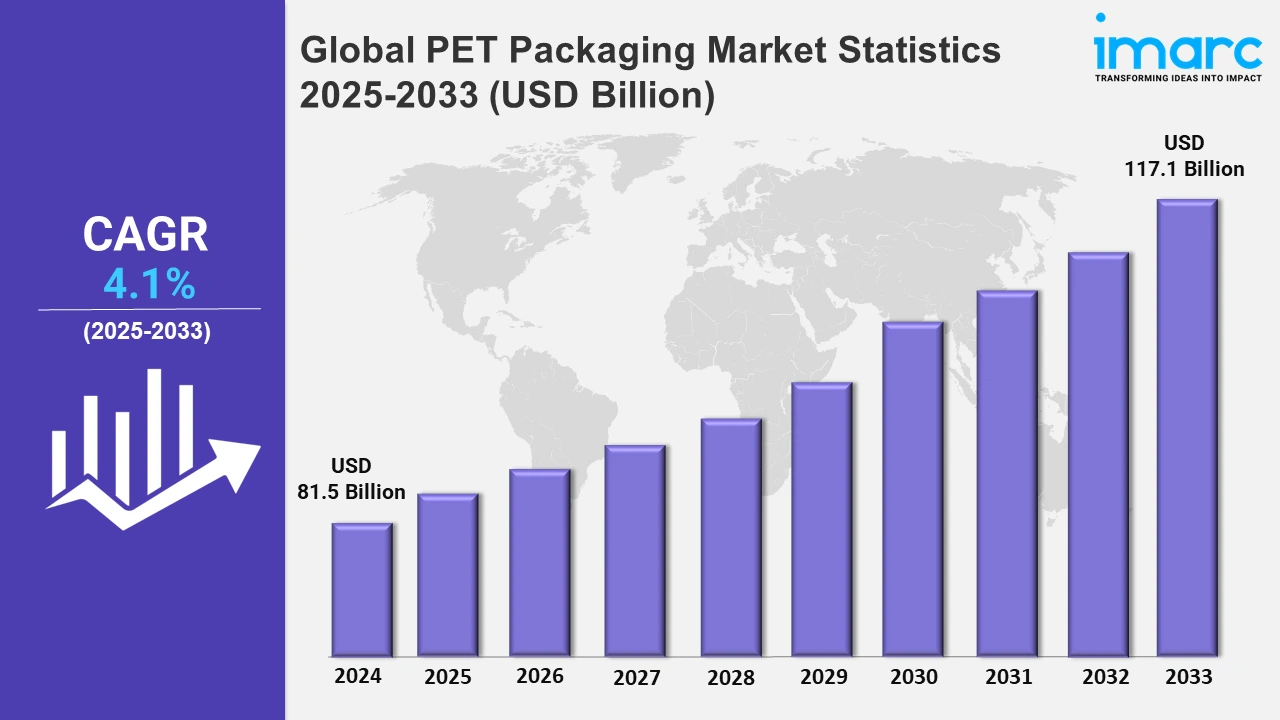

Global PET Packaging Market Expected to Reach USD 117.1 Billion by 2033, North America Led with 38.7% Market Share in 2024

Global PET Packaging Market Statistics, Outlook and Regional Analysis 2025-2033

The global PET packaging market size was valued at USD 81.5 Billion in 2024, and it is expected to reach USD 117.1 Billion by 2033, exhibiting a growth rate (CAGR) of 4.1% from 2025 to 2033.

To get more information on this market, Request Sample

The most influencing factor for the PET packaging market is consumers' ever-growing demand for environmental-friendly products. Growing concerns over plastic waste have led to increasing usage of recycled PET and other environment-friendly materials. Strict laws and enforcement by governments and environmental groups push companies toward more sustainable practices in their operations. Improved recycling technologies and biodegradable alternatives have also contributed to the adoption of PET packaging. In an effort to meet the environmentally friendly preferences of consumers, companies are increasing their investment in sustainable innovation to reduce their environmental footprint. Coca-Cola India, for instance, introduced 100% recycled PET (rPET) packaging in 250ml bottles, marking a significant step toward a circular economy. The initiative, which reduces carbon emissions by 36% through lightweighting and by 66% when compared to conventional virgin PET, exemplifies the growing trend. As businesses like Coca-Cola align with sustainability goals, the PET packaging market is expected to expand, driven by environmental responsibility and consumer demand for greener products.

The expansion of e-commerce, exemplified by initiatives like Amazon's Global Selling program, has become a significant driver for the PET packaging market. Amazon expects Indian exporters to sell $5 billion worth of small-ticket items in 2024, up from $3 billion in 2023, reflecting the rising number of online shoppers and the growing global trade. With the advancement of more and more businesses doing e-commerce, the requirements of packaging are evolving more toward safe delivery and sustainable delivery during transport. The properties that characterize PET are strength, low weight, and transparency. PET is, therefore, appropriate for almost any product marketed to the consumer market. It may incorporate foods and beverages (F&B), toilet tissues, and other cosmetics products. As the world faces demand for safe easy, convenient, and attractive packaging, firms continue resorting to PETs, for secure long distance solutions in transportation. The boom for shopping online is very gradual and this boosts use of PET packaging as e-commerce protects and looks fashionable.

Global PET Packaging Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Asia-Pacific, Europe, Latin America, and the Middle East and Africa. According to the report, North America accounted for the largest market because of consumers' preference for recyclable packaging and the demand for lightweight, environmentally friendly packaging.

North America PET Packaging Market Trends:

The North American market for PET packaging is also growing with high demand and significant growth as consumers favor light, strong, and recyclable packaging solutions. In general, there is increasing consumer and business demand to decrease plastic waste, leading the market towards rPET, and also due to an increase in the growth rate of the e-commerce sector that increases the demand for safety packaging during transportation. Beverages, food, and personal care have been major contributors, which focus on innovations in packaging in an eco-friendly way. Regulatory pressures and sustainability initiatives further support the adoption of PET packaging across different sectors.

Asia-Pacific PET Packaging Market Trends:

Growing levels of urbanization, industrialization, and disposable income are the main drivers of rapid growth in the Asia-Pacific PET packaging market. The region is growing due to the strong demand from the food, beverage, and personal care industries, among other things, and advances in recycling technology and a move towards sustainable packaging.

Europe PET Packaging Market Trends:

In Europe, PET packaging demand is driven by stringent environmental regulations and the increasing adoption of rPET. The region emphasizes sustainability, with consumers seeking eco-friendly solutions. The beverage and food industries are major contributors, with innovations in biodegradable and lightweight packaging enhancing market growth in Europe.

Latin America PET Packaging Market Trends:

In Latin America, the PET packaging market is growing steadily, driven by demand from the food, beverage, and personal care sectors. Sustainability concerns are pushing companies toward using recyclable PET. Increasing disposable incomes, urbanization, and evolving retail trends are also fueling the shift to more efficient and eco-friendly packaging solutions.

Middle East and Africa PET Packaging Market Trends:

The rising demand for packaged food and beverages and consumers' increasing tendency toward green packaging are the drivers of the MEA PET packaging market. The government initiatives for encouraging recycling, rapid urbanization, and changes in consumer lifestyles in emerging markets are supporting the adoption of PET packaging in the region.

Top Companies Leading in the PET Packaging Industry

Some of the leading PET packaging market companies include Amcor plc, Berry Global, Graham Packaging Company, Dunmore Corporation, Huhtamäki Oyj, Resilux NV, E. I. du Pont de Nemours and Company, Silgan Holdings Inc., GTX Hanex Plastic, Comar LLC, Sonoco Products Company, Nampak Ltd., CCL Industries Inc., Smurfit Kappa Group, Rexam PLC, among many others.

- In June 2024, Amcor Corp agreed to buy Berry Global Group for $8.4 billion in an all-stock combination. The value of shares in Berry is at a 10% premium per share, which stands at $73.59 after the announced deal. Postmerger, Amcor shareholders are to have two-thirds, while the company will have Chief Executive Officer Peter Konieczny remain.

Global PET Packaging Market Segmentation Coverage

- On the basis of the packaging type, the market has been categorized into rigid packaging and flexible packaging, wherein rigid packaging represents the leading segment due to its widespread use in beverages, food, and personal care products. It offers durability, protection, and ease of handling, making it ideal for packaging liquids and fragile items.

- Based on the form, the market is divided into amorphous PET and crystalline PET, amongst which amorphous PET dominates the market due to its transparency, ease of molding, and versatility in packaging applications. Its ability to be formed into complex shapes and its high-quality surface finish make it ideal for use in food, beverage, and personal care packaging, contributing to its market leadership.

- On the basis of the pack type, the market has been classified into bottles and jars, bags and pouches, trays, lids/caps and closures, and others. Among these, bottles and jars account for the majority of the market share due to their versatility, convenience, and widespread use in beverages, food, and personal care products. Their ability to provide product safety, ease of storage, and attractive design makes them the preferred choice for both consumers and manufacturers in the PET packaging market.

- Based on the basis of the filling technology, the market has been categorized into hot fill, cold fill, aseptic fill, and others, wherein cold fill represents the leading segment because of its function of maintaining beverage freshness as well as its nutritional contents without the application of higher temperatures. Its wide acceptance in packaging juice, milk, and other perishables is due to product integrity and shelf-life extension for which it maintains dominance over the segment.

- On the basis of the end user, the market has been segmented into the beverages industry, (bottled water, carbonated soft drinks, milk and dairy products, juices, beer, and others), household goods sector, food industry, pharmaceutical industry, and others. Among these, the beverage industry accounts for the majority of the market share due to the high demand for bottled drinks, including water, carbonated beverages, and juices. PET's lightweight, durable, and recyclable properties make it ideal for beverage packaging, ensuring product safety and ease of transport, which drives its dominance.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 81.5 Billion |

| Market Forecast in 2033 | USD 117.1 Billion |

| Market Growth Rate 2025-2033 | 4.1% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Rigid Packaging, Flexible Packaging |

| Forms Covered | Amorphous PET, Crystalline PET |

| Pack Types Covered | Bottles and Jars, Bags and Pouches, Trays, Lids/Caps and Closures, Others |

| Filling Technologies Covered | Hot Fill, Cold Fill, Aseptic Fill, Others |

| End Users Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Amcor plc, Berry Global, Graham Packaging Company, Dunmore Corporation, Huhtamäki Oyj, Resilux NV, E. I. du Pont de Nemours and Company, Silgan Holdings Inc., GTX Hanex Plastic, Comar LLC, Sonoco Products Company, Nampak Ltd., CCL Industries Inc., Smurfit Kappa Group, Rexam PLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on PET Packaging Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)