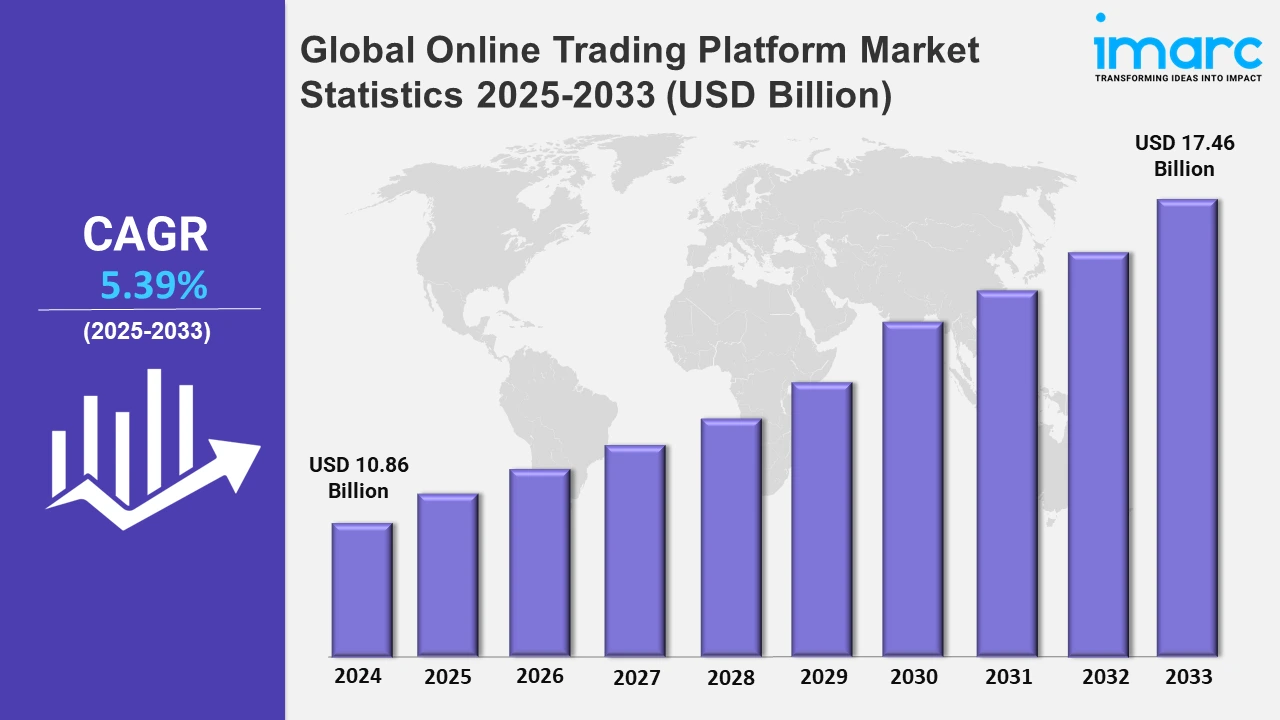

Global Online Trading Platform Market Expected to Reach USD 17.46 Billion by 2033 - IMARC Group

Global Online Trading Platform Market Statistics, Outlook and Regional Analysis 2025-2033

The global online trading platform market size was valued at USD 10.86 Billion in 2024, and it is expected to reach USD 17.46 Billion by 2033, exhibiting a growth rate (CAGR) of 5.39% from 2025 to 2033.

To get more information on this market, Request Sample

The increased demand for customized trading platforms from a variety of end users, including governments and non-profit banks, is driving the demand for online trading platforms. Furthermore, the market is being driven by an increasing usage of customized trading platforms that can be configured to meet local regulatory requirements and investor protection measures, such as risk management protocols, account monitoring, and reporting functions. Furthermore, customized trading platforms offer various benefits, including ease of use, lower costs, and fewer risks of error, all of which contribute to a good prognosis for market expansion. Furthermore, the growing number of retail investors who prefer to manage their own investments has increased demand for customized trading platforms. For example, in September 2024, CBOE collaborated with Globacap, a UK IT startup, to develop a U.S. trading platform for private company shares. The platform, CBOE Private Markets, is in the pilot stage after being registered as a broker-dealer with FINRA. Private markets are becoming more popular, with high-profile firms choosing to remain private for an extended period. CBOE's move reflects a trend among financial heavyweights to capitalize on this interest in alternative assets beyond traditional stocks and bonds.

Moreover, technological improvements have a significant impact on the worldwide online trading platform market. With the rapid advancement of digital technology, online trading platforms have become more complex, user-friendly, and feature-rich. These technology breakthroughs, such as the incorporation of artificial intelligence, blockchain, automation, and high-frequency trading, are transforming the online trading platform market dynamics by increasing efficiency, enabling complicated strategies, and improving user experience. For instance, in March 2024, Options Technology collaborated with Trader Evolution to provide increased API access and trading software solutions. This alliance intends to provide clients with innovative software, customized API connectivity, and comprehensive multi-asset class market data. The collaboration used Trader Evolution's expertise in financial software solutions and a backend-centric platform to create cutting-edge, scalable strategies adapted to changing client needs. Besides this, retail investors are turning to simple tools, such as internet trading, that can be accessed from anywhere to manage their money. Moreover, retail investors now account for a sizable share of equities trading activity, which is one of the primary reasons driving market growth. Furthermore, as they offer lower transaction costs and brokerage fees than traditional methods, they are becoming increasingly popular among retail investors with limited resources or smaller investment quantities. Additionally, these platforms provide retail investors with real-time market data, news, charts, and research tools, thereby increasing transparency and allowing retail investors to actively manage their portfolios. The surge in retail trading activity, fueled by the accessibility and cost-effectiveness of these platforms, has greatly increased demand for online trading platforms in numerous countries. Furthermore, ongoing technological improvements and the integration of AI-powered tools on these platforms are improving user experience and contributing to the global growth in online trading platform demand. For example, in April 2024, uTrade Solutions introduced uTrade Algos, a trading platform for retail investors, in Goa. The platform includes built-in and back-tested investment techniques designed to help equity traders plan, strategize, and automate trades with artificial intelligence. According to uTrade Solutions, the platform allows traders to make informed investment decisions and evaluate financial returns in real time using completely automated Algo-based trading.

Global Online Trading Platform Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for online trading platform owing to the rising smartphones penetration and the widespread adoption of digital technologies.

North America Online Trading Platform Market Trends:

North America dominates the overall market, owing to the modern infrastructure, high-speed internet access, and widespread advanced technology usage. Furthermore, the region's extensive and well-established financial industry, which includes major stock exchanges, brokerage firms, and institutional investors, provides the market with lucrative growth potential. For example, in July 2024, CRA International, Inc. introduced an improved NFX trading platform for the Natural Fibre Exchange. The portal now allows for international wool purchasing and selling, with the goal of attracting more global buyers and sellers. CRA's Auctions & Competitive Bidding Practice has vast experience with auction and market design.

Europe Online Trading Platform Market Trends:

Countries like Germany, France, and Italy have seen a surge in fintech services, which offer innovative trading solutions and user-friendly platforms. This trend has attracted a new wave of retail investors, contributing to the expansion of the online trading platform industry. Moreover, the introduction of diverse trading instruments, including cryptocurrencies, commodities, and derivatives, has attracted a broader spectrum of investors. This diversification is particularly prominent in countries like Switzerland and the Netherlands, where investors seek alternative assets, further propelling the industry demand.

Asia-Pacific Online Trading Platform Market Trends:

The Asia-Pacific region sees explosive growth in mobile trading platforms like Zerodha in India and Tiger Brokers in China, fueled by smartphone penetration and financial literacy initiatives. Governments encourage digital financial inclusion, with India’s UPI integration into trading platforms boosting accessibility. The region’s young population and digital-first approach propel the demand for mobile-friendly trading platforms.

Latin America Online Trading Platform Market Trends:

Platforms like Bitso in Mexico cater to high demand driven by unstable fiat currencies and remittance needs. Brazil's regulatory approval for crypto trading further accelerates the trend. Latin Americans leverage digital assets for economic stability, making crypto trading platforms a defining feature of this market.

Middle East and Africa Online Trading Platform Market Trends:

In the Middle East and Africa, the growth of fintech supports the online trading platform market. Initiatives like Saudi Arabia's Vision 2030 foster digital finance. South Africa sees robust forex trading interest. The region's untapped potential and rising internet penetration create a fertile ground for online trading platforms tailored to regional needs.

Top Companies Leading in the Online Trading Platform Industry

Some of the leading online trading platform market companies include Ally Financial Inc., Cboe Global Markets Inc., Charles Schwab & Co. Inc., Chetu Inc., Devexperts LLC, E-Trade Financial Corporation (Morgan Stanley), FMR LLC, Interactive Brokers LLC, MarketAxess Holdings Inc., Plus500 Ltd, and Tradestation Group Inc. (Monex Group Inc.), among many others. For instance, in September 2024, CBOE collaborated with a London-based tech firm, Globacap, to launch a U.S. trading platform for shares of closely held companies. Also, in November 2024, FMR LLC, a well-known investment business, increased its portfolio by acquiring an extra 182,163 shares of Hanmi Financial Corp, a bank focused on serving multi-ethnic communities in the United States.

Global Online Trading Platform Market Segmentation Coverage

- On the basis of the component, the market has been bifurcated into platform and services, wherein platform represented the largest segment. The increasing demand for lower transaction costs and reduced brokerage fees are propelling the adoption of online trading platforms.

- Based on the type, the market is categorized into commissions and transaction fees, amongst which commissions accounted for the largest market share mainly, due to their enhanced offering of advanced trading tools, research resources, and customer support.

- On the basis of the deployment mode, the market has been divided into on-premises and cloud. Among these, cloud represented the largest segment as it offers scalability, allowing for seamless handling of increased user traffic and data volumes, and fluctuating trading activity.

- Based on the application, the market is bifurcated into institutional investors and retail investors, wherein institutional investors accounted for the largest market share. Institutional investors have access to advanced trading technology, including high-frequency trading (HFT) algorithms and algorithmic trading platforms, which allow them to execute a large number of trades with precision and speed.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 10.86 Billion |

| Market Forecast in 2033 | USD 17.46 Billion |

| Market Growth Rate 2025-2033 | 5.39% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Platform, Services |

| Types Covered | Commissions, Transaction Fees |

| Deployment Modes Covered | On-premises, Cloud |

| Applications Covered | Institutional Investors, Retail Investors |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ally Financial Inc., Cboe Global Markets Inc., Charles Schwab & Co. Inc., Chetu Inc., Devexperts LLC, E-Trade Financial Corporation (Morgan Stanley), FMR LLC, Interactive Brokers LLC, MarketAxess Holdings Inc., Plus500 Ltd, Tradestation Group Inc. (Monex Group Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)