Global Nutraceuticals Market Expected to Reach USD 877.8 Billion by 2033 - IMARC Group

Global Nutraceuticals Market Statistics, Outlook and Regional Analysis 2025-2033

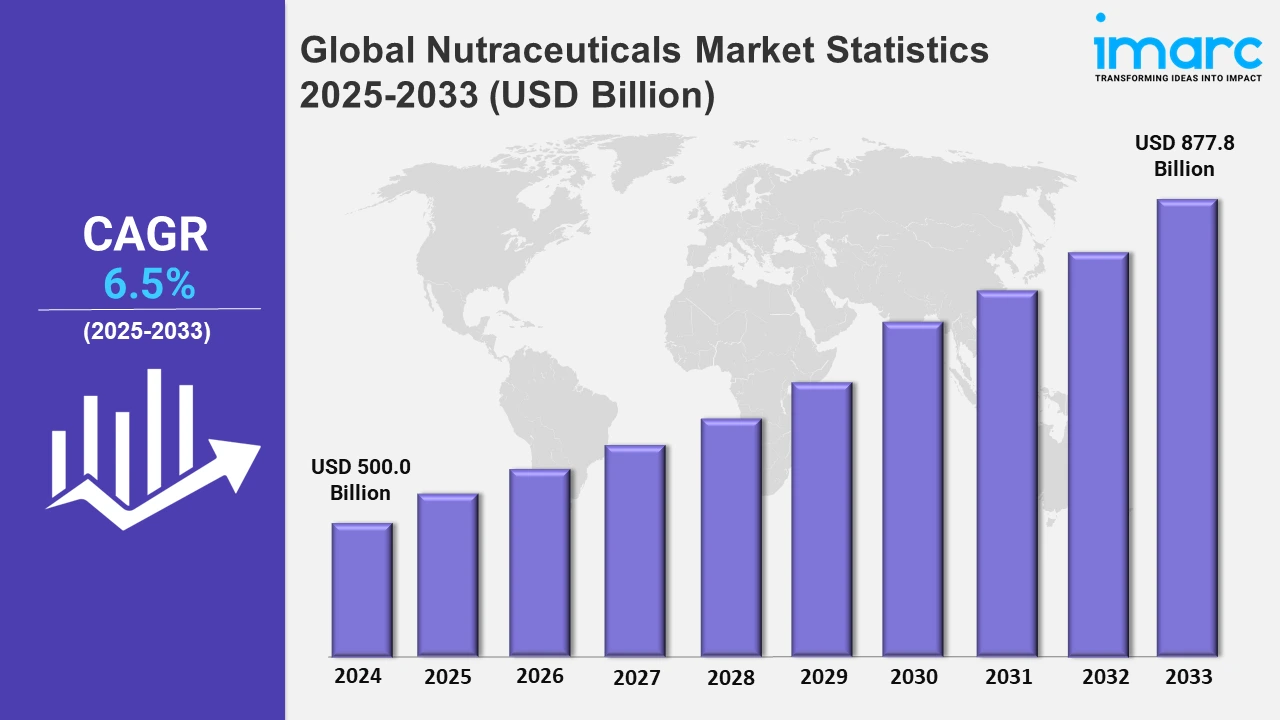

The global nutraceuticals market size was valued at USD 500.0 Billion in 2024, and it is expected to reach USD 877.8 Billion by 2033, exhibiting a growth rate (CAGR) of 6.5% from 2025 to 2033.

To get more information on this market, Request Sample

Customers are increasingly looking for clean-label nutraceutical goods that are devoid of artificial ingredients, preservatives, and genetically modified organisms (GMOs). Manufacturers are responding by reducing ingredient lists and emphasizing natural and identifiable components on packaging. For example, in July 2024, Renewtra entered the market in India, delivering the country's first clinically validated and transparent-label nutraceutical goods.

Moreover, the global health crisis has raised consumer awareness towards the need for a robust immune system and general health, resulting in demand for nutraceuticals that promise to improve immunity. For instance, in June 2024, the Department of Atomic Energy (DAE) collaborated with IDRS Labs Pvt. Ltd., Bengaluru, to unveil AKTOCYTE, a nutraceutical authorized by the Food Safety and Standards Authority of India (FSSAI). This medication is intended to improve the quality of life for cancer patients receiving radiation, especially those with pelvic cancer. Furthermore, nutraceutical firms are increasingly concentrating on producing functional products that treat particular health issues, including immunity, digestion, and cognitive wellness. In addition to this, they are using novel formulas and natural components to suit customer desire for personalized and effective solutions. Also, the emergence of e-commerce creates a substantial opportunity for nutraceutical companies to broaden their reach and increase income. Consumers are gravitating toward high-performance nutraceuticals, which are seen as more effective and adaptable than traditional choices. For example, the rising need for functional beverages in Japan is being pushed by companies such as Yakult Honsha and Kirin Holdings. These companies have produced probiotic beverages, fortified waters, and plant-based supplements to appeal to health-conscious customers.

Global Nutraceuticals Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which United States, Germany, the United Kingdom, France, Spain, Italy, Japan, China, Russia, India, Brazil, and Mexico. According to the report, the United States accounted for the largest nutraceuticals market share due to its robust research and development activities, established industry leaders, and high consumer demand.

United States Nutraceuticals Market Trends:

The United States holds the largest share of the market owing to the shift toward customized nutrition. Consumers are increasingly looking for personalized supplements to deal with their health concerns. For example, Nestlé Health Science's 2019 acquisition of Persona Nutrition resulted in vitamin subscription services tailored to individual health data. The growing emphasis on technology and data-driven wellness is leading businesses to create proficient platforms that provide tailored product suggestions, meeting consumer expectations for more effective and specialized health solutions.

Germany Nutraceuticals Market Trends:

The industry in Germany prioritizes memory enhancement, which is driven by aging demographics and growing mental wellness awareness. Products containing omega-3 fatty acids, ginkgo biloba, and nootropics are growing popular among consumers. For example, Queisser Pharma provides Doppelherz Aktiv Meno, a supplement that improves brain function and vitality. Similarly, Orthomol offers Orthomol Mental for concentration and stress relief. These goods represent Germany's taste for high-quality and scientifically validated solutions that improve mental function and productivity.

United Kingdom Nutraceuticals Market Trends:

Plant-based nutraceuticals are gaining popularity in the U.K. due to an increasing vegan population. Companies are creating supplements made from algae, pea protein, and other plant sources to fulfill the requirement. For example, in 2022, Holland & Barrett increased its vegan supplement offering to appeal to customers looking for cruelty-free and long-term health solutions. This rise shows the U.K.'s shift toward environmentally sensitive and plant-based eating trends.

France Nutraceuticals Market Trends:

Anti-aging nutraceuticals are reshaping the industry in France as people search for ways to live longer lives. Products that promote skin health, joint mobility, and vitality are extremely popular among older adults. For example, the French company Arkopharma introduced collagen supplements to increase skin suppleness and decrease wrinkles. This emphasis on anti-aging reflects on maintaining appearance and quality of life.

Spain Nutraceuticals Market Trends:

Digestive health is a major concern of the nutraceutical industry in Spain. Probiotic and prebiotic pills are becoming more popular as people emphasize gut health for overall wellness. For example, Cinfa launched probiotic strains in 2021 to address particular digestive disorders. The increased understanding among Spaniards of the gut microbiota's influence on immunity and metabolism is driving this move toward gut-focused nutraceuticals.

Italy Nutraceuticals Market Trends:

In Italy, omega-3 fatty acids, coenzyme Q10, and plant sterols are the most popular cardiovascular health supplements. Italians prioritize heart health because they are historically aware of the effects of nutrition on health. For example, in 2022, Aboca introduced an omega-3-rich supplement to help with heart and vascular function. This movement emphasizes the value of preventative health measures in Italian lifestyle choices.

Japan Nutraceuticals Market Trends:

In Japan, the aging population boosts demand for nutraceuticals that target senior-specific needs, including bone density and joint health. Calcium and glucosamine supplements are very popular. For example, in 2020, Meiji Holdings introduced a supplement line targeted at active aging. Japan's focus on healthy aging reflects its position as a global leader in elder wellness and longevity.

China Nutraceuticals Market Trends:

China incorporates Traditional Chinese Medicine (TCM) into modern nutraceuticals, mixing herbs like ginseng and astragalus with vitamins to promote overall health. For example, in 2023, By-Health developed a TCM-inspired supplement range to promote immunity and vitality. This fusion appeals to health-conscious customers by combining traditional practices with recent studies.

Russia Nutraceuticals Market Trends:

The nutraceutical industry promotes immunity-boosting goods, owing to heightened health awareness following the epidemic in Russia. Vitamins C, D, and echinacea are the most popular supplements. For example, in 2021, Evalar developed an immune health range aimed at seasonal ailments. Russian customers prefer inexpensive and useful items that improve their resilience to common health concerns.

India Nutraceuticals Market Trends:

Herbal nutraceuticals based on Ayurveda propel industry growth in India. Products containing turmeric, ashwagandha, and tulsi are popular for holistic well-being. For example, Dabur launched an immune booster based on ashwagandha in 2022. This development shows Indian customers' inclination for natural and reliable therapies that benefit both physical and mental health.

Brazil Nutraceuticals Market Trends:

As the fitness culture in Brazil grows, weight control pills are becoming increasingly popular. Green tea extract, Garcinia cambogia, and fiber-rich products are quite popular. For example, Sanavita developed a fat-burning pill in 2021 to appeal to people who want to live healthy lives. The development reflects Brazil's emphasis on physical activity and nutritional balance.

Mexico Nutraceuticals Market Trends:

Energy-boosting nutraceuticals are in high demand in Mexico, owing to a youthful workforce looking for natural stimulants. Guarana, ginseng, and B-complex vitamins are widely utilized. For example, Grupo Omnilife introduced an energy supplement in 2023 that targets weariness. This demand reflects Mexican consumers' preference for simple and effective items that promote productivity and vitality.

Top Companies Leading in the Nutraceuticals Industry

Some of the leading nutraceuticals market companies include Danone, Kirin Holdings Company Limited, Mondelez International Inc., Morinaga Milk Industry Co. Ltd., Nestle, Otsuka Pharmaceutical Co. Ltd., PepsiCo Inc., The Coca-Cola Company, Yakult Honsha Company Limited, among many others. For example, in February 2021, Danone acquired the plant-based nutrition company Follow Your Heart. The acquisition helped the company bolster its plant-based portfolio, which also includes brands Silk and So Delicious.

Global Nutraceuticals Market Segmentation Coverage

- Based on the product, the market has been classified into personalized foods (bakery products, confectionery, dairy products, oil & fats, snack bars, and other foods) and personalized beverages (chocolate based FP drinks, bottled water, concentrates, energy drinks, fruit vegetable juices, RTD tea, sports drinks, and others), wherein personalized beverages represent the most preferred segment. A shift in demand for customized experiences that cater to individual tastes and health concerns is a significant growth-inducing factor.

- Based on the indication, the market is categorized into digestive and immune health, energy & alertness health, heart health, bone & joint, cognitive health, and beauty health, amongst which digestive and immune health dominate the market. This is primarily driven by the growing awareness among consumers toward digestive issues and immune support. To support this, nutraceutical companies are working on a diverse range of products designed to meet these requirements.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 500.0 Billion |

| Market Forecast in 2033 | USD 877.8 Billion |

| Market Growth Rate 2025-2033 | 6.5% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered |

|

| Indications Covered | Digestive and Immune Health, Energy & Alertness Health, Heart Health, Bone & Joint, Cognitive Health, Beauty Health |

| Countries Covered | United States, Germany, United Kingdom, France, Spain, Italy, Japan, China, Russia, India, Brazil, Mexico |

| Companies Covered | Danone, Kirin Holdings Company Limited, Mondelez International Inc., Morinaga Milk Industry Co. Ltd., Nestle, Otsuka Pharmaceutical Co. Ltd., PepsiCo Inc., The Coca-Cola Company, Yakult Honsha Company Limited., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Nutraceuticals Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)