Global Offshore Support Vessels Market Set to Reach USD 61.3 Billion by 2033, Asia Pacific Led with 25% Market Share in 2024

Global Offshore Support Vessels Market Statistics, Outlook and Regional Analysis 2025-2033

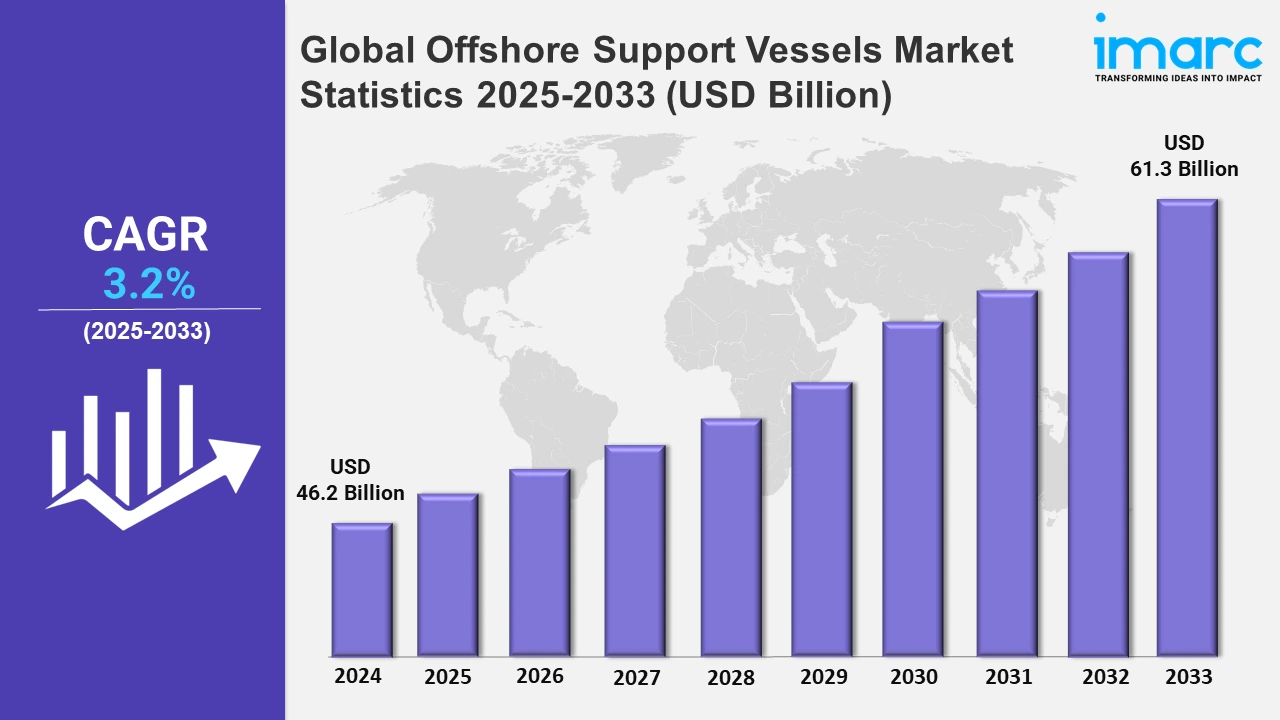

The global offshore support vessels market size was valued at USD 46.2 Billion in 2024, and it is expected to reach USD 61.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.2% from 2025 to 2033.

To get more information on this market, Request Sample

The rising demand for energy is encouraging offshore oil and gas exploration, especially in deep-water and ultra-deep-water regions. Offshore support vessels play a crucial role in supplying equipment, personnel, and logistical support to rigs and platforms. The increasing focus on untapped offshore reserves is driving the demand for offshore support vessels. Besides this, the market is witnessing a growing demand for versatile vessels designed to cater to both traditional oil and gas sectors and renewable energy projects. These sophisticated vessels frequently include eco-friendly fuel choices, state-of-the-art technology, and versatile functionalities, rendering them ideal for various offshore tasks. The focus on environmental compliance and operational efficiency is driving investments in such innovative vessel designs. In 2024, Sea1 Offshore announced contracts with Cosco Shipping to build two advanced offshore energy support vessels, scheduled for delivery between Q1 and Q2 2027. These ST-245 design vessels, methanol-ready and equipped with biofuel-compatible generators, cater to both oil, gas, and renewable energy markets.

Additionally, the increasing deployment of subsea infrastructure, such as pipelines and cables for energy transmission, is expanding the role of offshore support vessels in inspection, maintenance, and repair operations. This growth is further supported by the integration of robotics and remotely operated vehicles (ROVs), which require specialized vessels. Moreover, leading companies are actively investing in fleet modernization to enhance operational efficiency and meet evolving industry standards. These initiatives often involve long-term contracts for new vessel construction, incorporating advanced technologies and sustainability requirements. Such investments reflect a commitment to maintaining competitive operations in offshore oil and gas activities, boosting demand for high-quality offshore support vessels. In 2024, Petrobras announced a $2.8 billion deal to build and charter 12 support vessels for offshore platforms, with construction by Bram Offshore and Starnav in Santa Catarina. The investment aligns with Petrobras' 2025-2029 fleet modernization plan, requiring 40% local content during the construction phase. These vessels will support operations for 12 years after a mobilization period of up to four years.

Global Offshore Support Vessels Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific holds the largest market share, driven by expanding offshore exploration, rising energy demand, and significant investments in maritime infrastructure development.

North America Offshore Support Vessels Market Trends:

North America is showing steady growth in the market primarily due to increased exploration and production activities in the Gulf of Mexico. Advanced maritime infrastructure, a well-trained workforce, and efficient offshore operations characterize the region. North America offers attractive features with respect to vessel technology, including its eco-friendly propulsion systems. With stable demand from oil and gas projects and a high emphasis on operational safety, North America continues to remain a crucial player in the market.

Asia-Pacific Offshore Support Vessels Market Trends:

Asia Pacific leads the market, driven by robust offshore oil and gas activities across countries like China, India, and Southeast Asia. The region benefits from extensive coastlines, abundant marine resources, and active exploration projects. Moreover, the area's advantageous position for international trade routes enhances its standing in the offshore support vessels sector. Supportive government policies and investments in energy exploration additionally boost the need for offshore vessels. For example, in 2024, the Minister of Petroleum and Natural Gas revealed that India offers a ₹100 billion investment opportunity in energy exploration and production by 2030. Exploration is expected to rise from 10% to 16% of the sedimentary basins by 2024, supported by investments of ₹7,500 crore in seismic data gathering and aerial surveys. The initiative aims to enhance resource utilization and exploration coverage significantly.

Europe Offshore Support Vessels Market Trends:

Europe possesses a considerable portion of the market, driven by ongoing offshore initiatives in the North Sea and Baltic areas. The market is bolstered by the increasing need for renewable energy, especially offshore wind farms, that necessitate specialized ships for building and upkeep. Innovations in vessel design and sustainable practices establish Europe as a frontrunner in contemporary offshore vessel solutions. Strong regulatory frameworks and industry collaborations further support the market growth in this region.

Latin America Offshore Support Vessels Market Trends:

Latin America shows promising growth potential in the offshore support vessels market, with significant contributions from Brazil and Mexico. The region is rich in untapped offshore resources, leading to heightened demand for advanced vessels. Encouraging government policies and collaborations with global energy firms are boosting offshore exploration. The developing shipbuilding capabilities in Latin America and the emphasis on upgrading maritime fleets strengthen the region's standing in the global market, presenting growth prospects.

Middle East and Africa Offshore Support Vessels Market Trends:

The Middle East and Africa constitute an expanding market for offshore support vessels, bolstered by extensive offshore oil and gas resources. Nations such as Saudi Arabia, the UAE, and Nigeria are putting money into offshore exploration, impacting the need for specialized vessels. The area gains from key maritime positions and growing partnerships with global offshore service companies. Concentrated initiatives aimed at improving port facilities and updating fleets further reinforce the Middle East and Africa's position in the market.

Top Companies Leading in the Offshore Support Vessels Industry

Some of the leading offshore support vessels market companies include Bourbon, Cyan Offshore Pty Ltd., DOF Group ASA, Grupo CBO, Havila Shipping ASA, Hornbeck Offshore, Nam Cheong Limited, Ostensjo Rederi, Pacific Radiance Ltd., Sea 1 Offshore, SEACOR Marine, Solstad, Tidewater Inc., Vroon, among many others. In 2024, DOF Group finalized a $1.1 billion deal to acquire Maersk Supply Service, incorporating 78 offshore support vessels (OSVs) into its fleet, which includes 65 owned vessels. This purchase lowers the average age of the fleet and enhances DOF's standing in the oil, gas, and offshore wind industries. The vessels will operate under the DOF brand.

Global Offshore Support Vessels Market Segmentation Coverage

- On the basis of the type, the market has been divided into anchor handling towing supply vessel, platform supply vessel, fast supply intervention vessel, multi-purpose service vessel, and others, wherein anchor handling towing supply vessel represents the leading segment. The anchor handling towing supply vessel segment leads the market due to its versatility in managing complex offshore operations. This vessel is mainly utilized for towing and anchoring offshore platforms, rigs, and other structures, rendering it essential in exploration and production operations. Its capability to manage robust operations, such as anchor installation and recovery in deep seas, is establishing it as the favored option in the expanding offshore energy industry.

- Based on the water depth, the market is classified into shallow water and deepwater, amongst which shallow water dominates the market. Shallow water holds the largest market share due to the greater concentration of offshore exploration and production operations in shallow areas. These regions are more economical and easier technically than deepwater operations, making them more appealing for oil and gas firms. Offshore projects in shallow waters gain advantages from improved accessibility, decreased operational risks, and minimal equipment needs, which increases the demand for vessels tailored for these conditions.

- On the basis of the fuel, the market has been bifurcated into fuel oil and LNG. Among these, fuel oil accounts for the majority of the market share. Fuel oil dominates the market because of its dependability and effectiveness in satisfying the substantial energy needs of offshore activities. It offers a reliable and strong power source, crucial for demanding activities like towing, anchor management, and supply transport. The extensive accessibility of fuel oil, along with a robust refueling infrastructure, guarantees smooth operations for vessel operators. Its economical nature and alignment with the current fleet render it a favored option, maintaining its leadership in the market.

- Based on the service type, the market is segregated into technical services, inspection and survey, crew management, logistics and cargo management, anchor handling and seismic support, and others. Technical services involve maintenance, repair, and engineering support for offshore support vessels to ensure optimal performance. Inspection and survey focus on safety checks, condition assessments, and compliance verification for vessels and offshore installations. Crew management covers recruitment, training, and deployment of skilled personnel for vessel operations. Logistics and cargo management includes transportation, storage, and handling of supplies and equipment for offshore projects. Anchor handling and seismic support encompasses anchor placement, towing operations, and seismic data collection for exploration. Others consist of specialized services such as firefighting, rescue, and emergency response.

- Based on the application, the market is categorized into oil and gas applications and offshore applications. Among these, oil and gas applications holds the biggest market share. Oil and gas applications hold the majority of share in the market, driven by the critical role these vessels play in exploration, drilling, production, and maintenance activities. Offshore support vessels are essential for transporting equipment, materials, and personnel to and from oil rigs and platforms, ensuring uninterrupted operations in the energy sector. The worldwide dependence on oil and gas as main energy sources, along with continuous exploration in offshore areas, persists in fueling the need for ships designed for these uses.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 46.2 Billion |

| Market Forecast in 2033 | USD 61.3 Billion |

| Market Growth Rate 2025-2033 | 3.2% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Anchor Handling Towing Supply Vessel, Platform Supply Vessel, Fast Supply Intervention Vessel, Multi-Purpose Service Vessel, Others |

| Water Depths Covered | Shallow Water, Deepwater |

| Fuels Covered | Fuel Oil, LNG |

| Service Types Covered | Technical Services, Inspection and Survey, Crew Management, Logistics and Cargo Management, Anchor Handling and Seismic Support, Others |

| Applications Covered | Oil and Gas Applications, Offshore Applications |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bourbon, Cyan Offshore Pty Ltd., DOF Group ASA, Grupo CBO, Havila Shipping ASA, Hornbeck Offshore, Nam Cheong Limited, Ostensjo Rederi, Pacific Radiance Ltd., Sea 1 Offshore, SEACOR Marine, Solstad, Tidewater Inc., Vroon, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Offshore Support Vessels Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)