Global Needle Coke Market Expected to Reach USD 6.7 Billion by 2033 - IMARC Group

Global Needle Coke Market Statistics, Outlook and Regional Analysis 2025-2033

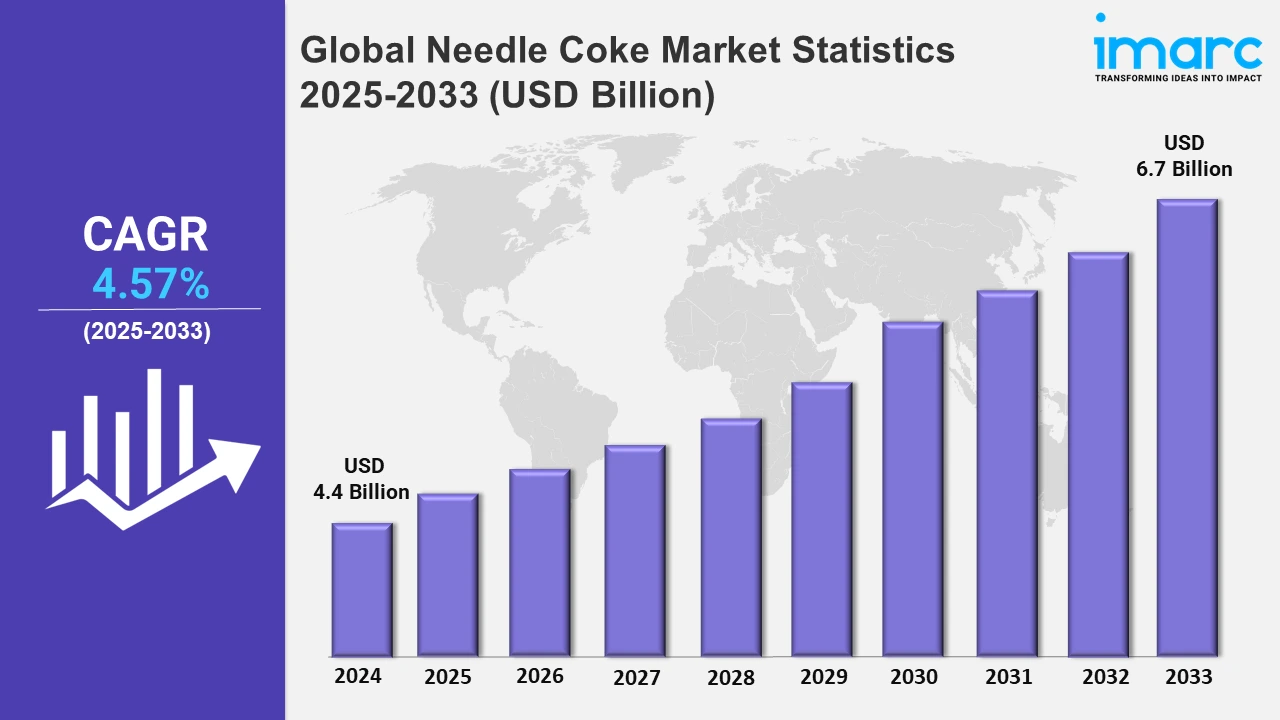

The global needle coke market size was valued at USD 4.4 Billion in 2024, and it is expected to reach USD 6.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.57% from 2025 to 2033.

To get more information on this market, Request Sample

The market is primarily driven by the increasing demand from the steel and aluminum industries, the rise of electric vehicles (EVs), and advancements in energy storage technologies. Needle coke is a crucial raw material used to make graphite electrodes, elemental in electric arc furnaces (EAF) employed in steelmaking. The global shift toward EAF technology, driven by its lower carbon emissions than traditional blast furnaces, has significantly increased the demand for needle coke. For example, in January 2024, Voestalpine contracted Primetals Technologies for the implementation of a 180-ton EAF Ultimate at the Austrian steelmaker's site in Linz, Austria. This is scheduled to go into starthide in 2027. The EAF Ultimate will have an essential role in the voestalpine green transition program "greentec steel." The first step is the construction of one electric arc furnace at each of the voestalpine sites, in Linz and Donawitz. The expansion of the steel industry, especially in emerging markets, further propels the market growth.

With the increased adoption of electric vehicles, the demand for lithium-ion batteries has increased. Lithium-ion batteries require synthetic graphite anodes, which are manufactured using needle coke. Thus, with increased electric vehicle sales, the electric vehicle market is expected to expand with global efforts to reduce carbon emissions and increase renewable energy adoption, further boosting the demand for needle coke. In line with this, calculations by the US Department of Energy showed that electric cars and trucks have the advantage over gas-fueled vehicles because, during their lifetime, they emit fewer carbon emissions. The carbon equivalent produced by EVs is 3,932 pounds a year, while that for gas-powered vehicles is 11,435. Needle coke is also used in lithium-ion batteries besides energy storage systems and portable electronic devices. Growth in such renewable energy projects has rendered the demand for energy-efficient storage systems increasingly relevant and thus plays a pivotal role by making it possible through the enabling of high-performance batteries. High-quality needle coke production technologies keep evolving, and the application in aeronautical and defense industries will be instrumental in driving the growth of the market.

Global Needle Coke Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share owing to growing steel production using electric arc furnaces, rising electric vehicle adoption fueling lithium-ion battery demand, and the region’s expanding industrial and infrastructure development.

North America Needle Coke Market Trends:

In North America, the increasing demand for electric vehicles coupled with innovations in energy storage technologies has driven dynamic market activity, while the steel industry also accounts for a sizeable customer base. Stimulated by government policies regarding funding for renewable energy projects as well as a general trend towards sustainability in industrial practices across the region, needle coke demand is further extended.

Asia-Pacific Needle Coke Market Trends:

The increasing steel production through electric arc furnaces, widespread adoption of electric vehicles (EVs), and growing lithium-ion battery production are propelling the demand for needle coke in Asia Pacific. According to industry reports, finished steel imports by India, during the April-October period, have risen to 5.7 million metric tons - the highest in seven years. Similarly, in October 2024, India's Tata Steel announced that it has entered into a contract with Tenova from Italy for an electric arc furnace facility at its Port Talbot plant in Wales, weeks after the largest steelworks in Britain closed all blast furnace-based production. Besides, the demand from rapidly expanding industrialization and infrastructure projects among countries such as China, India, and Japan also contributes considerably to the need for needle coke in the region.

Europe Needle Coke Market Trends:

In Europe, stringent environmental regulations promoting electric vehicle adoption, robust energy storage initiatives, and increasing demand for sustainable steel production drive the needle coke market. The region's focus on decarbonization and renewable energy storage further amplifies the demand for high-quality graphite materials derived from needle coke.

Latin America Needle Coke Market Trends:

The burgeoning steel production, infrastructural uplift, and growing urbanization are driving the market growth in Latin America. The mounting construction projects involving renewable and green energy schemes in countries like Brazil and Mexico are influencing the demand for needle coke in lithium-ion battery production.

Middle East and Africa Needle Coke Market Trends:

In the Middle East and Africa, the market is driven by industrialization, infrastructure expansion, and rising steel production. The region’s focus on diversifying economies and increasing investments in renewable energy projects also boosts demand for needle coke in energy storage and advanced manufacturing sectors.

Top Companies Leading in the Needle Coke Industry

Some of the leading needle coke market companies include Asbury Carbons Inc., GrafTech International Ltd., Graphite India Limited, Mitsubishi Chemical Holdings Corporation, Nippon Steel Chemical & Material Co., Ltd., Phillips 66 Company, Sojitz Corporation, Sumitomo Corporation, and among many others.

In October 2024, Jinzhou Petrochemical Co., Ltd. completed equipment construction of its 400,000tpa needle coke processing project, which entered the hot-commissioning phase and is expected to commence production in November. When the project becomes entirely operational, Jinzhou Petrochemical will have a total production capacity of 350,000tpa of needle coke products.

Global Needle Coke Market Segmentation Coverage

- On the basis of the type, the market has been categorized into coal-tar pitch-derived and petroleum-derived wherein petroleum derived represent the leading segment. The high yield, extensive availability, and superior quality of petroleum-derived needle coke are driving its growth in the market. Its consistent performance in manufacturing graphite electrodes and synthetic graphite for lithium-ion batteries makes it the preferred option for industries such as electric vehicles, steelmaking, and energy storage solutions.

- Based on the grade, the market is classified into intermediate, premium, and super premium. Amongst which super premium dominate the market. By extremely high-quality, low sulfur, and high structural integrity characteristics, super premium needle coke has held the largest share in the market. It has been used to produce high-end graphite electrodes and synthetic graphite anodes, utilized as components in electric arc furnaces and advanced lithium-ion batteries for electric vehicles (EVs).

- On the basis of the application, the market has been divided into graphite electrodes, silicon metal and ferroalloys, lithium-ion battery, carbon black, rubber compounds, and others, amongst which graphite electrodes dominate the market. The critical role of graphite electrodes in electric arc furnaces (EAF) for steel production is driving the segment growth in the market. Needle coke's superior conductivity, high-temperature resistance, and low thermal expansion make it ideal for producing durable, high-performance electrodes essential for the growing global demand for sustainable steelmaking.

- Based on the end use industry, the market is segregated into aluminum and steel, automotive, semiconductor, and others. The aluminum and steel industries dominate the needle coke market due to the critical use of graphite electrodes in electric arc furnaces, driven by increasing global steel production and demand for lightweight materials in construction and manufacturing. In the automotive sector, the rising production of electric vehicles alludes to an increased demand for needle coke, since the electric vehicle uses batteries with synthetic graphite anodes made from needle coke. The semiconductor industry contributes significantly to the needle coke market as synthetic graphite, produced using needle coke, is essential for high-performance components and heat dissipation materials in advanced electronics manufacturing.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 4.4 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Market Growth Rate 2025-2033 | 4.57% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Coal-tar Pitch Derived, Petroleum Derived |

| Grades Covered | Intermediate, Premium, Super Premium |

| Applications Covered | Graphite Electrodes, Silicon Metal and Ferroalloys, Lithium-ion Battery, Carbon Black, Rubber Compounds, Others |

| End Use Industries Covered | Aluminum and Steel, Automotive, Semiconductor, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asbury Carbons Inc., GrafTech International Ltd., Graphite India Limited, Mitsubishi Chemical Holdings Corporation, Nippon Steel Chemical & Material Co., Ltd., Phillips 66 Company, Sojitz Corporation, Sumitomo Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)