Global Next Generation Sequencing Market Expected to Reach USD 85.4 Billion by 2033 – IMARC Group

Global Next Generation Sequencing Market Statistics, Outlook, and Regional Analysis 2025-2033

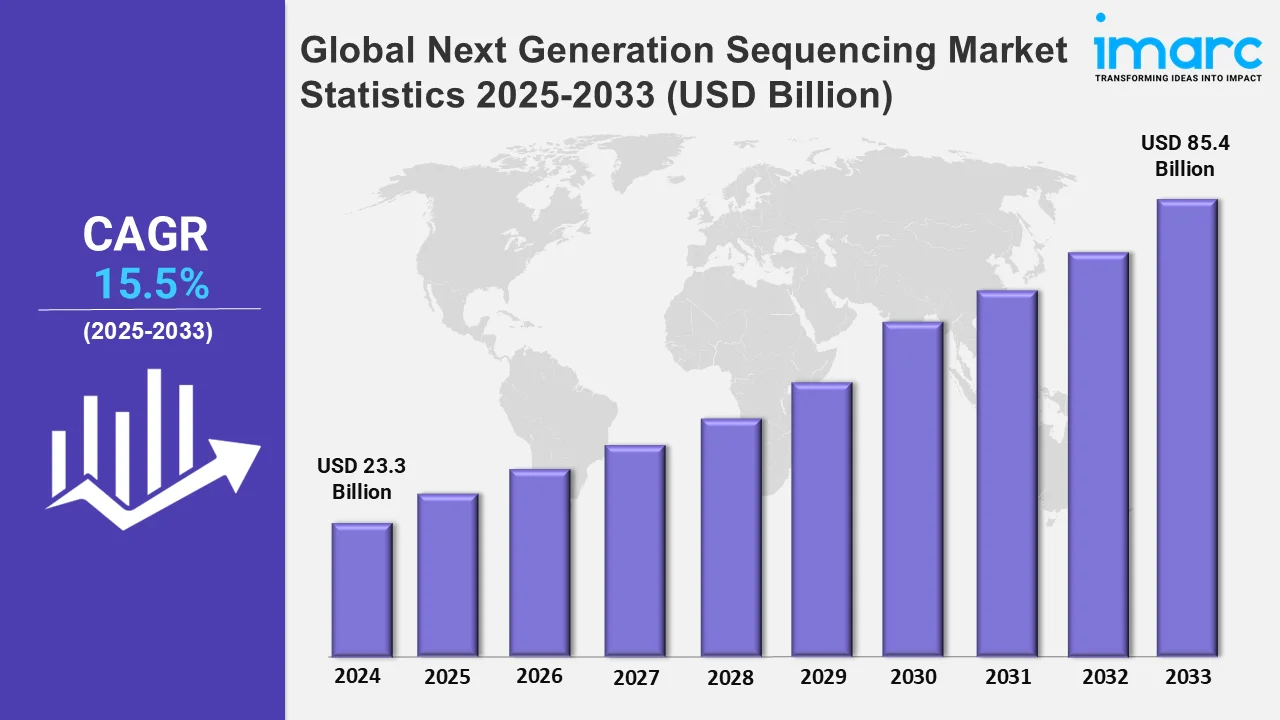

The global next generation sequencing market size was valued at USD 23.3 Billion in 2024, and it is expected to reach USD 85.4 Billion by 2033, exhibiting a growth rate (CAGR) of 15.5% from 2025 to 2033.

To get more information on this market, Request Sample

Next generation sequencing is transforming cancer diagnostics by facilitating the identification of specific mutations for targeted treatments. In October 2024, NeoGenomics introduced AML Express, a next gen sequencing assay for quick genetic analysis of acute myeloid leukemia (AML). The test provides extensive results within only three to four days, fulfilling an essential requirement in AML diagnostics. Next-generation sequencing is essential in prenatal testing, detecting genetic disorders early in fetal growth. Monitoring infectious diseases utilizes next generation sequencing for swift pathogen detection and precise outbreak tracking. The incorporation of this technology in rare disease diagnosis improves precision and shortens the diagnostic journey for patients. Pharmacogenomics employs it to customize medications according to a person's genetic composition, enhancing treatment results. In transplant medicine, it aids in tracking graft wellbeing and identifying initial indications of rejection. Liquid biopsy uses allow for non-invasive cancer detection, enhancing patient comfort and minimizing diagnostic delays. Reproductive health witnesses increasing use of next generation sequencing for embryo assessment in in vitro fertilization processes. In addition, progress in metagenomics enables comprehensive investigation of microbiomes, supporting research on gut health and immunity.

Enhanced sequencing platforms now offer faster processing speeds and higher accuracy, improving efficiency and adoption rates. Advanced bioinformatics tools streamline data analysis, enabling researchers to process vast genomic datasets effectively. For instance, in October 2024, Illumina launched the MiSeq i100 Series, offering faster and simpler next-generation sequencing for labs. The systems provide rapid turnaround with room-temperature storage, removing cold-chain needs. Available in two models, the MiSeq i100 and MiSeq i100 Plus, they deliver up to 100 million reads. These systems use Illumina’s XLEAP-SBS chemistry, reducing waste and enhancing speed. Moreover, portable sequencing devices are expanding applications in remote and field settings. Automation in library preparation reduces hands-on time and minimizes errors in sequencing workflows. Single cell sequencing technologies provide deeper insights into cellular heterogeneity and gene expression dynamics. High-throughput sequencing enables large-scale projects, such as population genomics and clinical diagnostics, with remarkable precision. Advances in long-read sequencing help overcome challenges associated with complex regions of the genome. Multi-omics integration combines genomics with proteomics and metabolomics, creating comprehensive datasets for holistic research.

Global Next Generation Sequencing Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounts for the largest market share due to strong funding in research and development (R&D), advanced infrastructure, and widespread technology adoption.

North America Next Generation Sequencing Market Trends:

North America dominates the market, driven by advanced healthcare infrastructure, along with considerable funding in research and development (R&D). The United States holds the largest share, supported by government initiatives like the Precision Medicine Initiative. High adoption rates in clinical diagnostics and personalized medicine further strengthen the market growth. Robust collaborations between academic institutions and biotech companies enhance innovation and technology development. Canada contributes through research funding and increasing usage of next generation sequencing in rare disease diagnostics. The presence of major market players propels regional market growth significantly. Favorable regulatory frameworks and streamlined approval processes for next generation sequencing -based diagnostics encourage wider implementation. The region leads in cancer genomics and companion diagnostics, impelling market growth in the oncology sector. In November 2024, Avantor partnered with Quantum-Si to distribute its Next-Generation Protein Sequencing (NGPS) technology. This collaboration will expand access to Quantum-Si’s proteomics solutions in the North America. The platform uses single-molecule sequencing for protein and biomarker identification, enhancing research in drug discovery and diagnostics.

Asia-Pacific Next Generation Sequencing Market Trends:

Asia Pacific is an emerging market, fueled by rising healthcare investments and genomic research. Countries like China, Japan, and India are driving regional market through large-scale genomic initiatives. Government-funded projects, such as China's Genome Project, provide substantial support for innovation. Increasing prevalence of cancer and genetic disorders increases the demand for next generation sequencing-based diagnostics and treatment. The expanding biotechnology industry in the region fosters the development and adoption of advanced sequencing technologies. Growing interest in precision medicine and population genomics aligns with regional healthcare priorities.

Europe Next Generation Sequencing Market Trends:

Europe represents a significant market owing to its robust research funding and technological adoption. The region benefits from initiatives like the European Genome-Phenome Archive promoting genomic research and data sharing. Countries like the UK, Germany, and France lead in clinical and academic research applications. Strong emphasis on cancer genomics and personalized medicine drives the demand for next generation sequencing technologies. Regulatory support for advanced diagnostics enhances the adoption of next generation sequencing in clinical settings. Collaborations between biotech companies and academic institutions foster innovative solutions and technology advancements.

Latin America Next Generation Sequencing Market Trends:

The market for next generation sequencing in Latin America is growing, supported by expanding healthcare systems and investments in research and development (R&D). Countries like Brazil and Mexico lead in adopting next generation sequencing technologies for clinical and academic applications. Rising awareness about genetic disorders and cancer drives demand for advanced sequencing tools and diagnostics. Government and private sector investments in biotechnology support regional market growth and technology adoption. Limited access to high-end infrastructure presents challenges, but reduced sequencing costs improve accessibility. Collaborative efforts with global companies bring cutting-edge technologies and expertise to the region, which bolster the market growth in the region.

Middle East and Africa Next Generation Sequencing Market Trends:

The market for next generation sequencing in the Middle East and Africa is in the nascent stage of growth. Rising healthcare investments and genomic research and development (R&D) initiatives are influencing adoption of sequencing technologies. Countries like South Africa and Saudi Arabia lead in regional efforts to incorporate next generation sequencing in healthcare. Growing interest in precision medicine and rare disease diagnostics supports market expansion in the region. Government and private sector collaborations foster research and training in genomic sciences and technologies.

Top Companies Leading in the Next Generation Sequencing Industry

Some of the leading next generation sequencing market companies include 10x Genomics Inc., Agilent Technologies, Inc., BGI Genomics (BGI Group), Bio-Rad Laboratories, Inc., Eurofins Scientific SE, F. Hoffmann-La Roche Ltd. (Roche Holding AG), Illumina, Inc., Macrogen Inc., Novogene Co., Ltd., QIAGEN N.V., Takara Bio Inc., and Thermo Fisher Scientific Inc., among many others. In October 2024, Becton Dickinson and Company introduced a robotics solution that automates single-cell research, improving efficiency and consistency. It integrates with Hamilton’s STAR liquid handling platform, enhancing DNA library preparation for sequencing. This new system reduces manual labor, increasing throughput and reliability. The solution is designed to enhance large-scale genetic studies, particularly in genomics and next generation sequencing.

Global Next Generation Sequencing Market Segmentation Coverage

- On the basis of the sequencing type, the market has been categorized into whole genome sequencing, targeted resequencing, whole exome sequencing, RNA sequencing, CHIP sequencing, De Novo sequencing, methyl sequencing, and others, wherein targeted resequencing represents the leading segment. Targeted resequencing is more cost-effective compared to whole genome or exome sequencing. It enables focused analysis of specific genomic regions associated with diseases or traits. Researchers prefer this method for its ability to deliver high-resolution data for critical areas. Targeted approaches reduce data processing requirements, making it accessible for various research settings. It is employed in diagnostics, especially for identifying disease-specific mutations. Its utility in oncology for analyzing cancer-related genes strengthens the growth of the market.

- Based on the product type, the market has been classified into instruments, reagents and consumables, and software and services, amongst which reagents and consumables dominates the market.Reagents and consumables dominate because they are essential for every step in the sequencing workflow. Frequent usage in library preparation, amplification, and sequencing drives recurring demand. High utilization rates in both research and clinical diagnostics fuels consistent market growth. Advances in reagent formulations enhance sequencing accuracy and data quality significantly. Bulk procurement by large laboratories and academic institutions contributes to the segment's revenue share. Customization options for specific sequencing platforms increase product adoption and usability.

- On the basis of the technology, the market has been divided into sequencing by synthesis, ion semiconductor sequencing, single-molecule real-time sequencing, nanopore sequencing, and others. Among these, sequencing by synthesis accounts for the majority of the market share.Sequencing by synthesis offer high accuracy leading to widespread adoption in next generation sequencing workflows. It enables high-throughput sequencing, making it suitable for large-scale genomic and transcriptomic studies. The technology's ability to produce long and short-read sequences enhances its versatility across applications. Continuous innovation in sequencing by synthesis reagents and instruments ensures improved performance and user-friendliness. Its compatibility with various library preparation methods broadens its appeal in research and diagnostics. The reduction in costs using sequencing by synthesis technology catalyzes its demand among academic and clinical users.

- Based on the application, the market is segregated into biomarker and cancer, drug discovery and personalized medicine, genetic screening, diagnostics, agriculture and animal research, and others. Where biomarker and cancer hold the largest market share. Biomarker and cancer applications dominate due to next generation sequencing’s critical role in precision oncology advancements. The technology identifies genetic mutations and actionable biomarkers for targeted therapies and immunotherapies. High prevalence of cancer worldwide drives demand for early detection and personalized treatment solutions. Companion diagnostics for cancer therapies heavily rely on next generation sequencing to stratify patient populations effectively. Research on tumor heterogeneity and resistance mechanisms leverages next generation sequencing for in-depth molecular insights.

- On the basis of the end-user, the market has been classified into academic institutes & research centers, hospitals & clinics, pharmaceutical & biotechnology companies, and others, amongst which academic institutes & research centers represents the largest segment. Academic institutes and research centers lead due to their extensive use of next generation sequencing in genomics research. Significant funding from government and private sectors supports large-scale projects in these institutions. Academic research fosters innovation, driving the development of new next generation sequencing applications and methodologies. High utilization in population genetics and evolutionary studies enhances the segment’s prominence. Collaborative efforts with biotech companies facilitate access to cutting-edge sequencing technologies and resources. Training and skill development initiatives increase next generation sequencing usage within research facilities across the globe.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 23.3 Billion |

| Market Forecast in 2033 | USD 85.4 Billion |

| Market Growth Rate 2025-2033 | 15.5% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sequence Types Covered | Whole Genome Sequencing, Targeted Resequencing, Whole Exome Sequencing, RNA Sequencing, CHIP Sequencing, De Novo Sequencing, Methyl Sequencing, Others |

| Product Types Covered | Instruments, Reagents and Consumables, Software and Services |

| Technologies Covered | Sequencing by Synthesis, Ion Semiconductor Sequencing, Single-Molecule Real-Time Sequencing, Nanopore Sequencing, Others |

| Applications Covered | Biomarker and Cancer, Drug Discovery and Personalized Medicine, Genetic Screening, Diagnostics, Agriculture and Animal Research, Others |

| End-Users Covered | Academic Institutes & Research Centers, Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 10x Genomics Inc., Agilent Technologies, Inc., BGI Genomics (BGI Group), Bio-Rad Laboratories, Inc., Eurofins Scientific SE, F. Hoffmann-La Roche Ltd. (Roche Holding AG), Illumina, Inc., Macrogen Inc., Novogene Co., Ltd., QIAGEN N.V., Takara Bio Inc., Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Next Generation Sequencing Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)