Global RF Front End Module Market Expected to Reach USD 65.0 Billion by 2033 - IMARC Group

Global RF Front End Module Market Statistics, Outlook and Regional Analysis 2025-2033

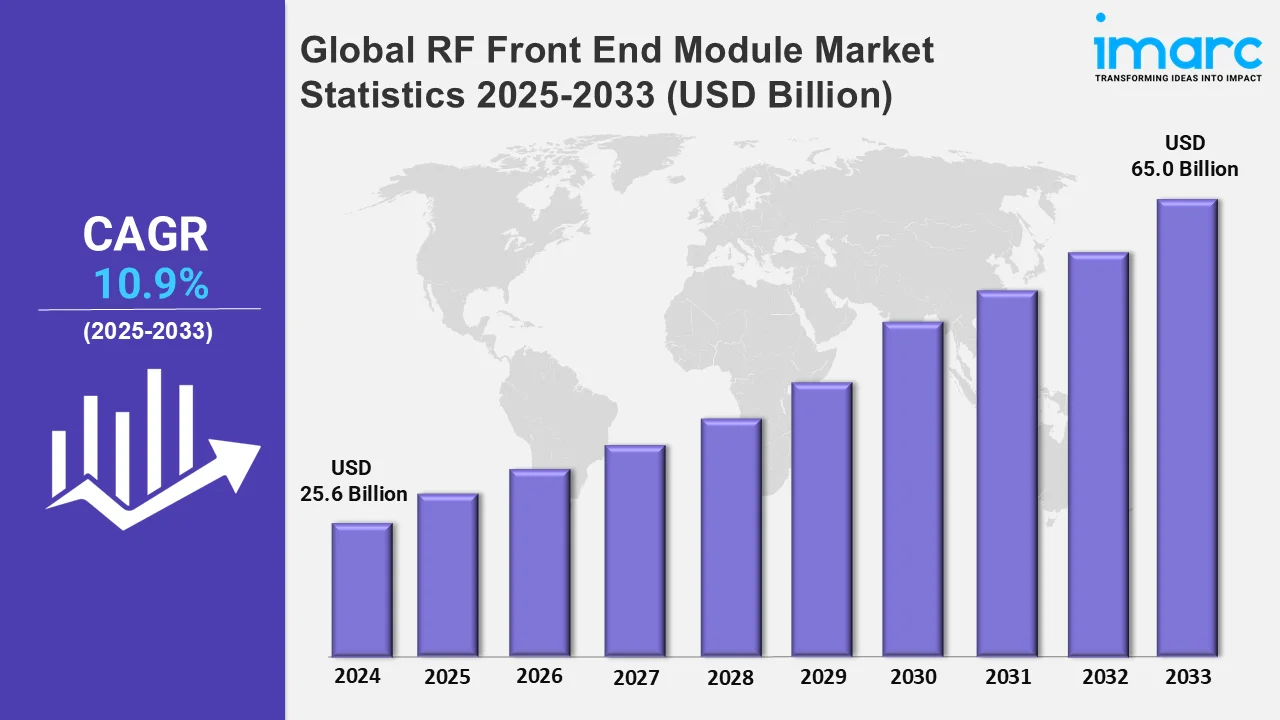

The global RF front end module market size was valued at USD 25.6 Billion in 2024, and it is expected to reach USD 65.0 Billion by 2033, exhibiting a growth rate (CAGR) of 10.9% from 2025 to 2033.

To get more information on this market, Request Sample

The most significant factor driving the market is the deployment of 5G networks worldwide. The technology of 5G provides high-speed and low-latency communication by using advanced RF front-end modules and working at higher frequencies. With the growing deployment of 5G infrastructure by telecom operators, the demand for high-performance radio frequency components for smartphones, base stations, and other connected devices has increased. Another growth-inducing factor is the expansion of the Internet of Things (IoT). RF front-end modules are crucial for enabling effective signal processing since millions of devices, from industrial sensors to household appliances, require continuous wireless connectivity. For example, in April 2024, QuantalRF-the pioneer developer of RF semiconductor and antenna solutions-launched the QWX27105 innovative single-chip 5-7 GHz front-end IC, the first offering in the Elementum ™ family of Wi-Fi 7 products. The product overcomes existing GaAs and SiGe products as it includes all RF front-end components in an ultra-compact CMOS SOI architecture. The increasing adoption of IoT solutions in smart homes, healthcare, agriculture, and other sectors is boosting the demand for high-performance RF components.

The demand for smartphones, particularly in the emerging markets, has been one of the most important reasons for the heightened demand for advanced RF modules. Advanced RF front-end modules to handle additional features like 5G, multiple frequency bands, and faster data rates with smartphones are witnessing significant demand. The increasing trend in the RF technology in terms of smaller, efficient, and cost-effective module development has been contributing to the expansion of the FEM market. For example, in September 2024, a Finish fabless semiconductor company, CoreHW, cooperated with Presto Engineering, a French ASIC design and production service provider, to develop a new 2.4-GHz RF front-end module (FEM) supporting Bluetooth, Zigbee, Thread, and the industrial, scientific, and medical (ISM) Internet of Things (IoT) in an ultra-small, thin wafer-scale package. The module includes both a low-noise amplifier (LNA) and a high-efficiency power amplifier (PA). These innovations help in the integration of several functionalities and reduce the size and cost of the entire system. Investments in 5G and telecommunication infrastructure across governments worldwide will continue to facilitate the demand for RF front-end modules as a part of larger digital transformation efforts.

Global RF Front End Module Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share owing to rapid 5G deployment, high smartphone production, and expanding consumer electronics and IoT markets.

North America RF Front End Module Market Trends:

The growing 5G deployments, a thriving automotive sector that prioritizes connected automobiles, and the strong need for IoT and smart home devices are the main factors propelling the RF front-end module market in North America. Significant investments in telecommunications infrastructure and quick technical developments also fuel market expansion.

Asia-Pacific RF Front End Module Market Trends:

Large-scale 5G rollouts, growing smartphone penetration, and the region's leadership in semiconductor manufacturing are all contributing to Asia-Pacific's strong development. As the market is accelerated by rising consumer electronics demand, countries like China, India, and Japan are investing in IoT and smart cities. For instance, in May 2024, a leading international semiconductor foundry, United Microelectronics Corporation ("UMC") unveiled the first 3D integrated circuit (IC) solution for RFSOI technology in the market. The stacked silicon technique, which is available on UMC's 55nm RFSOI platform, decreases die size by over 45% without compromising radio frequency (RF) performance. This allows users to effectively incorporate more RF components to meet the increased bandwidth needs of 5G.

Europe RF Front End Module Market Trends:

The robust automotive and aerospace industries' adoption of cutting-edge communication technologies is driving the RF front-end module market in Europe. Along with strict rules on communication efficiency, the region's emphasis on 5G infrastructure, smart manufacturing, and IoT usage in industrial applications further promotes growth.

Latin America RF Front End Module Market Trends:

The market in Latin America is aided by growing mobile internet usage and developing telecommunications networks, especially in Brazil and Mexico. The industry is expanding owing to government measures to upgrade digital infrastructure and the growing use of IoT devices, although development is constrained by slower 5G implementation.

Middle East and Africa RF Front End Module Market Trends:

The growing investments in 5G infrastructure and smart city initiatives, especially in the Gulf nations, are contributing factors in the Middle East and Africa. The demand is also fueled by the growing use of smartphones and the integration of cutting-edge communication technology in industrial settings, even in the face of regional economic difficulties.

Top Companies Leading in the RF Front End Module Industry

Some of the leading RF front end module market companies include Broadcom Inc., Infineon Technologies AG, Murata Manufacturing Co. Ltd., NXP Semiconductors N.V., Qorvo Inc., Skyworks Solutions Inc., STMicroelectronics N.V., Taiyo Yuden Co. Ltd., TDK Corporation, Teradyne Inc., Texas Instruments Incorporated, among many others.

In September 2024, Specialty analog foundry Tower Semiconductor Ltd of Migdal Haemek, Israel announced the production of Wi-Fi 7 RF front-end module (FEM) devices based on its 300mm radio frequency silicon-on-insulator (RFSOI) technology. Through their partnership with Broadcom Inc., Tower has made it possible for Wi-Fi FEM devices to be fully integrated on a single RFSOI die. The solution outperforms current non-SOI technologies in terms of efficiency and performance.

Global RF Front End Module Market Segmentation Coverage

- On the basis of the component, the market has been categorized into RF filters, RF switches, RF power amplifiers, and others, wherein RF filters represent the leading segment. RF filters dominate the largest market share due to their important function in maintaining signal integrity by removing undesirable frequencies. The increasing usage of 5G, IoT, and wireless devices has increased demand for high-performance filters, resulting in their market dominance.

- Based on the application, the market is classified into consumer electronics, automotive, wireless communication, and others. The extensive usage of smartphones, tablets, and wearable technologies has created a significant demand for small, high-performing RF front-end modules in consumer electronics. In automotive, the demand for reliable radio frequency (RF) technology is increased by advanced driver-assistance systems (ADAS), vehicle-to-everything (V2X) communication, and in-car connection. In wireless communication, advanced RF modules are needed to allow high-speed, low-latency connectivity as 5G networks are deployed and the Internet of Things grows.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 25.6 Billion |

| Market Forecast in 2033 | USD 65.0 Billion |

| Market Growth Rate 2025-2033 | 10.9% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | RF Filters, RF Switches, RF Power Amplifiers, Others |

| Applications Covered | Consumer Electronics, Automotive, Wireless Communication, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Broadcom Inc., Infineon Technologies AG, Murata Manufacturing Co. Ltd., NXP Semiconductors N.V., Qorvo Inc., Skyworks Solutions Inc., STMicroelectronics N.V., Taiyo Yuden Co. Ltd., TDK Corporation, Teradyne Inc. and Texas Instruments Incorporated |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)