Global Protein Therapeutics Market Expected to Reach USD 617.5 Billion by 2033 - IMARC Group

Global Protein Therapeutics Market Statistics, Outlook and Regional Analysis 2025-2033

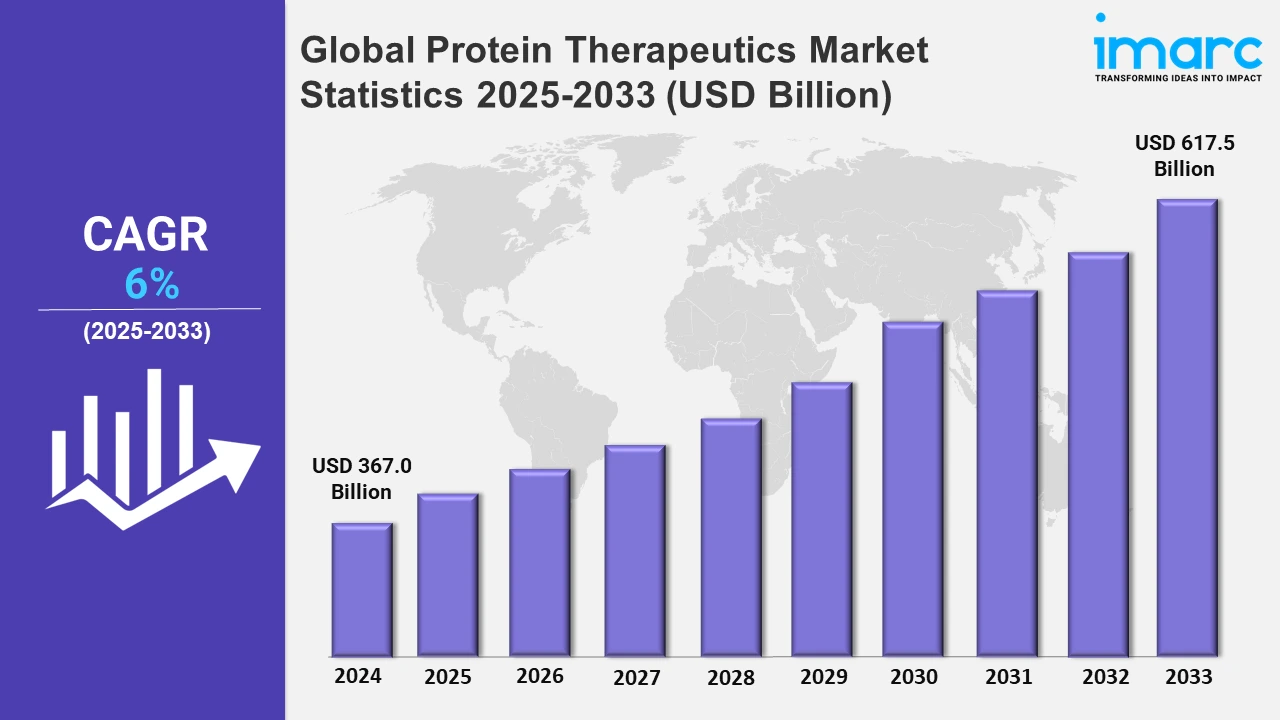

The global protein therapeutics market size was valued at USD 367.0 Billion in 2024, and it is expected to reach USD 617.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6% from 2025 to 2033.

To get more information on this market, Request Sample

Advancement in biopharmaceutical research and manufacturing technology in the protein therapeutics is the driving force for the market. Recombinant DNA technology and protein engineering facilitate safe and effective protein-based drug products. The increasing trend of chronic and rare diseases like heart diseases, cancer, and diabetes increases the demand and chronical diseases account for 74% of all global deaths, as cited by the WHO. Pharmaceutical companies are investing in biologics to fulfill these requirements. Enlaza Therapeutics is an example, raising USD 100 Million in Series A funding on April 30, 2024, led by J.P. Morgan's Life Sciences group, Amgen Ventures, and Regeneron Ventures. The funding is for Enlaza's War-LockTM covalent biologic platform, advancing protein therapeutics with improved specificity, safety, and efficacy, particularly in oncology, while developing a rich pipeline of clinical solutions.

Growing focus on personalized medicine and targeted therapies is a major driver for the protein therapeutics market. These therapies offer customized treatment for patients according to their genetic makeup, thereby improving treatment efficacy with fewer side effects. Strategic collaborations are also driving innovation in this space. On September 24, 2024, Generate: Biomedicines announced a collaboration with Novartis, which used AI to discover novel protein therapeutics. This collaboration brings together AI-assisted drug discovery with biology and clinical development expertise in Novartis to address key unmet medical needs. Potential milestone payments exceeded USD 1 Billion, and the collaboration received USD 65 Million upfront. Regulatory agencies that expedite approvals of biologics and biosimilars are influencing the market growth positively. Furthermore, growing healthcare spending and the global trend toward adopting sophisticated treatments provide support for increasing demand for protein-based therapeutics, ensuring that these play an important role in treating various complex medical conditions.

Global Protein Therapeutics Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of its advanced healthcare infrastructure, strong research, and development (R&D) investments, high adoption rates, and the prevalence of chronic diseases.

North America Protein Therapeutics Market Trends:

The protein therapeutics market in North America is experiencing significant growth due to advanced healthcare infrastructure, extensive research activities, and widespread adoption of biologics. Chronic diseases like diabetes and cancer are major drivers, with the CDC reporting in 2024, that from August 2021 to August 2023, diabetes affected 15.8% of U.S. adults, including 11.3% diagnosed cases. Men showed higher prevalence rates than women, at 18% and 12.9%, respectively. Strong government support for biotechnology innovations and the presence of leading pharmaceutical companies is further strengthening the region's market position. These factors collectively establish North America as a key player in the global market, fostering continuous advancements and growth in the sector.

Asia-Pacific Protein Therapeutics Market Trends:

Asia Pacific is growing very fast in the protein therapeutics market due to increased investment in healthcare and increased awareness of biologics. Countries like China and India are investing highly in research in biotechnology and encouraging local production of protein therapies. The growing incidence of chronic diseases and increasing middle-class population with easy access to healthcare services is the reason for the market to grow quicker.

Europe Protein Therapeutics Market Trends:

Growth in the Europe market is steady and well-supported through government funding for research in biotechnology and significant spending on healthcare. The region has an established pharmaceutical industry and strict regulatory standards that guarantee high standards of biologics. Increased cases of autoimmune and genetic disorders are strengthening demand for innovative treatments based on protein, which in turn triggers further market development, especially through efforts aimed at simplification of approval procedures.

Latin America Protein Therapeutics Market Trends:

The market in Latin America is expanding as governments increase healthcare funding and improve access to biologic therapies. Brazil and Mexico are key contributors, driven by rising healthcare awareness and collaborations with global pharmaceutical companies. However, limited infrastructure and high treatment costs remain challenges. Despite this, advancements in biosimilars are making protein therapies more accessible, fostering growth across the region.

Middle East and Africa Protein Therapeutics Market Trends:

Middle East and Africa protein therapeutics market is growing moderately. Rising healthcare investments and awareness about biologics have driven this growth. Better health infrastructure and higher per capita income among the population in the GCC countries have resulted in their dominating the market. The low-income areas of the region are not very accessible to advanced therapies, but with international organization partnerships, there is a growing availability and affordability of such therapies.

Top Companies Leading in the Protein Therapeutics Industry

Some of the leading protein therapeutics market companies include Amgen Inc., Abbott Laboratories, Abbvie Inc., Baxter International Inc., Biogen Inc., Csl Behring L.L.C. (CSL Limited), Eli Lilly and Company, F. Hoffmann-La Roche AG (Roche Holding AG), Johnson & Johnson, Merck & Co. Inc., Novo Nordisk A/S (Novo Holdings A/S) and Pfizer Inc., among many others. On January 31, 2024, Abbott launched PROTALITY, a high-protein nutrition shake designed for adults pursuing weight loss while preserving muscle mass. Each shake provides 30 grams of protein, 8 essential B vitamins, and 25 other nutrients, addressing protein needs for weight loss maintenance and muscle health. PROTALITY supports individuals using GLP-1 medications, calorie-restricted diets, or post-weight loss surgery. Available in Milk Chocolate and Vanilla, the shakes cater to busy lifestyles and are sold online and at major retailers.

Global Protein Therapeutics Market Segmentation Coverage

- Based on products, the market is classified into monoclonal antibodies (mAbs), human insulin, erythropoietin, clotting factors, fusion protein, and others. Monoclonal antibodies (mAbs) lead in the market, given their specificity toward certain disease pathways. This has been a promising avenue for effective treatments in conditions such as cancers, autoimmune diseases, and infectious diseases. With rising demand for diagnostics and therapeutics due to continuous innovation and product approvals, biotechnology advancements combined with increased investment in personalized medicine enhance their adoption leading to mAbs holding the largest protein therapeutics market size.

- On the basis of therapy area, the market has been categorized into metabolic disorders, immunological disorders, hematological disorders, cancer, hormonal disorders, genetic disorders, and others. The biggest market share is held by metabolic disorders, attributed to lifestyle changes and the increasing number of aging populations suffering from diseases like diabetes, obesity, and hypercholesterolemia. Such disorders have long-term management needs and create continuous demand for protein therapeutics. Advancements in biologics and targeted therapies for metabolic conditions, along with strong healthcare investments, further bolster the segment's dominance in the protein therapeutics market.

- Based on function, the market is bifurcated into enzymatic and regulatory activity, special targeting activity, vaccines, and protein diagnostics. Enzymatic and regulatory proteins significantly catalyze biochemical reaction and maintain cellular processes so that they are highly considered in therapeutic applications. Some targeting proteins help drugs with high precision in the delivering process to target cells or tissues, thereby maximizing drug efficacy while minimizing adverse side effects. Protein-based vaccines, such as subunit and conjugate vaccines, effectively ensure immunization by eliciting focused immune responses. Protein diagnostics use biomarkers to detect and monitor diseases at an early stage, thereby providing accuracy and reliability in medical diagnostics.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 367.0 Billion |

| Market Forecast in 2033 | USD 617.5 Billion |

| Market Growth Rate (2025-2033) | 6% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Monoclonal Antibodies (mAbs), Human Insulin, Erythropoietin, Clotting Factors, Fusion Protein, Others |

| Therapy Areas Covered | Metabolic Disorders, Immunological Disorders, Hematological Disorders, Cancer, Hormonal Disorders, Genetic Disorders, Others |

| Functions Covered | Enzymatic and Regulatory Activity, Special Targeting Activity, Vaccines, Protein Diagnostics |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amgen Inc., Abbott Laboratories, Abbvie Inc., Baxter International Inc., Biogen Inc., Csl Behring L.L.C. (CSL Limited), Eli Lilly and Company, F. Hoffmann-La Roche AG (Roche Holding AG), Johnson & Johnson, Merck & Co. Inc., Novo Nordisk A/S (Novo Holdings A/S) and Pfizer Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Protein Therapeutics Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)