Saudi Arabia Data Center Colocation Market Expected to Reach USD 1,659 Million by 2033 - IMARC Group

Saudi Arabia Data Center Colocation Market Statistics, Outlook and Regional Analysis 2025-2033

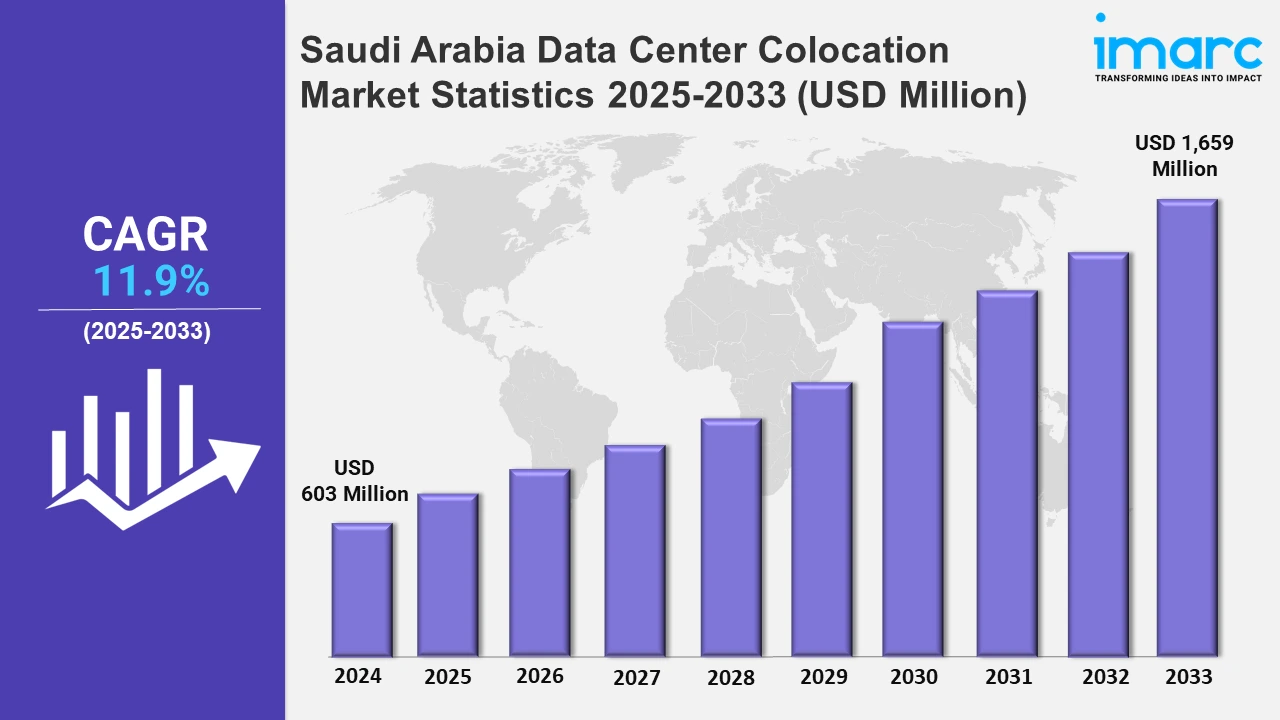

The Saudi Arabia data center colocation market size was valued at USD 603 Million in 2024, and it is expected to reach USD 1,659 Million by 2033, exhibiting a growth rate (CAGR) of 11.9% from 2025 to 2033.

To get more information of this market, Request Sample

The expansion of 5G networks in Saudi Arabia is significantly propelling the growth of the data center colocation market. This is accelerating data consumption and the proliferation of Internet of Things (IoT) devices. For instance, in November 2024, Zain KSA, a Saudi telco, acquired a new spectrum in the 600 MHz band to improve its 5G Standalone (5G SA) mobile services. The Arab telco stated that the 600 MHz spectrum allows for more extensive coverage across Saudi Arabia's cities, towns, distant areas, and highways, increasing the service reach, quality, and capacity of its 5G network. The carrier also stated that this frequency range provides greater flexibility in offering sophisticated 5G services, such as Internet of Things (IoT) and smart city solutions. This surge necessitates advanced data center facilities to manage and process the increased data traffic efficiently.

Moreover, the increasing internet penetration in Saudi Arabia is a significant driver of the data center colocation market's growth. For instance, according to Statista, the population share of having an internet connection in Saudi Arabia is expected to increase by 7.2 % between 2024 and 2029. After the tenth straight year of growth, internet penetration is expected to reach 75.4%, thereby marking a new high in 2029. As more individuals and businesses come online, there's a surge in data generation and consumption, driving the need for expanded data center facilities to handle the growing data volumes. Favorable government policies, including tax incentives and streamlined regulations, are encouraging investments in data center facilities. For instance, Saudi Arabia provides incentives, such as lower corporate income tax rates and customs duty exemptions, to data centers working in the information and communications technology (ICT) and digital economy sectors. These measures aim to position Saudi Arabia as a regional hub for data services, further propelling the growth of the colocation market.

Saudi Arabia Data Center Colocation Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Northern and Central Region Data Center Colocation Market Trends:

Riyadh, situated in the Central region, serves as a strategic hub for data center investments due to its central location and well-developed infrastructure. The city's connectivity and accessibility make it an attractive site for colocation facilities.

Western Region Data Center Colocation Market Trends:

The proliferation of cloud computing, big data analytics, and IoT applications has escalated the need for robust data center services. Businesses in the Western Region are increasingly seeking colocation services to enhance scalability, security, and cost-efficiency.

Eastern Region Data Center Colocation Market Trends:

The Eastern region, encompassing cities like Dammam, benefits from its proximity to major subsea cable routes, enhancing international connectivity. This strategic position makes it an attractive hub for data center operations.

Southern Region Data Center Colocation Market Trends:

The Southern region's focus on diversifying its economy beyond oil, including investments in technology sectors, which creates a favorable environment for data center growth.

Top Companies Leading in the Saudi Arabia Data Center Colocation Industry

Some of the key players have been mentioned in the report.

Saudi Arabia Data Center Colocation Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into retail colocation and wholesale colocation. Retail colocation is a service where clients lease smaller portions of a data center's infrastructure. This is ideal for businesses with moderate data hosting needs that want managed services and support. While wholesale colocation targets larger enterprises, cloud service providers, and organizations with significant IT needs. It involves leasing substantial portions of a data center.

- Based on the organization size, the market is categorized into small and medium enterprises and large enterprises. Building and maintaining an in-house data center can be prohibitively expensive for SMEs. Colocation offers a cost-effective alternative by providing a shared infrastructure, reducing capital expenditures, and allowing businesses to pay only for the space and resources they need. Moreover, large enterprises often require substantial and scalable data center resources to support extensive operations and data-intensive applications. Colocation provides the necessary infrastructure to accommodate such demands.

- On the basis of the end use industry, the market has been divided into BFSI, manufacturing, IT and telecom, energy, healthcare, government, retail, education, entertainment and media, and others. Stringent regulations necessitate secure data storage and management, prompting BFSI institutions to adopt colocation services that offer robust security measures. Moreover, the integration of IoT, AI, and automation in manufacturing processes generates vast amounts of data, requiring efficient storage and processing solutions provided by colocation centers. Furthermore, the implementation of digital government services necessitates secure and scalable data storage and processing capabilities.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 603 Million |

| Market Forecast in 2033 | USD 1,659 Million |

| Market Growth Rate 2025-2033 | 11.9% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Retail Colocation, Wholesale Colocation |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Use Industries Covered | BFSI, Manufacturing, IT and Telecom, Energy, Healthcare, Government, Retail, Education, Entertainment and Media, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Saudi Arabia Data Center Colocation Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)