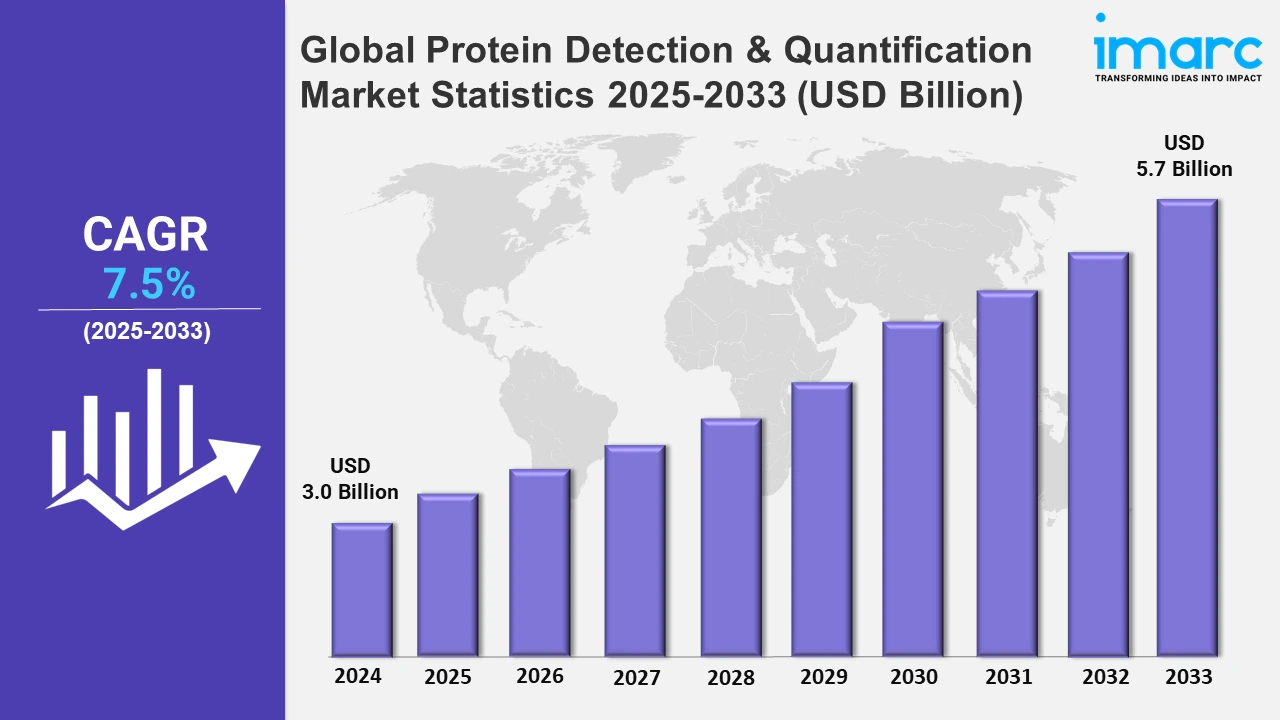

Global Protein Detection & Quantification Market Expected to Reach USD 5.7 Billion by 2033 - IMARC Group

Global Protein Detection & Quantification Market Statistics, Outlook and Regional Analysis 2025-2033

The global protein detection & quantification market size was valued at USD 3.0 Billion in 2024, and it is expected to reach USD 5.7 Billion by 2033, exhibiting a growth rate (CAGR) of 7.5% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing cases of chronic and infectious diseases is causing a major impact on the protein detection & quantification market worldwide. 74% of deaths worldwide in 2023 occurred because of non-communicable disease (NCDs). In the same year, 17.9 million people died from cardiovascular illnesses alone, with 10 million dying from cancer. This has increased the use of protein biomarkers in cancer diagnosis, which has indirectly affected the demand for diagnostic instruments. Therefore, in order to discover disease-specific biomarkers, such as HER2 in breast cancer or C-reactive protein (CRP) for inflammation, methods based on protein detection employing mass spectrometry have become indispensable for early identification and successful intervention. These trends highlight the critical role of protein detection in modern healthcare.

Technological innovation in proteomics is also driving the market growth. The global proteomics revenue is estimated to reach USD 36.3 billion in 2023 and is expected to grow at a rate of 14.4% through 2032. Advanced instruments such as mass spectrometers and next-generation sequencing (NGS)-based platforms have greatly improved the sensitivity and accuracy of protein analysis. According to industry reports, integration of artificial intelligence (AI) in data analysis has somewhat reduced the time necessary for complex proteomic studies by over 30%. Automation is also gaining traction, as a large portion of laboratory investments in 2023 is being seen for automated liquid chromatography systems. These technologies enable high-throughput screening, a feature required for large-scale proteomic studies and clinical applications. Innovations in portable and label-free detection devices are also expanding the application of protein quantification to point-of-care (PO) settings, broadening accessibility and market potential.

Global Protein Detection & Quantification Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the research, North America had the largest market share due to rising healthcare expenditure, expanding biotechnology sectors, and greater usage of breakthrough diagnostic technologies.

North America Protein Detection & Quantification Market Trends:

North America leads the global protein detection & quantification market, driven by advanced healthcare infrastructure, robust research funding, and the widespread adoption of cutting-edge proteomics technologies. The United States is playing a dominant role due to significant investments in life sciences research. Federal agencies such as the National Institute of Health (NIH) allocated nearly USD 48 billion to biomedical research in 2023, much of which supports proteomics studies. The growing demand for personalized medicine and biologics, including monoclonal antibodies, has further fueled the market. Additionally, the presence of key players strengthens North America’s position as a market leader. The region's early adoption of technologies such as mass spectrometry and NGS platforms also contributes to its dominance.

Asia-Pacific Protein Detection & Quantification Market Trends:

Due to the rising chronic disease rates and increased research expenditures in countries such as China, India, and Japan, protein detection and quantification is a developing industry in Asia Pacific. Government programs encouraging life sciences and growing biotechnology firms also help the region's market. With its emphasis on proteomics research and increasing use of cutting-edge diagnostic technologies, China is a regional leader. Furthermore, Asia Pacific's need for protein quantification technology is being fueled by rising healthcare costs and a move toward customized therapy. Its market position is further reinforced by the low cost of research equipment and the outsourcing of clinical trials to the area.

Europe Protein Detection & Quantification Market Trends:

Due to robust academic research, established biotechnology industries, and government financing programs like Horizon Europe, Europe has a substantial market share in protein detection and quantification. The UK, France, and Germany are at the forefront of the regional market, with Germany being the largest contributor. As precision medicine becomes more important and biosimilars are developed, there is an increasing demand for protein analysis technologies. Strict regulatory systems that prioritize safety and quality in treatments and diagnostics also help Europe, promoting advances in proteomics research and clinical applications.

Latin America Protein Detection & Quantification Market Trends:

With nations like Brazil, Mexico, and Argentina propelling regional expansion, Latin America is a developing market for protein detection and quantification. Two main factors driving market development in the area are rising healthcare costs and increased interest in customized medicine. Even while Latin America's proportion is now lower than that of North America and Europe, the region is gradually adopting more advanced proteomics and diagnostic technologies. In the upcoming years, there will likely be a greater need for protein detection technologies as a result of government and private sector investments in healthcare infrastructure upgrades.

Middle East and Africa Protein Detection & Quantification Market Trends:

Protein detection and quantification is a relatively recent but expanding field in the Middle Eastern and African region. Expanding healthcare infrastructure and growing awareness of chronic illnesses are the main causes that are propelling the region's market growth, especially in Gulf Cooperation Council (GCC) nations like Saudi Arabia and the United Arab Emirates. International collaborations and funding initiatives dedicated to combating infectious diseases like HIV and malaria are also driving the need for protein detection technologies in Africa. It is anticipated that continuous healthcare reforms and government measures would propel consistent expansion in this region, notwithstanding obstacles including restricted access to cutting-edge research instruments in some places.

Top Companies Leading in the Protein Detection and Quantification Industry

Some of the leading protein detection & quantification market companies include Agilent Technologies, Inc., Bio-Rad Laboratories, Inc, Bio-Techne, Biotium, HORIBA Group, Inanovate Inc., Merck KGaA, Olink, Promega Corporation, Qiagen N.V., RayBiotech, Inc., Sartorius AG, among many others.

In January 2024, Agilent Technologies Inc. released a new automated parallel capillary electrophoresis system for protein analysis at the 23rd Annual PepTalk Conference called the Agilent ProteoAnalyzer system. This new platform is said to simplify and improve the efficiency of analyzing complex protein mixtures which is an important process for analytical workflows across the pharma, biotech, food analysis, and academia sectors.

Global Protein Detection & Quantification Market Segmentation Coverage

- On the basis of the product, the market has been categorized into kits and reagents/consumables, instruments, and services, wherein kits and reagents/consumables represent the leading segment. This is due to their recurring demand in routine protein analysis and diagnostics. They are essential in labs all around the world because of their simplicity, uniformity, and platform compatibility.

- Based on the technology, the market is classified into colorimetric assays, immunological methods, chromatography, mass spectrometry, spectroscopy instruments, and others, amongst which colorimetric assays dominates the market. This is because to their cost, appropriateness for high-throughput screening, and ease of usage. Considering they are thought to produce reliable results for quantitative analysis, they are essential in clinical and research labs.

- On the basis of the application, the market has been divided into drug discovery and development, clinical diagnosis, and others. The majority of the market share among them is accounted for by drug development and discovery. The fact that proteins are essential for comprehending disease processes and identifying therapeutic targets is one of the main causes contributing to the growing use of protein detection methods in drug discovery and development. Additionally, sophisticated protein quantification technologies are used increasingly as pharmaceutical corporations' significantly involve in R&D expenditures.

- Based on the end user, the market is segregated into academic research institutes, biotechnology and pharmaceutical companies, contract research organization, and others. The biggest market share is held by pharmaceutical and biotechnology companies. These corporations are dominant because they utilize protein detection extensively in medication research, quality assurance, and biologics production. They rely heavily on precise protein quantification for regulatory compliance and product innovation.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 3.0 Billion |

| Market Forecast in 2033 | USD 5.7 Billion |

| Market Growth Rate 2025-2033 | 7.5% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Kits and Reagents/Consumables, Instruments, Services |

| Technologies Covered | Colorimetric Assays, Immunological Methods, Chromatography, Mass Spectrometry, Spectroscopy Instruments, Others |

| Applications Covered | Drug Discovery and Development, Clinical Diagnosis, Others |

| End Users Covered | Academic Research Institutes, Biotechnology and Pharmaceutical Companies, Contract Research Organization, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies, Inc., Bio-Rad Laboratories, Inc, Bio-Techne, Biotium, HORIBA Group, Inanovate Inc., Merck KGaA, Olink, Promega Corporation, Qiagen N.V., RayBiotech, Inc., Sartorius AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)