Global Oats Market Expected to Reach USD 6.6 Billion by 2033 - IMARC Group

Global Oats Market Statistics, Outlook and Regional Analysis 2025-2033

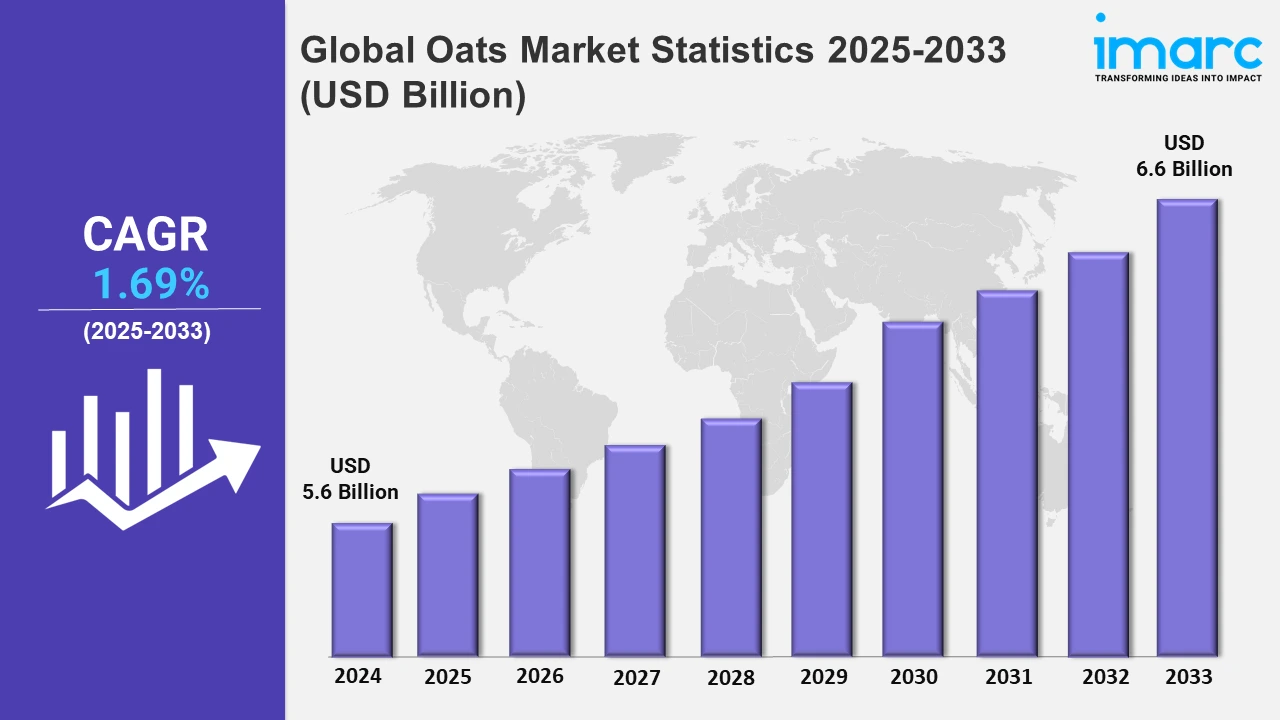

The global oats market size was valued at USD 5.6 Billion in 2024, and it is expected to reach USD 6.6 Billion by 2033, exhibiting a growth rate (CAGR) of 1.69% from 2025 to 2033.

To get more information on this market, Request Sample

As individuals become increasingly concerned about their health and prefer natural and nutritious meals, the requirement for oats and oat-containing products grows. The oats market is also stimulated by the rising consciousness about the impact of nutrition on an individual's health. For example, according to the USDA Foreign Agricultural Services, the European Union produced around 5.39 million metric tons of oats in 2023.

Moreover, the market is shifting towards more sustainable packaging alternatives, focusing on recyclable and biodegradable materials. This appeals to environmentally aware customers, as these materials aid in decreasing plastic waste while increasing convenience with single-serve sizes for eco-friendly and on-the-go choices. For instance, in March 2020, Nature's Path Foods launched a range of single-serve oatmeal cups featuring innovative packaging made from recyclable and compostable materials. The eco-friendly packaging aligns with the company's commitment to sustainability and addresses consumer concerns about plastic waste. Furthermore, producers of oats are focused on innovation to meet the growing demand for sustainable and high-quality goods. Besides this, they are improving manufacturing methods to increase efficiency and fulfill environmental laws. For example, the rise in demand for organic oats in North America, pushed by the rising health consciousness, has encouraged firms like General Mills, Quaker Oats, and Nature's Path to broaden their product offerings. To meet this requirement, these firms are producing innovative oat-based goods, including oat milk, granola, and snacks.

Global Oats Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Russia, Canada, Australia, the United States, Chile, China, Ukraine, and others. According to the report, Russia accounted for the largest oats market share due to the elevating awareness among individuals across the country towards the health benefits associated with the consumption of oats.

Russia Oats Market Trends:

Russia holds the largest share of the market, owing to its expanding production activities. Russia was one of the leading oats users in 2020, with an estimated 4.3 million tons of consumption. This significant consumption is driven by the usage of oats in both human and animal diets, demonstrating the grain's importance in Russian agricultural and food sectors.

Canada Oats Market Trends:

Canada is one of the world's largest oat exporters, accounting for over 62% of worldwide oat exports in 2020. The country's superior farming methods and processing infrastructure allow it to produce high-quality oats for both domestic and international markets. Canadian oats are renowned for their quality, making them a popular choice in international markets.

Australia Oats Market Trends:

Australia significantly contributes to worldwide oat production, with an emphasis on both home consumption and exports. The Grains Research and Development Corp. in Australia unveiled an Oat Grain Quality Consortium to address the requirement for advancements in R&D activities.

United States Oats Market Trends:

In the U.S., there is a growing demand for oat-based goods driven by consumers' growing health consciousness. In 2020, the U.S. was one of the leading oat consumers. This need can be observed in the popularity of oatmeal, oat milk, and other oat-based snacks among individuals, which comply with health-conscious eating trends.

Chile Oats Market Trends:

Chile is an emerging player in the oats market, with key players promoting both domestic consumption and exports. The output reached approximately 458,000 metric tons in 2023. The country's ideal temperature and growing circumstances promote oat cultivation, and there is the possibility of growth in both production and processing capacity.

China Oats Market Trends:

China has experienced an increase in oat consumption, stimulated by the rising health consciousness and diverse diets among its people. China is one of the world's prominent oat markets, recording almost USD 1 Billion in 2019. This rising demand has resulted in increased imports to fulfill consumer demands, indicating a huge opportunity for exporters targeting the market in China.

Ukraine Oats Market Trends:

Ukraine is known for its oat-producing capabilities, which contribute to both internal trading activities and exports. The country's agriculture industry promotes oat production, and there is room for expansion in export markets, notably in Europe. Ukraine's strategic location and fertile land make it a major participant in the regional oats market.

Other Oats Market Trends:

Other countries like Germany are witnessing an increase in demand for plant-based oat products, notably oat milk, driven by a rising vegan and flexitarian population. In 2021, Germany accounted for 15% of the European plant-based beverage market. Leading companies released new oat milk tastes, increasing local consumption and exports. This transition is consistent with consumers' growing health and environmental concerns, establishing oats as a flexible ingredient in sustainable food production.

Top Companies Leading in the Oats Industry

Some of the leading oats market companies include Avena Foods Limited, Bagrry's, Blue Lake Milling, Bob’s Red Mill Natural Foods, Grain Millers, Inc., Honey Brunches of Oats (Post Consumer Brands, LLC.), Kellanova, Marico, McCann's (B&G Foods, Inc.), Morning Foods, Nature's Path, Richardson Food & Ingredients, The Quaker Oats Company (PepsiCo.), among many others. In February 2020, Avena Foods Limited, the Canadian premier processor of Purity Protocol gluten-free oats, announced the construction of a new oat processing facility to meet the growing demand for plant-based and nutritious foods and beverages.

Global Oats Market Segmentation Coverage

- Based on the product type, the market has been classified into flakes, flour, bran, and others, wherein flakes lead the market. This is primarily driven by the shifting consumer preference for convenient and ready-to-eat (RTE) breakfast alternatives.

- Based on the application, the market has been categorized into food use and feed use, amongst which feed use dominates the market. The increasing demand for livestock feed additives and supplements, particularly those promoting animal health and productivity, is a significant growth-inducing factor.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 5.6 Billion |

| Market Forecast in 2033 | USD 6.6 Billion |

| Market Growth Rate 2025-2033 | 1.69% |

| Units | Million Tons, Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Flakes, Flour, Bran, Others |

| Applications Covered | Food Use, Feed Use |

| Countries Covered | Russia, Canada, Australia, United States, Chile, China, Ukraine, Others |

| Companies Covered | Avena Foods Limited, Bagrry's, Blue Lake Milling, Bob’s Red Mill Natural Foods, Grain Millers, Inc., Honey Brunches of Oats (Post Consumer Brands, LLC.), Kellanova, Marico, McCann's (B&G Foods, Inc.), Morning Foods, Nature's Path, Richardson Food & Ingredients, The Quaker Oats Company (PepsiCo.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Oats Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)