Global Polyolefin Catalyst Market Expected to Reach USD 3.8 Billion by 2033 - IMARC Group

Global Polyolefin Catalyst Market Statistics, Outlook and Regional Analysis 2025-2033

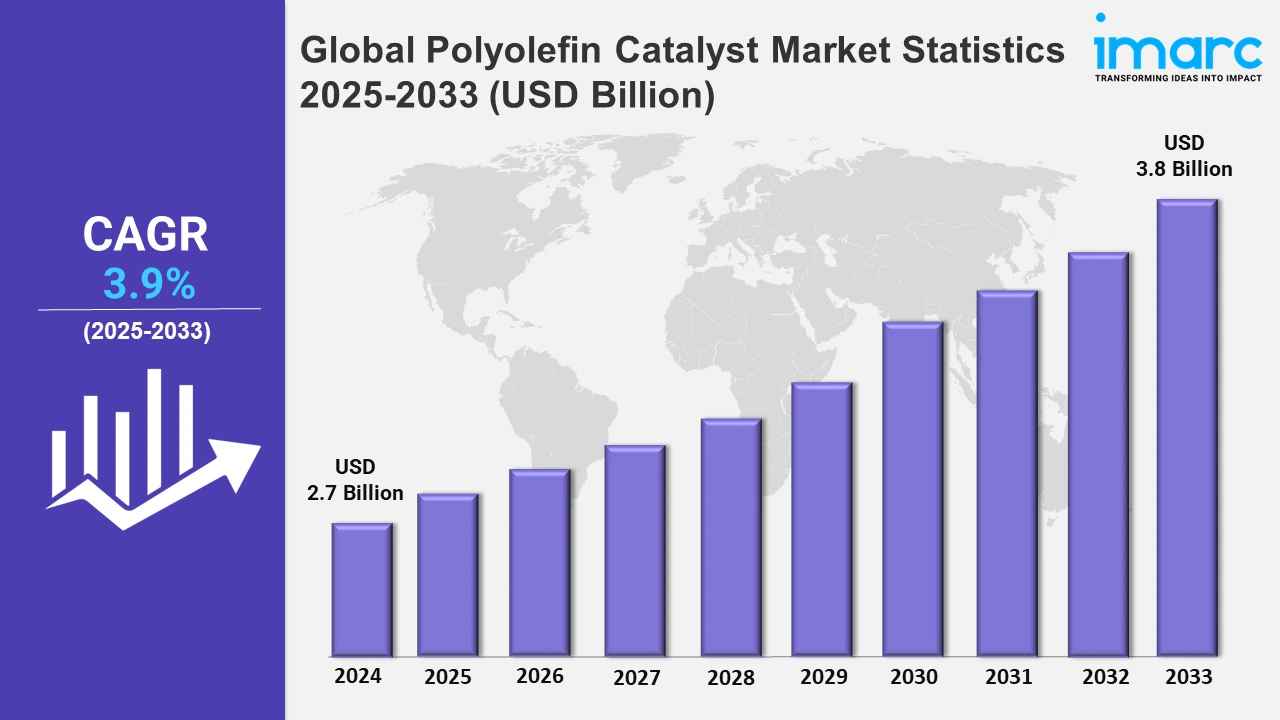

The global polyolefin catalyst market size was valued at USD 2.7 Billion in 2024, and it is expected to reach USD 3.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.9% from 2025 to 2033.

To get more information on this market, Request Sample

The growing demand for polyolefins in diverse end-use industries such as packaging, automotive, and construction is a primary driver for the global market. This can be attributed to the lightweight properties, durability, and cost efficiency of polyolefins such as polyethylene (PE) and polypropylene (PP), which make them integral to manufacturing and industrial applications. Uzbekistan exported 21,900 tons of polyethylene in January 2024, with a value of USD 17.3 Million. This was up by 4,800 tons from the same period in 2023, according to the State Statistics Agency. Along with this, innovations in catalyst technologies, such as metallocene and Ziegler-Natta catalysts, are enhancing production efficiency, allowing manufacturers to develop high-performance polyolefins with tailored properties. Additionally, the rising trend toward sustainable packaging, fueled by stringent government regulations and consumer preference for eco-friendly solutions, is propelling the adoption of advanced catalysts that support recyclable polyolefin production. Moreover, the expansion of the e-commerce sector, which relies heavily on durable and flexible packaging materials, is further increasing the demand for polyolefins, driving growth in the catalyst market.

The inclination for improved polymerization processes to achieve greater product quality and energy efficiency is significantly supporting the market. Industry players are investing in research and development to innovate next-generation catalysts capable of delivering higher yields while minimizing environmental impact. On 6th February 2024, catalytic electrodes developer AZUL Energy raised ¥475 Million, or USD 3.2 Million, in a third-party allotment of new shares for its Series A Funding, led by Spiral Capital, with participation by TOHOKU University Venture Partners, JMTC Capital, Mitsubishi UFJ Capital, Governance Partners, and existing investor Spurcle in a total of six firms. In addition, the rising adoption of lightweight materials in the automotive industry, driven by fuel efficiency and emission reduction goals, is fueling demand for polyolefin-based components. In emerging markets, rapid urbanization and industrial growth are accelerating construction activities, increasing the need for polyolefins in infrastructure projects. The market is further supported by the growing inclination toward bio-based polyolefins, which necessitate advanced catalyst technologies to ensure performance and sustainability. Furthermore, the critical role of catalysts in meeting changing market demands is ensuring consistent growth in the polyolefin catalyst sector.

Global Polyolefin Catalyst Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of rapid industrialization and urbanization as well as strong demand from the packaging, automotive, and construction industries.

Asia-Pacific Polyolefin Catalyst Market Trends:

Asia Pacific dominates the market due to a strong industrial base in the region, rapid urbanization, and increasing demands from key end-use industries such as packaging, automotive, and construction. This can be attributed to the advancement of consumer goods and the growth of infrastructure development for large populations with disposable income. The market is also driven significantly by major manufacturing centers such as China, India, and Southeast Asia through encouraging government policies and by making substantial investments in petrochemical industries. In addition, the increasing e-commerce sector in the region increases the demand for flexible packaging, thereby escalating the demand for polyolefins and their catalysts. The Asia-Pacific region, hosting two of the world's largest petrochemical companies, validated HDPE production models using plant data from operations producing over 600,000 metric tons annually, underscoring the region's role as a key player in global polyolefin manufacturing. The region's advantage of cheap labor and raw materials, along with constant innovation in catalyst technologies, makes Asia-Pacific a market leader in this segment.

North America Polyolefin Catalyst Market Trends:

North America remains a significant market for polyolefin catalysts due to its mature industrial base and growing demand for lightweight materials in automotive and aerospace applications. The region's robust packaging sector, bolstered by e-commerce growth, contributes to rising polyolefin consumption. Additionally, advancements in catalyst technologies are supported by substantial investments in R&D from key players in the United States. With an emphasis on energy-efficient production and sustainability, North America continues to drive innovation in polyolefin catalyst applications.

Europe Polyolefin Catalyst Market Trends:

Europe's market is characterized by a strong orientation towards sustainability and innovation in polymer production. This region's demanding automotive and packaging industries are highly oriented towards high-performance polyolefins tailored with respect to properties supported by innovative catalyst technologies. High regulations over the environment lead to research into recyclable and bio-based polyolefins and push further research in the area of catalysts. Leading players in Germany and France are investing in research and development activities to enhance productivity and thus making Europe an essential player in the market globally.

Latin America Polyolefin Catalyst Market Trends:

The market in Latin America is expanding due to increasing infrastructure projects and growing demand for polyolefins in packaging and construction. Brazil and Mexico are also witnessing strong industrial growth, leading to an increase in demand for efficient polymerization catalysts. The agriculture industry of the region also relies on polyolefins for greenhouse films and irrigation systems, which add to the growth of the market. Local governments' focus on industrialization and trade agreements enhances opportunities for market players to invest in advanced catalyst technologies.

Middle East and Africa Polyolefin Catalyst Market Trends:

The Middle East and Africa represent a growing market for polyolefin catalysts, driven by abundant petrochemical resources and expanding industrialization. The region’s significant oil and gas production serves as a key feedstock for polyolefin manufacturing, supporting market growth. Increasing investments in infrastructure and construction projects across GCC countries and Africa enhance demand for polyolefins. Additionally, the shift toward diversifying economies in the Middle East encourages advancements in polymer production technologies, driving further adoption of efficient catalyst systems.

Top Companies Leading in the Polyolefin Catalyst Industry

Some of the leading polyolefin catalyst market companies include Albemarle Corporation, Clariant AG, Honeywell International Inc., INEOS Capital Limited, Japan Polypropylene Corporation (Mitsubishi Chemical Corporation), LyondellBasell Industries N.V., Mitsui Chemicals Inc., Nova Chemicals Corporation, Sinopec Catalyst Co. Ltd. (China Petroleum & Chemical Corporation), Toho Titanium Co. Ltd. (JX Nippon Mining & Metals Corporation), W. R. Grace, Company, and Zeochem AG, among others. On 20th June 2024, W. R. Grace & Co. (Grace), a leader in global PP process and polyolefin catalyst technologies, announced that Bharat Petroleum Corporation Limited (BPCL), India's second-largest oil marketing company, has expanded its licenses for Grace's UNIPOL® polypropylene process technology. BPCL plans to implement this technology, along with CONSISTA® catalysts, in new reactor units with capacities of 400 kilotons per annum (KTA) in Kochi, Kerala, and 550 KTA in Bina, Madhya Pradesh. This collaboration aims to enable BPCL to produce a diverse array of high-quality polypropylene resins to meet the increasing demand in India.

Global Polyolefin Catalyst Market Segmentation Coverage

- On the basis of the type, the market has been categorized into Ziegler-Natta catalyst, single site catalyst, chromium catalyst, and others, wherein Ziegler-Natta catalyst represent the leading segment, as they are flexible, cost-effective, and highly effective in producing high-performance polyolefins such as polyethylene and polypropylene. Their broad usage in packaging, automotive, and construction industries can be attributed to their ability to allow for precise control of polymer properties. Additionally, advancements in catalyst formulations have enhanced their efficiency and broadened application scopes, maintaining their prominence in the market. This segment’s reliability and adaptability solidify its leadership position globally.

- Based on the classification, the market is classified into polypropylene, polyethylene, and others, amongst which polyethylene dominates the market, driven by its extensive applications in packaging, construction, and consumer goods. Its versatility, cost-effectiveness, and superior mechanical properties make it a preferred choice for manufacturing durable and lightweight products. The rise in demand for flexible packaging in the food and e-commerce industries further enhances its consumption. Additionally, advancements in catalyst technologies have enabled the production of high-density and low-density polyethylene variants, meeting diverse industry requirements and sustaining its market leadership.

- On the basis of the application, the market has been divided into injection molding, blow molding, films, fibers, and others. Among these, films account for the majority of the market share, primarily driven by their extensive use in packaging, agriculture, and industrial applications. Polyolefin-based films, including polyethylene and polypropylene variants, are valued for their flexibility, durability, and cost-effectiveness. The growing e-commerce industry and increasing demand for food packaging bolster this segment's growth. Additionally, agricultural applications, such as greenhouse films and mulching, contribute significantly. Continuous advancements in catalyst technology enable the production of high-performance films, solidifying their market dominance.

- Based on the end use industry, the market is segregated into automobile, construction, healthcare, electronics, packaging, and others. Packaging is the dominant end-use industry segment of polyolefins, due to the increasing demand for light, durable, and cost-effective materials. The most significant applications of polyolefins in flexible and rigid packaging are found in food, beverages, and consumer goods, facilitated by the growth of the e-commerce and retail sectors. Along with this, the growing demand for sustainable and recyclable packaging increases the demand speed.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2.7 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Market Growth Rate 2025-2033 | 3.9% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Ziegler-Natta Catalyst, Single Site Catalyst, Chromium Catalyst, Others |

| Classifications Covered | Polypropylene, Polyethylene, Others |

| Applications Covered | Injection Molding, Blow Molding, Films, Fibers, Others |

| End Use Industries Covered | Automobile, Construction, Healthcare, Electronics, Packaging, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Albemarle Corporation, Clariant AG, Honeywell International Inc., INEOS Capital Limited, Japan Polypropylene Corporation (Mitsubishi Chemical Corporation), LyondellBasell Industries N.V., Mitsui Chemicals Inc., Nova Chemicals Corporation, Sinopec Catalyst Co. Ltd. (China Petroleum & Chemical Corporation), Toho Titanium Co. Ltd. (JX Nippon Mining & Metals Corporation), W. R. Grace, Company, Zeochem AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)