Global Preclinical CRO Market Expected to Reach USD 11.3 Billion by 2033 - IMARC Group

Global Preclinical CRO Market Statistics, Outlook and Regional Analysis 2025-2033

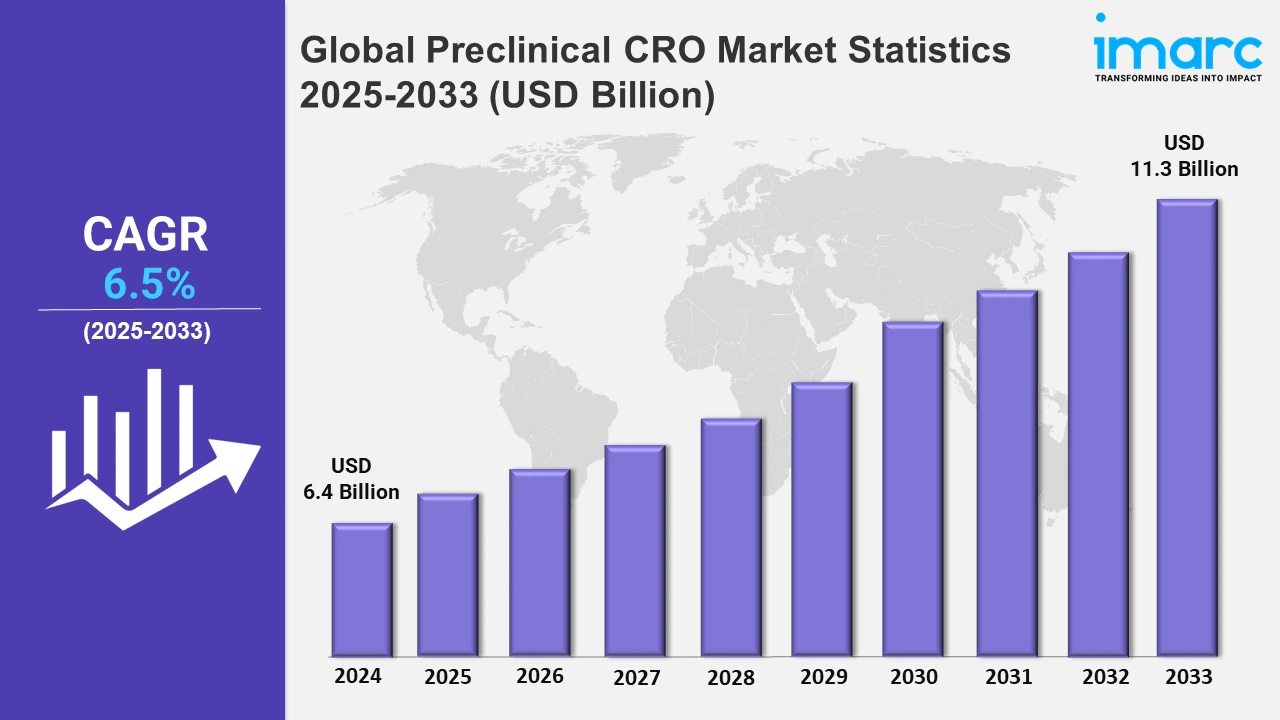

The global preclinical CRO market size was valued at USD 6.4 Billion in 2024, and it is expected to reach USD 11.3 Billion by 2033, exhibiting a growth rate (CAGR) of 6.5% from 2025 to 2033.

To get more information on this market, Request Sample

The preclinical CRO market is growing given the increased demand for cost-effective and efficient drug discovery processes, which leads pharmaceutical and biotechnology companies to outsource preclinical research to specialized organizations. The complexity in drug development, which requires higher expertise in toxicology, pharmacology, and ADME studies, is also driving the outsourcing trend. Regulatory requirements that insist on the need for complete preclinical evaluations have made the role of CROs more definitive in satisfying global standards. For instance, on July 11, 2024, Satellos Bioscience submitted a clinical research proposal to Australia's HREC under the TGA's CTN scheme for SAT-3247, a small molecule drug for muscle regeneration, supported by preclinical studies that met global regulatory benchmarks. Also, there's an increased emphasis on biologics and personalized medicine that elevates the demand for preclinical services tailored to novel therapeutic modalities like gene and cell therapies while innovations in AI-driven study designs are augmenting CRO collaborations.

The global expansion of pharmaceutical research and development (R&D) activities, particularly in emerging markets, is significantly driving the growth of the preclinical CRO sector. The rising prevalence of chronic diseases and the increasing demand for innovative treatments further boost the need for preclinical services. Advanced technologies such as in-silico modeling, 3D cell culture systems, and organ-on-chip platforms are enhancing the quality and predictive accuracy of preclinical studies, solidifying their role in drug discovery. For example, on September 24, 2024, Hesperos’ Human-on-a-Chip technology supported Dianthus Therapeutics’ FDA submission for a Phase II trial of DNTH103 for generalized myasthenia gravis, demonstrating the efficacy of organ-on-chip technology in improving nerve transmission and reducing muscle fatigue. Collaborations between CROs and academic institutions continue to drive cutting-edge innovations, reinforcing their indispensability in the drug development process and further accelerating the advancement of preclinical research methodologies.

Global Preclinical CRO Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of its advanced research infrastructure, significant pharmaceutical investments, skilled professionals, and strong collaborations between academia and industry.

North America Preclinical CRO Market Trends:

North America leads the preclinical CRO market due to its advanced research infrastructure, high R&D investments, along with the widespread presence of major pharmaceutical and biotechnology companies. The region benefits from strong collaboration between academia and industry, fostering innovation in drug discovery. Additionally, the growing focus on outsourcing preclinical studies to reduce costs and timelines is further driving market growth. Regulatory support and government funding for drug development initiatives also contribute to the market's expansion in this region. For instance, on August 7, 2024, Bruker Corporation invested in NovAliX, a preclinical CRO specializing in drug discovery, to advance biophysical methods and technologies in Europe and the U.S. The partnership aims to enhance NovAliX’s services using Bruker’s expertise in NMR, biosensors, and mass spectrometry, fostering innovation in drug discovery and development of new medicines.

Asia-Pacific Preclinical CRO Market Trends:

The preclinical CRO market in Asia Pacific is developing very fast, considering that this market is promoted with the low-cost service provisions, high investments made on research and development, and improvement of pharmaceutical industries. The countries of the region have emerged to become critical locations as they hold highly qualified personnel with very modernized laboratory structures. Increased cases of chronic conditions, among other requirements, will prompt companies to seek outsourced preclinical research within this region. Favorable regulatory reforms and government support further augment market growth.

Europe Preclinical CRO Market Trends:

Europe holds a significant share of the market, supported by a strong pharmaceutical sector and stringent regulatory requirements for drug development. The region's focus on precision medicine and biotechnology innovations drives demand for preclinical services. Countries like Germany, the UK, and France are leading due to their advanced research capabilities. Additionally, increased outsourcing of preclinical trials to reduce operational costs and improve efficiency contributes to market growth across the European region.

Latin America Preclinical CRO Market Trends:

Steadily developing Latin American market is characterized by its burgeoning pharmaceutical sector as well as rising clinical research activities in the region. Brazil and Mexico, with enhanced research infrastructure, show the beginning of these developments while government support for R&D, is increasing the opportunities of doing business in the region. The growth in demand for cost-effective solutions is also driving global companies toward this region. Moreover, the rise in chronic diseases and increased interest in innovative drug development are propelling this market.

Middle East and Africa Preclinical CRO Market Trends:

In the Middle East and Africa, the preclinical CRO market is growing gradually with rising emphasis on improving healthcare infrastructures and pharmaceutical research capabilities, particularly in countries such as South Africa and the UAE, wherein global collaboration and investment are promoting the development of the research base of the preclinical research capabilities. Rising demand for cost-efficient solutions in drug development and new therapies also drive the potential of the market in the region.

Top Companies Leading in the Preclinical CRO Industry

Some of the leading preclinical CRO market companies include Charles River Laboratories Inc., Covance Inc. (Laboratory Corporation of America Holdings), Eurofins Scientific, ICON Plc, MD Biosciences Inc. (MLM Medical Labs), Medpace, Parexel International Corporation, PPD Inc., and Wuxi AppTec, among many others. On February 21, 2024, Charles River Laboratories and Wheeler Bio have partnered to accelerate preclinical to clinical transitions through Wheeler's Portable CMC platform. This alliance integrates Charles River’s antibody discovery expertise with Wheeler’s advanced CMC capabilities, reducing timelines and complexity for early-stage biotech companies. Wheeler’s CGMP-ready facilities and modular workflows support high-quality, affordable clinical supply production. The collaboration streamlines preclinical CRO and CDMO services, optimizing drug discovery and enabling faster progression to first-in-human trials.

Global Preclinical CRO Market Segmentation Coverage

- On the basis of service, the market has been categorized into bioanalysis and DMPK studies, toxicology testing, and others. The toxicology testing segment holds the largest market share due to its critical role in ensuring the safety of drugs, chemicals, and other substances before human exposure. This testing is integral to regulatory compliance, helping identify potential risks early in the development process. The growing complexity of drug formulations and increased demand for precision medicine have further amplified the need for robust toxicology studies. Additionally, advancements in in-vitro and in-silico toxicology methods are driving the segment’s growth.

- Based on end use, the market is bifurcated into biopharmaceutical companies, government and academic institutes, and medical device companies, amongst which biopharmaceutical companies dominate the market due to their reliance on preclinical testing to ensure the efficacy and safety of biologics and novel therapies is at a high level. The level of investment in R&D is high, and they need services that cover all aspects of drug discovery and development. Increasing demands for biologics including monoclonal antibodies and gene therapies also add strength to their dominance. Contracting with specialized CRO firms helps biopharmaceutical companies streamline operations and reduce costs, escalating their market share.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 6.4 Billion |

| Market Forecast in 2033 | USD 11.3 Billion |

| Market Growth Rate 2025-2033 | 6.5% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Bioanalysis and DMPK Studies, Toxicology Testing, Others |

| End Uses Covered | Biopharmaceutical Companies, Government and Academic Institutes, Medical Device Companies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Charles River Laboratories Inc., Covance Inc. (Laboratory Corporation of America Holdings), Eurofins Scientific, ICON Plc, MD Biosciences Inc. (MLM Medical Labs), Medpace, Parexel International Corporation, PPD Inc., Wuxi AppTec, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Preclinical CRO Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)