Global Oil and Gas Security Market Expected to Reach USD 49.3 Billion by 2033 - IMARC Group

Global Oil and Gas Security Market Statistics, Outlook and Regional Analysis 2025-2033

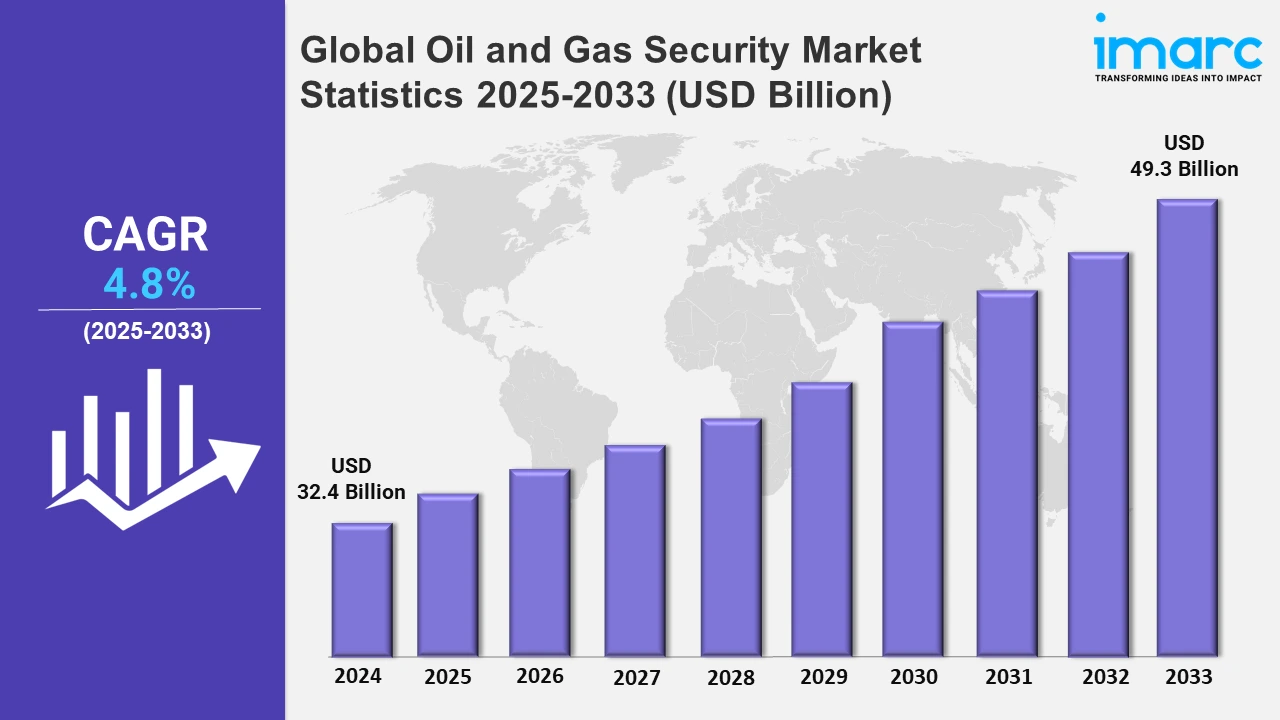

The global oil and gas security market size was valued at USD 32.4 Billion in 2024, and it is expected to reach USD 49.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.8% from 2025 to 2033.

To get more information on this market, Request Sample

The oil and gas security market are expanding due to increasing cyber threats targeting critical energy infrastructure, driving significant investments in advanced cybersecurity solutions to safeguard operations. The adoption of digital technologies, including the Internet of Things (IoT) and artificial intelligence (AI), across the sector heightened vulnerabilities, necessitating robust security frameworks to mitigate risks. For example, on October 16, 2024, IFS launched three innovations for its Energy & Resources division, including AI-powered IFS BOLO 15 for advanced oil and gas accounting, AP invoicing to improve cash flow, and brine leasing capabilities for lithium projects. These tools streamline workflows, enhance sustainability, and support clean energy transitions. Additionally, stringent government regulations mandating infrastructure protection and rising geopolitical tensions have amplified the need for comprehensive physical and cyber security measures. Advanced surveillance and perimeter control systems further enhance security, ensuring operational resilience and mitigating sabotage risks within the oil and gas industry.

The increasing complexity of global supply chains in oil and gas operations heightened risks, driving demand for robust supply chain security measures. The industry's growing emphasis on minimizing downtime and ensuring uninterrupted production is further accelerating the adoption of advanced monitoring technologies as well as predictive maintenance. Additionally, the transition to renewable energy sources and smart grids necessitates integrating security solutions to manage and protect hybrid energy infrastructures. For example, on December 16, 2024, bp and XRG launched Arcius Energy, a joint venture aimed at developing a competitive international natural gas portfolio, beginning in Egypt. Combining bp’s 60 years of expertise with XRG’s investment strategy, Arcius Energy supports lower-carbon energy solutions, leveraging assets like Egypt’s Zohr and Atoll fields. With the sector’s increasing reliance on automation and remote monitoring, investments in real-time threat detection and response systems are crucial for ensuring operational safety and resilience against evolving threats.

Global Oil and Gas Security Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of its advanced infrastructure, stringent regulatory frameworks, increasing cyber threats, and significant investments in security technologies and solutions.

North America Oil and Gas Security Market Trends:

The North American oil and gas security market is driven by advanced energy infrastructure, increasing cyber threats, and stringent regulations targeting critical operations. Efforts to protect pipelines, storage facilities, and offshore platforms are fueling investments in advanced security technologies. On June 18, 2024, the U.S. Department of Energy (DOE) introduced Supply Chain Cybersecurity Principles, supported by industry leaders like Siemens and Honeywell, to address risks across electricity, oil, and natural gas systems globally. These principles focus on energy digitization and clean energy integration. Additionally, the growing adoption of AI-driven monitoring systems and IoT-enabled devices strengthens real-time threat detection, ensuring operational safety and resilience in the oil and gas sector.

Europe Oil and Gas Security Market Trends:

The oil and gas security market in Europe is characterized by the commitment of the region to strict environmental and safety standards. Escalating geopolitical tensions and energy supply vulnerabilities create an increasing need for the strengthening of security measures for energy assets. The investments made in high-tech surveillance systems, perimeter controls, and cyber threat management solutions are growing. Government-private firm collaborative initiatives have also driven the development of cutting-edge security technologies.

Asia-Pacific Oil and Gas Security Market Trends:

Asia Pacific has experienced a high growth rate of the oil and gas security market, driven by the continually rising energy demand and increasing exploration activities. Improving maritime security in regions such as the South China Sea is forcing investments in advanced systems of monitoring and threat detection. Cybersecurity measurements against attacks on digital infrastructure is fast becoming a priority. Countries, including China and India, emphasize the adoption of advanced technology for securing pipelines, refineries, and offshore platforms.

Latin America Oil and Gas Security Market Trends:

The oil and gas security market in Latin America is growing due to the ever-increasing threat of vandalism, theft, and sabotage targeting energy infrastructure. Investments are being made by both governments and private companies in drones and access control systems as the measures for protection of their assets. The rising oil production in the region, particularly Brazil and Mexico, will drive up demand for integrated security solutions that ensure uninterrupted operations and protect these critical energy resources.

Middle East and Africa Oil and Gas Security Market Trends:

The Middle East and Africa market is augmenting as the investments in physical security, which includes surveillance and perimeter control, are high in protecting facilities against terrorist attacks and sabotage. Cybersecurity also becomes important with the growing cyberattacks targeting critical energy infrastructure of the key exporting nations such as Saudi Arabia and Nigeria.

Top Companies Leading in the Oil and Gas Security Industry

Some of the leading oil and gas security market companies include ABB Ltd., Cisco Systems Inc., General Electric Company, Honeywell International Inc., Intel Corporation, Lockheed Martin Corporation, Microsoft Corporation, Parsons Corporation, Siemens Aktiengesellschaft, Waterfall Security Solutions, among many others. On September 19, 2024, ABB launched a new suite of ABB Care services for mining automation and hoisting, offering proactive maintenance to enhance mining asset performance, minimize downtime, and improve operational efficiency. Customizable solutions include alarm management, cybersecurity, lifecycle management, and tiered plans for hoist systems. ABB's approach, shaped by decades of expertise and over 1,200 control systems delivered, supports predictive maintenance strategies, increasing system reliability and safety. These innovations align with sustainability goals and address challenges like rising costs and talent shortages in the mining industry.

Global Oil and Gas Security Market Segmentation Coverage

- Based on component, the market is classified into software and services. Software dominates the market attributed to their pivotal role in enabling advanced functionalities, integration, and adaptability across various systems. They power real-time monitoring, analytics, and automation, enhancing operational efficiency and decision-making. With the rise of Internet of Things (IoT) and artificial intelligence (AI) technologies, software ensures seamless communication between hardware components and supports predictive maintenance, cybersecurity, and scalability. Additionally, their customizable nature allows industries to tailor solutions to specific needs, making them indispensable in modern, technology-driven operations.

- On the basis of security type, the market has been categorized into cyber security, operational security, command and control, screening and detection, surveillance, access control, perimeter security, and others. The largest market share belongs to surveillance due to the critical aspect of security for most industries as it allows monitoring of facilities, identifying threats, and denial of access. Advances in technologies like AI-driven video analytics, thermal imaging, and remote monitoring render surveillance absolutely necessary in protecting critical infrastructure, from energy to transportation to manufacturing.

- Based on application, the market is bifurcated into exploring and drilling, transportation, pipelines, distribution and retail services, and others. Exploration and drilling involve locating and extracting oil and gas resources, relying on advanced technologies for efficient resource identification and recovery. Transportation focuses on moving extracted resources via ships, trucks, and railways, ensuring safe and timely delivery to processing facilities. Pipelines provide a cost-effective and continuous method for transporting oil and gas over long distances, with emphasis on safety and maintenance. Distribution ensures the delivery of processed fuels to regional hubs. Retail services handle end-user supply through gas stations and energy providers.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 32.4 Billion |

| Market Forecast in 2033 | USD 49.3 Billion |

| Market Growth Rate 2025-2033 | 4.8% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Security Types Covered | Cyber Security, Operational Security, Command and Control, Screening and Detection, Surveillance, Access Control, Perimeter Security, Others |

| Applications Covered | Exploring and Drilling, Transportation, Pipelines, Distribution and Retail Services, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Cisco Systems Inc., General Electric Company, Honeywell International Inc., Intel Corporation, Lockheed Martin Corporation, Microsoft Corporation, Parsons Corporation, Siemens Aktiengesellschaft, Waterfall Security Solutions etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)