Saudi Arabia Green Data Center Market Expected to Reach USD 3,879 Million by 2033 - IMARC Group

Saudi Arabia Green Data Center Market Statistics, Outlook and Regional Analysis 2025-2033

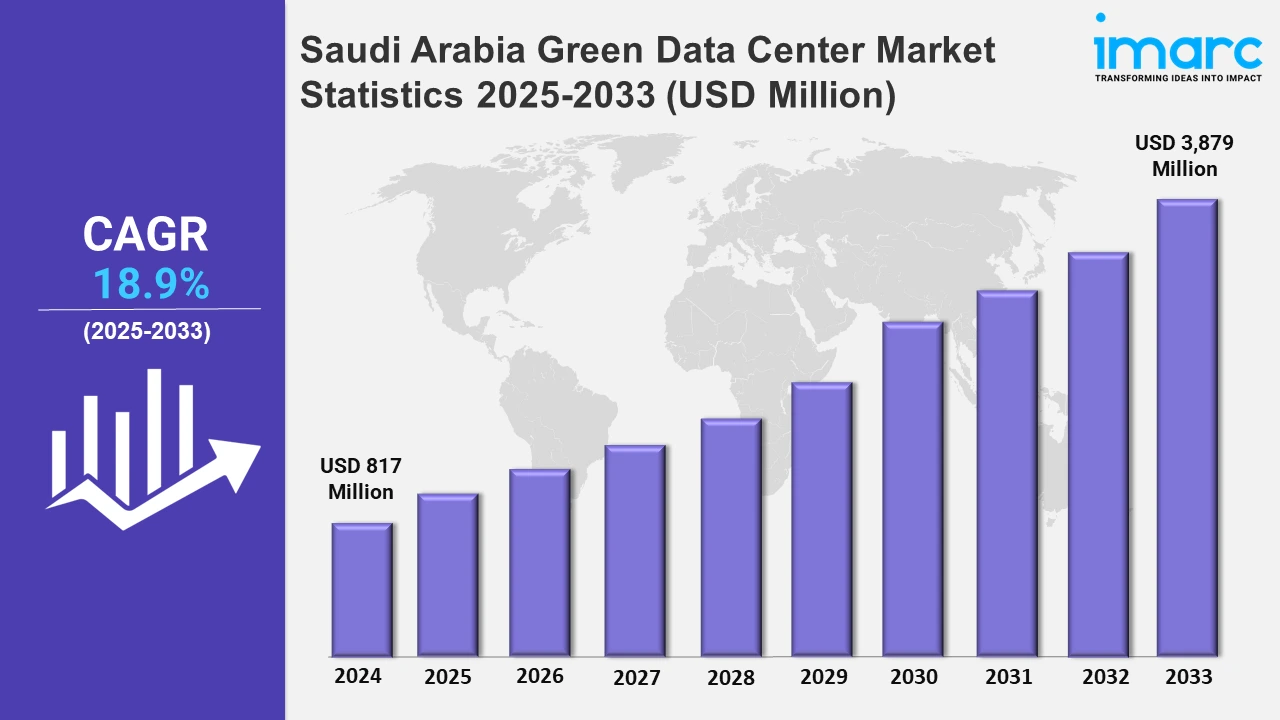

The Saudi Arabia Green Data Center market size was valued at USD 817 Million in 2024, and it is expected to reach USD 3,879 Million by 2033, exhibiting a growth rate (CAGR) of 18.9% from 2025 to 2033.

To get more information on this market, Request Sample

The Saudi Arabia green data center market is experiencing significant growth primarily driven by the government’s push for sustainable initiatives under Vision 2030. For instance, in November 2024, Pure Data Centres announced its partnership with Dune Vaults to develop hyperscale data centers in Saudi Arabia, targeting over 100MW capacity. The joint venture aims to align with Vision 2030 addressing rising demand for secure, low-latency services and supporting economic growth through advanced digital infrastructure initiatives. Rising energy costs and the need for efficient cooling solutions are prompting businesses to adopt eco-friendly technologies. Investments in renewable energy sources such as solar power are ensuring a greener energy supply for data centers. Organizations are prioritizing energy-efficient IT infrastructure including modular data centers and advanced cooling techniques to meet sustainability goals. Additionally, regulatory frameworks promoting carbon neutrality are influencing operators to implement green practices.

The key trends in the market include increasing utilization of liquid cooling systems and smart energy management solutions to reduce operational costs. Widescale integration of artificial intelligence (AI) for energy optimization and predictive maintenance is becoming popular. For instance, in September 2024, ICS Arabia, in partnership with Lumaotong Group and China Mobile International began construction on the Desert Dragon Data Centers which will have a total capacity of 187 MW. This project aims to enhance Saudi Arabia's digital infrastructure and support a variety of services including cloud hosting and artificial intelligence. Additionally, collaborations with renewable energy companies as well as hyperscale data centers is changing the pattern. The green certifications such as LEED are now an issue of key focus, which innovates sustainability in design and construction. These developments evidently exhibit a greater trend of eco-friendly and cost-effective data centers in Saudi Arabia.

Saudi Arabia Green Data Center Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region

Northern and Central Region Saudi Arabia Green Data Center Market Trends:

The Northern and Central regions of Saudi Arabia's green data center market are embracing renewable energy integration driven by Vision 2030 goals. These regions are prioritizing solar-powered facilities, advanced cooling systems and AI-based energy optimization. Hyperscale data centers and partnerships with global tech firms are fostering sustainable infrastructure and meeting growing digital demands.

Western Region Saudi Arabia Green Data Center Market Trends:

The Western Region of Saudi Arabia's green data center market is witnessing growth driven by sustainable initiatives tied to NEOM and Red Sea projects. Focus on renewable energy integration, energy-efficient cooling technologies and smart infrastructure is reshaping the sector. Partnerships for hyperscale centers reflect increasing demand for eco-friendly digital solutions in the region.

Eastern Region Saudi Arabia Green Data Center Market Trends:

The Eastern Region of Saudi Arabia's green data center market is focusing on integrating renewable energy sources like solar and wind mainly driven by Vision 2030 goals. The region is adopting energy-efficient cooling technologies and smart management systems with significant investment in hyperscale facilities to support growing demand for cloud services and digital transformation.

Southern Region Saudi Arabia Green Data Center Market Trends:

The Southern region of Saudi Arabia's green data center market is witnessing a rise in demand for sustainable infrastructure driven by increased investments in renewable energy projects. Enhanced energy-efficient technologies such as advanced cooling systems and a focus on reducing carbon footprints are shaping the region's market aligning with national sustainability goals.

Top Companies Leading in the Saudi Arabia Green Data Center Industry

Leading market players in Saudi Arabia's green data center sector are prioritizing sustainable practices by adopting renewable energy sources, optimizing energy consumption, and integrating advanced cooling technologies. They are investing in eco-friendly designs and building infrastructure to meet growing data demands while aligning with the country’s sustainability goals. Companies are also forming partnerships to leverage innovative technologies, enhance operational efficiency and reduce carbon emissions. For instance, in May 2024, Uzbekistan announced its partnership with Saudi Arabia's DATAVOLT to construct eco-friendly data centres in Tashkent and Bukhara part of its “Uzbekistan – 2030” strategy. The project begins with a $150 million facility in Tashkent eventually expanding to 250MW capacity aiming to attract international tech firms and enhance investment prospects. These strategies aim to position them as key contributors to the region's green digital transformation.

Saudi Arabia Green Data Center Market Segmentation Coverage

- On the basis of the component, the market has been categorized into solutions (power systems, servers, monitoring and management systems, networking systems, cooling systems, and others) and services (system integration services, maintenance and support services, and training and consulting services). The solutions segment includes essential components for green data centers such as power systems optimized for energy efficiency, high-performance servers and advanced networking systems. The services segment encompasses system integration to streamline green data center operations and ensure compatibility among various components. Maintenance and support services are pivotal in minimizing downtime and maintaining efficiency.

- Based on the data center type, the market is classified into colocation data centers, managed service data centers, cloud service data centers, and enterprise data centers. Colocation data centers in Saudi Arabia provide shared and energy-efficient infrastructure for multiple businesses to house their IT equipment sustainably. Managed service data centers offer comprehensive IT management and support within environmentally friendly facilities tailored to Saudi enterprises. Cloud service data centers deliver scalable and green cloud computing resources through energy-efficient platforms across Saudi Arabia. Enterprise data centers are dedicated optimized facilities for large organizations in Saudi Arabia emphasizing sustainability and reduced energy consumption.

- On the basis of the industry vertical, the market has been divided into healthcare, BFSI, government, telecom and IT and others. Healthcare green data centers in Saudi Arabia ensure secure, energy-efficient storage and management of sensitive medical information. BFSI green data centers provide sustainable and reliable IT infrastructure tailored to the banking, financial services and insurance sectors. Government green data centers offer ecofriendly solutions for managing and safeguarding public sector data and applications. Telecom and IT green data centers delivers energy efficient and scalable infrastructure to support the information technology (IT) and telecommunications industries.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 817 Million |

| Market Forecast in 2033 | USD 3,879 Million |

| Market Growth Rate 2025-2033 | 18.9% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Data Center Types Covered | Colocation Data Centers, Managed Service Data Centers, Cloud Service Data Centers, Enterprise Data Centers |

| Industry Verticals Covered | Healthcare, BFSI, Government, Telecom and IT, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Saudi Arabia Green Data Center Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)