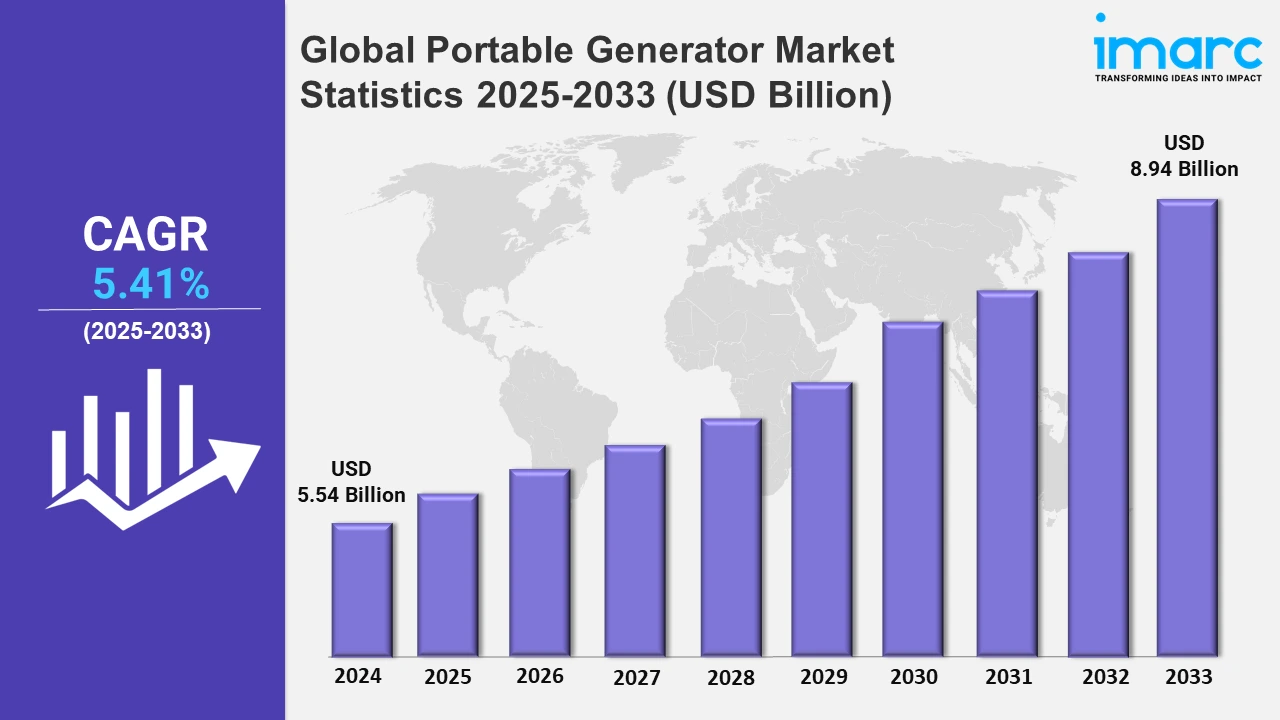

Global Portable Generator Market Expected to Reach USD 8.94 Billion by 2033, Asia Pacific Led with 32.7% Market Share in 2024 - IMARC Group

Global Portable Generator Market Statistics, Outlook and Regional Analysis 2025-2033

The global portable generator market size was valued at USD 5.54 Billion in 2024, and it is expected to reach USD 8.94 Billion by 2033, exhibiting a growth rate (CAGR) of 5.41% from 2025 to 2033.

To get more information on this market, Request Sample

The rising demand for backup power solutions across residential, commercial, and industrial sectors is primarily driving the global market. The increased frequency of power outages caused by old electrical grids and adverse weather conditions has propelled the dependence on portable generators to maintain uninterrupted power supply. Increased demand for portable generators across Europe is driven mainly by the need for effective, reliable power solutions during construction sites and event management. These devices have to be feature rich and high performance of compact design and integrated with advanced safety mechanisms while operating. For example, on 24 July 2024, Bobcat introduced the PG40 and PG50 portable generators in Europe, enhancing reliability and efficiency for diverse applications. Designed for construction and events, these generators feature high performance, compact design, and advanced safety. The launch highlights Bobcat's commitment to innovation in power solutions tailored to European market demands. Moreover, the increasing focus on portable and user-friendly equipment for diverse applications matches the growing usage of generators that provide for continuity in operation under tough conditions.

Furthermore, the growing adoption of renewable energy systems, such as solar-powered portable generators, is further propelling the market growth by providing a more ecological and sustainable alternative to their traditional diesel or gasoline-powered variants. The integration of modern technologies in portable generators has also been growing significantly. Growing demand for safety and regulatory compliance has fueled demand for portable generators with higher standards of carbon monoxide emissions. There is also growing awareness about health hazards related to carbon monoxide poisoning from generators, leading to better testing and certification procedures. Manufacturers are giving top priority to adherence to ANSI/PGMA G300 and CSA standards, introducing innovations that emphasize safety, such as CO-shutoff technology. For instance, On 26th September 2024, UL Solutions inaugurated a dedicated portable generator testing facility in North America to support safety standards, focusing on reducing carbon monoxide risks. The lab aims to ensure compliance with ANSI/PGMA G300 and CSA standards, strengthening preventive measures against generator-related carbon monoxide poisoning.

Global Portable Generator Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, Middle East and Africa, and Latin America. According to the report, Asia Pacific accounted for the largest market share on account of industrialization, frequent power outages, urbanization, infrastructure development, and government initiatives to enhance energy reliability.

Asia-Pacific Portable Generator Market Trends:

The market for portable generators in Asia Pacific is leading well on account of the rising levels of industrialization, recurrent power outages, and increased demand for backup power. The growth is further amplified by rapid urbanization as well as ongoing infrastructure projects, thus facilitating the acceptance of portable generators for domestic and commercial use; this further supports government efforts in enhancing the reliability of power supply.

North America Portable Generator Market Trends:

North America is growing in the market due to the advanced technological infrastructure, high penetration of internet adoption, and the presence of major digital marketing and tech companies are all present in this region. The region has a very developed e-commerce landscape, and many businesses are investing in SEO and digital advertising to maintain their competitive edge. There are also many leading search engines and platforms in the U.S., which adds to the demand for effective strategies in digital marketing. Furthermore, the increasing demand for reliable and sustainable energy solutions is supporting the market. With the increasing frequency of power outages and the growing need for energy independence. For example, on 27th June 2024, Generac Power Systems, a leader in energy solutions, acquired PowerPlay Battery Energy Storage Systems from SunGrid Solutions. PowerPlay specializes in turnkey Battery Energy Storage Systems (BESS) for commercial and industrial projects up to 7 MWh. This acquisition complements Generac’s existing portfolio, including portable generators, by enhancing its offerings for resilient, efficient, and sustainable energy solutions. The acquisition strengthens Generac's commitment to providing comprehensive energy solutions to meet the growing demand for backup power and energy storage in various industries.

Europe Portable Generator Market Trends:

The portable generator market in Europe is growing due to a greater demand for reliable, clean power solutions, following recent climate change-driven events and instability in the power grid. Renewable energy and sustainability are being pursued, thus driving the advancement of portable generator technology, especially hybrid and solar-powered variants.

Latin America Portable Generator Market Trends:

In Latin America, frequent interruptions in the power supply-especially in rural areas-lead to increasing demand for commercial and residential backup power sectors. Portable generators have picked up on this growing trend, further propelled by market growth by demand for low cost and efficiency in power. Adoption for events and outdoor activities adds to market growth.

Middle East and Africa Portable Generator Market Trends:

In the Middle East and Africa, there is massive growth in the portable generator market as there are several under construction projects along with infrastructures. Besides this, many regions experience power failure at different points in time, making portable generators the ideal option for the residential as well as the industrial sectors as the demand for off-grid power continues to grow in the area.

Top Companies Leading in the Portable Generator Industry

Some of the leading portable generator market companies include Briggs & Stratton Corporation, Cummins Inc., Honda Motor Co., Ltd., Eaton Corporation PLC, Generac Power Systems Inc. among many others. On May 15, 2024, Briggs & Stratton enhanced its 26kW Power Protect™ home standby generator, offering 68% more motor starting power than competitors and 7% more power on natural gas. The updated model includes the longest warranty in its category, catering to growing demand for reliable portable generators, especially in preparation for active hurricane seasons.

Global Portable Generator Market Segmentation Coverage

- On the basis of the fuel type, the market has been categorized into portable diesel generators, portable gas generators, and others wherein portable diesel generators represent the leading segment, as they are the best for portable power applications due to their efficiency in fuel consumption, ruggedness, and the provision of long run times on continuous operation. They are suited for commercial and industrial applications requiring long runtime and reliability. Additionally, diesel fuel has higher energy density than others, making the generator cost-effective for large-scale applications.

- Based on the application, the market is classified into residential, commercial, industrial, and infrastructure, amongst which residential dominates the market. This dominance can be attributed to an enhanced focus on ensuring reliability for power backup in times of outages caused by natural disasters, storms, or grid failure. As emphasis is on home security and comfort, portable generators are vital for running major appliances, heating, and lighting in times of need, hence safety and convenience are maintained during emergencies.

- On the basis of the power output, the market has been divided into less than 3 kW, 3-10kW, and more than 10kW. Among these, less than 3 kW accounts for the majority of the market share, as they have an output below 3 kW are the most frequently utilized, as they adequately power smaller devices and appliances, making them ideal for home and leisure use. Their compact design, cost-effectiveness, and portability render them perfect for camping, outdoor events, and emergency situations at home, which aids their prevalence in the marketplace.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 5.54 Billion |

| Market Forecast in 2033 | USD 8.94 Billion |

| Market Growth Rate 2025-2033 | 5.41% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Portable Diesel Generators, Portable Gas Generators, Others |

| Applications Covered | Residential, Commercial, Industrial, Infrastructure |

| Power Outputs Covered | Less than 3 kW, 3-10kW, More than 10kW |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Briggs & Stratton Corporation, Cummins Inc., Honda Motor Co., Ltd., Eaton Corporation PLC, Generac Power Systems Inc. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Portable Generator Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)