Construction Equipment Market Size, Share, Trends and Forecast by Solution Type, Equipment Type, Type, Application, Industry, and Region, 2026-2034

Construction Equipment Market Size and Share:

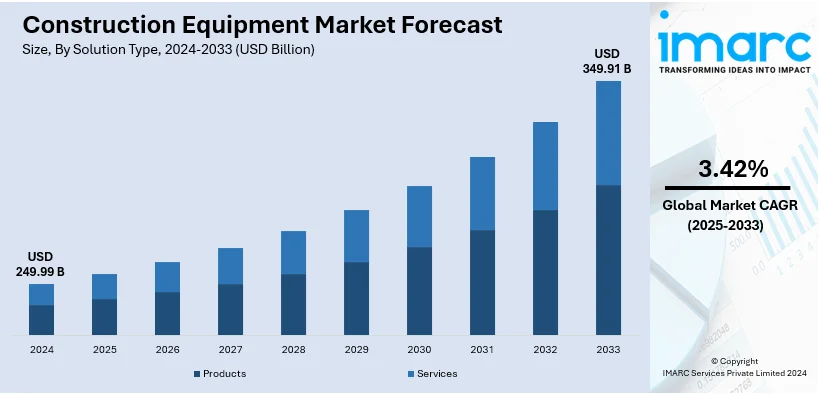

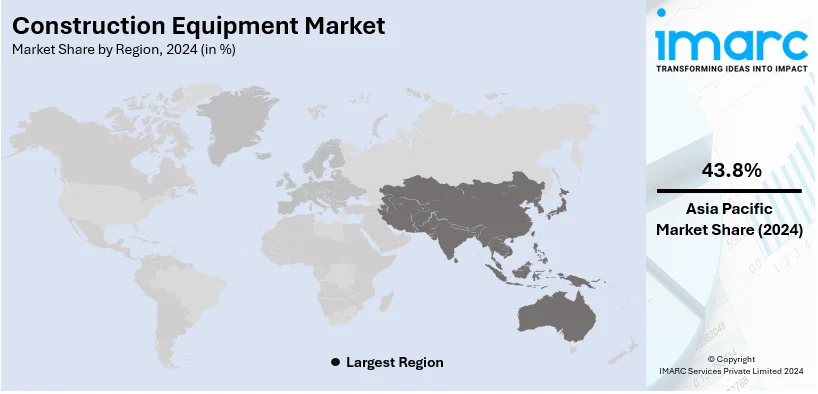

The global construction equipment market size was valued at USD 249.99 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 349.91 Billion by 2034, exhibiting a CAGR of 3.42% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 43.8% in 2024. The market growth is fueled by rapid urbanization, major technological advancements, and a growing emphasis from key players on innovation and sustainability to address the increasing demand for products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 249.99 Billion |

| Market Forecast in 2034 | USD 349.91 Billion |

| Market Growth Rate 2026-2034 | 3.42% |

Government initiatives and investments are crucial drivers of growth in the construction equipment market. In the United States, as of February 2023, over 4,600 bridge projects have been launched, and repairs have commenced on more than 69,000 miles of roads, significantly boosting demand for construction equipment. Public-private partnerships (PPPs) further amplify this demand by leveraging private capital for public infrastructure projects. In 2023, the U.S. saw a surge in PPPs, with numerous large-scale projects initiated across transportation and energy sectors, attracting billions in private investments. Furthermore, countries like Italy have implemented substantial stimulus plans, such as the National Recovery and Resilience Plan, which allocates nearly €200 billion for infrastructure, thereby increasing the demand for construction machinery.

To get more information on this market, Request Sample

The U.S. construction equipment market is emerging as a major disruptor, holding 73.70% of the total share. The U.S. government has initiated substantial investments to upgrade and expand infrastructure. Notably, the Bipartisan Infrastructure Law allocates $1.2 trillion for projects encompassing roads, bridges, and public transit systems. This significant funding is propelling demand for construction machinery across various sectors. Furthermore, the use of telematics, automation, and electrification in these devices is augmenting operational efficiency and lowering environmental impact. Additionally, rapid urbanization and population increases are driving the need for residential and commercial construction, thereby escalating the demand for construction equipment. The U.S. construction sector saw a 12% growth in output in 2024, with spending exceeding $2 trillion.

Construction Equipment Market Trends:

Increasing Infrastructure Development

Infrastructure development is a significant driver of the global construction equipment market. As economies expand and urbanize, the demand for new infrastructure—such as roads, bridges, and airports—escalates, necessitating heavy machinery like excavators, bulldozers, and concrete mixers. Governments and private investors allocate substantial budgets to these projects, further propelling the market. For instance, the World Bank's Transport Global Practice committed approximately USD 24.9 billion to low-carbon and climate-resilient infrastructure solutions through 232 projects since fiscal 2017. This surge in infrastructure projects not only offers immediate opportunities for equipment manufacturers and rental companies but also stimulates related industries, including cement, steel, and construction materials.

Rapid Urbanization

Urbanization is a worldwide phenomenon, as increasing numbers of people migrate to cities in pursuit of better opportunities and enhanced living conditions. According to an industrial report, in China, the urbanization rate reached approximately 66.2% in 2023, up from below 20% in 1980. Projections indicate that by 2050, China will add 255 million urban dwellers, while India will add 416 million. This rapid urbanization propels the demand for commercial and residential and commercial, as well as infrastructure like sewage systems, water supply, and public transportation. Construction equipment plays a pivotal role in shaping modern cities, from high-rise buildings to mass transit systems. The urbanization trend is particularly prominent in emerging economies, where massive construction projects are reshaping city skylines. These countries, such as China and India, represent significant growth markets for construction equipment manufacturers.

Continuous Demand for Replacement Equipment

Several construction machines have a limited service, and as they age, maintenance expenses increase, and efficiency declines. Construction equipment, on average, serve efficiently for 10 to 15 years. This creates a continuous demand for replacement equipment. For example, in August 2024, Kobelco Construction Equipment India Pvt Ltd launched the SK80 Excavator under India's 'Make in India' initiative, highlighting enhanced fuel efficiency and cutting-edge features. As construction firms strive to boost productivity and comply with emission regulations, they are increasingly investing in newer, more technologically advanced machinery.

Technological advancements, such as fuel-efficient engines, better hydraulics, and telematics systems for predictive maintenance, are key drivers of replacement demand. Equipment manufacturers often introduce updated models with improved features, enticing consumers to upgrade their fleets.

Stringent Environmental Regulations

Environmental regulations and concerns are shaping the construction equipment market. Governments worldwide are imposing stricter emissions standards, pushing the industry toward more sustainable solutions. This has driven the creation of electric and hybrid construction machinery, resulting in lower emissions and operational expenses. For example, the U.S. Environmental Protection Agency (EPA) has set strict emission regulations for nonroad diesel engines, including those used in construction equipment, with the goal of minimizing pollutants like nitrogen oxides (NOx) and particulate matter (PM). Major manufacturers are investing in environmentally friendly equipment to comply with regulations and enhance public perception. For example, Volvo Construction Equipment and Liebherr are focusing on electric and hybrid machinery to align with strict EU emissions regulations. The European Green Deal has spurred innovation, with USD 1.04 Billion invested in research and development for sustainable construction technologies in 2023. In addition to emissions, regulations related to noise pollution, fuel efficiency, and safety also influence the design and adoption of construction equipment. Companies that invest in environmentally friendly equipment can benefit from reduced operating costs and improved public perception.

Rapid Technological Advancements

Technological advancements continue to propel the growth of the construction equipment market. The adoption of digital technologies, including GPS and IoT sensors, and AI, has enhanced equipment efficiency, safety, and maintenance. Telematics systems allow operators to monitor machine performance remotely, enabling predictive maintenance and reducing downtime. Automation is another key trend, with the development of autonomous construction vehicles and robotic systems for tasks like bricklaying and concrete pouring. For instance, Komatsu's autonomous dump trucks in mining operations have improved efficiency by 20%. These advancements improve productivity and also address labor shortages in the construction industry.

Construction Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global construction equipment market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on solution type, equipment type, type, application, and industry.

Analysis by Solution Type:

- Products

- Services

The products segment of the construction equipment market includes a variety of heavy machinery and equipment utilized for different construction activities. These include excavators, bulldozers, loaders, cranes, concrete mixers, and many others. They are used for earthmoving, material handling, and other concrete construction activities. Excavators are multi-functional, used to dig and construct trenches, for excavating and foundations. A bulldozer does all things related to shoveling, namely heavy bulldozing and ground or site preparation by smoothing off. The loader digs earth away and feeds it on belts running down their length; the cranes elevate heavy objects to higher altitude. A concrete mixer just mixes the right amount, at the right consistency.

Analysis by Equipment Type:

- Heavy Construction Equipment

- Compact Construction Equipment

Heavy construction equipment encompasses a wide range of machinery designed for heavy-duty tasks in large-scale construction projects. This segment includes equipment such as excavators, bulldozers, cranes, loaders, and dump trucks. These machines are characterized by their size, power, and capacity, making them essential for tasks such as, earthmoving, excavation, and material handling in major infrastructure projects. The heavy construction equipment segment is a substantial part of the market due to the critical role it plays in projects such as, highway construction, skyscraper development, and mining operations. Governments and private sector investors heavily rely on this equipment to complete large-scale projects efficiently.

Analysis by Type:

- Loader

- Cranes

- Forklift

- Excavator

- Dozers

- Others

Loaders are versatile construction machines used for material handling and earthmoving tasks. They are commonly employed in construction, mining, agriculture, and landscaping projects. Loaders come in various sizes and configurations, such as wheel loaders and skid steer loaders. These machines are known for their efficiency in loading materials such as dirt, gravel, and debris. Their popularity stems from their adaptability to different applications and the ability to work in a wide range of terrains.

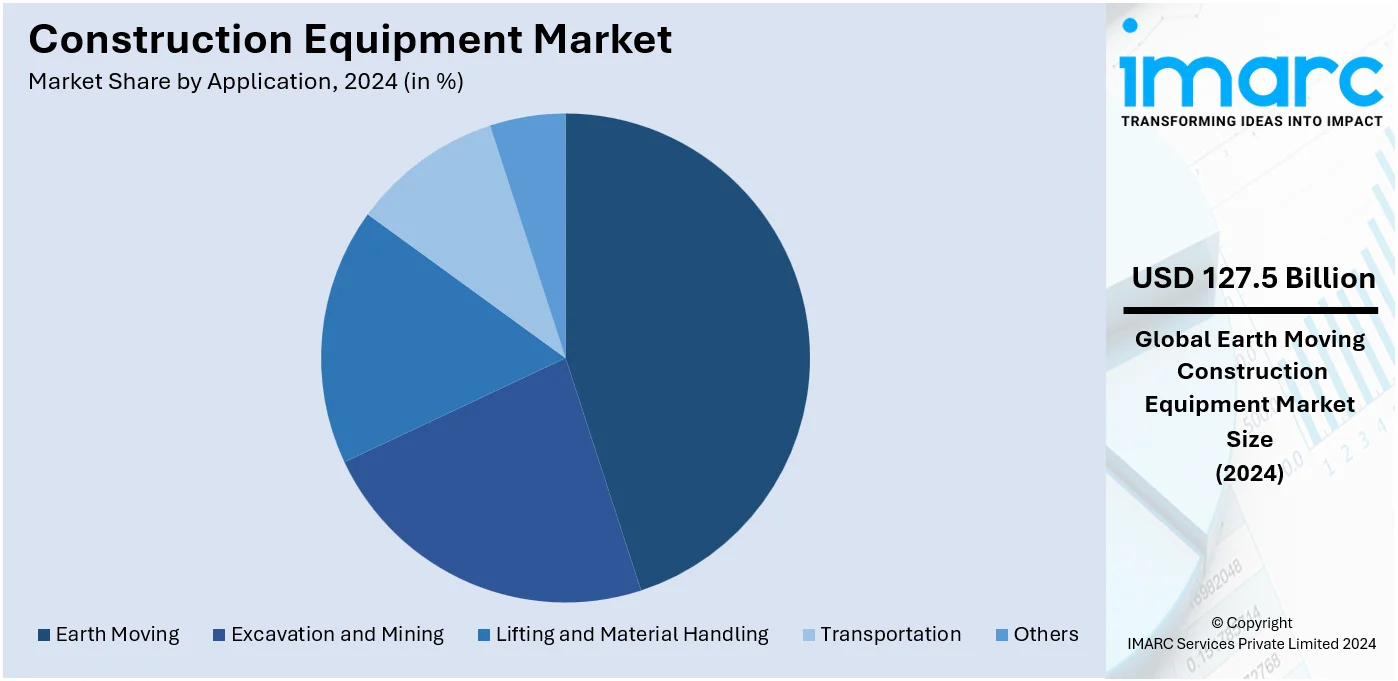

Analysis by Application:

- Excavation and Mining

- Lifting and Material Handling

- Earth Moving

- Transportation

- Others

Earth moving equipment represents a significant segment of the construction equipment market. This category includes machines such as bulldozers, excavators, backhoes, and loaders, designed primarily for tasks involving moving earth and other materials. Earthmoving equipment is essential for various construction projects, from digging foundations for buildings to creating trenches for utilities. These machines are valued for their versatility and are utilized in both urban and rural environments. The demand for earthmoving equipment is strongly linked to infrastructure development, road construction, and land grading projects.

Analysis by Industry:

- Oil and Gas

- Construction and Infrastructure

- Manufacturing

- Mining

- Others

The construction and infrastructure sector plays a key role in driving the global construction equipment market.. This segment encompasses a wide range of projects, including residential and commercial buildings, roads, bridges, airports, and utilities. The demand for construction equipment in this industry is primarily driven by population growth, urbanization, and government investments in infrastructure development. Excavators, bulldozers, cranes, and concrete mixers are essential equipment in this sector. Emerging economies, with rapid urbanization and a need for modern infrastructure, represent moderate growth markets for construction equipment manufacturers.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 43.8%. The Asia Pacific region dominates the global construction equipment market. Rapid urbanization, population growth, and infrastructure development in countries such as, China and India have fueled substantial demand for construction machinery. These nations invest heavily in building roads, bridges, airports, and urban infrastructure, driving the need for excavators, cranes, and concrete equipment. Moreover, the growth of the region is fueled by emerging markets in Southeast Asia. Asia Pacific is also witnessing the adoption of technologically advanced equipment, including electric and hybrid machinery, to address environmental concerns.

Key Regional Takeaways:

North America Construction Equipment Market Analysis

The construction equipment market in North America is experiencing robust growth driven by significant infrastructure investments, technological advancements, and urban expansion. Technological integration, such as the adoption of GPS-enabled machinery, telematics, and automation, has improved the efficiency and safety of construction operations. The shift toward electric and hybrid construction equipment, driven by stringent emission norms and government incentives, is also reshaping the market landscape. Urbanization trends and population growth are creating a surge in residential and commercial construction projects, particularly in metropolitan areas. Additionally, the rise in mining activities, particularly in Canada, has led to increased demand for heavy-duty machinery. Rental services have also gained traction, providing cost-effective solutions for small- and medium-scale contractors.

United States Construction Equipment Market Analysis

Large infrastructure investments and advanced technologies in the U.S. help the construction equipment market. According to the U.S. Census Bureau, the construction spending in the U.S. reached USD 1.97 Trillion in 2023, supporting the demand for equipment. Federal initiatives such as the USD 1.2 Trillion Infrastructure Investment and Jobs Act support machinery purchases for projects in transportation, energy, and broadband. Key producers include Caterpillar and Deere & Company, which capitalize on the domestic market to manufacture modern excavators, loaders, and paving equipment. According to an industrial report, demand in 2023 rose 12% for electric construction equipment within the U.S. boundaries in response to sustainability measures. Exports continue at strong levels, with USD 12 Billion in sales of U.S. origin construction machinery. The drive in the U.S. to keep its construction industry modernized and green will ensure continued, strong demand while federal tax incentives related to energy-efficient construction aid new products. With heavy investment in smart technologies such as telematics, the U.S. leads by integrating AI and IoT solutions into the construction equipment.

Europe Construction Equipment Market Analysis

Europe's construction equipment market is growing with great force on account of its robust urbanization and green energy policies. According to the European Construction Industry Federation, the amount of investment in construction activities in Europe has reached about USD 1.9 Trillion by 2023. Germany, France, and Italy dominate the market through renovation and smart city development projects. As per an industrial report, in Germany, it has already earmarked about USD 52.5 Billion for 2023 towards upgrading green infrastructure. Demand for compact construction machinery jumped 18% in 2023 as urban projects increasingly look for space-efficient equipment. The big players, such as Volvo CE and Liebherr, are now emphasizing electric and hybrid machinery, as the EU has set strict emissions regulations. The European Green Deal is an innovation platform that invests USD 1 Billion in R&D on sustainable construction technologies in 2023. Rental services are growing by 20% in rental revenues because smaller contractors are seeking cost-effective solutions. Modernization in Europe ensures that the continent will remain a critical market for high-tech construction equipment.

Asia Pacific Construction Equipment Market Analysis

Asia Pacific construction equipment is growing fast, especially because of the urbanization process and the massive investment in infrastructure. According to Government Accountability Office (GAO), China's construction industry output value exceeded 31 Trillion Yuan, which is around USD 4.5 Trillion, and is greatly influenced by the Belt and Road initiative, as of 2023. India's Union Budget for the 2023-24 financial year has committed INR 10 lakh crore (about USD 120 billion) to infrastructure, more than triple its 2019 level, spurring demand for equipment including excavators and cranes. Due to the thrust of smart city development, the sales of automated machinery increase by 15% in 2023. Komatsu and Sany Heavy Industry dominate the region, but the international company is seen working with a local company for growth opportunity. As per an industrial report, the use of electric construction equipment grew by 20% in 2023 with the enforcement of stricter emissions. The incorporation of telematics and AI in the equipment is now more favorable as it boosts productivity. The region's diverse projects, from megacities to rural infrastructure, position Asia Pacific as the fastest-growing construction equipment market globally.

Latin America Construction Equipment Market Analysis

Latin America's construction equipment market is witnessing rapid growth, mainly due to urbanization and infrastructure modernization. Mexico's National Power System Development Program 2023-2037 calls for significant development of electricity generation, transmission, and distribution; this further increases the demand for earthmoving equipment like bulldozers and loaders. According to trade.gov, regional manufacturers, like JCB Latin America, have recorded a 10% rise in sales in 2023 and attribute it to localized products offered. As demand for cost-effectiveness rises, so has the rental market by 15%. A 12% growth increase in 2023 can be seen in electric machinery, along with investment in renewable energy. Public-private partnerships and government incentives for modernization also contribute to this growth. A combination of large-scale urban projects and ongoing infrastructure upgrades in rural regions across Latin America would ensure consistent demand in advanced construction equipment.

Middle East and Africa Construction Equipment Market Analysis

The construction equipment market in the Middle East and Africa is growing due to the rise of megaprojects and urbanization. International Monetary Fund data indicate Saudi Arabia set aside USD 100 Billion for its Vision 2030 infrastructure projects in 2023, further fueling equipment demand. As per an industrial report, in Africa, construction spending reached USD 196.77 Billion in 2023, with significant investment in energy and transport networks. Companies such as Caterpillar and Hitachi Construction Machinery lead the market, supplying to large-scale developments such as the NEOM city project in Saudi Arabia. According to an industrial report, demand for renewable energy projects boosted sales of solar-powered equipment by 10% in 2023. South Africa's infrastructure upgrade initiative saw a 12% rise in construction machinery imports. The region is witnessing efficiency of smart technologies such as the GPS and AI-driven machinery that dominate its construction equipment sector, thus positioning it among major markets for growth.

Competitive Landscape:

The key players in the market are highly engaged in various strategic moves to stay ahead of the competition. These industry leaders consistently allocate resources to research and development (R&D) in order to create innovative product lines featuring eco-friendly and technologically advanced equipment. They also focus on sustainability by offering electric and hybrid machinery to comply with strict emissions regulations. Moreover, these companies increase their global presence by entering the emerging markets where construction activities are gaining momentum. They also emphasize consumer support and service, providing wide-ranging maintenance and training programs. Strategic partnerships and acquisitions are also common to expand their product portfolios and access new consumer segments.

The report provides a comprehensive analysis of the competitive landscape in the construction equipment market with detailed profiles of all major companies, including:

- AB Volvo

- Caterpillar Inc.

- CNH Industrial N.V.

- Deere & Company

- Doosan Infracore

- Hitachi Construction Machinery

- Komatsu Ltd.

- Liebherr-International AG

Latest News and Developments:

- September 2025: HD Hyundai Construction Equipment India Private Limited unveiled its brand-new 20T Smart X Plus excavator lineup alongside the BS-V Wheel Loaders. The introduction showcased five new excavator models within the 20-Ton category, engineered to operate effectively in various environments. These machines were designed to cater to the construction, mining, irrigation, and infrastructure industries, while also enhancing HD Hyundai’s product range in these crucial areas.

- August 2025: Mahindra Construction Equipment Division (MCE), a segment of the Mahindra Group, introduced its innovative CEV-V range of machines aimed at setting new standards in their fields, providing enhanced features and greater comfort while adhering to the latest industry regulations. The recently enhanced CEV-V series of Mahindra EarthMaster SX Backhoe Loader and Mahindra RoadMaster G100 motor grader was equipped with more powerful engines that complied with CEV-V emission regulations.

- July 2025: Daimler India Commercial Vehicles unveiled its latest BharatBenz construction and mining series, featuring HX and Torqshift models, aimed at India's swiftly growing construction and mining equipment market. The updated range was rigorously tested through practical trials with over 150 trucks utilized on India's challenging construction and mining locations.

- April 2025: Case Construction Equipment expanded its equipment range with two additional compact wheel loaders, featuring an electric variant, two new motor graders, and a small articulated loader equipped with a telescopic arm. The launch featured improvements to current machines, introducing new technology and choices for dozers, compact track loaders, and skid steer loaders.

- January 2025: The leading company and creator of the articulated hauler, Volvo Construction Equipment (Volvo CE), revealed its largest and most ambitious articulated hauler. Offering exceptional innovations, the collection was crafted to address contemporary demands for interconnected solutions, enhanced productivity, and reduced emissions, prioritizing human needs.

Construction Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solution Types Covered | Products, Services |

| Equipment Types Covered | Heavy Construction Equipment, Compact Construction Equipment |

| Types Covered | Loader, Cranes, Forklift, Excavator, Dozers, Others |

| Applications Covered | Excavation and Mining, Lifting and Material Handling, Earth Moving, Transportation, Others |

| Industries Covered | Oil and Gas, Construction and Infrastructure, Manufacturing, Mining, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Volvo, Caterpillar Inc., CNH Industrial N.V., Deere & Company, Doosan Infracore, Hitachi Construction Machinery, Komatsu Ltd., Liebherr-International AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, construction equipment market forecast, historical and current market trends, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global construction equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the construction equipment industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Construction equipment refers to a wide range of machinery, tools, and vehicles specifically designed to perform various tasks associated with construction projects. These tasks include excavation, lifting, transportation, drilling, paving, grading, and demolition. The equipment is essential for efficient, safe, and cost-effective construction activities in sectors such as residential, commercial, industrial, and infrastructure development.

The construction equipment market was valued at USD 249.99 Billion in 2024.

IMARC estimates the global construction equipment market to exhibit a CAGR of 3.42% during 2025-2033.

The market is expanding to implementation of various government initiatives, increasing infrastructure development, rapid urbanization, continuous demand for replacement equipment, stringent environmental regulations, and ongoing technological advancements.

In 2024, products represented the largest segment by solution type, as they are used in a range of construction tasks, including earthmoving, material handling, and concrete work.

Heavy construction equipment leads the market by equipment type as it encompasses a wide range of machinery designed for heavy-duty tasks in large-scale construction projects.

The loaders are the leading segment by type, as they are versatile construction machines used for material handling and earthmoving tasks.

Earthmoving equipment is the leading segment by application, as it is essential for various construction projects, from digging foundations for buildings to creating trenches for utilities.

The construction and infrastructure is the leading segment by industry because it encompasses a wide range of projects, including residential and commercial buildings, roads, bridges, airports, and utilities.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global construction equipment market include AB Volvo, Caterpillar Inc., CNH Industrial N.V., Deere & Company, Doosan Infracore, Hitachi Construction Machinery, Komatsu Ltd., Liebherr-International AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)