Stainless Steel Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Stainless Steel Price Trend, Index and Forecast

Track real-time and historical stainless steel prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Stainless Steel Prices January 2026

| Region | Price (USD/KG) | Latest Movement |

|---|---|---|

| Northeast Asia | 1.75 | 4.2% ↑ Up |

| Europe | 3.16 | 10.9% ↑ Up |

| India | 2.47 | 3.3% ↑ Up |

| Middle East | 2.73 | -2.5% ↓ Down |

| Southeast Asia | 2.62 | 13.4% ↑ Up |

| North America | 2.92 | -0.3% ↓ Down |

Stainless Steel Price Index (USD/KG):

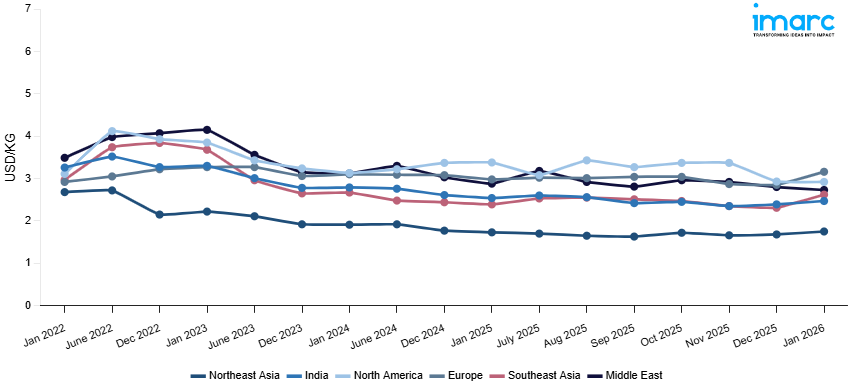

The chart below highlights monthly stainless steel prices across different regions.

Get Access to Monthly/Quarterly/Yearly Prices, Request Sample

Market Overview Q3 Ending September 2025

Northeast Asia: Demand softened particularly in downstream sectors such as construction and certain manufacturing, partly due to weakening investment in real estate and infrastructure in China and neighbouring markets. On the supply side, raw material inputs, especially nickel, saw an oversupply push, which caused downward pressure. Notably, Indonesia’s export quotas for nickel pig iron eased some cost burdens for mills in the region. Shipping and logistics costs remained elevated due to persistent bottlenecks, but improvements compared to earlier in the year limited their impact. Currency fluctuations also played a role as many Northeast Asian producers experienced local currency strengthening vs USD, which reduced cost of imported raw materials when priced in USD, thus helping margin stabilization. Domestic logistics and energy costs, however, remained significant cost components, with energy prices in some Northeast Asian countries higher due to regulatory and environmental compliance charges.

Europe: Europe witnessed a contrasting picture. With September showing a slight increase, the region benefitted from protective trade measures and a restrained supply environment. European stainless steel producers faced competition from cheaper imports, but rising energy costs and strict environmental regulations added cost pressure that allowed domestic producers to maintain or raise base prices in some product grades. Demand remained weak to moderate as construction, consumer goods, and industrial sectors showed slow growth, with firms delaying purchases in the face of macroeconomic uncertainty. On the supply side, reduced production in some high-cost regions limited available capacity, lending support to pricing.

India: Demand from infrastructure, real estate, and manufacturing sectors softened, slowed by rising interest rates and inflationary pressures that inhibited large capex. On the supply side, raw materials saw mixed movements. Domestic logistics continued to be expensive due to fuel cost variability, seasonal monsoon effects increasing transportation challenges, and power cost for steel plants under environmental compliance costs. Currency fluctuations also impacted costs as the Indian rupee’s movements increased the cost of imported raw materials when sourced in USD. Inventory levels among traders appear elevated, which led sellers to discount in order to clear stocks. Overall, the decline in prices reflected demand‐side weakness combined with only partial relief from raw material and logistics cost pressures.

Middle East: The Middle East saw a moderate decline in stainless steel prices. Demand was mixed including strong from oil and gas, infrastructure and petrochemical projects, but subdued in construction and consumer sectors due to economic headwinds, inflation and cost of capital. On the supply side, raw materials were largely imported, meaning that cost components like freight, customs duties, and port handling had an outsized impact. Energy costs, while generally lower in some Middle Eastern countries, were affected by domestic subsidies and regulatory changes, as environmental compliance and local content rules added cost burdens. Currency dynamics also played a role, especially in countries with weaker currencies vs USD, raising the local cost of imports. Domestic logistics challenges added further cost. In some Gulf countries, government infrastructure spending helped support baseline demand, but the support was insufficient to prevent a moderate price decline overall.

Southeast Asia: Southeast Asia saw a mild decline in stainless steel prices. Key demand sectors exhibited slower growth due to weaker global demand and inflation squeezing margins. On the supply side, raw material input costs softened somewhat, helping to moderate cost pressures, but freight and port handling costs remained volatile, especially for imports from supplier hubs. Domestic transportation and energy remain significant cost components for many Southeast Asian producers. Customs, tariffs, and trade policy, especially import duties on finished stainless steel or semi-finished products affected landed cost. Additionally, currency depreciation in some countries increased import input costs. Inventory accumulation in prior quarters led some suppliers to discount to maintain cash flow.

North America: Stainless steel prices in North America recorded a decline. The downward movement was largely attributed to muted demand from the construction and automotive sectors, where order volumes slowed amid cautious inventory management. On the supply side, stable production levels from US mills and steady import inflows maintained adequate availability, adding pressure to sellers. Feedstock costs for nickel and chromium showed limited support as global benchmark prices eased, while lower energy and logistics costs further softened overall pricing. Currency stability of the US dollar against key trading partners reduced import volatility but also limited upward momentum. Overall, the North American stainless steel market reflected subdued end-user demand and oversupply conditions, leading to a steady price correction.

Stainless Steel Price Trend, Market Analysis, and News

IMARC's latest publication, “Stainless Steel Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the stainless steel market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of stainless steel at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed stainless steel prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting stainless steel pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

.webp)

Stainless Steel Industry Analysis

The global stainless steel industry size reached USD 171.94 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 266.39 Billion, at a projected CAGR of 4.98% during 2026-2034. The market is driven by increasing demand across construction, automotive, consumer goods, and energy applications, supported by stainless steel’s durability, corrosion resistance, and recyclability.

Latest developments in the stainless steel industry:

- September 2025: Jindal Steel International submitted a non-binding offer to acquire Thyssenkrupp Steel Europe (TKSE). The proposal included over EUR 2 billion in investment directed at expanding electric-arc furnace capacity, preserving production in Germany, advancing green steel initiatives, and taking on pension liabilities.

- June 2025: Nippon Steel completed its USD 14.9 billion acquisition of US Steel. The deal included commitments for about USD 11 billion in investment into US operations by 2028, including funding for a new mill.

- May 2024: Jindal Stainless announced a strategic investment of INR 5,400 crores to enhance its melting and downstream capacities. The plan encompassed a joint venture in Indonesia for a 1.2 MTPA melt shop, expansion in Jajpur, and acquiring a 54% stake in Chromeni Steels; these moves were aimed to increase melting capacity by over 40% to 4.2 MTPA & improve product mix and sustainability.

- February 2024: Acerinox, via its wholly owned US subsidiary North American Stainless (NAS), entered into a definitive agreement to acquire Haynes International, a US manufacturer of high-performance alloys. The acquisition was an all-cash transaction and signals Acerinox’s push to strengthen its product portfolio in technologically advanced stainless steel & alloy grades.

Product Description

Stainless steel is an iron-based alloy containing a minimum of 10.5% chromium, which provides its signature corrosion resistance. Depending on composition, it may also include nickel, molybdenum, and other alloying elements to enhance strength, formability, and resistance to oxidation. Stainless steel is available in several grades, including austenitic, ferritic, martensitic, and duplex, each offering specific performance benefits. It is widely used in construction for structural components, in automotive manufacturing for exhaust systems and body parts, in consumer goods for appliances and kitchenware, and in energy infrastructure for pipelines and equipment. Its ability to withstand harsh environments, coupled with high recyclability, makes it indispensable in both industrial and consumer applications. The balance of strength, durability, and aesthetic appeal continues to drive its adoption worldwide.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Stainless Steel |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Stainless Steel Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of stainless steel pricing, covering global and regional trends, spot prices at key ports, and a breakdown of ex-works, FOB, and CIF prices.

- The study examines factors affecting stainless steel price trend, including supply-demand shifts and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The stainless steel price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The stainless steel prices in January 2026 were 1.75 USD/Kg in Northeast Asia, 3.16 USD/Kg in Europe, 2.47 USD/Kg in India, 2.73 USD/Kg in the Middle East, 2.62 USD/Kg in Southeast Asia, and 2.92 USD/Kg in North America.

The stainless steel pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for stainless steel prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)