Global Precious Metals Market Expected to Reach USD 328.9 Billion by 2033 - IMARC Group

Global Precious Metals Market Statistics, Outlook and Regional Analysis 2025-2033

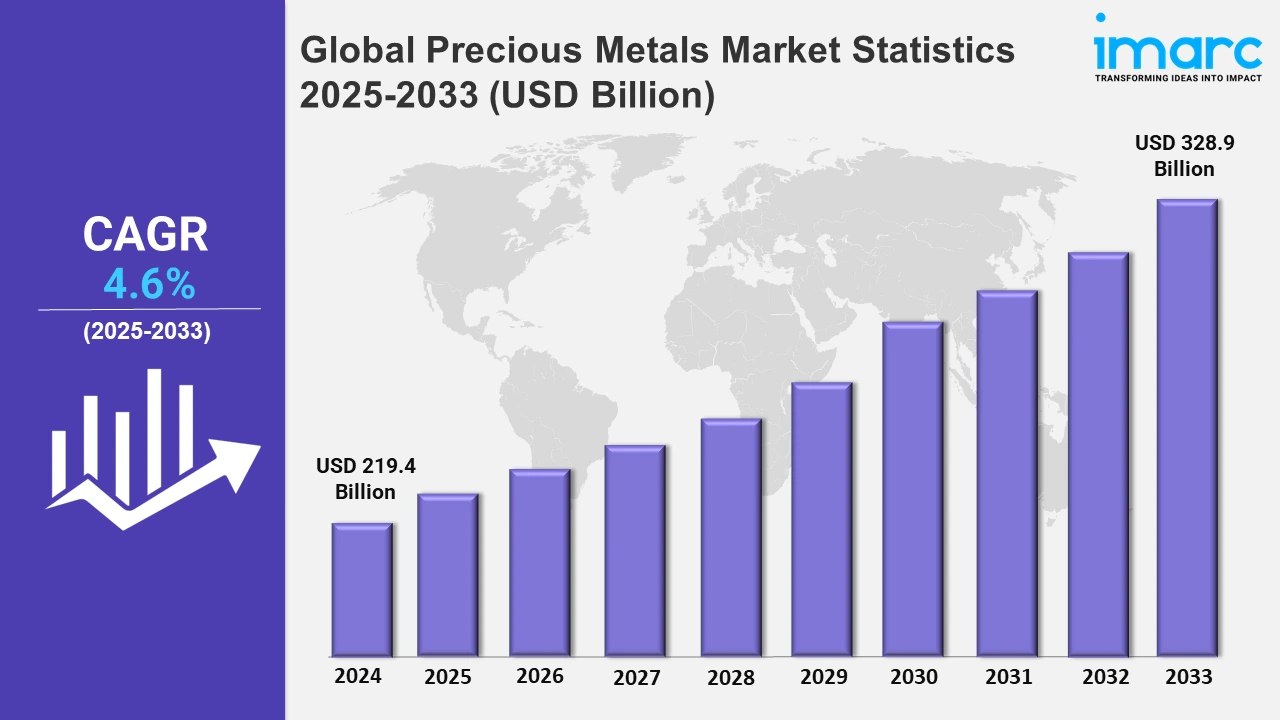

The global precious metals market size was valued at USD 219.4 Billion in 2024, and it is expected to reach USD 328.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.6% from 2025 to 2033.

To get more information on this market, Request Sample

The market is majorly driven by the growing demand due to economic, industrial, and geopolitical factors. The rising need for metals, such as gold, silver, platinum, and palladium, as an investment during economic uncertainty contributes to market growth. According to an industrial report on September 27, 2024, silver prices rose to USD 32.71 per ounce, marking the highest level since 2012, while gold reached a new record of USD 2,685.58 per ounce. These increases are attributed to expectations of further interest rate cuts by the Federal Reserve, which enhances the appeal of non-yielding assets like precious metals. Additionally, potential industrial demand, particularly from China's economic stimulus efforts, has further supported silver's price appreciation. Investors prefer precious metals as a hedge against inflation and currency devaluation, especially in volatile financial markets. Apart from the industrial importance of these metals, silver and platinum are vital to electronics, automotive production, and renewable energy technology.

The development of sustainable, efficient extraction technology also influences the growth of the precious metals market. Innovations such as hydrometallurgical processes, bioleaching, and electrochemical recovery methods are rising in significance. For example, on August 26, 2024, researchers from the University of Camerino, Italy, announced a novel method to recover silver from end-of-life solar cells. At an efficiency rate of 98%, this method combines hydrometallurgical processes, which use aqueous solutions to extract metals, with electrochemical methods, including electrodeposition-redox replacement, to enhance silver recovery. The approach offers a more environmentally friendly alternative to traditional metal extraction methods, thereby reducing energy consumption and carbon emissions. Besides its monetary value, the growing need for sustainability and green technology enhances the applications of silver and palladium in photovoltaic devices and catalytic converters. The emerging applications of the medical and technological realms, for example, platinum in anticancer agents and silver, which prevents bacterial growth, have broadened the opportunities.

Global Precious Metals Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of diverse economies, cultural practices, and industrial needs.

Asia-Pacific Precious Metals Market Trends:

The Asia-Pacific is the key region contributing to the global precious metals market. Strong economic growth, urbanization, and cultural attractions toward gold and silver are influencing the market growth. Key regions such as China and India are the two high gold consumers in the world due to their culture, traditions, jewelry industries, and investment preferences. Additionally, the region utilizes precious metals in electronics and renewable energy sectors, such as solar panel manufacturing. Moreover, the region's growing middle class and expanding wealth result in increased investments and strategic collaborations, which facilitates the growth of the market in the region. For example, on October 28, 2024, Metso announced an agreement to deliver a precious metals refinery to Hindalco Industries in India. The refinery will feature Metso's advanced technology for the recovery of valuable metals, enhancing Hindalco's production capabilities. This partnership highlights Metso's commitment to delivering advanced solutions that support the sustainable growth of the metals industry.

North America Precious Metals Market Trends:

North America is an important region in the global market of precious metals due to the presence of vast reserves, advanced mining infrastructure, and robust requirements in all sectors. The United States and Canada are the greatest producers of gold, silver, and platinum, with well-established mining operations and steady supply. In addition to consumption, North America also propels demand for precious metals in the electronic, jewelry, and automotive manufacturing sectors, especially for catalytic converters. The stable economic and regulatory environment in the region fosters investment in mining and exploration activities, which further solidifies the market presence.

Europe Precious Metals Market Trends:

Europe holds a vital place in the precious metals market due to increased industrial demand. The region is a major consumer of precious metals like gold, silver, and platinum, driven by their usage in sectors such as renewable energy, automotive manufacturing, and advanced technologies. Countries like Germany and Switzerland lead in refining and processing, with Switzerland renowned for its gold refining. The region's importance in the market is further increased due to Europe's focus on sustainable and green technologies like catalytic converters and solar panels. The region's preference for gold as a safe-haven asset further supports its influence on global demand and pricing, especially since historical times.

Latin America Precious Metals Market Trends:

Latin America has a crucial role in the precious metal market and is known for its large variety of natural reserves. It is one of the most important contributors to world precious metals production. Among other countries, Peru, Mexico, and Brazil are leading producers of gold and silver. Colombia is famous for producing the highest quality gold in the world. The mining industry plays a critical role in this region's economy, which contributes to jobs and export revenue. In addition, foreign investment in this region's mineral wealth has further helped to modernize its mining operations. Latin America is an inevitable source for the world's supply chain of precious metals as it is due to their rich deposits and strategic value.

Middle East and Africa Precious Metals Market Trends:

The Middle East and Africa are crucial due to their historical value in gold and platinum mining activities and the mineral wealth that lies in the regions. South Africa stands out as one of the leading producers of PGMs and gold with an already established mining infrastructure in place that supports global supply. The Middle East provides a strategic location for some countries, particularly the UAE, to act as key trading hubs for precious metals. The cultural importance of gold, particularly in jewelry and investments, further drives regional demand. Moreover, the unexplored reserves and exploration activities of Africa attract global investment. At the same time, its production contributes to industrial and technological applications worldwide, thereby emphasizing the critical role the region plays in the market.

Top Companies Leading in the Precious Metals Industry

Some of the leading precious metals market companies include Anglo American Platinum Limited, AngloGold Ashanti, Barrick Mining Corporation, First Majestic Silver Corp, Freeport-McMoRan, Fresnillo Plc, Gold Fields Limited, Harmony Gold Mining Company Limited, Kinross Gold Corporation, Newmont Corporation, Pan American Silver Corp., PJSC Polyus, and Randgold & Exploration Company Limited, among others. On November 14, 2024, Gold Fields announced its intention to divest smaller mining operations in Ghana and Peru to prioritize larger, high-value projects. The company plans to focus on developing its Salares Norte mine in Chile and the newly acquired Windfall project in Quebec, Canada, from Osisko Mining. This strategic realignment is aimed at optimizing operational efficiency and maximizing returns from core assets.

Global Precious Metals Market Segmentation Coverage

- On the basis of the metal type, the market has been categorized into gold (jewelry, investment, technology, and others), platinum (auto-catalyst, jewelry, chemical, petroleum, Medical, and others), silver (industrial application, jewelry, coins and bars, silverware, and others), and palladium ( auto-catalyst, electrical, dental, chemical, jewelry, and others) , wherein gold represents the leading segment. Gold holds a significant position in the precious metals market, with immense value and demand due to its durability and wide acceptance. It is a financial asset as well as a symbol of wealth, which explains its need in different sectors. Gold is an important hedge against inflation and currency fluctuations, which makes it a haven during times of economic uncertainty. Its liquidity and ability to retain value render it a preferred investment for individuals and institutions. Its cultural and historical importance also supports its stature, making it one of the core components of the global precious metals market.

- Based on the application, the market is classified into jewelry, investment, electricals, automotive, chemicals, and others, amongst which jewelry dominates the market. The application of precious metals as jewelry forms the greatest share of precious metal consumption and it reflects cultural and economic importance. Gold, silver, platinum, and other precious metals are in high demand due to their aestheticism, malleability, and the possibility of their very enduring value in time. Therefore, the need for jewelry remains quite intact in many possibilities. Design innovations and the use of rare metals like palladium and platinum further expand market opportunities. Jewelry, being a form of wearable wealth, not only expresses style but also becomes an investment, thereby emphasizing its critical role in sustaining the precious metals market globally.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 219.4 Billion |

| Market Forecast in 2033 | USD 328.9 Billion |

| Market Growth Rate 2025-2033 | 4.6% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Metal Types Covered |

|

| Applications Covered | Jewelry, Investment, Electricals, Automotive, Chemicals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Anglo American Platinum Limited, AngloGold Ashanti, Barrick Mining Corporation, First Majestic Silver Corp, Freeport-McMoRan, Fresnillo Plc, Gold Fields Limited, Harmony Gold Mining Company Limited, Kinross Gold Corporation, Newmont Corporation, Pan American Silver Corp., PJSC Polyus, Randgold & Exploration Company Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Precious Metals Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)