Global Optical Wavelength Services Market Expected to Reach USD 9.2 Billion by 2033 - IMARC Group

Global Optical Wavelength Services Market Statistics, Outlook and Regional Analysis 2025-2033

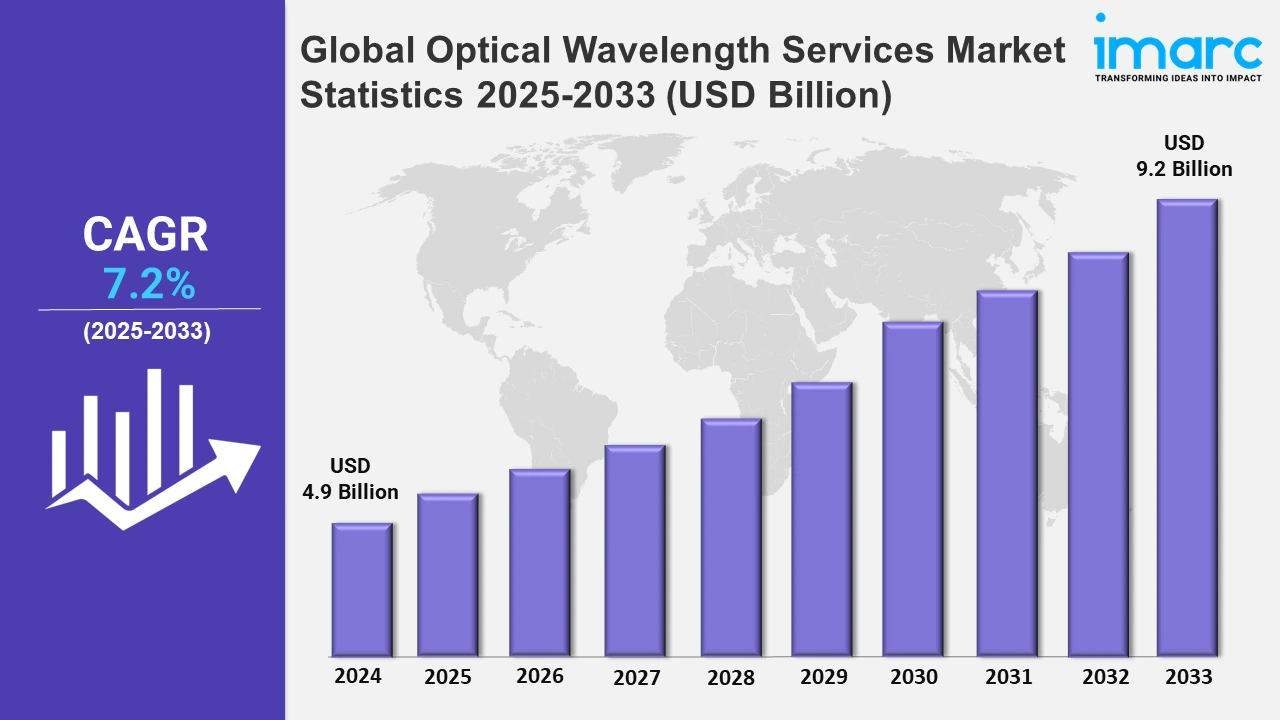

The global optical wavelength services market size was valued at USD 4.9 Billion in 2024, and it is expected to reach USD 9.2 Billion by 2033, exhibiting a growth rate (CAGR) of 7.2% from 2025 to 2033.

To get more information on this market, Request Sample

At present, the rising data traffic due to video streaming, cloud computing, and Internet of Things (IoT) applications is driving the demand for high-capacity, reliable optical wavelength services. Moreover, enterprises across various industries are seeking high-speed and secure data transmission to support their operations, leading to higher adoption of optical wavelength services. Besides this, the increasing number of data centers worldwide, driven by the need to support digital transformation and cloud services, is catalyzing the demand for optical wavelength services to provide the needed bandwidth and scalability. In line with this trend, Astound Business Solutions launched a 400G wavelength service in 2024, utilizing Ciena’s WaveLogic 5 technology to deliver significant capacity tailored for carriers, enterprises, and public sector clients. This new service is specifically designed to meet the growing connectivity demands of data centers and educational institutions. Additionally, Astound is deploying Ciena’s Waveserver 5 platform across its extensive long-haul network, supporting the scalability required for modern data infrastructure.

Furthermore, the increasing traction of remote and hybrid working models is driving the need for robust data transmission services to support video conferencing, collaboration tools, and secure access to company networks. In addition, the development of advanced optical technologies is enabling higher data transmission rates and improved network efficiency. Innovations in spectral efficiency and transmission optimization are enhancing the capability to meet the rising demand for low-latency, large-capacity network solutions, supporting the expansion of intelligent computing and data-heavy applications. These advancements help service providers offer more reliable and scalable services, catering to the growing needs of enterprises and public sector organizations. Apart from this, the expansion of digital infrastructures and the need for faster data transfer are encouraging telecom providers to invest in advanced optical technologies. These solutions support rapid deployment and scalable network enhancements, ensuring service providers can meet the growing bandwidth requirements of modern enterprises and users. In 2024, Conterra Networks launched its 400Gb/s wavelength services for carrier clients in Texas, North Carolina, and Louisiana using Ciena’s WaveLogic 5 Extreme technology. This move enhances Conterra’s network capacity and deployment speed, bolstering its ability to meet increasing bandwidth demands efficiently.

Global Optical Wavelength Services Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of the presence of leading tech companies and presence of numerous tech companies in the region.

North America Optical Wavelength Services Market Trends:

North America is a leading segment in the market, driven by its advanced telecommunication infrastructure and high adoption of cutting-edge technologies. The demand is driven by the presence of major tech companies, data centers, and strong cloud service growth. North American enterprises are prioritizing scalable, high-capacity networks to support data-intensive operations and digital transformation initiatives. In 2024, Zayo announced the completion of five new carrier-diverse 400G wavelength routes across North America, enhancing connectivity and expanding on-demand network capabilities. These routes provide unique, high-capacity paths connecting key markets and bolster Zayo's position as a leader in 400G-enabled infrastructure. The upgrades support fast, reliable connections crucial for high-bandwidth applications.

Asia-Pacific Optical Wavelength Services Market Trends:

The Asia Pacific is experiencing growth in the optical wavelength services market on account of the expanding internet penetration, increasing digitalization, and the rising number of data centers. The thriving tech ecosystem and investments in network infrastructure are strengthening the market growth. The rise in IT and telecom services further enhance the adoption of high-capacity optical solutions, positioning Asia Pacific as a key region in the market.

Europe Optical Wavelength Services Market Trends:

The rising demand for optical wavelength services in Europe, supported by advancements in network technology and a strong focus on digital transformation across industries is bolstering the market growth. The widespread implementation of high-speed broadband and increasing reliance on cloud-based applications is contributing to the market growth.

Latin America Optical Wavelength Services Market Trends:

The optical wavelength services market in Latin America is growing as many countries in the region are investing in improving their telecom infrastructure to support expanding data requirements. Rising internet usage and the increasing adoption of advanced connectivity solutions are offering a favorable market outlook in the region.

Middle East and Africa Optical Wavelength Services Market Trends:

The Middle East and Africa region is progressing in the optical wavelength services market due to growing investments in communication networks and increasing adoption of digital services. The focus of the region on strengthening IT infrastructure and expanding broadband coverage is supporting the market growth.

Top Companies Leading in the Optical Wavelength Services Industry

Some of the leading optical wavelength services market companies include AT&T, CarrierBid Communications, Colt Technology Services Group Limited, Comcast Corporation, Crown Castle, Deutsche Telekom AG, Lumen Technologies, Nokia Corporation, Verizon, Windstream Intellectual Property Services, LLC and Zayo Group, LLC, among many others. In 2024, Colt Technology Services and Ciena announced a milestone achievement in transatlantic data transmission with a 1.2 Tb/s wavelength trial on Colt’s Grace Hopper subsea cable. Utilizing Ciena’s WaveLogic 6 Extreme technology, this trial doubled wavelength capacity and improved energy efficiency, showcasing enhanced bandwidth and reduced power consumption. Colt plans to integrate this technology into its network for future 400Gbe and 800Gbe services.

Global Optical Wavelength Services Market Segmentation Coverage

- On the basis of the bandwidth, the market has been categorized into less than 10 Gbps, 40 Gbps, 100 Gbps, and more than 100 Gbps, wherein less than 10 Gbps represent the leading segment. Less than 10 Gbps holds the biggest share in the market because of its cost-effectiveness and ability to meet the needs of small to mid-sized enterprises (SMEs). The demand is driven by businesses that prioritize efficient data transmission for standard operations, such as video conferencing, data backups, and routine cloud services. Its dominance is also attributed to widespread applications across various sectors that require robust connectivity without the cost implications of higher bandwidth options.

- Based on the interface, the market is classified into OTN, Sonet, and ethernet, amongst which ethernet dominates the market. Ethernet accounts for the majority of the market share because of its widespread adoption and versatility across various industries. The ability of ethernet to provide scalable, high-speed data transmission with seamless integration into existing network infrastructure makes it a preferred choice. Its compatibility with both local and wide area networks, combined with cost-efficiency and ease of deployment, drives its dominance.

- On the basis of the organization size, the market has been divided into small and medium-sized enterprises and large enterprises. Among these, large enterprises account for the majority of the market share. Large enterprises are the leading segment in the market as they often have the financial resources to invest in premium services that ensure high bandwidth, minimal latency, and network resilience. The dominance of this segment is further driven by sectors such as IT, finance, and telecom, which rely heavily on robust connectivity solutions.

- Based on the application, the market is segregated into short haul, metro, and long haul. Short haul involves optical wavelength services used for data transmission over relatively short distances, typically within campuses or data centers, offering quick and efficient connectivity solutions. Metro covers services used within metropolitan areas to connect various business locations and data centers, supporting urban network needs with high-capacity and scalable solutions. Long haul refers to optical wavelength services designed for transmitting data over extensive distances, often between cities or across countries, ensuring reliable and secure communication for large-scale operations.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 4.9 Billion |

| Market Forecast in 2033 | USD 9.2 Billion |

| Market Growth Rate 2025-2033 | 7.2% |

| Units | Billion USD |

| Segment Coverage | Bandwidth, Interface, Organization Size, Application, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AT&T, CarrierBid Communications, Colt Technology Services Group Limited, Comcast Corporation, Crown Castle, Deutsche Telekom AG, Lumen Technologies, Nokia Corporation, Verizon, Windstream Intellectual Property Services, LLC, Zayo Group, LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)