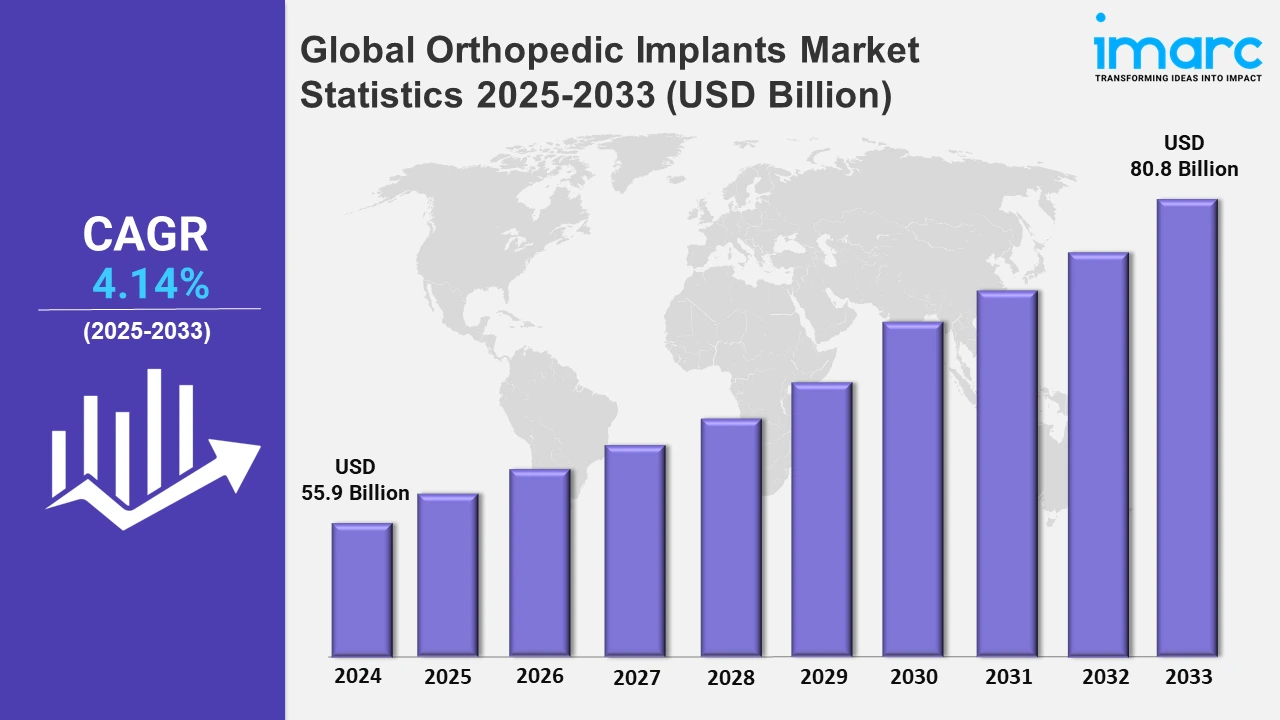

Global Orthopedic Implants Market to Grow at 4.14% During 2025-2033, Reaching USD 80.8 Billion by 2033

The global orthopedic implants market size was valued at USD 55.9 Billion in 2024, and it is expected to reach USD 80.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.14% from 2025 to 2033.

To get more information on this market, Request Sample

An increase in sports participation, coupled with a higher incidence of related injuries and trauma cases, is significantly augmenting the demand for orthopedic implants. High-impact sports and physically demanding activities often lead to joint injuries or fractures that necessitate surgical intervention. Additionally, numerous advancements in medical imaging processes and surgical techniques allow for quicker and more precise diagnosis and treatment, thereby encouraging the use of implants for faster recovery. Trauma cases from accidents and falls also contribute to the rising need for implants, ensuring the continued expansion of the orthopedic implants market as hospitals and clinics equip themselves to address these conditions effectively. According to BMJ Journals, sports injuries comprised 1.12% of all trauma cases, predominantly affecting males (86.1%) with an average age of 24.97 years. Students were most affected (48.6%), and football accounted for 66.7% of injuries. Fractures were common (59.7%), and severe injuries made up 73.7% of cases.

The growing elderly population is another major driver in the orthopedic implants market. From 1974 to 2024, the global share of individuals aged 65 and older nearly doubled, rising from 5.5% to 10.3%, with projections from the United Nations indicating it will double again to 20.7% by 2074. The number of people aged 80 and above is expected to more than triple within the same timeframe. Age-related conditions, including osteoporosis, arthritis, and fractures, which often require surgical intervention, are becoming increasingly common. The need for joint replacements and bone repair solutions is closely linked to an aging demographic prone to musculoskeletal issues. This trend is significantly driving the demand for orthopedic implants that improve mobility and reduce pain. The combination of longer life expectancy and a more active elderly population is promoting market growth as healthcare systems adapt to meet these changing needs.

Global Orthopedic Implants Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of advanced healthcare infrastructure, high prevalence of orthopedic conditions, and continuous adoption of innovative implant technologies.

North America Orthopedic Implants Market Trends:

The North American orthopedic implants market is driven by advanced technological integration, including robotic-assisted surgery and 3D printing for personalized implants. A notable development in the region is the recent partnership between THINK Surgical and Maxx Orthopedics during February 2024, which is aimed at incorporating the Freedom Knee System into THINK's ID-HUB database for use with the TMINI Miniature Robotic System, expanding implant options and access to robotic-assisted knee replacements. The market benefits from strong healthcare infrastructure and substantial R&D investments, supporting innovative solutions. The high prevalence of conditions like osteoarthritis and access to top-quality surgical care further fuel market growth.

Asia-Pacific Orthopedic Implants Market Trends:

In the Asia-Pacific region, the market for orthopedic implants is mainly fueled by an expanding aging population and a rising occurrence of bone diseases linked to aging. The region is experiencing increased use of minimally invasive surgical methods, aided by growing healthcare facilities and government funding. The swift growth of cities and enhanced availability of healthcare services is significantly augmenting the overall market demand in developing nations across Asia Pacific.

Europe Orthopedic Implants Market Trends:

Europe's orthopedic implants market trends include an enhanced focus on biocompatible materials and sustainable practices. The area's strict regulatory requirements are promoting innovation in resilient, long-lasting implants. Moreover, increased emphasis on rehabilitation and post-surgery care is driving the need for top-notch orthopedic solutions. The high occurrence of sports-related injuries further fuels market interest in innovative treatment solutions.

Latin America Orthopedic Implants Market Trends:

In Latin America, the market dynamics for orthopedic implants are shaped by the growing accessibility of cutting-edge medical technologies and enhancements in healthcare infrastructure. Increasing awareness of orthopedic treatments and improved access to surgical options are enhancing market opportunities. In some countries, economic expansion is resulting in increased healthcare spending, which is increasing the demand for implants.

Middle East and Africa Orthopedic Implants Market Trends:

The orthopedic implants market in the Middle East and Africa is shaped by an enhanced focus on expanding medical tourism and specialized surgical services. Government efforts to improve healthcare infrastructure and increase investment in modern medical technologies are supporting market growth. Rising rates of trauma and injury from road accidents also contribute to the growing demand for implants in the region.

Top Companies Leading in the Orthopedic Implants Industry

Some of the leading orthopedic implants market companies include Arthrex Inc., Auxein, B. Braun SE, CONMED Corporation, Enovis Corporation, Exactech, Inc., Globus Medical, Medical Devices Business Services, Inc. (Johnson & Johnson), Narang Medical Limited, Smith & Nephew plc, Stryker Corporation, The Orthopaedic Implant Company, United Orthopedic Corporation, among many others. On September 4, 2024, Arthrex launched OrthoPedia Patient, a digital platform offering videos on orthopedic implants and related treatments. It covers orthopedic anatomy, pathologies, treatment options, and surgical animations of minimally invasive techniques. Developed by clinical specialists and peer-reviewed, this resource supports patient education as surgical technology advances, emphasizing accessible knowledge for both professionals and patients.

Global Orthopedic Implants Market Segmentation Coverage

- On the basis of the product, the market has been categorized into reconstructive joint replacements (knee replacement implants, hip replacement implants, and extremities), spinal implants (spinal fusion implants, vertebral compression fracture (VCF) devices, and motion preservation devices/non-fusion devices), dental implants (root form and plate form dental implants), trauma, orthobiologics (demineralized bone matrix (DBM), allograft, bone morphogenetic protein (BMP), viscosupplementation products, synthetic bone substitutes, and others), and others, wherein reconstructive joint replacements represent the leading segment. This can be attributed to the widespread occurrence of joint-related conditions such as osteoarthritis and rheumatoid arthritis, especially in the elderly population. These processes enhance mobility and life quality, thereby creating a higher demand. Moreover, continual improvements in surgical methods and implant materials improve patient results, making reconstructive joint replacements a commonly embraced and vital option in orthopedic treatment.

- Based on the type, the market is classified into knee, hip, wrist, and shoulder, dental, spine, ankle, and others, amongst which knee dominates the market. This can be attributed to the high incidences of knee-related conditions, such as osteoarthritis and sports injuries. An increasing elderly population and the rising need for total knee replacement surgeries lead to its prevalence. Innovations in knee implant design and robotic-assisted techniques additionally bolster this segment's robust market standing.

- Based on the biomaterial, the market has been divided into metallic biomaterials (stainless steel, titanium alloy, cobalt alloy, and others), ceramic biomaterials, polymers biomaterials, and others. Among these, metallic biomaterials account for the majority of the market share due to their durability, strength, and biocompatibility. Materials such as titanium and cobalt-chromium alloys are widely used for joint and bone replacements because they offer excellent load-bearing capacity and corrosion resistance. These properties render metallic biomaterials a preferred choice for long-lasting and effective orthopedic solutions.

- Based on the end user, the market is segregated into hospitals, orthopedic clinic, ambulatory surgical centers, and others. Hospitals hold a significant position in the market, offering comprehensive surgical capabilities and advanced medical technology. Orthopedic clinics play a notable role by providing specialized, high-volume joint and bone procedures, ensuring focused patient care. Ambulatory surgical centers are also gaining market traction due to their cost-effective, efficient surgeries and shorter recovery times, appealing to convenience-seeking patients.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 55.9 Billion |

| Market Forecast in 2033 | USD 80.8 Billion |

| Market Growth Rate (2025-2033) | 4.14% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered |

|

| Types Covered | Knee, Hip, Wrist and Shoulder, Dental, Spine, Ankle, Others |

| Biomaterials Covered |

|

| End Users Covered | Hospitals, Orthopedic Clinic, Ambulatory Surgical Centers, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arthrex Inc., Auxein, B. Braun SE, CONMED Corporation, Enovis Corporation, Exactech, Inc., Globus Medical, Medical Devices Business Services, Inc. (Johnson & Johnson), Narang Medical Limited, Smith & Nephew plc, Stryker Corporation, The Orthopaedic Implant Company, United Orthopedic Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Orthopedic Implants Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)