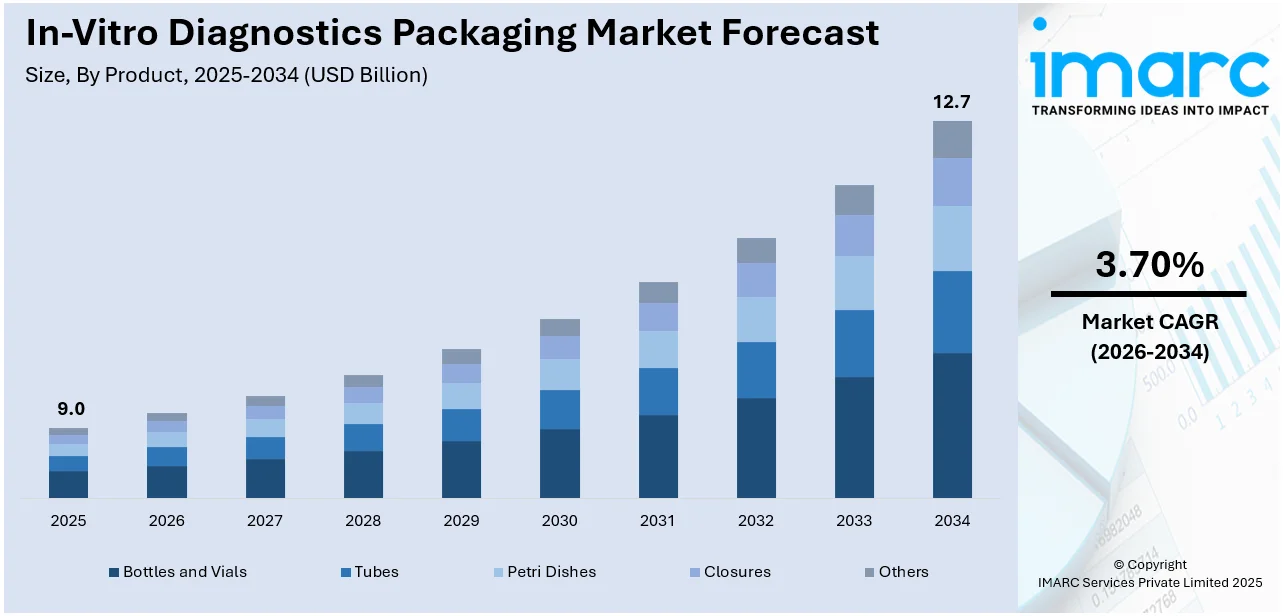

In-Vitro Diagnostics Packaging Market Report by Product (Bottles and Vials, Tubes, Petri Dishes, Closures, and Others), Application (Diabetes, Infectious Diseases, Cardiology, Autoimmune Diseases, Oncology, Drug Testing, and Others), and Region 2026-2034

In-Vitro Diagnostics Packaging Market Size:

The global in-vitro diagnostics packaging market size reached USD 9.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 12.7 Billion by 2034, exhibiting a growth rate (CAGR) of 3.70% during 2026-2034. The rising prevalence of various chronic diseases, such as cancer, diabetes, and autoimmune disorders, increasing focus on enhanced patient safety, and the escalating demand for home healthcare and self-testing solutions is impelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 9.0 Billion |

|

Market Forecast in 2034

|

USD 12.7 Billion |

| Market Growth Rate 2026-2034 | 3.70% |

In-Vitro Diagnostics Packaging Market Analysis:

- Major Market Drivers: Stringent regulatory compliance, coupled with advancements in diagnostic techniques, is impelling the market growth.

- Key Market Trends: The rising prevalence of various chronic diseases and increasing focus on patient safety are latest industry trends.

- Geographical Trends: North America dominates the market share, on account of the expanding manufacturing facilities. The Asia Pacific region stands as another key region in the market due to rising demand for in-vitro diagnostics tests among patients.

- Competitive Landscape: Key players in the market are investing in capacity expansion to generate increased market revenue. They are also introducing in-vitro diagnostics with compact packaging solutions.

- Challenges and Opportunities in the Market: While the market faces challenges, such as maintaining compliance with regulatory standards, it also meets opportunities due to the increasing need for eco-friendly packaging materials and designs.

To get more information on this market Request Sample

In-Vitro Diagnostics Packaging Market Trends:

Growing Prevalence of Chronic Diseases

There were around 608,570 cancer deaths in the United States in 2021 according to the American Cancer Society. The increasing incidence of various chronic diseases, such as cancer, diabetes, and autoimmune disorders, is catalyzing the demand for in-vitro diagnostic tests among patients. People are suffering from these diseases due to changing sedentary lifestyle, poor eating habits, and lack of physical routine. Additionally, there is a rise in the need for in-vitro diagnostics products among the geriatric population, as they are more prone to severe diseases, thereby impelling the growth of the market. Furthermore, the growing demand for efficient and secure packaging solutions to ensure the security and safety of in-vitro diagnostic devices is offering a positive in-vitro diagnostics packaging market outlook across the globe.

Rising Need for Patient Safety and Convenience

In-vitro diagnostics packaging is vital to ensure the safe storage, transportation, and handling of in-vitro diagnostic devices or products. It prevents the spread of harmful germs and creates a safer environment for individuals. Packaging, including vials, has minimal interaction between the sample and the vial and prevents high-viscosity fluids from interlinking. Moreover, there is an increase in the focus on enhancing patient safety while providing convenience in healthcare delivery. In addition, the rising need to improve patient outcomes, along with enhancing healthcare expenditure worldwide, is supporting the in-vitro diagnostics packaging market growth. Furthermore, pharmaceutical packaging solutions companies are aiming to provide enhanced safety to individuals. SGD Pharma launched a new range of Type I tubular vials on 5 February 2024, featuring Velocity Vial coating technology of Corning company. The product assists in accelerating pharmaceutical filling-line productivity and enhances the global delivery of injectable treatments while providing improved patient safety.

Increasing Focus on Home Healthcare and Self-Testing

The escalating demand for user-friendly and tamper-evident packaging solutions due to rising home healthcare and self-testing devices is impelling the market growth. People are increasingly seeking packaging solutions that are lightweight, easy to carry, and compact. Packaging products provide chemical resistance, enhanced durability, transparency, and affordability. Moreover, the increasing employment of in-vitro diagnostics devices or kits that are used in home care settings is catalyzing the demand for in-vitro diagnostics packaging solutions. Apart from this, numerous major companies are focusing on launching in-vitro diagnostics kits that are easy to use by individuals at their homes. For instance, NeoDx Biotech Labs introduced a real-time polymerase chain reaction (PCR)-technology-based in-vitro diagnostic kit on 23 September 2023 for identifying autoimmune disorders among individuals.

In-Vitro Diagnostics Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2026-2034. Our report has categorized the market based on product and application.

Breakup by Product:

- Bottles and Vials

- Tubes

- Petri Dishes

- Closures

- Others

Bottles and vials hold the biggest market share

The in-vitro diagnostics packaging market report has provided a detailed breakup and analysis of the market based on the product. This includes bottles and vials, tubes, petri dishes, closures, and others. According to the report, bottles and vials represented the largest segment in the in-vitro diagnostics packaging market.

Bottles and vials are containers that are used for storing several diagnostic solutions. They are generally made from different materials, such as glass, high-quality plastics, and silicone. They provide a secure environment for sensitive substances, reduce the risks of contamination and microbes, and maintain the integrity of the contents to ensure accurate test results. They also protect the diagnostic content from ultraviolet (UV) lighting, moisture, and dust. Besides this, they assist in reducing damage while transporting from one place to another and increase the shelf life of products. In addition, there is an increase in the need for eco-friendly packaging solutions that reduces carbon footprint in the environment. Furthermore, the rising adoption of bottles and vials as an in-vitro diagnostics packaging solutions, as they minimize the chances of errors in diagnostic results and are non-reactive, is bolstering the market growth. On 13 July 2023, Corning Incorporated unveiled its Corning® Viridian™ Vials, to expand the company’s pharmaceutical glass-packaging product-line. These Vials can lower vial-manufacturing carbon-dioxide-equivalent (CO2e) emissions by up to 30% and improve filling-line efficiency by around 50%. These vials are also manufactured by utilizing 100% renewable energy, which aligns with sustainability goals.

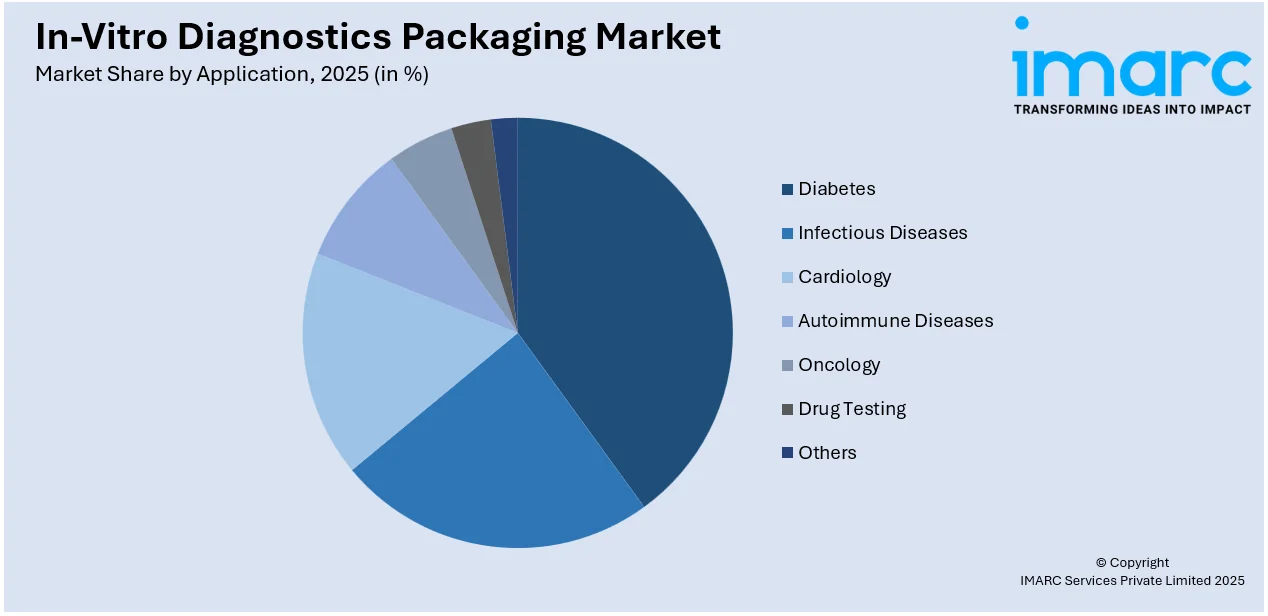

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Diabetes

- Infectious Diseases

- Cardiology

- Autoimmune Diseases

- Oncology

- Drug Testing

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes diabetes, infectious diseases, cardiology, autoimmune diseases, oncology, drug testing, and others.

Diabetes is a chronic disease that occurs when the blood glucose in the body is excessive. They comprise type 1 diabetes, type 2 diabetes, prediabetes, and gestational diabetes. There is a rise in the prevalence of diabetes due to shift in dietary preferences, changing living standards, and lack of physical exercise among individuals. Additionally, people are adopting effective and portable diabetes management solutions. They are also preferring packaging solutions that allow them to test their glucose levels conveniently and on-the-go without any hassle.

Infectious diseases are caused by bacteria, viruses, fungi, or parasites. They can cause common cold, fever, whooping cough, thrush, athlete’s feet, and urinary tract infections (UTIs) among individuals. Moreover, packaging materials protect diagnostic antibodies and antigens from light, moisture, and temperature fluctuations. The rising demand for effective packaging solutions that provide accurate and error-free healthcare results is impelling the market growth.

The increasing adoption packaging solutions in cardiology applications for preserving or collecting blood specimens from patients suffering from various cardiovascular conditions, such as chronic heart disease, stroke, and peripheral arterial disease. Moreover, tubes and vials packaging benefit in maintaining the integrity of the blood samples during transportation.

Autoimmune diseases are the result of the immune system accidentally attacking the body of an individual rather than protecting it. They comprise psoriatic arthritis, rheumatoid arthritis (RA), Crohn’s disease, celiac disease, and psoriasis. Besides this, packaging for autoimmune disease testing products includes quality control materials and solutions. These materials are packaged to maintain stability and integrity and allow healthcare facilities or laboratories to perform routine quality control checks.

The growing demand for packaging solutions in oncology applications due to the rising number of cancer cases among the masses around the world is positively influencing the market. Tubes, vials, and slides are widely used for collecting or preserving blood, tissue, and body fluids, from patients suffering from cancer. These packaging solutions assist in providing enhanced patient care and safety.

In-vitro diagnostics play a crucial role in drug testing by enabling the accurate and reliable detection of drugs and their metabolites in biological specimens. Laboratory-based drug testing involves complex assays and instrumentation for analyzing biological specimens.

Breakup by Region:

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- Latin America

North America dominates the market, accounting for the largest in-vitro diagnostics packaging market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. According to the report, North America represents the largest regional market for in-vitro diagnostics packaging.

Various companies are aiming to expand their market reach by opening infrastructure facilities in the North America region. On 12 March 2024, Bormioli Pharma, an international manufacturer of pharmaceutical packaging and medical devices, announced an increase of 47% in its North American sales for 2023. This growth is a result of the evolving infrastructure and expanded capacity of the company that is tailored to meet the demands of the North American pharmaceutical market, including an increased need for pharmaceutical glass vials. In addition, the rising demand for point-of-care testing (POCT) devices among patients is supporting the market growth. Besides this, stringent regulatory standards related to the packaging of medical devices are contributing to the market growth in the North America region.

Competitive Landscape:

- The global in-vitro diagnostics packaging industry report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

- Key players in the in-vitro diagnostics packaging market research are investing in capacity expansion to generate increased in-vitro diagnostics packaging market revenue. On 26 January 2024, SGD Pharma, a leading provider of molded glass primary packaging solutions for the pharmaceutical sector, unveiled a new siliconization operation at its Saint-Quentin Lamotte (SQLM) plant in France. The company enhances its range of in-house services by adopting its glass siliconization, ensuring improved flexibility of vial sizes. Besides this, major manufacturers are also focusing on launching advanced in-vitro diagnostics solutions that offer enhanced customizable options in devices while providing improved efficiency. For example, Thermo Fisher Scientific launched the Applied Biosystems QuantStudio 5 Dx real-time PCR system for in-vitro diagnostic use on 25 March 2021. The product offers flexibility of customizable solutions and high-quality data output for molecular diagnostic testing. It provides results in about 30 minutes and is available in compact packaging that allows it to fit in any laboratory setting.

In-Vitro Diagnostics Packaging Market News:

- 11 December 2023: Thermo Fisher Scientific Inc launched the KingFisher™ Apex™ Dx, an automated nucleic acid purification instrument, and Applied Biosystems™ MagMAX™ Dx Viral or Pathogen NA Isolation Kit for the isolation and purification of viral and bacterial pathogens from respiratory biological specimens. The MagMAX Dx Viral/Pathogen NA Isolation Kit benefit laboratories meet greener policies with REACH-compliant components and ethically sourced packaging.

- 12 May 2021: Amcor introduced its patented Dessiflex® packaging technology that protects in-vitro diagnostics (IVD) and point-of-care (POC) test devices by incorporating the desiccant into the sealant layer of the packaging and eliminating the need for additional moisture.

- 25 May 2021: Stevanato Group unveiled a licensing agreement with Corning Incorporated to offer a combined solution to provide biopharmaceutical companies with improved levels of protection for injectable drugs. Corning Valor® RTU Vials with SG EZ-fill® technology benefit in offering the industry the unique combination of Corning Valor® Glass vial attributes with SG EZ-fill® integration and packaging advantages.

In-Vitro Diagnostics Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bottles and Vials, Tubes, Petri Dishes, Closures, Others |

| Applications Covered | Diabetes, Infectious Diseases, Cardiology, Autoimmune Diseases, Oncology, Drug Testing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the in-vitro diagnostics packaging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global in-vitro diagnostics packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the in-vitro diagnostics packaging industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The in-vitro diagnostics packaging market was valued at USD 9.0 Billion in 2025.

The in-vitro diagnostics packaging market is projected to exhibit a CAGR of 3.70% during 2026-2034, reaching a value of USD 12.7 Billion by 2034.

The in-vitro diagnostics packaging market is driven by the need for safe, contamination-free packaging to protect sensitive diagnostic tools and reagents. Growing demand for personalized medicine, rapid testing solutions, and technological advancements in diagnostic procedures also encourage the development of innovative, durable, and reliable packaging materials and designs.

North America dominates the in-vitro diagnostics packaging market due to its advanced healthcare infrastructure, strong presence of leading diagnostic companies, and high demand for innovative medical technologies. The region’s focus on research, development, and adoption of personalized medicine further drives the need for specialized, high-quality diagnostic packaging solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)