Global Pedometer Market Expected to Reach USD 3.4 Billion by 2033 - IMARC Group

Global Pedometer Market Statistics, Outlook and Regional Analysis 2025-2033

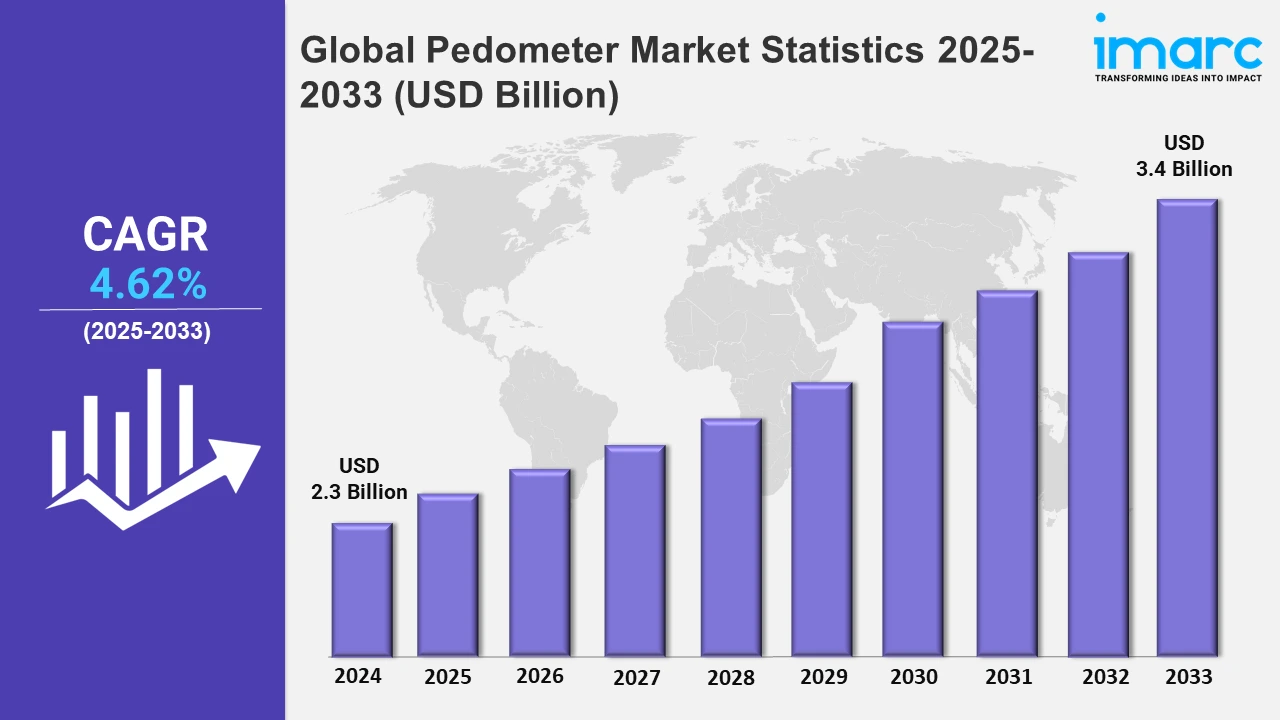

The global pedometer market size was valued at USD 2.3 Billion in 2024, and it is expected to reach USD 3.4 Billion by 2033, exhibiting a growth rate (CAGR) of 4.62% from 2025 to 2033.

To get more information on this market, Request Sample

The adoption of wristwatch technology to evaluate physical fitness demonstrates the trend toward continuous health monitoring. This strategy, used by the U.S. Space Force Guardians, highlights the rising dependence on wearable gadgets to replace traditional fitness tests with real-time data processing. For example, in August 2023, Garmin announced the deployment of its smartwatches to help assess the physical fitness of U.S. Space Force Guardians. The Air Force Research Laboratory (AFRL) commissioned the two-year project, which would look at the usefulness of smartwatch technology in replacing yearly physical fitness exams.

Moreover, the use of remote patient monitoring to address health inequalities improves healthcare accessibility. Innovative technologies, such as VitalSight, which focuses on high blood pressure management in underprivileged communities, offer preventive care, lowering the risk of heart attacks and strokes in vulnerable groups. For instance, in August 2023, OMRON Healthcare partnered with EPIC Health, a Detroit-based health system, to address health inequities and lower the incidence of heart attacks and strokes in underprivileged populations. The collaboration would leverage VitalSight, OMRON's inaugural remote patient monitoring service focused on high blood pressure treatment, especially for individuals with uncontrolled Stage 2 hypertension. Furthermore, pedometer manufacturers are developing new products to fulfill the rising demand for superior wearable fitness solutions. These gadgets now integrate step tracking, calorie monitoring, and app connectivity to improve the user experience. Additionally, the aftermarket pedometer industry has considerable business prospects as fitness awareness grows. Smart pedometers are becoming increasingly popular among consumers because of their multi-functionality and durability. For example, key firms such as Xiaomi, Huawei, and Samsung are driving Asia Pacific's surge in demand for smart pedometers. These firms provide inexpensive and feature-rich fitness bands to the expanding urban fitness-conscious population in countries, such as India and China. Their strategic partnerships with prominent fitness applications allow for seamless activity monitoring, bolstering their market domination and meeting the need for dependable, cost-effective, and creative fitness-tracking gadgets.

Global Pedometer Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest pedometer market share on account of the extensive research and development (R&D) activities in wearable technology.

North America Pedometer Market Trends:

North America holds the largest share of the market owing to the increased use of fitness technologies for health monitoring. Fitbit and Apple lead, combining step monitoring with health applications to appeal to fitness-conscious customers. Fitbit's relationships with healthcare professionals in the U.S., for example, provide step-tracking solutions for chronic disease management, fueling demand for pedometers in wellness programs and for personal usage.

Europe Pedometer Market Trends:

In Europe, corporate wellness campaigns drive pedometer’s demand. Employers in nations, such as Germany and the U.K., promote fitness with step-tracking gadgets. Garmin's wearable pedometers are a popular choice since they integrate with corporate health applications. Deutsche Telekom, for example, uses Garmin devices in employee fitness programs to promote physical exercise while bringing down workplace healthcare expenditures.

Asia Pacific Pedometer Market Trends:

The market in Asia Pacific depends on low prices and increased fitness awareness. Xiaomi is the market leader in China and India, offering low-cost smart bands with pedometers. For example, Xiaomi's Mi Band series sells well owing to its price-performance ratio, which appeals to urban consumers interested in fitness tracking and daily activity monitoring. Furthermore, partnerships with fitness applications, such as Huawei Health and Samsung Health, also improve device functionality, increasing customer interest throughout the region.

Latin America Pedometer Market Trends:

Government health efforts throughout Latin America are driving pedometer’s adoption. Brazil uses step-tracking programs to combat obesity. Huawei, a major player, sells pedometer-equipped smartwatches such as the Huawei Band, which are integrated into fitness projects funded by state organizations to promote active lives in metropolitan neighborhoods. Furthermore, gyms and fitness clubs in countries such as Mexico are implementing pedometer-linked incentive systems to increase member engagement and measure progress.

Middle East and Africa Pedometer Market Trends:

Pedometer sales are increasing in the Middle East and Africa due to increased demand for quality exercise equipment. The UAE leads with wearable manufacturers such as Samsung, which offers step tracking in premium smartwatches. For example, the Dubai Fitness Challenge features Samsung Galaxy Fit devices, emphasizing fitness tracking in events and encouraging active lifestyles around the region.

Top Companies Leading in the Pedometer Industry

Some of the leading pedometer market companies include Fitbit (Google LLC), Garmin Ltd., HRM USA Inc., OMRON Healthcare Co. Ltd. (OMRON Corporation), Xiaomi Inc., and Yamasa Tokei Keiki Co. Ltd., among many others. For example, in August 2023, Fitbit (Google LLC) announced a comprehensive redesign of its app, which aims to simplify user experience while offering enhanced customization and streamlined access to key statistics. Incorporating Google's Material Design standards, the updated app features new visuals, revised icons, and a refined color palette, along with a simplified navigation structure condensed into three primary tabs, i.e., Today, Coach, and You.

Global Pedometer Market Segmentation Coverage

- On the basis of the product type, the market has been classified into smart pedometer, manual pedometer, and others, wherein smart pedometer represents the most preferred segment. Smart pedometers are gaining popularity as customers' interest in health and fitness is growing, owing to the smartphone connection and multi-functional capabilities, such as heart rate tracking and sleep monitoring.

- Based on the application, the market is categorized into commercial competition, personal use, and others, amongst which personal use dominates the market. The rising awareness of the advantages of physical fitness, as well as the need to monitor daily activity levels, has driven up demand for pedometers for personal use.

- Based on the distribution channel, the market is segmented into online stores, retail stores, supermarkets, and others, wherein retail stores dominate the market. Retail stores continue to be an important channel for pedometer sales, owing to the ability for customers to try out the product before purchasing.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2.3 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Market Growth Rate 2025-2033 | 4.62% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Smart Pedometer, Manual Pedometer, Others |

| Applications Cosvered | Commercial Competition, Personal Use, Others |

| Distribution Channels Covered | Online Stores, Retail Stores, Supermarkets, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Fitbit (Google LLC), Garmin Ltd., HRM USA Inc., OMRON Healthcare Co. Ltd. (OMRON Corporation), Xiaomi Inc., Yamasa Tokei Keiki Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)