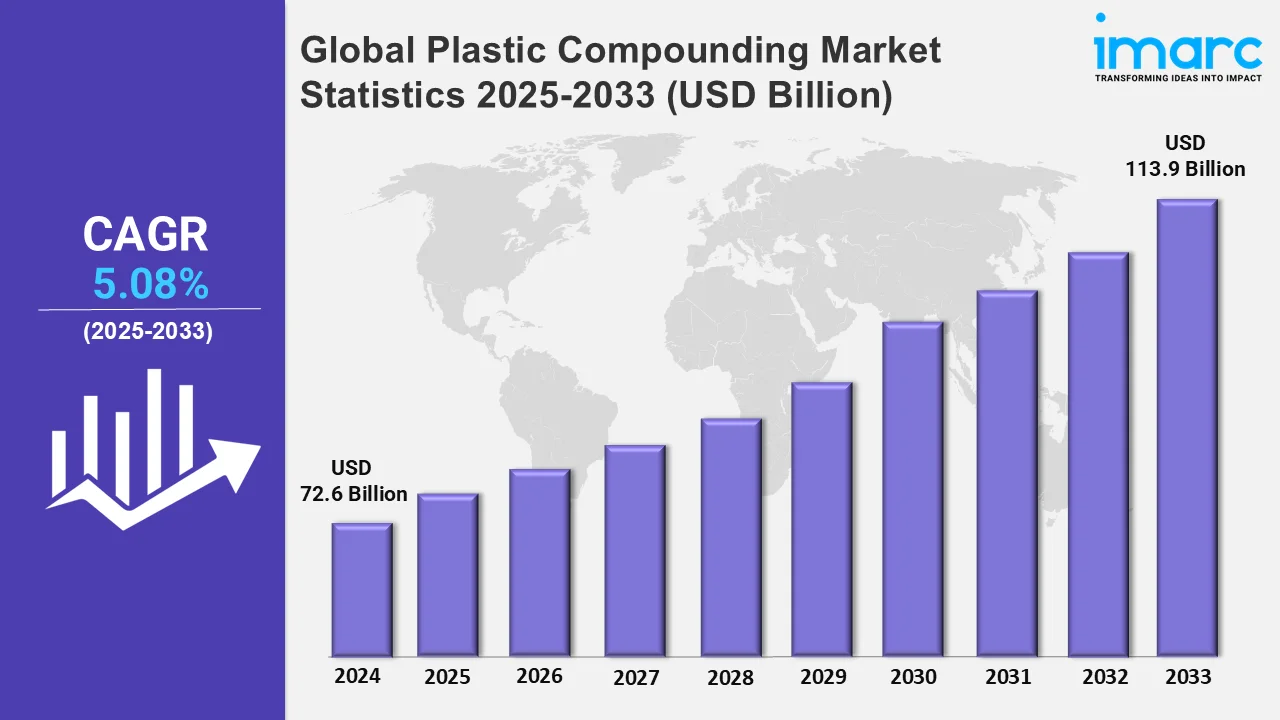

Global Plastic Compounding Market to Grow at 5.08% During 2025-2033, Reaching USD 113.9 Billion by 2033 – IMARC Group

Global Plastic Compounding Market Market Statistics, Outlook and Regional Analysis 2025-2033

The global plastic compounding market size was valued at USD 72.6 Billion in 2024, and it is expected to reach USD 113.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.08% from 2025 to 2033.

To get more information on this market, Request Sample

The automotive sector consumes a lot of plastic products which helps to enhance vehicle efficiency, reduce weight, as well as save fuel. For instance, plastics make between 12-17 % of the weight of a vehicle, which is more or less 150-200 kilos per vehicle. Moreover, vehicles of today contain 26.2 kg of recyclable plastic per vehicle. The automobile industry is a significant source of economic activity in the European Union, directly and indirectly employing 13.8 million people, accounting for 6.1% of total employment in the EU. Motor vehicle manufacturing employs 2.6 million people, accounting for 8.5% of total EU manufacturing employment. Due to stringent environmental regulations and consumer demand for fuel efficiency, plastic compounds are the backbone of automobile manufacture. Plastics contribute to fuel conservation and reduction of greenhouse gases since they reduce the weight of vehicles.

Consumer electronics and electrical companies are booming industries that raise demand for plastic compounds. There are approximately 150 Kg a year in demand for plastic in Western Europe compared to a world average of 60 Kg a year. With electronic devices, including smartphone use, tablet usage, and even wearable technology, plastic materials become more indispensable due to its qualities, which include resistance, flexibility, and thermal ability—features of plastic compounds in their pure form. Additionally, plastic materials used in electronics face greater challenges with the miniaturization of electronic devices and complex designs, which call for more innovative materials able to support complicated designs and ensure efficient insulating capabilities for electronic components. Additionally, countries around the world have recognized this sector's need for sustainable policies, and thus circular economy policies are necessary. Improvement efforts to augment the recyclability of plastics are now being put in place, both as part of resource consumption and reduced impacts on the environment. As these efforts have been implemented, demand is expected to grow for plastic compounds specifically designed for the electronics sector. This will motivate material science innovation to satisfy demands from consumers and support regulatory policies.

Global Plastic Compounding Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of rapid industrialization and increasing investments in automotive, construction, and electronics industries.

Asia Pacific Plastic Compounding Market Trends:

Rapid industrialization and investments in automotive, construction, and electronics have made the Asia Pacific region dominant in the plastic compounding market. The nations, for instance, China, India, and Japan, are experiencing an increased demand for lightweight material in automobiles so as to meet the required fuel economy standards. Also, urbanization and infrastructure project expansions increase the usage of plastic compounds for pipes, fittings, and insulation materials. Moreover, as a result of stronger environmental regulations and higher awareness among consumers, environment-friendly plastic compounds that can be recycled are increasingly getting popular in this region. Additionally, electronics require strong, heat-resistant polymers, which is why the industry is still growing.

North America Plastic Compounding Market Trends:

Advances in vehicle manufacturing, where lightweight materials are gradually replacing metals to improve fuel efficiency, are driving the plastic compounding market in North America. The area also gains from its established packaging and building sectors, which use plastic compounds for long-lasting and sustainable uses. Growing environmental consciousness and regulatory requirements are in line with the growing demand for bioplastics and recycled materials. Additionally, the need for plastic compounds in pharmaceutical packaging and medical devices is fueled by the expanding healthcare industries in the US and Canada. The market in this area is further strengthened by R&D initiatives and technological advancements.

Europe Plastic Compounding Market Trends:

The market for plastic compounding is being driven in Europe by the robust automobile industry that focuses on manufacturing cars to be lightweight, for it has to meet stringent emission standards of the EU. Yet another major sector is that of the building industry which widely employs plastic compounds in the areas of flooring, insulation, and piping. Sustainable programs like the EU Green Deal and the circular economy goals have also fuelled the demand for recyclable and bio-based plastic compounds. The rising usage of advanced polymers in 5G, other high-tech applications, and even electronics acts as an important growth driver. Another factor that is speeding up commercial development is government aid to research and development in terms of green materials.

Latin America Plastic Compounding Market Trends:

The market for plastic compounding is growing in Latin America as a result of increased infrastructure development and building activity in nations like Brazil and Mexico. The usage of lightweight and high-performance plastic compounds is increased by the expanding automotive sector, which is fueled by both domestic demand and export prospects. The growing need for flexible and affordable materials, especially in the food and beverage industries, is another factor contributing to the packaging industry's success. Businesses are investigating bio-based and recyclable options to satisfy customer preferences and regulatory requirements as sustainability concerns progressively gain traction.

Middle East and Africa Plastic Compounding Market Trends:

The Middle East and Africa region sees growth in the plastic compounding market due to rapid urbanization and industrialization, particularly in construction and infrastructure development. Countries like Saudi Arabia and the UAE are major consumers, leveraging plastic compounds for durable and cost-efficient building materials. The automotive and packaging sectors are also growing, supported by increasing domestic demand. Furthermore, government initiatives promoting sustainability and recycling are driving the adoption of eco-friendly plastic compounds. Emerging economies in Africa are witnessing a surge in demand for lightweight plastics in agriculture and consumer goods, further contributing to market growth.

Top Companies Leading in the Plastic Compounding Industry

Some of the leading plastic compounding market companies include Adell Plastics Inc., AKRO-PLASTIC GmbH, Aurora Material Solutions, Covestro AG, Kraton Corporation, Kuraray Co., Ltd, LyondellBasell Industries Holdings B.V., Polyvisions, Inc., Ravago Manufacturing Group of Companies, among many others.

In August 2024, Aurora completed the expansion of its Streetsboro facility. This expansion added over 140 million pounds of compounding capacity and extended the company’s leading in thermoplastic compounding of rigid polyvinyl chlorides (PVCs), rigid PVC alloys, and CPVC.

Global Plastic Compounding Market Segmentation Coverage

- On the basis of the product, the market has been categorized into polyethylene (PE), polypropylene (PP), thermoplastic vulcanizates (TPV), thermoplastic polyolefins (TPO), polyvinyl chloride (PVC), polystyrene (PS), polyethylene terephthalate (PET), polybutylene terephthalate (PBT), polyamide (PA), polycarbonate (PC), acrylonitrile butadiene systems (ABS), others, wherein polypropylene (PP) represent the leading segment. This dominance is due to the versatile properties: high chemical resistance, a light structure, and cost-effectiveness. Widely used across industries, PP offers very good performance in packaging, automobiles, and various consumer goods. Its recyclability also goes in sync with the sustainability goals that improve demand in regions with rigorous environmental regulations.

- Based on the application, the market is classified into automotive, building and construction, electrical and electronics, packaging, consumer goods, industrial machinery, medical device, optical media, others, amongst which automotive dominates the market. Plastic compounds such as polypropylene, polycarbonate, and thermoplastic elastomers are extensively used in manufacturing vehicle interiors, exteriors, and under-the-hood components. The shift towards electric vehicles (EVs) has further boosted the demand for advanced plastics to enhance battery efficiency and insulation.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 72.6 Billion |

| Market Forecast in 2033 | USD 113.9 Billion |

| Market Growth Rate 2025-2033 | 5.08% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Polyethylene (PE), Polypropylene (PP), Thermoplastic Vulcanizates (TPV), Thermoplastic Polyolefins (TPO), Polyvinyl Chloride (PVC), Polystyrene (PS), Polyethylene Terephthalate (PET), Polybutylene Terephthalate (PBT), Polyamide (PA), Polycarbonate (PC), Acrylonitrile Butadiene Systems (ABS), Others |

| Applications Covered | Automotive, Building and Construction, Electrical and Electronics, Packaging, Consumer Goods, Industrial Machinery, Medical Device, Optical Media, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adell Plastics Inc., AKRO-PLASTIC GmbH, Aurora Material Solutions, Covestro AG, Kraton Corporation, Kuraray Co., Ltd, LyondellBasell Industries Holdings B.V., Polyvisions, Inc., Ravago Manufacturing Group of Companies, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)