Global Ready to Drink Tea and Coffee Market Expected to Reach USD 194.2 Billion by 2033 - IMARC Group

Global Ready to Drink Tea and Coffee Market Statistics, Outlook and Regional Analysis 2025-2033

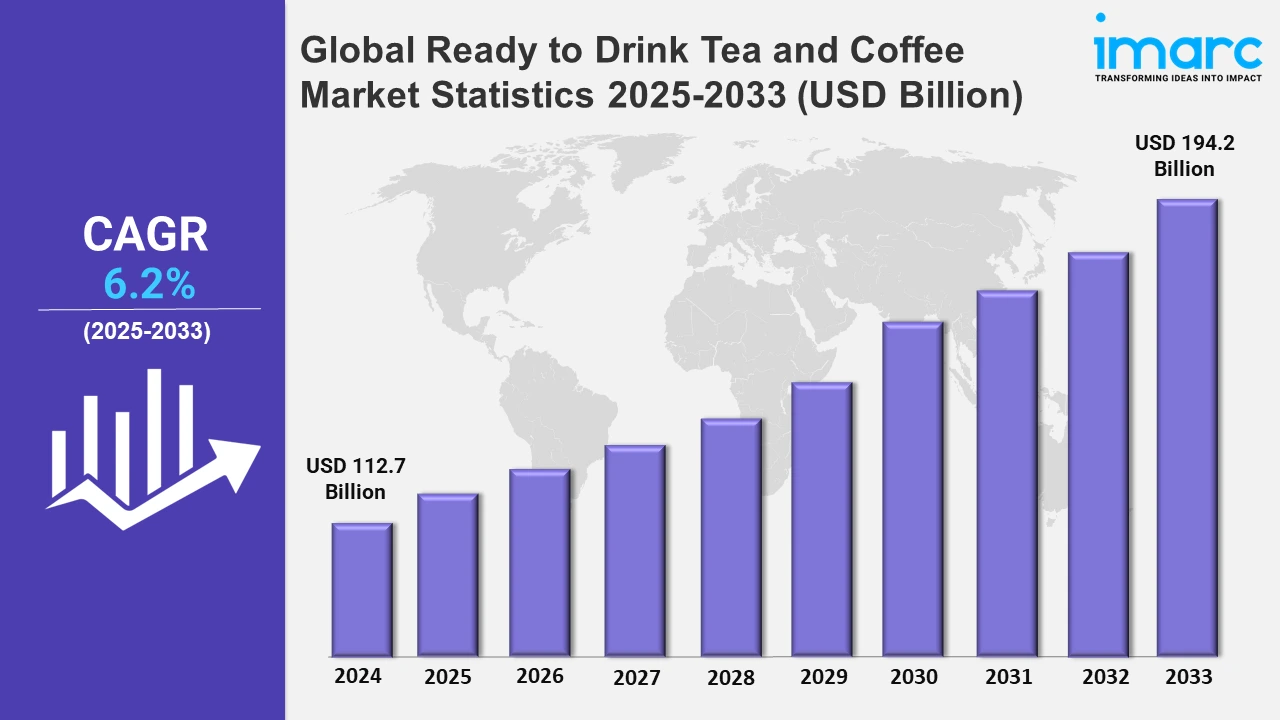

The global ready to drink tea and coffee market size was valued at USD 112.7 Billion in 2024, and is expected to reach USD 194.2 Billion by 2033, exhibiting a growth rate (CAGR) of 6.2% from 2025 to 2033.

To get more information on this market, Request Sample

The global ready to drink tea and coffee market is rapidly growing, propelled by the changes in consumer palate and new lifestyle trends. Concerning the various social aspects, such as wellness and functionality trends, RTD tea and coffee beverages with natural ingredients, low sugar addition, and added benefits are on demand. Several new drinks that contain adaptogens, antioxidants and vitamins which offer energy, relaxation and, immunity boost are being actively launched in the market following recent trends around health and wellness. Another factor which is fueling the growth of RTD tea and coffee market, is the emerging preference for premium and specialty RTD drinks influenced by the improved standards of living of consumers in the global developed and developing markets. Consumers today also prefer premium flavors that they have not experienced before along with a quality-based focus on artisanal coffee beverages, cold coffee, and good teas. Apart from this, there has also been a shift toward sustainable and environment friendly packaging.

The major driving force for the global RTD tea and coffee market is the changing trend in consumer lifestyles. With busy schedules and work pressure, consumers seek products which can be prepared and consumed immediately. RTD tea and coffee products are well suited to the time-starved adult consumer, especially the growing middle class in towns and cities. The increased consciousness of consumers worldwide has led to the popularity of low calorie, sugar-free and value added ready to drink beverages. These products offer refreshment while catering to specific health needs, such as energy boosting or stress relief. Additionally, the rise of specialty coffee culture and the increasing popularity of premium coffee drinks is contributing to market expansion. The market is also benefitting from the growing trend of plant-based diets, with more people choosing dairy-free alternatives, such as oat milk and almond milk, in their RTD beverages.

Global Ready to Drink Tea and Coffee Market Statistics, By Region

The major regional markets for ready to drink tea and coffee include North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America. According to the report, Asia-Pacific accounted for the largest market share on account of rapid urbanization, coupled with the adoption of Western lifestyles and preferences.

Asia-Pacific Ready to Drink Tea and Coffee Market Trends:

The Asia Pacific ready-to-drink (RTD) tea and coffee market is witnessing a rapidly paced growth owing to the shifting consumer preferences for convenience, health, and also premiumization. According to industry reports, India is the largest consumer of tea (540,000 metric tonnes) and is the fourth largest tea exporter worldwide. Consequently, the prevalence of ready to drink culture has also quickly taken shape. This is because of the diverse and vibrant culinary cultures present across the Asia Pacific region, which have effectively influenced a wide range of unique and innovative RTD beverage flavors, appealing to various tastes. Along with the demand for functional beverages with health benefits, such as low-sugar and antioxidant-rich drinks, consumers are also favoring plant-based and dairy-free options, driving the growing popularity of vegan and lactose-free diets.

North America Ready to Drink Tea and Coffee Market Trends:

The North American RTD tea and coffee market is on an upward trend due to higher inclination towards functional beverages with special health benefits. New entrants like oat milk and almond milk are also playing the role of growth factors because the increased demand is also influenced by those who are vegan and do not consume dairy products. The factors which spur growth in this market are the rising population with a demanding schedule, a shifting focus towards fitness and healthy living, and improved purchasing power leading to greater demands for quality and convenience within bottled water.

Europe Ready to Drink Tea and Coffee Market Trends:

The European ready-to-drink (RTD) tea and coffee market is experiencing growth due to rise in convenience consumption, health and indulgence, and premiumization. Significant trends include development of preferences for functional beverages, as more consumers become conscious of their sugar intake and choose plant-based options that have antioxidant properties. RTD cold brew coffees and specialty teas are also being regularly consumed, which are in-line with a growing trend toward selection of artisanal and premium products over regular ones. Moreover, increased market growth can be attributed to the growing population working and living in cities, an increase in the disposable income and availability of the beverages through online retail stores and convenience stores in the region.

Middle East and Africa Ready to Drink Tea and Coffee Market Trends:

The Middle East and Africa RTD tea and coffee market is growing at a fast rate mainly fueled by change in consumer lifestyles, increase in the disposable income, and the need for convenience. The trend in consumption comprises healthful benefits while focusing on the specific properties of the drink like low-sugar, organic, and antioxidant drinks. This trend is shifting the preference of consumers who are in turn looking for functional RTD teas with various herbal infusions, kombucha or green tea which are perceived to have several health benefits. Furthermore, cold brew coffee is becoming appealing to the young and affluent populations who want a smoother and less acidic coffee types than a traditionally brewed coffee.

Latin America Ready to Drink Tea and Coffee Market Trends:

The Latin America ready-to-drink (RTD) tea and coffee market is experiencing growth, driven by changing consumer preferences for convenience-based and health-focused products. Urbanization and busy lifestyles across countries are driving the demand for on-the-go beverages. Additionally, sustainability concerns are leading to a rise in eco-friendly packaging, with brands adopting recyclable and biodegradable materials. The market is also seeing a wave of premiumization, where consumers are willing to pay more for high-quality, gourmet beverages.

Top Companies Leading in the Ready to Drink Tea and Coffee Industry

Some of the leading ready to drink tea and coffee market companies include Asahi Breweries, Dr Pepper Snapple Group, Starbucks, The Coca Cola Company, Ajinomoto General Foods Inc., Ting Hsin International Group, Pepsico, Uni-President Enterprises Corporation, Nestlé, Dunkin' Brands, Keurig Dr Pepper, Hangzhou Wahaha Group, Ferolito Vultaggio & Sons, Keurig Dr Pepper, Hangzhou Wahaha Group, Lotte Chilsung, Monster Beverage, Acqua Minerale San Benedetto, Kirin Holdings Company, Unilever, Arizona Beverage Company and Suntory among many others.

- In April 2024, Starbucks recently revealed its revamped range of ready-to-drink, café -inspired beverages. Some selections from this new range includes the bottled Starbucks Frappuccino Chilled Coffee Drink and the Starbucks Caramel Waffle Cookie Oatmilk Frappuccino Chilled Coffee Drink among many others.

Global Ready to Drink Tea and Coffee Market Segmentation Coverage

- On the basis of the product, the market has been categorized into ready to drink (RTD) tea (black tea, fruit and herbal based Tea, oolong tea, and green tea), and ready to drink coffee (RTD) (ginseng, vitamin B, taurine, guarana, yerba mate, and acai berry), wherein ready to drink tea represents the leading segment. Among product segments, RTD tea has the largest market share because it is one of the oldest beverages consumed internationally with a vast history and tradition in many countries. This is why the notion of bottled or canned RTD tea is well understood by clients who prefer to consume teas prepared in this way. Further, there is a growing awareness of a healthy lifestyle among consumers, which is the reason why RTD tea is considered to be healthier than elaborated carbonated stimulants. The constant innovations in the RTD tea flavors that include green tea, herbal infusion, and fruit-added teas has also made the product to have a multitude of consumers.

- Based on the packaging, the market has been divided into glass bottle, canned, PET bottle, aseptic, and others. Among these, PET bottle accounts for the majority of the market share. One of the main advantages of PET bottles is its practicality combined with the ability to reuse it and make it more environmentally friendly, thus, it appropriate both to producers and the customers. This has the effect of making them portable making it easier for the consumers to handle the product especially those in transit. Furthermore, recyclability of PET bottles which emphasizes on brand reputation plays a vital role to appeal to green consumers.

- On the basis of the distribution channel, the market is classified into off-trade (independent retailers, supermarkets and hypermarkets, convenience stores, and others) and on-trade (food service and vending), amongst which off-trade dominates the market. It is convenient for the consumers to be able to get their desired RTD beverages while they shop for their groceries or any other products. Additionally, using off-trade distribution, the beverage manufacturers can reach a wide market base and also increase their retail visibility to be used as a tool for advertising through attractive displays and promotion and also proper brand association.

- Based on the additives, the market is segregated into flavors, artificial sweeteners, acidulants, nutraceuticals, preservatives, and others. Consumer palates are constantly seeking novel and enticing taste experiences, and flavored RTD beverages cater to this demand. Beverage manufacturers are continuously innovating and developing a wide array of flavors, ranging from classic favorites, including lemon, raspberry to even more exotic options, including lychee, passion fruit, and coconut. On the other hand, artificial sweeteners offer the advantage of providing sweetness without the added calories and are widely used to formulate low-calorie or sugar-free RTD beverages.

- On the basis of price segment, the market is classified into premium, regular, popular priced, fountain, and super premium. The ingredients, the flavors, and packaging of the premium segment RTD beverages are generally superior to the standard ones and are consumed by those consumers who are ready to spend a premium price for a unique, more superior product as compared to the standard beverages. On the other hand, the RTD tea and coffee could also be segmented under the normal products that falls within the reach of most customers in the market. These products are mainly orientated on delivering a good taste in a given product at an affordable price, which is good for regular intake.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 112.7 Billion |

| Market Forecast in 2033 | USD 194.2 Billion |

| Market Growth Rate 2025-2033 | 6.2% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered |

|

| Additives Covered | Flavors, Artificial Sweeteners, Acidulants, Nutraceuticals, Preservatives, Others |

| Packaging Covered | Glass Bottle, Canned, Pet Bottle, Aseptic, Others |

| Price Segments Covered | Premium, Regular, Popular Priced, Fountain, Super Premium |

| Distribution Channels Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Asahi Breweries, Dr Pepper Snapple Group, Starbucks, Pepsico, The Coca Cola Company, Ajinomoto General Foods Inc., Ting Hsin International Group, Uni-President Enterprises Corporation, Nestlé, Dunkin' Brands, Ferolito Vultaggio & Sons, Keurig Dr Pepper, Hangzhou Wahaha Group, Lotte Chilsung, Monster Beverage, Acqua Minerale San Benedetto, Kirin Holdings Company, Unilever, Arizona Beverage Company, Suntory, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)