Southern Region's isolated locations benefit from flexible one-time purchase choices that provide access to goods without requiring a regular commitment, as provided by services such as "Nile.com" in Abha.

Saudi Arabia Online Grocery Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Northern and Central Region Online Grocery Trends:

In cities, such as Riyadh, online grocery platforms are increasingly collaborating with established retail chains in the Northern and Central Region. Carrefour and Nana have expanded their online capabilities to include delivery from both physical shops and dedicated fulfillment facilities, catering to tech-savvy urban shoppers.

Western Region Online Grocery Trends:

In the Western Region, notably in Jeddah, there is an increasing demand for premium and organic food items. Danube and HyperPanda have capitalized on this trend, offering a wider range of organic, health-focused items via their online platforms, appealing to health-conscious customers.

Eastern Region Online Grocery Trends:

The Eastern Region, which includes Dammam, has experienced improvements in delivery logistics, with a focus on speed and dependability. LuLu Hypermarket has enhanced its delivery network to provide faster and more efficient delivery services, meeting the region's strong demand for on-time online grocery orders.

Southern Region Online Grocery Trends:

In the Southern Region, in cities such as Abha, there is a shift toward community-based online food purchasing. Nana has customized its services to rural and semi-urban regions, providing specialized delivery options and increasing access to food in less heavily inhabited areas, hence boosting convenience for local populations.

Top Companies Leading in the Saudi Arabia Online Grocery Industry

Some of the leading Saudi Arabia online grocery market companies have been mentioned in the report.

Saudi Arabia Online Grocery Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into vegetables and fruits, dairy products, staples and cooking essentials, snacks, meat and seafood, and others. The market provides fresh vegetables and fruits, both locally grown and imported. Dairy products include milk, cheese, and yogurt for everyday use. Staples and cooking essentials include rice, flour, and spices. Snacks give packaged delights, but meat and seafood provide fresh protein alternatives for consumers.

- Based on the business model, the market is categorized into pure marketplace, hybrid marketplace, and others. Pure marketplace links buyers and sellers without managing inventory. A hybrid marketplace combines third-party vendors with delivery services.

- On the basis of the platform, the market has been divided into web-based and app-based. The web-based grocery platform offers a smooth shopping experience with adaptable websites, a diverse product selection, and secure checkout. The app-based platform, on the other hand, provides greater convenience with customizable features, push alerts, and speedier on-the-go access.

- Based on the purchase type, the market is bifurcated into one-time and subscription. One-time purchases provide customers the freedom to choose items as required, but subscription services provide regular and scheduled delivery of food, providing ease and consistency for frequent shoppers.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1,543.7 Million |

| Market Forecast in 2033 | USD 5,925.7 Million |

| Market Growth Rate (2025-2033) | 15.87% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Vegetables and Fruits, Dairy Products, Staples and Cooking Essentials, Snacks, Meat and Seafood, Others |

| Business Models Covered | Pure Marketplace, Hybrid Marketplace, Others |

| Platforms Covered | Web-Based, App-Based |

| Purchase Types Covered | One-Time, Subscription |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)