Global Packaging Robots Market Expected to Reach USD 10,134.6 Million by 2033 - IMARC Group

Global Packaging Robots Market Statistics, Outlook and Regional Analysis 2025-2033

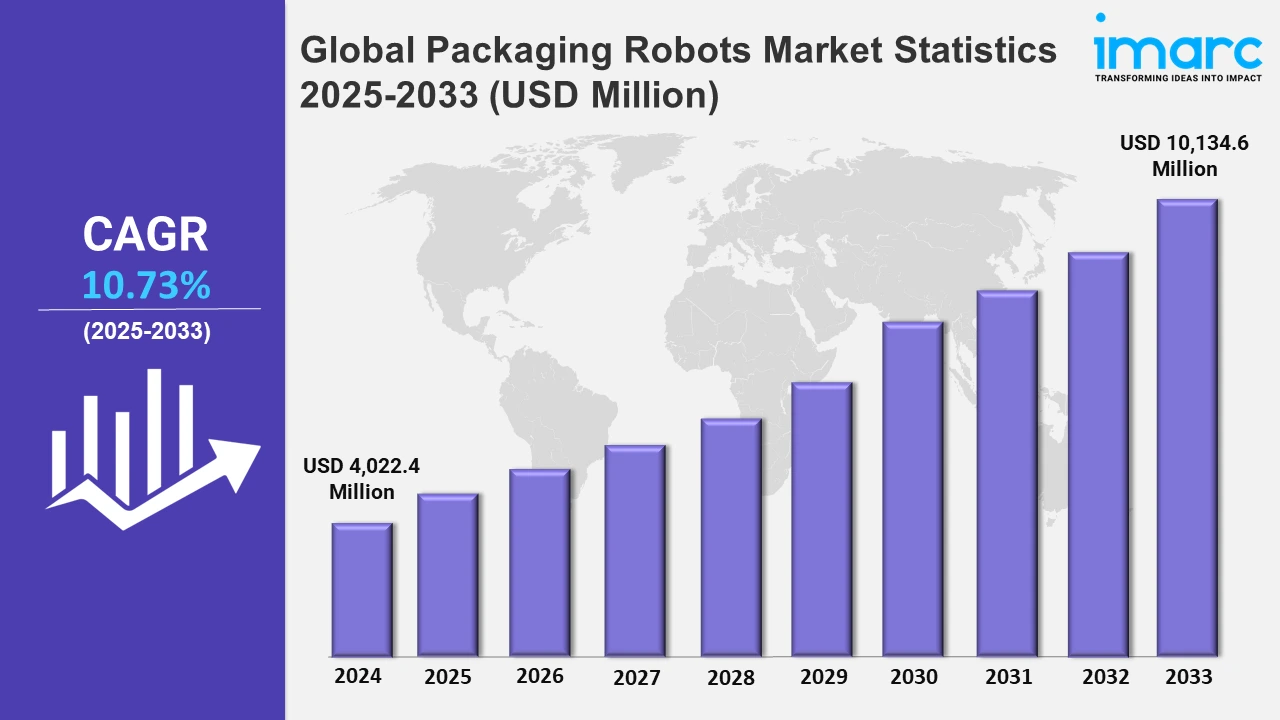

The global packaging robots market size was valued at USD 4,022.4 Million in 2024, and it is expected to reach USD 10,134.6 Million by 2033, exhibiting a growth rate (CAGR) of 10.73% from 2025 to 2033.

To get more information on this market, Request Sample

The need for speed, precision, and efficiency in business is compelling companies toward automated solutions. Packaging robots are at the front of the transformation. Manual methods will not be able to meet the pace of modern production lines, which require fast processing to match market requirements. For instance, the industrial sector of India is growing at a faster rate and the government is now targeting 9 percent plus economic growth, according to the NITI Aayog. The packaging robots, used with advanced technologies like artificial intelligence (AI) and machine learning (ML) are found useful in these kinds of industries as they carry out repetitive tasks with better precision. They not only have a lesser risk of human mistakes but also bring down the labor costs considerably. Industrial sectors like food and beverages (F&B), pharmaceuticals, and consumer goods mostly use robotic solutions since these sectors mandate quality and hygiene standards. A report indicates that 79% of food processors, manufacturers, and distributors anticipate higher revenues in 2023 compared to the previous year, with 77% expecting increased profits. These robots help manufacturers achieve greater precision and hence contribute to profit making. Additionally, packaging robots are versatile as they can easily adapt to different product types and packaging formats, making them ideal for diverse production needs.

The growth in e-commerce has helped transform the entire packaging industry. According to estimates, revenues from global business-to-consumer (B2C) e-commerce are expected to rise from USD$1 trillion in 2019 to USD$5.5 trillion by 2027. This growth rate of 14.4% on a compounded annual basis shows huge improvement and leads the sectors consumer electronics, fashion, furniture, toys/hobby, biohealth pharmaceuticals, media and entertainment beverages, and food for B2C e-commerce. Millions of packages are shipped daily across e-commerce and retail space, prioritizing speed and efficiency in their own respective businesses. Packaging robots fill the gap in enabling busy online shopping services to meet their high-volume demands. They provide open and simple ways to complete switching operations, such as picking, sorting, and palletized, which are required to fill orders quickly. In addition to speed, these also provide accuracy, thus minimizing possible damage during transport of delicate items. Packaging robots, meanwhile, are an area where innovation is being driven forward, with further developments in robotics, sensors, and AI driving progress. They are turning robots into modern equipment with vision systems and AI algorithms that identify, analyze, and handle wide-range jobs in a packaging task with minimal human intervention. These systems vaguely allow robots to perform complex operations, such as mixed-product palletizing, that were previously difficult for automation.

Global Packaging Robots Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of robust technological advances, comprising research institutes and creative businesses.

Asia-Pacific Packaging Robots Market Trends:

Asia Pacific has been dominating the market for packaging robots due to high-speed industrialization and a rapidly growing manufacturing sector within its countries, including China, India, and Japan. Due to the fast growth rate over the next few years of more than 21%, the e-commerce industry in India is largely boosting the demand for automated solutions for packaging. The growing investments from global and local manufacturers on the latest robotics are also fueling market growth. Governments in the region are highly promoting Industry 4.0 initiatives that support the adoption of robotics into manufacturing. The production cost advantages, and availability of experienced labor force make Asia Pacific a big innovation hub for packaging robotics. The food and beverage (F&B), electronics, and pharmaceutical industries are key contributors to this growth, leveraging robotics to enhance productivity and ensure quality.

North America Packaging Robots Market Trends:

North America is a major shareholder in the packaging robots market, driven by the high demand for advanced automation across industries. The well-established e-commerce ecosystem and consumer goods sector in the region drives this market. The United States leads in adopting robotics, with companies investing in AI-driven robots to enhance efficiency. Regulatory compliance in sectors like pharmaceuticals and food packaging further encourages the use of automated solutions. Aside from this, growing labor shortages and increasing labor costs in the region push manufacturers to adopt robotic systems in order to stay competitive.

Europe Packaging Robots Market Trends:

Europe is a mature market for packaging robots with countries such as Germany, UK, and France as pioneers in adopting the technology. The region's emphasis on sustainability has been enhancing the demand for robotics. Automotive, food, and beverage industries are among the first adopters who utilized the technology for high precision capabilities. Apart from this, strict quality measures of Europe, mainly in pharmaceuticals and food sectors, add robotics as an integral component of the production lines. Besides, the region has considerable investment in research and development (R&D) that enhances the robotics technology, thus contributing to the market growth on a steady curve.

Latin America Packaging Robots Market Trends:

The Latin American market is growing steadily, supported by increasing investments in automation across industries. It is driven by expanding manufacturing activities and a growing consumer base. The region's e-commerce sector, although smaller compared to North America or Asia Pacific, is witnessing robust growth, boosting the demand for packaging robots. Challenges such as fluctuating economic conditions and limited access to advanced technologies slow down widespread adoption but increasing awareness and investments by multinational companies are paving the way for growth.

Middle East and Africa Packaging Robots Market Trends:

The Middle East and Africa area is a growing market for packaging robots, owing to infrastructural development and the rise of manufacturing centers in nations such as the UAE, Saudi Arabia, and South Africa. One of the main drivers is the food and beverage sector, which provides a large amount of the region's packaging automation requirements. To increase efficiency and adhere to international norms, governments and the corporate sector are spending greater amounts of money in automation. Positive prospects are also provided by the growing industrialization and the rising demand for effective packaging solutions.

Top Companies Leading in the Packaging Robots Industry

Some of the leading packaging robots market companies include ABB Ltd., Comau S.p.A., Denso Wave Incorporated, Doosan Robotics Inc., FANUC America Corporation, Krones AG, Kuka AG, Mitsubishi Electric Corporation, Omron Robotics, ProMach Inc., Remtec Automation, LLC, Schneider Electric, Syntegon Technology GmbH, Yaskawa America, Inc., among many others.

In March 2024, ABB launched its rebuilt US robotics headquarters and manufacturing site in Auburn Hills, Michigan, to service ABB Robotics' sectors in packaging & logistics, food & beverage, construction, life sciences & healthcare, and automotive electric vehicle production in the United States. The company's dedication to long-term growth in the US market and its international investments in building robotics and automation capacity and creating new, highly skilled employment are both reflected in the enlarged facility.

Global Packaging Robots Market Segmentation Coverage

- On the basis of the gripper type, the market has been categorized into clamp, claw, vacuum, and others. Clamp grippers are suitable for applications needing a firm hold on heavier or rigid items as typically required for industrial packaging purposes. While claw grippers are suitable for high-speed operation and small to medium weights, they are typically found in applications that package consumer goods. Vacuum grippers ensure delicate and less regular, odd-shaped item handling where it can serve the interests of the food and beverages and e-commerce industries.

- Based on the application, the market is classified into picking and placing, packing (tray packing, case packing, filling, and others), and palletizing (case palletizing, bag palletizing, and de-palletizing), amongst which picking and placing dominates the market, as these tasks are fundamental in various industries, including food and beverages (F&B), pharmaceuticals, electronics, and consumer goods, where speed, precision, and adaptability are paramount. Picking and placing robots excel at handling repetitive, labor-intensive tasks with minimal errors, significantly reducing operational costs and boosting productivity.

- On the basis of the end user, the market has been divided into food and beverage, pharmaceutical, consumer products, logistics, and others. The food and beverage industry's strong need for automation to handle perishable goods and maintain hygienic standards is driving market expansion. Furthermore, in order to comply with regulatory standards, the pharmaceutical business depends on packaging robots for precise and sterile operations. Whereas consumer products benefit from packaging robots for high-speed handling of diverse items, meeting varied packaging needs. Logistics also utilize packaging robots to optimize sorting, picking, and palletizing processes for efficient supply chain management.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 4,022.4 Million |

| Market Forecast in 2033 | USD 10,134.6 Million |

| Market Growth Rate 2025-2033 | 10.73% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Gripper Types Covered | Clamp, Claw, Vacuum, Others |

| Applications Covered |

|

| End Users Covered | Food and Beverage, Pharmaceutical, Consumer Products, Logistics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Comau S.p.A., Denso Wave Incorporated, Doosan Robotics Inc., FANUC America Corporation, Krones AG, Kuka AG, Mitsubishi Electric Corporation, Omron Robotics, ProMach Inc., Remtec Automation, LLC, Schneider Electric, Syntegon Technology GmbH, Yaskawa America, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)