Saudi Arabia Food Packaging Market Expected to Reach USD 2,552.5 Million by 2033 - IMARC Group

Saudi Arabia Food Packaging Market Statistics, Outlook and Regional Analysis 2025-2033

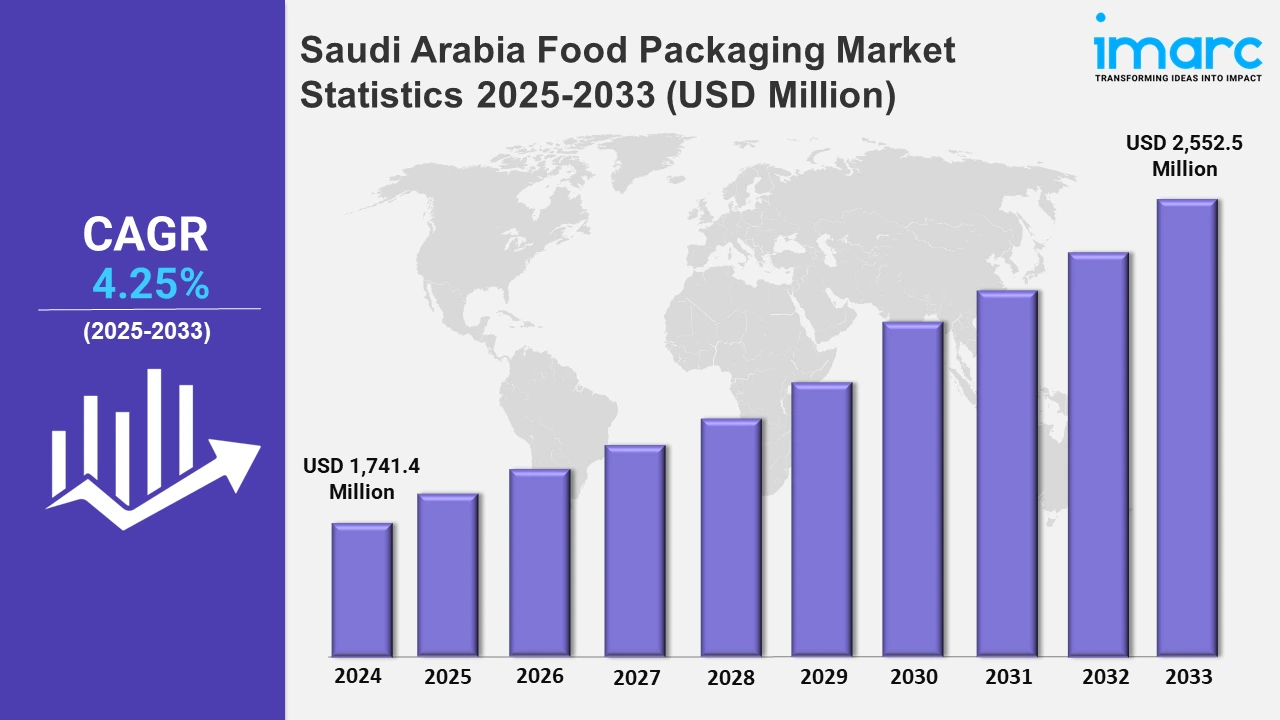

The Saudi Arabia food packaging market size was valued at USD 1,741.4 Million in 2024, and it is expected to reach USD 2,552.5 Million by 2033, exhibiting a growth rate (CAGR) of 4.25% from 2025 to 2033.

To get more information on this market, Request Sample

The growing awareness about environmental issues is driving the adoption of biodegradable, recyclable, and reusable packaging materials. Regulatory support for sustainable practices further accelerates this shift. In line with this, the growing urban population and increasing disposable income are leading to higher demand for convenient, ready-to-eat, and packaged food products. According to industry reports, as of November 2024, 92.3% of residents of KSA lives in urban areas. This, coupled with the expanding younger demographic and expatriate population base in Saudi Arabia, who prefer modern and sustainable packaging, is contributing to the market growth. As health consciousness rises, there is a demand for transparent, resealable, and portion-controlled packaging that ensures food safety and freshness.

The government’s focus on diversifying the economy and supporting non-oil sectors, including food and beverage, has spurred investments in food packaging technologies and infrastructure. In addition to this, innovations in packaging materials, such as smart and active packaging, enhance product shelf life and consumer engagement, attracting widespread adoption. For instance, in October 2024, Tetra Pak launched its 'Made, consumed and recycled in Saudi Arabia' campaign. The campaign enforces the company’s commitment to the economic diversification of the Kingdom’s economy, embracing the opportunity to highlight Tetra Pak’s role in reinforcing Saudi Arabia as a regional hub for food packaging and manufacturing in the Middle East.

Saudi Arabia Food Packaging Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region. In the northern and central regions, urbanization, and a growing middle class drive the demand for convenient, packaged food products. In the Western Region, high tourism inflow and a thriving hospitality sector boost the demand for innovative and sustainable food packaging solutions. In the Eastern Region, industrial growth and the presence of expatriate communities encourage the consumption of packaged foods and beverages. In the Southern Region, rising economic activities and increased retail penetration contribute to the growing adoption of modern food packaging.

Northern and Central Region Food Packaging Market Trends:

Rapid urbanization and an expanding middle class drive the demand for packaged food, supported by rising disposable incomes. With Riyadh as a key economic hub, the region sees strong growth in retail chains, modern supermarkets, and e-commerce, boosting the need for innovative and sustainable food packaging solutions.

Western Region Food Packaging Market Trends:

The Western Region, with Jeddah and Mecca, attracts millions of tourists annually, creating a high demand for food service packaging in the hospitality and catering sectors. The region’s vibrant lifestyle, combined with growing awareness of eco-friendly packaging, further fuels the need for advanced packaging solutions tailored to diverse consumer preferences.

Eastern Region Food Packaging Market Trends:

Known for its industrial hubs and expatriate population, the Eastern Region experiences significant demand for packaged foods due to busy lifestyles and higher purchasing power. The region’s proximity to key shipping ports also supports food export packaging, making it a vital contributor to the sector’s growth.

Southern Region Food Packaging Market Trends:

Economic diversification and infrastructure development in the Southern Region are driving growth in retail and food service sectors. Increased awareness about hygiene and food safety, coupled with rising access to modern grocery stores, has led to higher adoption of modern packaging materials for processed and fresh foods.

Top Companies Leading in the Saudi Arabia Food Packaging Industry

Some of the leading Saudi Arabia food packaging market companies include Flex Pack (ENPI Group), Napco National, National Plastic Factory, Packaging Product Company, Printopack, Salman Group, Saudi Arabian Packaging Industry WLL (SAPIN) (Al Suhaimi Holding Company), and Smart Pack Flexible Packaging, among many others.

In April 2024, SABIC, a global leader in the chemical industry, announced the successful roll-out of the first circular packaging project in Saudi Arabia as part of its TRUCIRCLE program to accelerate the implementation of a circular plastic economy. FONTE, a major player in the bakery industry in the Kingdom of Saudi Arabia (KSA), introduced bread bags made with SABIC’s certified circular polyethylene (PE) in their Oat Arabic Bread. The bags are made by Napco National, a vertically integrated Saudi manufacturer of flexible film and packaging products, using two food-contact certified circular polyethylene resin grades (LLDPE) from SABIC’s TRUCIRCLE portfolio.

Saudi Arabia Food Packaging Market Segmentation Coverage

- On the basis of the packaging type, the market has been categorized into flexible, paper and paperboard, rigid plastic, glass, metal, and others. Flexible packaging is ideal for snacks, ready-to-eat meals, and beverages, meeting consumer demand for convenience, lightweight, cost-effective, and versatile. Paper and paperboard are eco-friendly and recyclable, these materials cater to increasing sustainability awareness and regulatory support for reducing plastic use. Rigid plastic packaging is widely used for dairy products, beverages, and frozen foods due to its excellent barrier properties, including durability, lightweight, and resealable. Glass is preferred for premium and long-shelf-life products, glass packaging offers superior protection and is associated with high-quality branding. Known for durability and preserving freshness, metal packaging is extensively used for canned foods, beverages, and ready-to-eat meals, ensuring long shelf life.

- Based on the application, the market is classified into bakery, confectionary, pasta, and noodles, dairy products, sauces, dressings, and condiments, snacks and side dishes, convenience foods, meat, fish, and poultry, fruits and vegetables, and others. Rising demand for fresh and packaged baked goods drives the need for packaging that ensures freshness and extends shelf life in bakery. The popularity of chocolates and sweets requires visually appealing and protective packaging to maintain product quality and attract consumers to confectionery. The convenience and growing consumption of pasta and noodles necessitate durable, moisture-resistant packaging. High demand for milk, cheese, and yogurt emphasizes packaging that ensures hygiene, freshness, and temperature control. Increasing use of sauces, dressings, and condiments in home cooking and fast-food boosts demand for convenient and spill-proof packaging. The preference for on-the-go eating of snacks and side dishes fuels the need for flexible, resealable, and attractive packaging for snack foods. Busy lifestyles drive the demand for ready-to-eat meals and convenience foods, requiring innovative packaging that offers ease of use and longer shelf life. High consumption and the need for freshness, safety, and proper preservation demand vacuum-sealed and temperature-resistant packaging in meat, fish, and poultry. Packaging that minimizes spoilage and enhances shelf appeal is essential for fresh produce in the retail sector, particularly in fruits and vegetables.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1,741.4 Million |

| Market Forecast in 2033 | USD 2,552.5 Million |

| Market Growth Rate 2025-2033 | 4.25% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Packaging Types Covered | Flexible, Paper and Paperboard, Rigid Plastic, Glass, Metal, Others |

| Applications Covered | Bakery, Confectionary, Pasta, and Noodles, Dairy Products, Sauces, Dressings, and Condiments, Snacks and Side Dishes, Convenience Foods, Meat, Fish, and Poultry, Fruits and Vegetables, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Flex Pack (ENPI Group), Napco National, National Plastic Factory, Packaging Product Company, Printopack, Salman Group, Saudi Arabian Packaging Industry WLL (SAPIN) (Al Suhaimi Holding Company), Smart Pack Flexible Packaging, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Food Packaging Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)