Global Nematicides Market Expected to Reach USD 2.2 Billion by 2033 - IMARC Group

Global Nematicides Market Statistics, Outlook and Regional Analysis 2025-2033

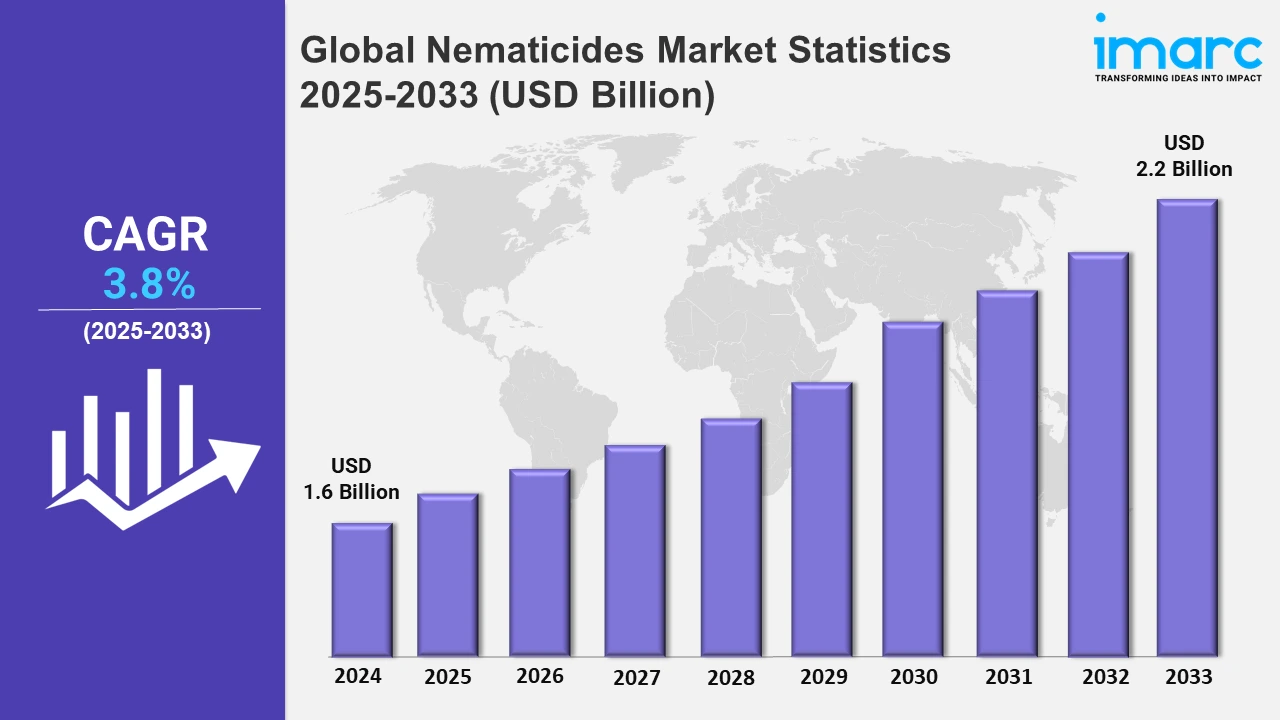

The global nematicides market size was valued at USD 1.6 Billion in 2024, and it is expected to reach USD 2.2 Billion by 2033, exhibiting a growth rate (CAGR) of 3.8% from 2025 to 2033.

To get more information on this market, Request Sample

The global nematicides market is witnessing significant growth, driven by increasing agricultural activities and the rising prevalence of pest infestations that threaten crop yields. According to the APS Journals, plant pathogens and pests are documented to cause up to 40% yield losses in major crops, such as maize, rice, and wheat, leading to annual worldwide economic losses of approximately USD 220 Billion. This mind-boggling economic impact brings forth urgent needs for effective pest management solutions, which force farmers to put into practice all the advanced nematicides to reduce losses and safeguard their interests. As food security becomes a global priority, particularly in densely populated regions, the demand for effective pest management solutions is surging. High-value crops such as fruits, vegetables, and cereals are most vulnerable to nematode attack, and farmers have been compelled to seek sophisticated nematicides to reduce losses. Furthermore, demand for sustainable farming has consequently increased the demand for bio-nematicides to offer a green and organic alternative in place of the chemical products that conventional nematicides provide.

Formulation innovations have led to the development of liquid, granular, and emulsifiable nematicides with superior efficacy and ease of application. Precision farming technologies have been able to target them precisely, minimize wastage, and increase profitability. Nematicide use is increasingly becoming a part of larger, integrated pest management systems, by which farmers can combine several control methods for more comprehensive crop protection. Favorable government initiatives and policies have been supporting market growth by boosting agricultural productivity. Subsidies and training programs in developing countries are encouraging farmers to adopt modern pest control techniques. In addition, strict regulations in the developed regions are compelling manufacturers to innovate and produce safer, more sustainable products that meet compliance standards. Newly identified trends include increased organic produce demand and growing nematicide application in greenhouse farming. Greenhouse agriculture provides an optimal environment for specifically targeted nematicide applications, which can easily take care of the menace posed by soil-based nematodes. Growing perceptions of the economic burden of nematode infestation are motivating investors to invest more in research and development for new solutions.

Global Nematicides Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of robust agricultural sector, particularly in the United States and Canada.

North America Nematicides Market Trends:

The North America nematicides market is expanding due to increasing agricultural activities and the need to address yield losses caused by nematode infestations. According to the United States Department of Agriculture, as U.S. agricultural exports are expected to reach $169.5 Billion in FY 2025, there is heightened pressure to maximize domestic productivity and quality. This has led to the growing demand for high-tech pest management solutions, such as bio-nematicides, in line with the requirement for sustainable and environmentally friendly practices. Government prescriptions toward the use of chemicals as pesticides set the priorities straight and encourage safer, environmentally friendly alternatives for further market growth. Technological innovations like precision farming promise targeted control of nematodes, making the process more efficient and less wasteful. Furthermore, growing demand for organically produced foods and an awareness about IPM strategies have motivated farmers to use a safer approach to pest control, which buttresses the nematicides market's concern with agricultural resiliency.

Asia Pacific Nematicides Market Trends:

Increasing nematode infestations in rice, fruits, and vegetable crops have significantly elevated the demand for nematicides across Asia Pacific. Governments are adopting measures for integrated pest management to increase agricultural productivity, while farmers are becoming aware about the protection of their yields. Bio-nematicides are gaining popularity due to their sustainability, especially in countries like India and China. In addition, growth in export-oriented agriculture and increased investment in crop protection products are further boosting this market.

Europe Nematicides Market Trends:

The focus on sustainable agriculture in Europe is driving the shift toward bio-nematicides and eco-friendly pest control solutions. Consumer preferences for organic and pesticide-free produce further advocate for the adoption of high-tech crop protection measures by farmers. Innovative technologies like nematode management are used in high-value crops in countries such as Spain, Italy, and France. The nematicides market in the region is influenced by the regulatory frameworks focusing on environmental safety and increased investments in precision farming methods.

Latin America Nematicides Market Trends:

The prominence of cash crops like soybeans, sugarcane, and coffee in Latin America has heightened the need for effective nematode control solutions. The modern pest management culture has made farmers adopt more efficient control methods against infestations and increase yield levels. Bio-nematicides are seen as a strong emerging trend in Brazil and Argentina, which supports the pursuit of sustainability and reduces dependency on chemical inputs. Increased knowledge of integrated pest management systems propels market dynamics forward, ensuring agricultural productivity and economic stability in the long term.

Middle East and Africa Nematicides Market Trends:

Concerns over soil health and nematode-induced yield losses are driving the adoption of nematicides in key crops like maize and wheat across the Middle East and Africa. Societies and international organizations are looking at food security by utilizing modern pest control technology for their nations. Bio-nematicides are quick to gain acceptance in African nations because it is environmentally compatible with sustainable farming. Furthermore, these nations' agricultural development and education programs further empower the farmers with the proper nematode management solutions.

Top Companies Leading in the Nematicides Industry

Some of the leading nematicides market companies include American Vanguard Corporation, BASF SE, Bayer AG, BioWorks Inc., Chr. Hansen Holding A/S, Corteva Inc., FMC Corporation, Isagro S.p.A., and Marrone Bio Innovations Inc, Sumitomo Chemical Co. Ltd., Syngenta AG, and UPL Limited, among many others.

- On June 10, 2024, BASF launched Nemasphere, a new nematode resistance trait for soybean growers. The new trait is expected to be available in 2028 pending regulatory approval. Nemasphere will provide SCN resistance without yield compromise. Developed through more than 200 U.S. field trials, the innovation from BASF offers up to 8 percent yield potential.

- In September 2024, At the 39th Brazilian Congress of Nematology, Bayer AG launched Vinemco, a biological nematicide with the bacterium Bacillus amyloliquefaciens. The company is targeting key nematode species with the new product, offering a sustainable solution. It also presented its conventional nematicide Verango Prime and CropStar insecticide, underlining efficiency and sustainability for Brazilian farmers.

Global Nematicides Market Segmentation Coverage

- Based on the chemical type, the market is segmented into fumigants, organophosphates, carbamates, and bio-nematicides. Among these, fumigants dominate the market, accounting for the largest share. Their flexibility also enables them to be applied to various crops, especially high-value crops including fruits, vegetables, and crops of commercial importance, where crop yield quality is paramount. This segment enjoys continuous product formulation innovations and advances in method application, which promote efficiency and safety.

- On the basis of the nematode type, the market is categorized into root-knot nematode, cyst nematode, and others. Root-knot nematode leads the market, representing the largest segment. These nematodes are infamous for causing massive damage to crop roots, resulting in severe yield losses in varied agricultural environments. Their immense spread, especially in warm temperatures and sandy soils, has increased the need for effective nematicides. Greater importance is attached to root-knot nematodes in crops like tomatoes, potatoes, and any other vegetables, which are more susceptible. With controlling economic losses from nematodes, the number of investments in solutions specifically targeting root-knot nematodes increased due to programs for awareness and governmental efforts.

- Based on the formulation, the market is divided into liquid, granular, emulsifiable concentrates, and others. Liquid formulations hold the largest share due to their superior ease of use and compatibility with modern farming practices. Liquid nematicides allow consistent distribution in their application through irrigation systems, providing uniform coverage of large agricultural fields. Their fast absorption and quick action against nematodes make them highly appropriate for high-value crops requiring immediate treatment. Advancements in liquid formulations, including the addition of surfactants and stabilizers, provide more effective results while reducing runoff for lower environmental impact and directly addressing concerns on sustainability. Farmers also find liquid nematicides convenient, as dosages and applications can be adjusted according to field conditions.

- On the basis of the application, the market is classified into grains and cereals, pulses and oilseeds, commercial crops, fruits and vegetables, and others. Among these, fruits and vegetables represent the largest segment. Highly valued crops like strawberries, lettuce, and peppers are more vulnerable to nematode attacks, encouraging farmers to make use of nematicides as a preventive and curative solution. This growing requirement for export-quality fruits and vegetables has also pushed farmers to take more drastic measures in the protection of crops since even slight infestations will cost the crop its marketability. Furthermore, high-quality requirements by the importing countries mean nematode management cannot be delayed. Integrated pest management initiatives, combined with the now developed nematicides designed for fruits and vegetables, are the other driving forces behind this market.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1.6 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Market Growth Rate 2025-2033 | 3.8% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Chemical Types Covered | Fumigants, Organophosphates, Carbamates, Bio-Nematicides |

| Nematode Types Covered | Root-knot Nematode, Cyst Nematode, Others |

| Formulations Covered | Liquid, Granular, Emulsifiable Concentrates, Others |

| Applications Covered | Grains and Cereals, Pulses and Oilseeds, Commercial Crops, Fruits and Vegetables, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Vanguard Corporation, BASF SE, Bayer AG, BioWorks Inc., Chr. Hansen Holding A/S, Corteva Inc., FMC Corporation, Isagro S.p.A., Marrone Bio Innovations Inc., Sumitomo Chemical Co. Ltd., Syngenta AG (China National Chemical Corporation), UPL Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Nematicides Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)