Data Center Colocation Market Size, Share, and Trends by Type, Organization Size, End Use Industry, Region, and Forecast 2025-2033

Data Center Colocation Market Size and Share:

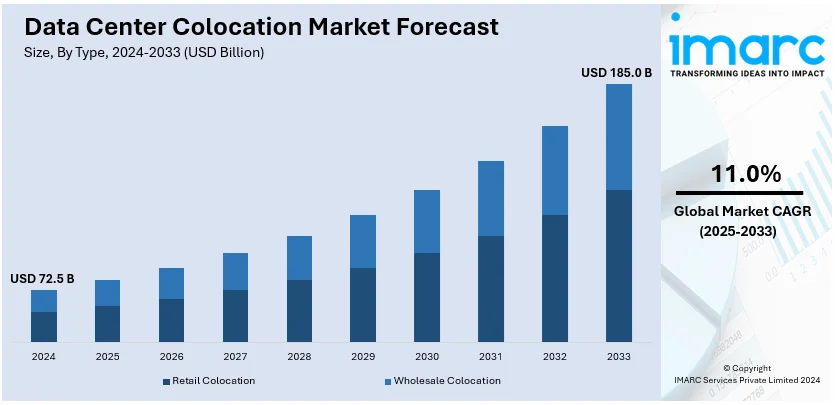

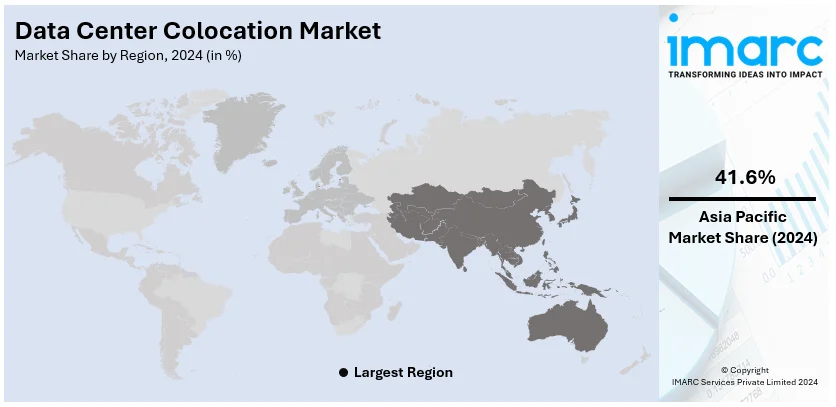

The global data center colocation market size was valued at USD 72.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 185.0 Billion by 2033, exhibiting a CAGR of 11.0% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 41% in 2024. The market is growing owing to the implementation of supportive regulatory frameworks, growing internet and cloud usage, and increasing focus digitization across the region. The market in North America is also expanding at a rapid pace due to advanced technology infrastructure, extensive regulatory framework, and significant number of colocation service providers and users.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 72.5 Billion |

|

Market Forecast in 2033

|

USD 185.0 Billion |

| Market Growth Rate (2025-2033) | 11.0% |

The exponential growth in data generated by businesses, the Internet of Things (IoT) devices, and cloud applications is driving demand for scalable and secure colocation facilities. Organizations require reliable infrastructure to store, manage, and analyze large volumes of data. In addition, there is an increase in the need for colocation, as it reduces the capital expenditure associated with building and maintaining private data centers. It offers predictable operational costs and access to advanced infrastructure without the need for large upfront investments. Furthermore, there is a rise of edge computing, driven by latency-sensitive applications like IoT, fifth generation (5G), and artificial intelligence (AI), which is stimulating the data center colocation market growth.

The United States data center colocation market is driven by the country’s status as a leading hub for digital transformation, cloud adoption, and technological innovation. The US is one of the largest and fastest-growing markets for data center colocation, with significant investments from global colocation providers and enterprises. In addition, the rising utilization of cloud services, streaming platforms, and IoT devices is catalyzing the demand for scalable colocation solutions. Businesses in the country are adopting hybrid and multi-cloud strategies, leveraging colocation for direct cloud connectivity. Besides this, the rollout of fifth generation (5G) networks and edge computing applications is leading to investments in colocation facilities closer to end-users to reduce latency.

Data Center Colocation Market Trends:

Rapid digitization across industries

The global digital transformation market reached USD 809.1 Billion in 2024, as claimed by the IMARC Group. The global market is growing due to the shift to rapid digitalization and the demand for improved information technology (IT) services in different sectors. The rising reliance on the Internet of Things (IoT) devices, along with the high consumption of digital content, are catalyzing the demand for data center colocation. For example, on an average, U.S. consumers pay around $61 per month for video streaming services. Additionally, 68% of people in the US pay for a TV subscription or live-streaming TV to gain access to content that is not offered on streaming video platforms. Besides this, data center colocations are becoming a popular choice for businesses wanting to expand their IT infrastructure without the high costs of building and running their data centers. This necessity is especially prominent in industries, such as financial services, healthcare, and online retail, where data plays a crucial role in their day-to-day functions.

Energy efficiency and sustainability concerns

Data centers are recognized for their significant energy use, and they are transitioning to eco-friendly measures. Colocation centers are at the forefront of this transition by using energy-saving cooling systems, integrating renewable energy sources, and constructing facilities that lower carbon emissions. This change addresses both the growing need for green practices from individuals and regulatory bodies, as well as providing long-term financial advantages in operations. According to the International Energy Agency (IEA), data centers are also responsible for around 1% of global electricity consumption. As a result, there is increase in the pressure for data centers to adopt energy-efficient technologies and renewable energy sources to reduce their environmental footprint. Moreover, the data center colocation market outlook indicates that an increasing number of companies are choosing colocation services that show a strong commitment to sustainability, seeing it as both a moral duty and a competitive advantage in the market. Colocation providers are gaining more clients and creating a positive market outlook by investing in renewable energy and highly efficient infrastructures.

Increasing demand for hybrid cloud solutions

Hybrid cloud solutions play a major role in boosting the data center colocation market share. Companies are more interested in the flexibility provided by hybrid clouds, enabling them to adapt their IT infrastructure to changing needs. Colocations facilitate companies in seamlessly integrating their cloud operations by providing sufficient bandwidth, reliability, and security. This setup is especially beneficial for companies handling large amounts of private information or requiring significant computing resources. As more companies prioritize digital transformation, the need for colocation services that support hybrid clouds is increasing. For instance, on December 2023, Lenovo announced that it widened its hybrid cloud platform for artificial intelligence (AI) by introducing new ThinkAgile hyperconverged solutions as well as ThinkSystem servers that enhance cloud deployment, hybrid connectivity, and AI capabilities, all powered by the latest Intel Xeon Scalable Processors. Around 90% of enterprises are already using some form of cloud services.

Data Center Colocation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global data center colocation market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, organization size, end use industry, and region.

Analysis by Type:

- Retail Colocation

- Wholesale Colocation

The retail colocation type stands as the largest type in 2024, holding around 60% of the market. Retail colocation caters to the needs of small to medium-sized businesses (SMBs) owing to its accessibility and scalability. SMBs are opting for this type in order to enhance their IT infrastructure. This colocation model allows businesses to rent space for their servers and computing hardware within a shared data center, offering the crucial benefits of physical security, power, cooling, and networking connectivity essential for their operations. It is an attractive option for companies seeking a cost-effective alternative. In addition, the flexibility to scale operations as necessary, combined with the perks of superior connectivity and managed services, keeps retail colocation in high demand among SMBs.

Analysis by Organization Size:

- Small and Medium Enterprises

- Large Enterprises

Large enterprises lead the industry with around 63% of the data center colocation market share in 2024. Large enterprises form the most significant portion of the market by organization size, driven largely by their extensive requirements for IT infrastructure, data security, compliance, and business continuity. The need for vast spaces and considerable power to accommodate their large server farms and are positioning these organizations ideal for colocation services. Apart from this, the opportunity for large organizations to utilize advanced technologies and services offered by colocation providers allows them to concentrate their resources on core business functions. Furthermore, large enterprises face stringent regulatory requirements, and colocation facilities are often equipped to handle these compliance needs with secure and certified environments. Large enterprises leverage colocation services to reduce capital expenditures and operational costs.

Analysis by End Use Industry:

- BFSI

- Manufacturing

- IT and Telecom

- Energy

- Healthcare

- Government

- Retail

- Education

- Entertainment and Media

- Others

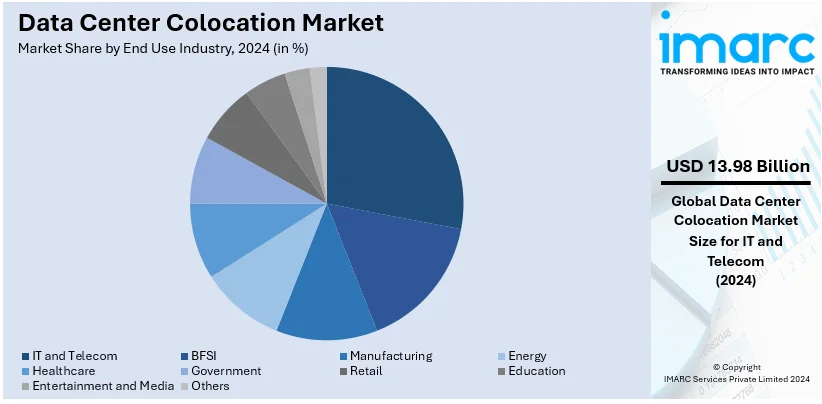

IT and telecom lead the market with around 19% of market share in 2024. The sector is mainly driven by the constant need for data storage, processing power, and fast and dependable connectivity to support a range of services such as cloud computing, mobile broadband, VoIP, and different streaming options. Colocation centers offer IT and telecom companies the ability to ensure reliability and maintain security for delivering uninterrupted services across the globe. In line with this, these sectors have the opportunity to connect through a wide range of connectivity choices and interact within a diverse environment that includes network, cloud, and content providers. Besides this, colocation providers help IT and telecom companies comply with data sovereignty and security regulations in various regions.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific represented the largest regional market, accounting for the largest market share of over 41%. During H1 2024, the Asia Pacific data center market's operational capacity was close to 12GW. The market for data center colocation is expanding significantly in the Asia Pacific region due to factors like the growing internet and cloud usage as well as rapid digitization. The region's top nations include China, India, and Japan, as governing bodies and businesses are making significant investments in IT infrastructure. The growth of over the top (OTT) platforms, e-commerce, and fintech enterprises is driving the region's data center colocation industry. The need for edge data centers to lower latency and improve user experiences is growing as 5G and IoT technologies are being adopted more widely. Government programs like China's New Infrastructure Plan and India's Digital India are also encouraging data center investments, which presents colocation operators with a number of opportunities. Moody's rating projects that APAC data center capacity is expected to increase at a CAGR of 20% through 2028, requiring $564 billion in investments.

Key Regional Takeaways:

North America Data Center Colocation Market Analysis

The market in North America is being driven by its advanced technology infrastructure, extensive regulatory framework, and significant number of colocation service providers and users. In addition, various top tech companies in the region require reliable, top-notch, and expandable data center solutions for their large digital activities. Apart from this, the increasing use of cloud computing, the Internet of Things (IoT) devices, and big data analytics by companies in North America is propelling the data center colocation market growth. Furthermore, the thriving IT and telecommunications industries, along with strict focus on cybersecurity and data privacy legislation, are catalyzing the demand for secure colocation services in the region, especially in the US.

United States Data Center Colocation Market Analysis

The United States accounted for around 89% market share in 2023. Rapid cloud service adoption, data expansion, and high demand for scalable IT infrastructure are major drivers of the market. According to estimates by JLL, the US currently has 12GW of colocation data center capacity, which is double when compared with the data of 2020 (6GW). Nearly half of this growth is attributable to Northern Virginia, which remains the largest US market. Austin, Texas; Salt Lake City, Utah; Atlanta, Georgia; and Las Vegas, Nevada are among the markets with rapid growth rate. As colocation facilities offer improved scalability, security, and reliability while lowering capital costs associated with constructing in-house data centers, businesses are increasingly choosing them. Moreover, there is a rise in the need for colocation services to manage mission-critical workloads and adhere to strict regulatory standards like HIPAA and PCI DSS. There is an increase in the demand for flexible colocation services because of the growing use of hybrid IT strategies. With the presence of tech behemoths like Google, Amazon, and Microsoft and a vast network of colocation providers like Equinix and Digital Realty, the US will hold more than 40% of the worldwide data center colocation market by 2024.

Europe Data Center Colocation Market Analysis

Cloud adoption, digital transformation, and stringent data protection laws are boosting the European data center colocation market growth. Owing to their strategic positions and developed infrastructure, nations like the Netherlands, Germany, and the United Kingdom are making significant contributions. With many facilities utilizing renewable energy sources to support the region's commitment to carbon neutrality, colocation providers in Europe are placing an increasing emphasis on sustainability. Additionally, colocation facilities are also used by sectors including manufacturing, e-commerce, and finance to serve applications that need strong security and low latency. According to a research, Europe's data center power usage is predicted to nearly triple by 2030, necessitating modifications to the grid's infrastructure and a significant increase in the supply of electricity.

Latin America Data Center Colocation Market Analysis

The digital transformation, rising cloud usage, and high demand from e-commerce sector is impelling the market growth. The region is seeing a steady increase in the number of data centers. Since 2022, there have been 90 ongoing projects in Latin America and about 30 new data centers constructed or in the planning stages (11 in Brazil and 10 in Chile). A significant portion of the colocation facilities are located in Brazil and Mexico, two important markets. Businesses in the region are depending on colocation services for scalability and cost optimization as a result of the rapidly growing middle class population.

Middle East and Africa Data Center Colocation Market Analysis

The expanding use of cloud services, internet adoption, and rising IT investments are driving the data center colocation market in the Middle East and Africa. Government-led programs like the UAE's Smart Dubai and Saudi Arabia's Vision 2030 are making both countries a dominant marketplace. The emphasis on digital transformation in these programs is increasing the demand for scalable and dependable colocation services. Companies are looking for affordable and secure IT infrastructure to manage growing data loads.

Competitive Landscape:

Companies are enhancing connectivity options within their facilities, enabling clients to directly connect to cloud services, other businesses, and global networks. Key players are investing in edge data centers to support low-latency applications and 5G deployments. Colocation providers are prioritizing energy efficiency and sustainability by transitioning to renewable energy sources. Furthermore, providers are adding managed IT services to their portfolio, enabling clients to offload tasks like server management, disaster recovery, and cybersecurity. They are also increasingly building hyperscale data centers to accommodate growing demand from cloud providers and large enterprises. On 8 July 2024, CyrusOne, a leading global data center owner, developer and operator specializing in delivering state-of-the-art digital infrastructure solutions, secured $9.7 Billion in new debt capital to fund datacenter growth.

The report provides a comprehensive analysis of the competitive landscape in the data center colocation market with detailed profiles of all major companies, including:

- AT&T Inc.

- CenturyLink Inc.

- China Telecom Corporation Limited

- Coresite Realty Corporation

- Cyrusone Inc.

- Cyxtera Technologies Inc.

- Digital Realty Trust Inc.

- Equinix Inc.

- Global Switch Limited

- Internap Corporation

- KDDI Corporation

- NTT Communications Corporation (Nippon Telegraph and Telephone Corporation)

- Verizon Enterprise Solutions Inc.

Latest News and Developments:

- On 30 May 2024, Google announced a US$ 2 Billion investment in Malaysia to establish its first data center and Google Cloud region in the country. The Malaysian government views the investment as a step forward in advancing the country's digital goals, with AI and other cutting-edge technologies helping local industries climb the global value chain.

- On 26 April 2024, CoreSite, a notable subsidiary of American Tower Corporation, announced an interesting new partnership with Oxide Computer Company to leverage colocation capabilities at CoreSite's Silicon Valley SV2 data center.

Data Center Colocation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Retail Colocation, Wholesale Colocation |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Use Industries Covered | BFSI, Manufacturing, IT and Telecom, Energy, Healthcare, Government, Retail, Education, Entertainment and Media, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AT&T Inc., CenturyLink Inc., China Telecom Corporation Limited, Coresite Realty Corporation, Cyrusone Inc., Cyxtera Technologies Inc., Digital Realty Trust Inc., Equinix Inc., Global Switch Limited, Internap Corporation, KDDI Corporation, NTT Communications Corporation (Nippon Telegraph and Telephone Corporation), Verizon Enterprise Solutions Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the data center colocation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global data center colocation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the data center colocation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Data center colocation is a service where businesses rent physical space, infrastructure, and sometimes management services in a third-party data center to house their servers, storage, and networking equipment. This setup allows organizations to maintain control over their hardware and data while leveraging the provider's robust infrastructure, security, and connectivity.

The global data center colocation market was valued at USD 72.5 Billion in 2024.

IMARC estimates the global data center colocation market to exhibit a CAGR of 11.0% during 2025-2033.

Rising energy efficiency and sustainability concerns, rapid digitalization across several sectors, the increasing demand for hybrid cloud solutions, and the integration of AI and ML to achieve diverse business goals, are primarily driving factors in the global data center colocation market.

In 2024, retail colocation represented the largest segment by type, driven by the rising need for scalable and cost-effective solutions.

Large enterprises lead the market by organization size owing to their extensive requirements for IT infrastructure, data security, compliance, and business continuity.

The IT and telecom is the leading segment by end use industry, driven by the constant need for data storage, processing power, and fast and dependable connectivity.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global data center colocation market include AT&T Inc., CenturyLink Inc., China Telecom Corporation Limited, Coresite Realty Corporation, Cyrusone Inc., Cyxtera Technologies Inc., Digital Realty Trust Inc., Equinix Inc., Global Switch Limited, Internap Corporation, KDDI Corporation, NTT Communications Corporation (Nippon Telegraph and Telephone Corporation), Verizon Enterprise Solutions Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)