Global Ready-to-Drink Beverages Market Expected to Reach USD 419.2 Billion by 2033 - IMARC Group

Global Ready-to-Drink Beverages Market Statistics, Outlook and Regional Analysis 2025-2033

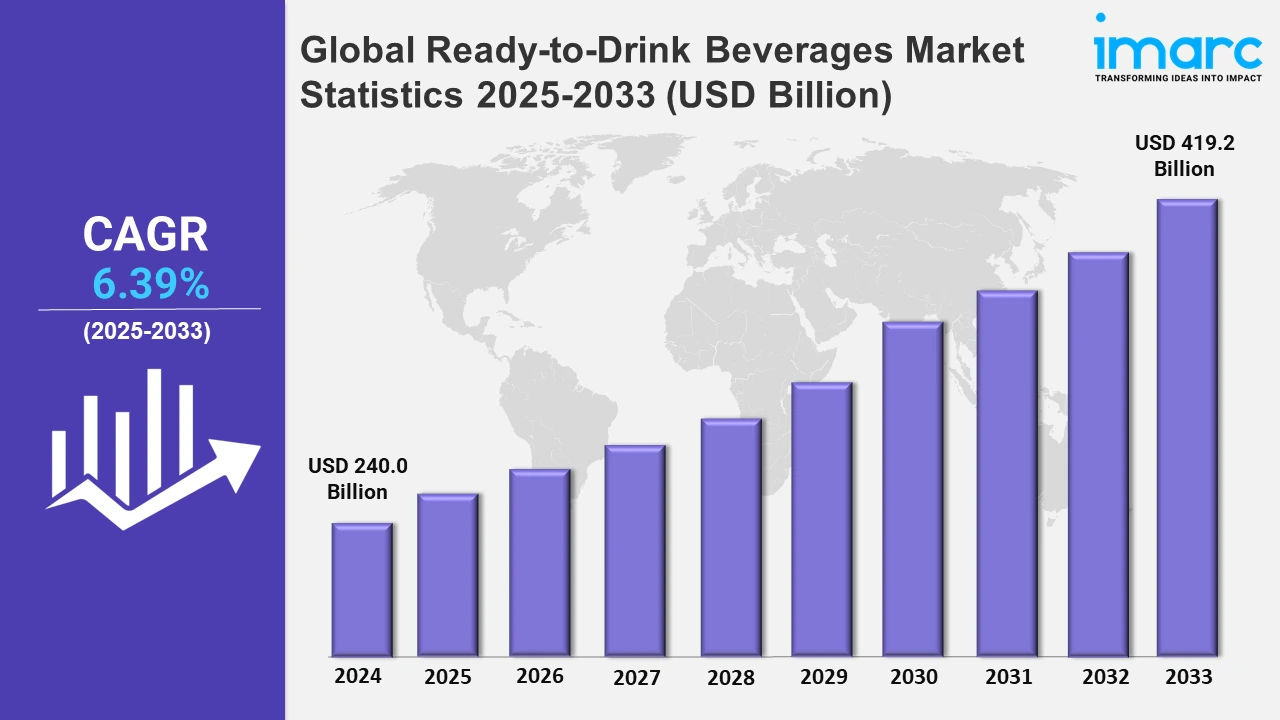

The global ready-to-drink beverages market size was valued at USD 240.0 Billion in 2024, and it is expected to reach USD 419.2 Billion by 2033, exhibiting a growth rate (CAGR) of 6.39% from 2025 to 2033.

To get more information on this market, Request Sample

The global ready-to-drink (RTD) beverages market is driven by a multitude of factors, the key among which is convenience. Beverage consumers are living hectic lifestyles and thereby are seeking drinks that are quick, easy, and portable. RTD beverages, consisting of bottled teas, coffees, juices, and energy drinks, as well as flavored waters, hit the spot by providing swift refreshment without preparation or hassle. The increasing urban population and dual-income households, especially in North America, Europe, and Asia Pacific, are contributing to this demand. Also, the middle-class population in emerging markets is fueling the need for affordable yet premium RTD products. In addition, consumers' increasing trend toward on-the-go consumption makes the convenience factor a central pillar of the RTD market.

The growing trend toward healthier and functional beverages is driving significant growth in the RTD category. Today, health-conscious consumers demand drinks that have functional benefits, such as enhancing their immune systems, giving them energy, supporting their digestive health, and helping hydrate their bodies. The most evident is found in the consumer habits of the millennials and Gen Z age groups, which prefer a range of drinks that reflect their concern for well-being. High-protein, low-sugar, organic, or plant-based ready-to-drink (RTD) beverages are highly sought after and are likely to remain a prime category. Products that contain vitamins, minerals, probiotics, and adaptogens are increasingly popular, too, as consumers look for drinks to deliver more than water. Additionally, the aspect of sustainability is one on which consumers are now highly concerned and worried. Beverage companies, through packaging, are responding by focusing on environmental-friendly packaging options: from recyclable materials to biodegradable ones. These influences are parallelly working along digital media and social channels where product innovation and marketing will happen; companies will look up to these channels as alternatives in introducing new flavors and ingredients and visually striking packages.

Global Ready-to-Drink Beverages Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of rising disposable incomes, urbanization, changing lifestyles, and a growing preference for convenient beverage options.

Asia Pacific Ready-to-Drink Beverages Market Trends:

The Asia Pacific ready-to-drink beverages market is growing at a fast pace, mainly due to the changing consumer preferences, increased disposable incomes, and an increase in demand for convenience. RTD drinks that are mostly tea and coffee-based, juices and bottled water, and energy drinks for all categories, are going all-out, with consumers gravitating to convenience. The key trends in the market are a health and wellness approach, as consumers are shifting toward low-sugar, organic, and functional drinks that deliver added benefits such as vitamins, minerals, and probiotics. Rising disposable income among consumers has led to the demand for high-quality RTD beverages as consumers are more than happy to spend money on premium, healthier, and convenient options. According to the National Bureau of Statistics of China, China's per capita disposable income rose to 30,941 yuan in the first three quarters of 2024, up by 5.2%, with urban residents earning 41,183 yuan, up by 4.5% and rural residents 16,740 yuan, up by 6.6%. Besides, the rising awareness about environmental sustainability also forces companies to consider packaging solutions that are not environmentally unfriendly. Product innovation in offerings is another reason for the increasing market influence of social media and digital platforms. New flavors and exotic ingredients become the latest from brands in their effort to cope with a taste preference that keeps on changing from its previous pattern. Increased convenience in RTD beverages by the millennials and Gen Z, along with their influence, continues to push the growth. Retail channels like supermarkets, and more so through online sales, will be expanded through such innovations and lifestyle changes of consumers.

North America Ready-to-Drink Beverages Market Trends:

Increasing health awareness and demand for functional drinks, such as RTD tea and coffee, fuel the North American market for ready-to-drink beverages. Consumers are increasingly looking for beverages with natural ingredients, low sugar, and added nutritional benefits. The region also witnesses high innovation in plant-based and dairy-alternative beverages. Growth in e-commerce and on-the-go lifestyles have further driven demand. High-grade packing and sustainability efforts in terms of recyclable bottles will appeal to that environmentally conscious consumer. Expanded retail networks and strategic tie-ups with food service vendors drive the market further forward.

Europe Ready-to-Drink Beverages Market Trends:

The RTD beverage market in Europe is one where organic, natural, and low-calorie products are in demand. RTD tea is another popular item, coupled with energy drinks and premium cold brews. Sustainability initiatives, such as green packaging and carbon-neutral production, are significant drivers of purchase. The trend of plant-based and functional drinks is favoring growth, which remains driven by wellness trends and innovative flavor diversity. Expanding availability through supermarkets, hypermarkets, and online channels and focusing on regional flavors is further strengthening regional appeal in the market.

Latin America Ready-to-Drink Beverages Market Trends:

The RTD beverage market in Latin America is driven by the growth in urbanization, change in lifestyle, and health-conscious choices. Functional beverages, such as RTD tea and dairy-based beverages, are gaining popularity and are supported by growing disposable incomes and exposure to international trends. Localized flavors and affordable price points will be the key drivers for market expansion, besides the upsurge in energy drink consumption among young consumers. Modern distribution channels consist of supermarket chains and convenience stores, although the e-commerce channel is growing in popularity. The thirst to quench hot weather temperatures also accelerates demand.

Middle East and Africa Ready-to-Drink Beverages Market Trends:

The Middle East and Africa benefit from a large and rapidly increasing youth population and rising incomes which translate to higher levels of disposable incomes. Increased demand for more convenience will fuel RTD beverage demand. Halal and culturally aligned beverages are becoming the first choice among consumers, while a hot climate is driving the demand for refreshing and hydrating beverages. International brands are going aggressive with expansions, whereas local players compete with their unique flavors and offerings. The expanding retail channels supermarkets and specialty stores further enhance the availability of outlets for beverages. Currently, RTD tea and dairy-based beverages are on a high consumption level under the beverage category, while energy drinks are way ahead among the youth.

Top Companies Leading in the Ready-to-Drink Beverages Industry

Some of the leading ready-to-drink beverages market companies include Asahi Group Holdings Ltd., Brown–Forman Corporation, Keurig Dr Pepper Inc., Nestlé S.A., O-AT-KA Milk Products LLC, PepsiCo Inc., Red Bull GmbH, Suntory Holdings Limited, The Coca-Cola Company, among many others.

- In September 2024, Coca-Cola launched a ready-to-drink cocktail with Bacardi under the name Bacardi Mixed with Coca-Cola, scheduled for 2025. The joint venture is taking advantage of a fast-growing RTD market by tapping into the alcohol business and leveraging brand names for increased consumer demand in premixed cocktails, following the expansion into the alcoholic beverages industry.

Global Ready-to-Drink Beverages Market Segmentation Coverage

- On the basis of the product type, the market has been divided into RTD tea, RTD coffee, energy drinks, yogurt drinks, dairy-based beverages, and others. The RTD tea segment dominates the market as it has gained popularity as a healthier alternative to carbonated drinks. As consumers become more health-conscious, the demand for beverages with functional benefits, such as antioxidants, vitamins, and low-calorie content, has increased. Organic, green, and herbal teas are also helping the growth of this segment. RTD tea is also versatile in flavor options and refreshing in taste, which makes it popular among a wide range of consumers. Health-conscious millennials and Gen Z are particularly attracted to RTD tea due to its light, refreshing taste and natural ingredients. In addition, the availability of RTD tea in all retail and food service channels ensures that it continues to lead the market.

- Based on the packaging, the market is categorized into bottles, tetra pack, sachet, tin can, and others. Amongst these categories, bottles are leading segment. Bottles lead the market due to better consumer convenience and strong association with premium product offerings. They are most liked by consumers for their convenience and ease of consumption in busy, on-the-go lifestyles that are more predominant in urban areas. Bottles also provide superior product preservation and are increasingly available in eco-friendly, recyclable materials, which resonates with environmentally conscious consumers. The popularity of bottled beverages is particularly evident in RTD coffee and energy drinks, where the packaging is designed to emphasize product quality and branding. Bottled beverage demand results from the needs of consumers in terms of convenience and hygiene, with bottle designs including fresh products and better aesthetic appeal.

- On the basis of the distribution channel, the market has been segmented into business-to-business (food service), business-to-consumer (supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others). The business-to-consumer segment constitutes the largest share of the market. This is mainly due to the high availability of RTD beverages and can easily be accessed in supermarkets, hypermarkets, and convenience stores. Consumers today live a busy lifestyle due to which they prefer and require beverages that are consumable and easily accessible. It is also important for a business-to-consumer-oriented channel to have a rich network of retailers and massive promotion that gives it high in-shop visibility. Supermarkets and hypermarkets offer a shopping experience at a single site that allows easy access to multiple RTD beverage ranges. Apart from this, impulse purchases are more common in convenience stores, which further drives the demand for RTD beverages. Widespread availability through traditional and modern retail distribution channels dominates the market for RTD beverages.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 240.0 Billion |

| Market Forecast in 2033 | USD 419.2 Billion |

| Market Growth Rate 2025-2033 | 6.39% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | RTD Tea, RTD Coffee, Energy Drinks, Yogurt Drinks, Dairy-based Beverages, Others |

| Packagings Covered | Bottles, Tetra Pack, Sachet, Tin Can, Others |

| Distribution Channels Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asahi Group Holdings Ltd., Brown–Forman Corporation, Keurig Dr Pepper Inc., Nestle S.A., O-AT-KA Milk Products LLC, PepsiCo Inc., Red Bull GmbH, Suntory Holdings Limited, The Coca-Cola Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)