Global Paper Cups Market Expected to Reach USD 9.1 Billion by 2033 - IMARC Group

Global Paper Cups Market Statistics, Outlook and Regional Analysis 2025-2033

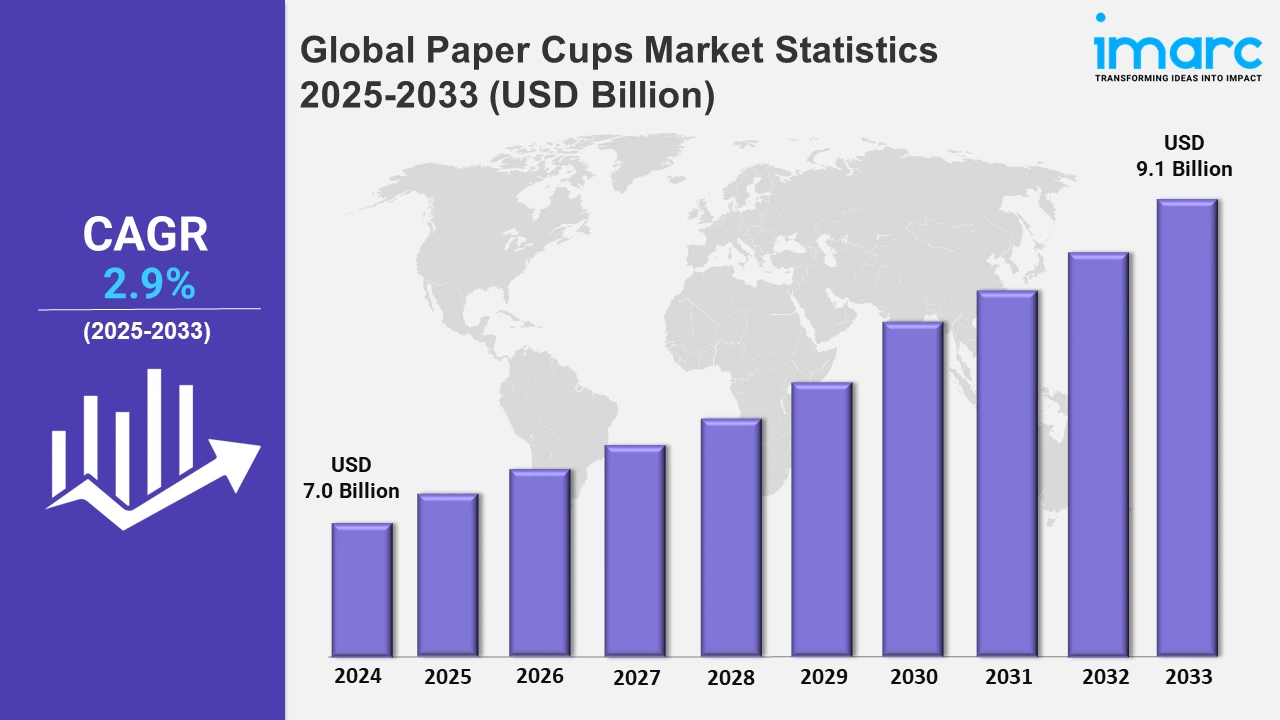

The global paper cups market size was valued at USD 7.0 Billion in 2024, and it is expected to reach USD 9.1 Billion by 2033, exhibiting a growth rate (CAGR) of 2.9% from 2025 to 2033.

To get more information on this market, Request Sample

The market is experiencing substantial growth in the paper cups industry, driven by the increased focus on sustainability and environmental responsibility. In response to this, food service operators and manufacturers are encouraged to innovate and implement eco-friendly alternatives due to stringent government laws and the rising awareness among consumers towards elevating pollution levels caused by single-use plastics. Along with this, to fulfill these demands, companies are focusing on integrating compostable and biodegradable materials into their products. For instance, Southwest Airlines unveiled bamboo-based cold beverage cups comprising 92.1% non-plastic materials, including 25% paper and 75% paper, with a PE lining in October 2024. Their objective of cutting the amount of single-use plastic trash annually by more than 1.5 million pounds is in line with this approach. In addition to addressing environmental issues, these developments strengthen brand positioning as sustainability-focused organizations, which accelerates market expansion.

Aligned with these trends, the cooperation of industry participants to improve the recycling paper cups infrastructure is another noteworthy factor responsible for the market growth. For example, in November 2024, a comprehensive report was released by Reconomy and Valpakin in collaboration with Footprint Intelligence to assist food service operators in implementing mandatory schemes for paper cup takeback programs. These programs aim to increase recycling rates and reduce environmental impact, with an estimated 3.2 billion paper cups that are in use each year in the UK. Simultaneously, research and development initiatives with innovative advancements in technology are paving the way for creative solutions in the paper cup segment. Reflecting this trend, Starbucks and Huhtamaki started testing biodegradable cold beverage cups with bioplastic liners and molded fiber closures in August 2024 for a few locations in the United States. It is a significant step toward developing packaging that is recyclable and compostable, and it complies with Extended Producer Responsibility regulations and Starbucks's upcoming year's sustainability goals.

Global Paper Cups Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, North America, Europe, South America, and the Middle East and Africa. According to the report, Asia Pacific accounts for the majority of shares in the market, driven by rapid urbanization and the expanding need for easy, quick, and environmentally friendly food packaging options in the region.

North America Paper Cups Market Trends:

The growing need for biodegradable alternatives from environmentally concerned consumers is strengthening the paper cup industry in North America. Concurrently, companies are encouraged to utilize recyclable materials by regulatory frameworks like California's single-use plastics ban. One notable example of the United States' transition to sustainability is Starbucks has introduced recyclable and biodegradable cups. The rising takeaway culture further boosts demand, especially in Canada, where coffee consumption heavily influences the market dynamics.

Europe Paper Cups Market Trends:

In Europe, the rising consumer preference for eco-friendly products and strict environmental restrictions are catalyzing the region's growth. Along with this, to ensure sustainability, countries like Germany facilitate the usage of paper cups that have earned the FSC certification. The introduction of recyclable alternatives is accelerated by the European Union's directive against single-use plastics. Aligning with these trends, Costa Coffee in the UK sets industry benchmarks by using paper cups that are 100% recyclable.

Asia Pacific Paper Cups Market Trends:

Asia Pacific dominates the overall market due to the growing food and beverage sector. Notably, the Australian business Huskee, which is well-known for its recycled coffee cups, was purchased by Duni Group's BioPak in April 2024. This strategic move supports BioPak's commitment to eco-friendly dining solutions and aligns with the region's push for circular practices. Concurrently, paper cups are becoming popular as a result of stringent laws being implemented by governments in Asia-Pacific to decrease the usage of single-use plastics. The acquisition demonstrates the market's emphasis on sustainable technologies, which are essential for resolving environmental issues and meeting customer demands.

South America Paper Cups Market Trends:

South America sees rising demand for paper cups fueled by increasing fast-food chains and government initiatives promoting sustainable products. Brazil's coffee culture drives the market, with paper cups widely used in cafes. Efforts like McDonald's switch to paper-based packaging in Brazil highlight the push for environmentally friendly alternatives, aligning with trends toward waste reduction and green materials.

Middle East and Africa Paper Cups Market Trends:

The Middle East and Africa market is shaped by the growing food delivery sector and environmental initiatives. In the United Arab Emirates, disposable paper cups are common in coffee shops like Starbucks. Dubai's stricter regulations strongly enact the use of biodegradable paper products to reduce plastic waste and gather steam. Apart from this, growing tourism further impels the demand for disposable, eco-friendly alternatives in the hotel sector.

Top Companies Leading in the Paper Cups Industry

Some of the leading paper cups market companies include Bender Limited, CEE Schisler Packaging Solutions, ConverPack, Inc., Dart Container Corporation, Georgia-Pacific Consumer Products LP, Go-Pak Group, Graphic Packaging International, LLC, Hotpack Packaging Industries LLC, Huhtamäki Oyj, Pactiv Evergreen Inc., Printed Cup Company, Seda International Packaging Group, Stora Enso, and Tekni-Plex, Inc., among many others. For instance, the largest paper cup recycling program in the UK was introduced in February 2024 as part of Go-Pak’s sustainability commitments with the National Cup Recycling Scheme.

Global Paper Cups Market Segmentation Coverage

- On the basis of the cup type, the market has been bifurcated into cold paper cups and hot paper cups, wherein hot paper cups represent the most preferred segment. The demand for hot paper cups has been largely influenced by the increasing trend of consumers consuming takeaway and on-the-go beverages and food products.

- Based on the wall type, the market is categorized into single wall, double wall, and triple wall, amongst which single wall dominates the market. Moreover, single wallpaper cups are extremely cost-effective and available in a wide variety of sizes. They are also preferred due to their lower energy and paper material consumption compared to double and multiple-wall cups.

- On the basis of the application, the market has been divided into tea and coffee, chilled food and beverage, and other food and beverages. Among these, tea and coffee exhibit a clear dominance in the market on account of the increasing number of cafes and tea shops around the world serving good-quality beverages to consumers is primarily bolstering the growth of this segment.

- Based on the end user, the market is bifurcated into coffee and tea shops, QSR and other fast food shops, offices and educational institutions, residential use, and others, wherein coffee and tea shops dominate the market. The establishment of affordable coffee shops is also attracting working individuals to sit and work in coffee houses.

- On the basis of the distribution channel, the market is segmented into institutional sales and retail sales. Currently, institutional sales account for the majority of the total market share. Institutional sales dominate the paper cups market due to high demand from sectors like food service, healthcare, and education, driving bulk orders for disposable, eco-friendly options and supporting the market's consistent growth and adoption.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 7.0 Billion |

| Market Forecast in 2033 | USD 9.1 Billion |

| Market Growth Rate 2025-2033 | 2.9% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cup Types Covered | Cold Paper Cups, Hot Paper Cups |

| Wall Types Covered | Single Wall, Double Wall, Triple Wall |

| Applications Covered | Tea and Coffee, Chilled Food and Beverage, Other Food and Beverages |

| End Users Covered | Coffee and Tea Shops, QSR and Other Fast Food Shops, Offices and Educational Institutions, Residential Use, Others |

| Distribution Channels Covered | Institutional Sales, Retail Sales |

| Regions Covered | Asia Pacific, Europe, North America, South America, Middle East and Africa |

| Companies Covered | Bender Limited, CEE Schisler Packaging Solutions, ConverPack, Inc., Dart Container Corporation, Georgia-Pacific Consumer Products LP, Go-Pak Group, Graphic Packaging International, LLC, Hotpack Packaging Industries LLC, Huhtamäki Oyj, Pactiv Evergreen Inc., Printed Cup Company, Seda International Packaging Group, Stora Enso, Tekni-Plex, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Paper Cups Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)