Global Polyols Market Expected to Reach USD 46.9 Billion by 2033, Asia Pacific Led with 44.3% Market Share in 2024 - IMARC Group

Global Polyols Market Statistics, Outlook and Regional Analysis 2025-2033

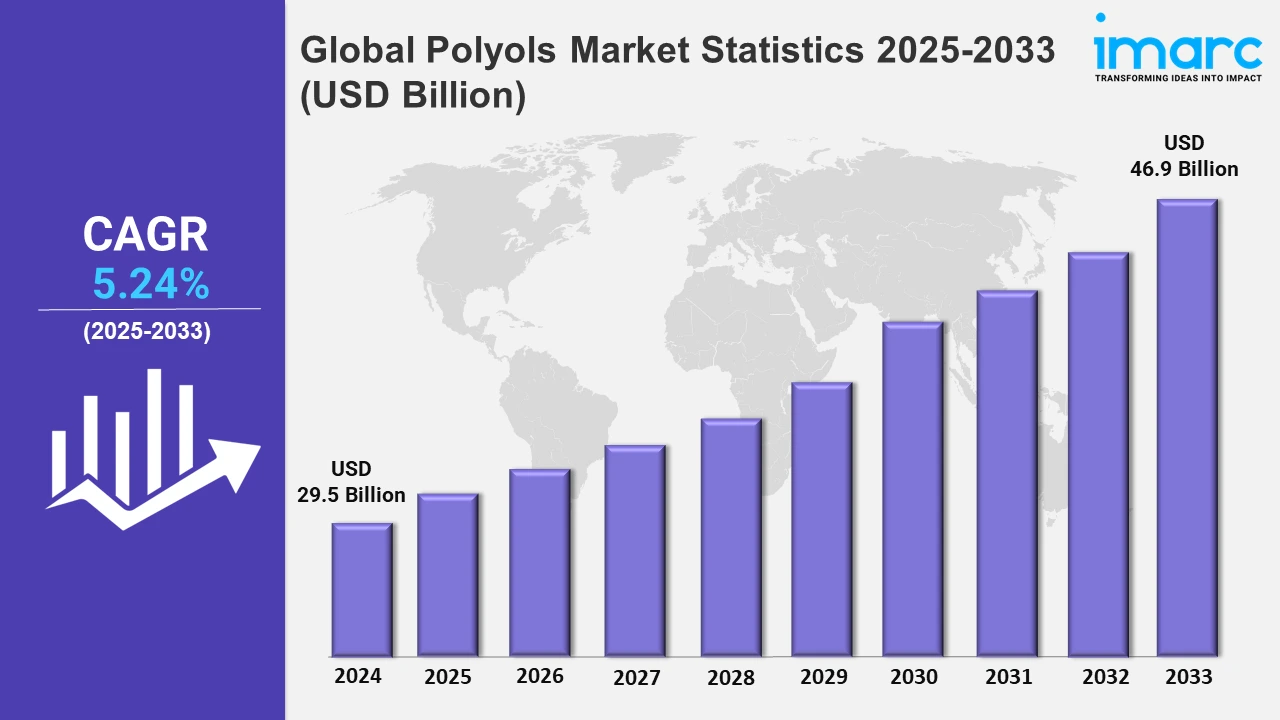

The global polyols market size was valued at USD 29.5 Billion in 2024, and it is expected to reach USD 46.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.24% from 2025 to 2033.

To get more information on this market, Request Sample

The market is majorly driven by the rising demand of the polyurethane due to its durability and versatility in construction, automotive, and furniture industries. Additionally, the growing application of polyols in flexible and rigid foams for insulation, cushioning, and packaging is further supporting the market. Furthermore, the increasing needs for lighter-weight materials in the production of automobiles for fuel-efficiency purposes is propelling the market. Similarly, the rise in the application of polyols in coatings, adhesives, and sealants is expanding their applications across the various industrial industries and, consequently, fueling market growth. Apart from this, the augmenting usage of polyols in the pharmaceutical industry for medical devices and pharmaceutical purposes is also broadening the market scope. Notably, on October 23, 2024, Manali Petrochemicals Limited (MPL) is expanding its portfolio with Propylene Glycol and Polyester Polyol projects, targeting food, beverage, construction, and appliance sectors. Plans include a West India greenfield polyol plant and renewable energy initiatives. MPL focuses on research and development (R&D), marketing, and operational efficiency, transitioning to RLNG to eliminate furnace oil usage. .

The market is further driven by the escalating awareness of bio-based polyols as an environmentally friendly alternative. Furthermore, the increasing concern over energy-efficient buildings with advanced insulation solutions is improving the usage of polyols in construction applications, which in turn is providing an impetus to the market. Notably, on January 9, 2024, Aether Industries commercialized Convergeo polyols technology with its partners H.B. Fuller and Saudi Aramco Technologies Company. This innovative platform will allow the production of polyols containing up to 40% carbon dioxide by weight, thereby reducing the overall CO₂ emissions. Convergeo polyols are designed for applications in the CASE (coatings, adhesives, sealants, elastomers) industry, providing a more sustainable alternative to traditional polyols. Moreover, continuous technological innovations in the production have improved the quality and performance of polyols, which is further contributing to the growth of the market. Besides this, the increasing investment in research and development (R&D) by key players to innovate new applications and products is ensuring sustained market demand.

Global Polyols Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Asia-Pacific, Europe, Latin America and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest market share on account of rapid industrialization, growing construction and automotive sectors, and increasing demand for polyurethane-based products in the region.

Asia-Pacific Polyols Market Trends:

As of 2024, Asia-Pacific dominates the market, holding 44.3% of the market share. The market is driven by rapid industrialization and urbanization in countries such as China and India. The demand for polyurethane is increasing in the construction and automotive sectors in the region, contributing to market growth. Furthermore, the furniture and bedding industries in Southeast Asia are on the rise, leading to an increase in the use of flexible foams, which are propelling market growth. Moreover, an enhanced focus on bio-based polyols along with favorable government policies, is further driving the regional market. For instance, on June 25, 2024, Changhua Chemical began construction in Lianyungang, Jiangsu, China on the country's first purpose-built facility for the manufacture of sustainable polyols from renewable carbon. This cutting-edge facility will produce Carnol™ - a new range of PCE polyols that will save 20-30% of greenhouse gas emissions, using Econic Technologies proprietary process that incorporates captured CO₂. It is projected to achieve an annual production capacity of around 80,000 tons by early 2025 and plans to scale up over 1 Million tons in the subsequent years.

North America Polyols Market Trends:

The market in North America is mainly driven by the increased demand for lightweight materials in automotive manufacturing to improve fuel efficiency. An enhanced focus on energy-efficient buildings, along with advanced insulation solutions, is significantly fueling the use of polyols. Moreover, increased research and development (R&D) investments in bio-based polyols are driving innovation in the region.

Europe Polyols Market Trends:

The Europe polyols market is gaining traction from the strict rules that encourage eco-friendly material usage, thereby increasing bio-based polyol adoption. The market is experiencing growth due to increasing investments in energy-efficient construction projects and the automobile sector. Moreover, advancements in production technologies are enhancing the efficiency and quality of polyols, which acts as an impetus to the market.

Latin America Polyols Market Trends:

Latin America is witnessing increased demand for polyols with the growth in infrastructure development and automotive manufacturing. Increasing polyurethane usage in flexible and rigid foams for insulation is also driving the growth of the market. Furthermore, accelerating awareness of energy-efficient solutions is fostering the usage of polyols in the region.

Middle East and Africa Polyols Market Trends:

The Middle East and Africa market is witnessing growing demand for polyols driven by the construction boom in Gulf countries. An enhanced focus on advanced insulation materials for energy-efficient buildings is augmenting market growth. In addition to this, increasing investments in infrastructure and industrial development are further fueling polyols' adoption.

Top Companies Leading in the Polyols Industry

Some of the leading polyols market companies include BASF SE, Royal Dutch Shell Plc, Mitsui Chemicals, Covestro AG, The Dow Chemical Company, Wanhua Chemical Group, Huntsman Corporation, LANXESS AG, Stepan Company and Repsol SA among many others. For instance, on January 22, 2024, Dow Chemical Company disclosed that its propylene oxide, propylene glycol, and polyols production site in Freeport, Texas, has garnered International Sustainability and Carbon Certification (ISCC) PLUS. . This certification is for Dow's efforts to reduce reliance on fossil feedstocks by incorporating waste-sourced materials, verified through an independent audit. The ISCC PLUS certification highlights Dow's commitment to producing more sustainable circular and bio-circular products for the polyurethanes market in North America.

Global Polyols Market Segmentation Coverage

- Based on the type, the market has been categorized into polyether polyols and polyester polyols, wherein polyether polyols represent the leading segment with 27.9% of the market share. This dominance can be attibuted to their low toxicity, versatility, and widespread use in flexible foams, detergents, emulsifiers, and papermaking additives. Their ability to enhance product durability and performance makes them indispensable in automotive, construction, and consumer goods industries, further driving their demand in the global market.

- Based on the application, the market is classified into flexible polyurethane foams, rigid polyurethane foams, CASE (coatings, adhesives, sealants, & elastomers), and others, where in flexible polyurethane foams dominate the market, holding 32.2% of the market share. Their dominance is driven by their extensive adoption in mattresses, furniture, and automotive seating. Their lightweight, durability, and comfort-enhancing properties render them a preferred material across industries. In addition to this, their energy-efficient manufacturing and recyclability contribute to their growing demand in sustainable product applications.

- Based on the industry, the market has been divided into carpet backing, packaging, furniture, automotive, building & construction, electronics, footwear, and others wherein packaging accounts for the majority of the market share, due to the rising use of polyols for flexible packaging solutions. These materials improve adhesion, durability, and moisture control, making them ideal for protecting products across industries. Their versatility and ability to meet sustainability demands further fuel their adoption in modern packaging applications.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 29.5 Billion |

| Market Forecast in 2033 | USD 46.9 Billion |

| Market Growth Rate 2025-2033 | 5.24% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyether Polyols, Polyester Polyols |

| Applications Covered | Flexible Polyurethane Foams, Rigid Polyurethane Foams, CASE (Coatings, Adhesives, Sealants & Elastomers), Others |

| Industries Covered | Carpet Backing, Packaging, Furniture, Automotive, Building & Construction, Electronics, Footwear, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | BASF SE, Royal Dutch Shell Plc, Mitsui Chemicals, Covestro AG, The Dow Chemical Company, Wanhua Chemical Group, Huntsman Corporation, LANXESS AG, Stepan Company, Repsol SA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Polyols Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)