Global Pharmacy Automation Market Expected to Reach USD 12.0 Billion by 2033 - IMARC Group

Global Pharmacy Automation Market Statistics, Outlook and Regional Analysis 2025-2033

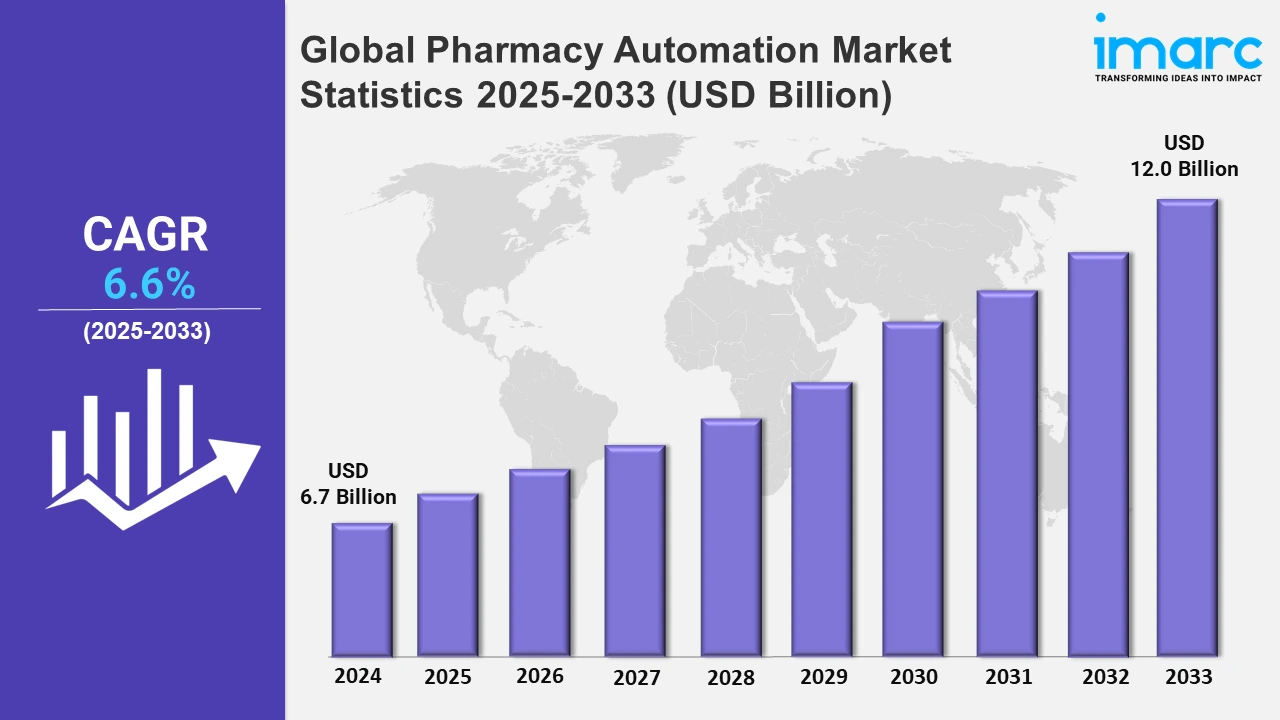

The global pharmacy automation market size was valued at USD 6.7 Billion in 2024, and it is expected to reach USD 12.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.6% from 2025 to 2033.

To get more information on this market, Request Sample

The growing incidence of chronic diseases and the trend toward personalized medicine are driving the demand for unit-dose packaging and customized dispensing systems. Automated systems can efficiently handle such tailored requirements, encouraging their adoption in both hospital and retail pharmacies. Besides this, the advent of AI-driven automation platforms in pharmacy operations is improving access, adherence, and experience of medication significantly. Advanced solutions like these optimize dispensing workflows, improve operational efficiency, and reduce costs, which enable the healthcare provider to offer more streamlined patient-centric services. In this context, such technologies help bridge gaps within the pharmacy value chain, therefore making collaboration between pharmacies and health institutions stronger, ultimately for the benefit of patients and also industry stakeholders involved. Alto introduced Alto Technologies in 2024 as a collection of pharmacy solutions that combine AI, automation, and pharmacists' knowledge. The Alto Complete™ platform enhances hub and dispensing processes, improving medication access, adherence, and patient experience while lowering expenses. This advancement seeks to optimize the pharmacy value chain for both industry collaborators and patients.

In addition to this, stringent regulations concerning medication safety and traceability are prompting healthcare providers to embrace automation to meet regulatory requirements. Automated systems facilitate precise record maintenance and reporting, aiding pharmacies in better meeting compliance standards. Moreover, the launch of subscription-based pharmacy automation services is offering affordable and scalable alternatives for healthcare systems. These services integrate advanced robotics, smart devices, and software to centralize and streamline medication management across diverse care settings. By tackling issues such as medication mistakes and staff shortages, these innovations allow pharmacies to boost operational efficiency, enhance inventory management, and guarantee patient safety, all while lowering the initial costs usually linked to automation technologies. In 2024, Omnicell introduced Central Med Automation Service, which is its subscription model meant to help centralize medication management within healthcare organizations. The product integrates robotics, intelligent devices, and software to maximize the potential for workflows, enhance inventory management, and provide improved patient safety in urgent care, clinics, and community environments. Such progress improves prescription errors and staffing shortages with pharmacy functions in terms of efficiency and scalability.

Global Pharmacy Automation Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru and others); and the Middle East and Africa (Turkey, Saudi Arabia, Iran, United Arab Emirates, and others). According to the report, North America accounted for the largest market share, driven by advanced healthcare infrastructure, rising adoption of automation technologies, and increasing demand for efficient pharmacy operations to enhance patient safety and reduce errors.

North America Pharmacy Automation Market Trends:

North America dominates the pharmacy automation market attributed to its advanced healthcare systems and increasing adoption rates of new technologies. The stringent regulatory guidelines for medication accuracy and safety are encouraging the implementation of automated systems across hospitals and retail pharmacies. The trend of integrating EHRs with pharmacy automation systems is also increasingly supporting the market growth. Furthermore, the emphasis on the improvement of patient safety and operational efficiency in pharmacies is further fortifying this region with significant investments in automation tools such as robotic dispensing systems and inventory management solutions. In 2024, Swisslog Healthcare and BD announced a partnership to automate pharmacy inventory management in US hospitals. The combined efforts of Swisslog's robotics with BD's inventory software are poised to bring about efficiency, simplify workflows, and enhance medication management in health systems. The partnership has responded to the increasing demands for sophisticated pharmacy automation solutions within North America.

Asia-Pacific Pharmacy Automation Market Trends:

The Asia Pacific pharmacy automation market is witnessing swift expansion due to the rising demand for effective medication management in healthcare settings. Countries like China, India, and Japan are embracing automation to reduce errors in dispensing and inventory management as well as enhancing the overall operational efficiency and patient safety. Rising healthcare infrastructure investments and the prevalence of chronic diseases further boost adoption. Additionally, advancements in AI-driven automation and the surge in e-pharmacy services are transforming pharmaceutical operations across the region, driving market expansion.

Europe Pharmacy Automation Market Trends:

Europe possesses a substantial portion of the pharmacy automation market, bolstered by its developed healthcare system and focus on minimizing medication errors. Numerous healthcare institutions in the area emphasize strategies that enhance workflow efficiency and guarantee adherence to stringent medication safety standards. The growing use of automated dispensing and packaging systems in hospitals and long-term care facilities highlights the area's commitment to enhancing pharmacy practices via automation.

Latin America Pharmacy Automation Market Trends:

Latin America is evolving into an emerging market for pharmacy automation because of the increasing need to improve workflows in pharmacies and ensure accuracy in medication dispensing. In hospitals and retail pharmacies, automation is increasingly used to address problems associated with inventory management and prescription errors. The focus on enhancing patient safety and streamlining pharmacy operations in this region is leading to a rise in advanced automated technologies.

Middle East and Africa Pharmacy Automation Market Trends:

The pharmacy automation market in the Middle East and Africa is expanding as healthcare providers adopt automated solutions to improve medication management and operational efficiency. The area is focusing on incorporating technology to reduce human mistakes in dispensing and improve the precision of inventory management. Initiatives to update healthcare systems and enhance patient safety measures via cutting-edge pharmacy technologies are also strengthening the growth in this market.

Top Companies Leading in the Pharmacy Automation Industry

Some of the leading pharmacy automation market companies include Baxter International Inc., Becton Dickinson and Company, Capsa Healthcare, Cerner Corp., Kirby Lester LLC, KUKA AG, McKesson Corporation, Omnicell Technologies, RxSafe LLC, Scriptpro LLC, Swisslog Holding AG, Takazono Corp., Talyst LLC, TCGRx Pharmacy Workflow Solutions, Yuyama Co. Ltd., among many others. In 2024, the first Kuwait Pharmacy Automation Conference was held in Kuwait City by BD (Becton, Dickinson and Company) and Advanced Technology Company (ATC). It focused on enhancing patient safety, reducing medication errors, and enhancing the efficiency of healthcare delivery through BD's pharmacy automation offerings. This initiative is aligned with the objectives of sustainable and high-quality health services in Kuwait.

Global Pharmacy Automation Market Segmentation Coverage

- On the basis of the product type, the market has been segregated into automated medication dispensing systems, automated storage & retrieval systems, automated packaging & labeling systems, tabletop tablet counters, and others, wherein automated medication dispensing systems represent the leading segment. The automated medication dispensing systems segment dominates the market, attributed to its widespread adoption in hospitals, retail pharmacies, and long-term care facilities. These systems enhance medication management by minimizing dispensing errors, improving inventory control, and streamlining workflows. With increasing focus on patient safety and operational efficiency, their demand is further bolstered by integration with EHRs and real-time inventory tracking features. The segment's growth is supported by advancements in technology, enabling precise and secure dispensing, thereby addressing the growing need for automation in pharmaceutical operations.

- Based on the application, the market is divided into drug dispensing and packaging, drug storage, and inventory management, amongst which drug dispensing and packaging dominate the market. The drug dispensing and packaging segment is the market leader because it plays a critical role in the proper and timely delivery of medications. Since automation minimizes human mistakes, patient safety is better ensured and pharmacy and other healthcare institutions can operate better. Increasing demand for unit dose dispensing systems and personalized medicine packaging supporting growth in the segment.

- On the basis of the end-user, the market has been classified into hospital pharmacies, retail pharmacies, and others. Among these, retail pharmacies account for the majority of the market share. Retail pharmacies are the leading market segment, with growing individual demand for fast and accurate prescription services. Implementing automation in retail settings helps optimize operations, reduce waiting times, and enhance customer satisfaction. Functions such as automated dispensing and real-time inventory monitoring improve efficiency and reduce errors. The increased attention to personalized medicine and its integration with healthcare systems bolsters the prevailing role of retail pharmacies in the market.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 6.7 Billion |

| Market Forecast in 2033 | USD 12.0 Billion |

| Market Growth Rate 2025-2033 | 6.6% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Automated Medication Dispensing Systems, Automated Storage & Retrieval Systems, Automated Packaging & Labeling Systems, Tabletop Tablet Counters, Others |

| Applications Covered | Drug Dispensing and Packaging, Drug Storage, Inventory Management |

| End-Users Covered | Hospital Pharmacies, Retail Pharmacies, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Baxter International Inc., Becton Dickinson and Company, Capsa Healthcare, Cerner Corp., Kirby Lester LLC, KUKA AG, McKesson Corporation, Omnicell Technologies, RxSafe LLC, Scriptpro LLC, Swisslog Holding AG, Takazono Corp., Talyst LLC, TCGRx Pharmacy Workflow Solutions, Yuyama Co. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Pharmacy Automation Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)