Global Rubidium Market Expected to Reach 4.0 Kilo Tons by 2033 - IMARC Group

Global Rubidium Market Statistics, Outlook and Regional Analysis 2025-2033

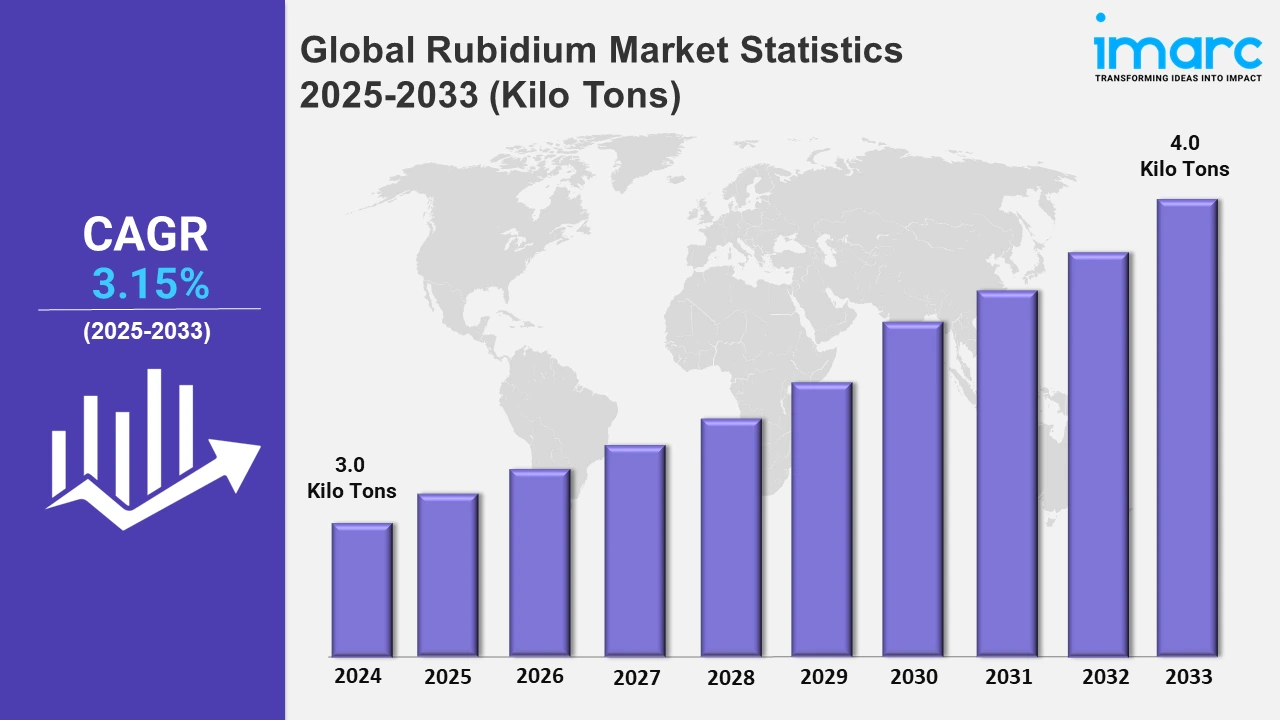

The global rubidium market size was valued at 3.0 Kilo Tons in 2024, and it is expected to reach 4.0 Kilo Tons by 2033, exhibiting a growth rate (CAGR) of 3.15% from 2025 to 2033.

To get more information on this market, Request Sample

The rubidium market is fueled by its critical role in advanced scientific and industrial applications. Its use in atomic clocks, renowned for precision timekeeping, underpins key technologies like GPS systems and telecommunications networks. The increasing adoption of rubidium in quantum computing significantly enhances its market potential, particularly in applications demanding high-purity materials. A notable example is NVIDIA's CUDA-Q platform, which integrates rubidium-based quantum processing units (QPUs) in Japan’s ABCI-Q supercomputer as announced on May 13, 2024. These QPUs, utilizing rubidium atoms controlled by laser light as qubits, are pivotal for advancing artificial intelligence (AI), energy, and biology research. Their identical structure ensures scalable, high-fidelity quantum processing for innovative applications. Additionally, rubidium's growing use in aerospace and defense sectors for specialized electronics and frequency standards bolsters demand. Rising investments in space exploration and satellite communication further drive market growth, with rubidium being essential in optical systems and energy storage solutions.

Another significant market driver is the expanding use of rubidium in healthcare and renewable energy sectors. In modern healthcare, rubidium plays a critical role in medical imaging and diagnostics, particularly in positron emission tomography (PET) scanners, highlighting its significance in advanced technologies. In renewable energy, rubidium-based lead-free perovskite solar cells are gaining attention for their high performance and sustainability. A June 2024 study by ScienceDirect demonstrated efficiencies of 29.75% and 33.61% for RbPbBr3 and RbSnCl3 absorbers, respectively, using SnS2 as an electron transport layer. This research underscores rubidium's potential in advancing safer, high-efficiency solar energy technologies. Furthermore, rubidium's growing use in specialty glass manufacturing, essential for optical and electronic devices, bolsters market demand. Besides this, increasing investments in mineral exploration and technological advancements ensure a stable supply and unlock new applications, solidifying rubidium's prominence across diverse industries.

Global Rubidium Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of its advanced technological applications, significant research investments, strong industrial demand, and the region's well-established infrastructure for specialized materials.

North America Rubidium Market Trends:

The rubidium market in North America is growing steadily due to its applications in atomic clocks, medical imaging, and advanced electronics. Strong research and development (R&D) investments and a robust industrial base enhance the region’s potential. Demand from defense and telecommunications sectors significantly drives growth, supported by advancements in materials science expanding rubidium's uses. Notably, on November 06, 2024, Teledyne Technologies announced the acquisition of aerospace and defense businesses from Excelitas for USD 710 Million, including Advanced Electronic Systems (AES) in the U.S., specializing in custom energetics, high-voltage semiconductor switches, and rubidium frequency standards for defense and space. The transaction, expected to close in 2025, highlights the rising importance of rubidium in high-tech and defense applications across the region.

Asia-Pacific Rubidium Market Trends:

Asia-Pacific is witnessing rapid growth in the rubidium market, driven by expanding industrialization and increasing investments in electronics and telecommunications. Countries like China, Japan, and South Korea are at the forefront, leveraging rubidium for cutting-edge technologies such as GPS systems and quantum computing. The region's focus on technological innovation and its vast consumer electronics industry contribute significantly to market demand. Additionally, the availability of raw materials and government support for advanced manufacturing bolster the market’s expansion.

Europe Rubidium Market Trends:

Europe's market is marked by growing demand from aerospace, telecommunications, and healthcare sectors. The region’s focus on technological advancement, particularly in atomic research and medical imaging, drives market growth. Countries like Germany, France, and the United Kingdom are investing heavily in R&D to explore new applications for rubidium in precision timing and spectroscopy. The strong regulatory framework and collaboration among research institutions further enhance Europe’s position in the global rubidium market.

Latin America Rubidium Market Trends:

The market in Latin America is gradually expanding, supported by growing adoption in electronics and healthcare applications. Although the region faces challenges such as limited access to raw materials and slower infrastructure development, rising investments in education and scientific research are expected to drive future growth in rubidium-based technologies.

Middle East and Africa Rubidium Market Trends:

The Middle East and Africa are emerging markets for rubidium, with increasing demand in the oil and gas, telecommunications, and medical sectors. While the limited availability of rubidium resources poses challenges, growing interest in importing and developing high-tech applications offers significant opportunities for expansion in these regions.

Top Companies Leading in the Rubidium Industry

Some of the leading rubidium market companies include American Elements, ESPI Metals Inc., Ganfeng Lithium Group, Inorganic Ventures Inc., Lanhit, Lepidico, Merck KGaA, Otto Chemie Pvt Ltd, Sinomine Resource Group Co. Ltd., among many others. On July 18, 2024, C.H. Sinomine Resources Group announced that it acquired Namibia's Tsumeb smelter for USD 49 Million from Dundee Precious Metals Inc, augmenting copper and sulfuric acid production. Sinomine also acquired Zambia's Kitumba Copper Mine, with significant copper reserves, and co-operates the Kahishi Copper-Gold Project. Through these strategic moves, the company strengthens its global mining portfolio while expanding caesium and rubidium resources to support sustainable growth.

Global Rubidium Market Segmentation Coverage

- Based on production process, the market is classified into lepidolite, pollucite, and others. Lepidolite represents the largest rubidium market segment driven by its high rubidium content and abundance as a mineral resource. It is a primary source for rubidium extraction, offering cost-effective processing compared to other minerals. Widely used in producing specialty glasses, electronics, and energy storage solutions, lepidolite meets growing industrial demand. Additionally, its association with lithium mining ensures consistent supply, further strengthening its market dominance. Increasing investments in mineral exploration solidify lepidolite's position as the leading rubidium segment.

- On the basis of grade, the market has been categorized into technical grade metal and high-purity grade. Technical grade metal dominates the market attributed to its widespread use in high-tech applications like atomic clocks, GPS systems, and specialized electronics. Its high purity and consistent quality make it ideal for precision technologies in aerospace, telecommunications, and defense. The rising demand for advanced scientific instruments and the growth of emerging industries, such as quantum computing, further drive its adoption. Additionally, robust R&D efforts and increasing investments in cutting-edge technologies solidify technical grade metal’s majority market share.

- Based on application sector, the market is bifurcated into biomedical research, electronics, specialty glass, pyrotechnics, and others, amongst which specialty glass leads the market. They hold the largest share due to its essential role in advanced optical applications, including fiber optics, laser systems, and space technologies. Rubidium's unique properties enhance glass performance, such as improved thermal stability and refractive accuracy, critical for high-tech uses. The growing demand for cutting-edge products in telecommunications, aerospace, and medical devices further drives its adoption. Additionally, advancements in precision glass manufacturing and rising investments in optical technologies solidify specialty glass as a dominant segment in rubidium applications.

| Report Features | Details |

|---|---|

| Market Size in 2024 | 3.0 Kilo Tons |

| Market Forecast in 2033 | 4.0 Kilo Tons |

| Market Growth Rate 2025-2033 | 3.15% |

| Units | Kilo Tons, Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Production Processes Covered | Lepidolite, Pollucite, Others |

| Grades Covered | Technical Grade Metal, High-purity Grade |

| Application Sectors Covered | Biomedical Research, Electronics, Specialty Glass, Pyrotechnics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Elements, ESPI Metals Inc., Ganfeng Lithium Group, Inorganic Ventures Inc., Lanhit, Lepidico, Merck KGaA, Otto Chemie Pvt Ltd, Sinomine Resource Group Co. Ltd. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)