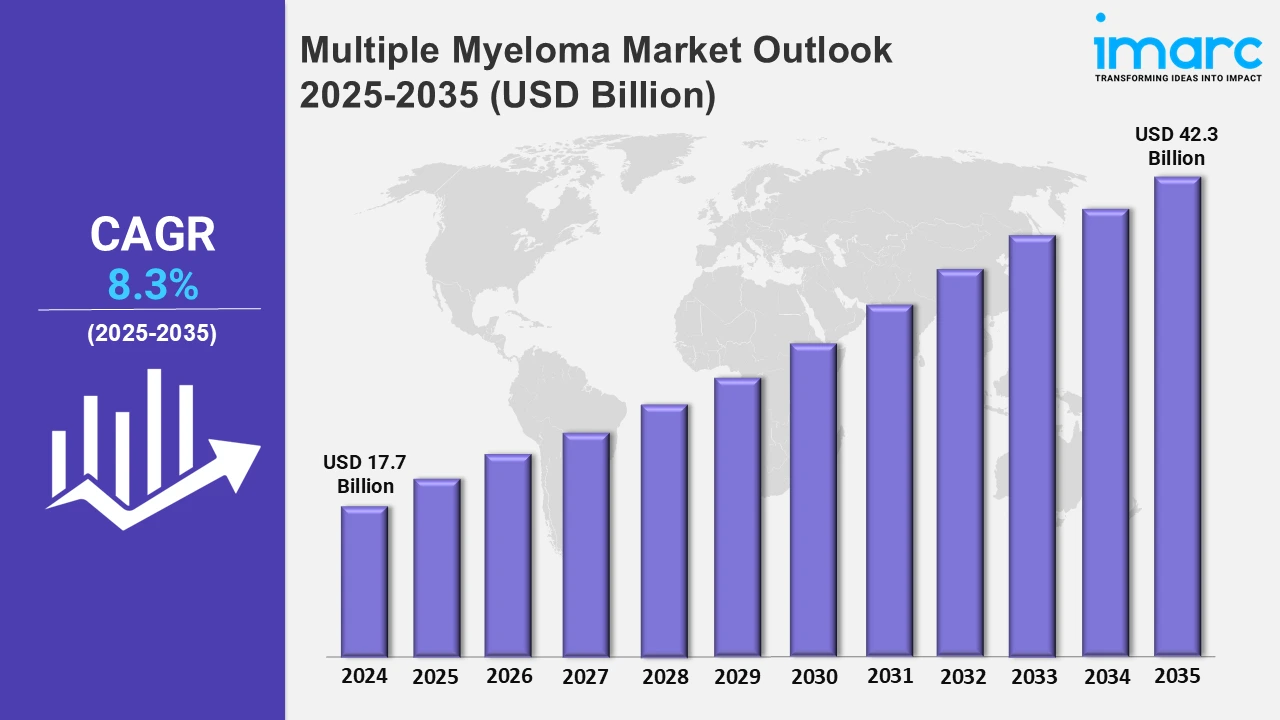

Multiple Myeloma Market Size to Reach USD 42.3 Billion by 2035, Impelled by Advancements in Early Detection

Multiple Myeloma Market Outlook 2025-2035:

The multiple myeloma market reached a value of USD 17.7 Billion in 2024. Looking forward, the market is expected to reach USD 42.3 Billion by 2035, exhibiting a growth rate (CAGR) of 8.3% during 2025-2035. The market is driven by the increased emphasis on early detection and diagnosis, advances in biomarkers, and diagnostic technologies, such as novel blood and urine tests. Additionally, the development of targeted therapies and innovative treatments is further propelling the market growth.

To get more information on this market, Request Sample

Advances in Early Detection and Diagnostic Technologies: Driving the Multiple Myeloma Market

The multiple myeloma market is increasingly driven by advances in early detection and diagnostic technologies. For example, the emergence of cutting-edge diagnostic technologies, such as biomarker assays, next-generation sequencing (NGS), liquid biopsy, and advanced imaging, has changed the way this disease is diagnosed and monitored. These technologies enhance specificity, sensitivity, and accuracy, thereby allowing healthcare providers to make more informed decisions about patient treatment. Moreover, one of the biggest developments is in the field of biomarker identification. Certain proteins, genetic mutations, and molecular markers have been discovered by researchers to identify multiple myeloma before any clinical signs appear. These biomarkers are currently being used to create blood tests and other non-invasive diagnostic assays that can diagnose the disease early and more precisely. Besides this, multiple myeloma can be diagnosed and staged more accurately using cross-sectional imaging modalities, such as CT and MRI. Whole-body MRI and PET are more reliable than radiography in diagnosing bone disease associated with multiple myeloma. Additionally, AI and machine learning technologies are being integrated into diagnostic tools for multiple myeloma in order to improve early detection. These tools can evaluate massive volumes of patient information, medical pictures, and genomic data, revealing patterns that older methods might not recognize. Collectively, these advances in early detection and diagnostic technologies improve the precision of multiple myeloma care, resulting in better patient outcomes and driving growth in the multiple myeloma market.

Development of Novel Therapies and Pharmacological Treatments: Contributing to Market Expansion

The multiple myeloma market is experiencing rapid growth and innovation due to the development of novel therapies and pharmacological treatments. One of the most important developments in the treatment of multiple myeloma is the rise of immunotherapies. These therapies harness the patient’s immune system to recognize and attack cancer cells more effectively. Additionally, the emergence of monoclonal antibodies like elotuzumab and daratumumab has changed the course of treatment. These medications target specific proteins on the surface of myeloma cells, designating them for destruction by the immune system. For instance, daratumumab has demonstrated notable effectiveness in treating both newly diagnosed and relapsed patients. It targets CD38, a protein that is abundantly expressed in myeloma cells. Another significant advancement is the development of chimeric antigen receptor (CAR) T-cell treatments. This novel strategy includes altering a patient's T-cells to express CARs, which particularly target cancer cells. CAR T-cell therapies, such as idecabtagene vicleucel (Abecma) and ciltacabtagene autoleucel (Carvykti), have shown promising results, particularly in patients with relapsed or refractory multiple myeloma who have gone through all other treatment options. Furthermore, proteasome inhibitors such as bortezomib, carfilzomib, and ixazomib, remain essential in multiple myeloma treatment. These drugs block the action of proteasomes, cellular complexes that break down proteins, leading to the accumulation of toxic proteins in myeloma cells and causing cell death. Besides this, immunomodulatory drugs (IMiDs), like lenalidomide and pomalidomide, which act by enhancing the immune system’s ability to fight cancer cells is also bolstering the market growth. Moreover, bispecific antibodies are showing promise as a therapeutic class since they can interact with immune cells and cancer cells at the same time. These medications have a dual method of action, causing the immune system to target and kill myeloma cells.

Marketed Therapies in Multiple Myeloma Market

Revlimid (Lenalidomide): Celgene

Revlimid (lenalidomide) when combined with dexamethasone is used to treat adult patients with multiple myeloma. Revlimid is recommended as a maintenance medication for adult patients with multiple myeloma who have had autologous hematopoietic stem cell transplantation (HSCT). Revlimid works through a unique pharmacological mechanism, modulating the substrate selectivity of the CRL4CRBN E3 ubiquitin ligase. In multiple myeloma, lenalidomide causes CRL4CRBN to ubiquitinate IKZF1 and IKZF3 proteins. The subsequent proteasomal breakdown of these transcription factors kills multiple myeloma cells.

Sarclisa (Isatuximab): Sanofi

Sarclisa (isatuximab) is used in combination with pomalidomide and dexamethasone to treat multiple myeloma in adults who have received at least two previous treatments, including lenalidomide and a proteasome inhibitor. Sarclisa is a monoclonal antibody that binds to a particular epitope on the CD38 receptor of multiple myeloma cells, resulting in unique anticancer action. It is intended to function through a variety of mechanisms, including programmed tumor cell death (apoptosis) and immunomodulatory activities.

Xpovio (Selinexor): Karyopharm

Xpovio (selinexor) is a prescription medication approved for use in combination with bortezomib and dexamethasone to treat adult patients with multiple myeloma who have undergone at least one prior therapy. Xpovio is an orally bioavailable selective inhibitor of nuclear export that inhibits exportin-1 (XPO1), a novel therapeutic target that is overexpressed in multiple myeloma.

Velcade (Bortezomib): Takeda Pharmaceutical/Janssen Pharmaceutical

Velcade (bortezomib) is a proteasome inhibitor that prevents the breakdown of proteins required for cell growth and development. Bortezomib prevents myeloma cells from proliferating and releasing substances that promote other myeloma cells. Bortezomib binds to the 26S proteasome, a mechanism that regulates protein breakdown and removal within cells. This blocks the breakdown of proteins required for apoptosis, or programmed cell death. The proteins accumulate inside the cell, causing it to die.

Empliciti (Elotuzumab): Bristol Myers Squibb/AbbVie

Empliciti is an immunostimulatory antibody that targets Signaling Lymphocyte Activation Molecule Family member 7 (SLAMF7), a glycoprotein found on the cell surface. SLAMF7 is expressed on myeloma cells, regardless of cytogenetic abnormalities. SLAMF7 is also expressed on natural killer cells, plasma cells, and, at lesser levels, certain immune cell subsets of differentiated cells in the hematopoietic lineage. Empliciti utilizes a dual mechanism of action. It activates the immune system directly through natural killer cells using the SLAMF7 pathway. Empliciti also targets SLAMF7 on myeloma cells, marking them for natural killer cell-mediated death via antibody-dependent cytotoxicity.

Emerging Therapies in Multiple Myeloma Market

Binimetinib: Array BioPharma/Ono Pharmaceutical/Pierre Fabre

Binimetinib is an orally bioavailable, small molecule being developed by Array Biopharma to treat multiple myeloma. Binimetinib, which is noncompetitive with ATP, binds reversibly and inhibits the activity of mitogen-activated extracellular signal-regulated kinases (MEK) 1 and 2. Inhibition of MEK1/2 hinders the activation of MEK1/2-dependent effector proteins and transcription factors, which inhibits growth factor-mediated cell signaling, including the downstream extracellular signal-related kinase (ERK). This may limit tumor cell proliferation as well as the generation of inflammatory cytokines such as interleukin 1, -6, and tumor necrosis factor.

Elranatamab: Pfizer

Elranatamab is an experimental humanized B-cell maturation antigen (BCMA)-CD3-targeted bispecific antibody (BsAb) that targets both BCMA-expressing multiple myeloma cells and CD3-expressing T-cells, combining them together and activating the T-cells to kill the myeloma cells. Elranatamab's binding affinities for BCMA and CD3 have been designed to produce strong T-cell-mediated anti-myeloma action. Given the current limitations on the availability of novel therapies in the triple-class exposed setting, elranatamab has the potential to reach a larger and more diverse patient population as an off-the-shelf option administered subcutaneously (SC), which is more convenient than intravenous administration.

Iberdomide: Celgene, Bristol-Myers Squibb

Iberdomide is a potent cereblon E3 ligase modulator (CELMoD drug) that has shown potential efficacy and safety as a monotherapy or in combination with other medications in patients with relapsed/refractory multiple myeloma. When compared to immunomodulatory medications, iberdomide has more tumoricidal and immune-stimulating properties. Iberdomide has been found in preclinical myeloma models to synergize with dexamethasone, proteasome inhibitors, and CD38 monoclonal antibodies.

Masitinib: AB Science

Masitinib is an oral tyrosine kinase inhibitor. It regulates the activity of mast cells and macrophages, which are essential immune cells, by targeting a small number of kinases while not inhibiting kinases known to be harmful at therapeutic dosages. Masitinib also helps to inhibit the platelet derived growth factor receptor, lymphocyte-specific protein tyrosine kinase, focal adhesion kinase, and fibroblast growth factor receptor 3 as well as CSF1R.

Nivolumab: Bristol-Myers Squibb/Ono Pharmaceuticals

Nivolumab is a completely human IgG4 monoclonal antibody targeting the programmed cell death-1 (PD-1/PDCD-1) receptor that has been developed by Bristol-Myers. It is specifically developed to use the body's immune system to help restore anti-tumor immunity. By harnessing the body’s immune system to fight cancer, nivolumab has become an important treatment option across multiple cancers.

| Drug Name | Company Name | MOA | ROA |

|---|---|---|---|

| Binimetinib | Array BioPharma/Ono Pharmaceutical/Pierre Fabre | MAP kinase kinase 1 inhibitors; MAP kinase kinase 2 inhibitors | Oral |

| Elranatamab | Pfizer | Cytotoxic T lymphocyte stimulants | Subcutaneous injection |

| Iberdomide | Celgene, Bristol-Myers Squibb | Ubiquitin protein ligase complex modulators | Oral |

| Masitinib | AB Science | Angiogenesis inhibitors; Colony-stimulating factor inhibitors | Oral |

| Nivolumab | Bristol-Myers Squibb/Ono Pharmaceuticals | Programmed cell death 1 receptor antagonists; T lymphocyte stimulants | Intravenous infusion |

Detailed list of emerging therapies in Multiple Myeloma is provided in the final report.

Leading Companies in the Multiple Myeloma Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Across the global multiple myeloma market, several leading companies are at the forefront of developing integrated platforms to enhance the management of multiple myeloma. Some of the major players include Celgene, Sanofi, and Karyopharm Therapeutics Inc. These companies are driving innovation in the multiple myeloma market through continuous research, diagnostic tools, and expanding their product offerings to meet the growing demand for multiple myeloma.

In September 2024, the U.S. Food and Drug Administration approved Sarclisa (isatuximab) in combination with bortezomib, lenalidomide, and dexamethasone (VRd) as a first-line treatment option for adult patients with newly diagnosed multiple myeloma who are not eligible for autologous stem cell transplant (ASCT).

In December 2020, Karyopharm Therapeutics Inc. announced that the Food and Drug Administration approved selinexor (XPOVIO) in combination with bortezomib and dexamethasone for the management of adult patients with multiple myeloma who have undergone at least one prior medication.

Key Players in Multiple Myeloma Market:

The key players in the Multiple Myeloma market who are in different phases of developing different therapies are Celgene, Bristol-Myers Squibb, Pfizer, Sanofi, AB Science, AbbVie, Array BioPharma, Ono Pharmaceutical, Pierre, and Others.

Regional Analysis:

The major markets for multiple myeloma include the United States, Germany, France, the United Kingdom, Italy, Spain, and Japan. According to projections by IMARC, the United States has the largest patient pool for multiple myeloma while also representing the biggest market for its treatment. This can be attributed to the rising incidence of the disease, particularly among the aging population, which increases demand for innovative treatments.

Moreover, numerous advancements in precision medicine, such as next-generation sequencing (NGS) and immunotherapies like CAR T-cell therapy and monoclonal antibodies, are improving survival rates and patient outcomes. Increased healthcare spending, robust R&D investments, and growing awareness about early diagnosis are also fueling market growth in the United States.

Besides this, the growing adoption of digital health tools, including telemedicine and remote monitoring, improves patient access to care. Government initiatives supporting cancer research and increased awareness about multiple myeloma further contribute to market growth in the U.S.

Recent Developments in Multiple Myeloma Market:

- In September 2023, data presented at the 2023 International Myeloma Society (IMS) Annual Meeting from the phase 1/2 CC-220-MM-001 trial (NCT02773030) demonstrated that patients with transplant-ineligible, newly diagnosed multiple myeloma showed deep responses with a manageable toxicity profile when using iberdomide (CC-220) in combination with bortezomib (Velcade) and dexamethasone (IberVd).

- In February 2023, Pfizer disclosed that its Biologics License Application (BLA) for elranatamab, an experimental B-cell maturation antigen (BCMA) CD3-targeted bispecific antibody (BsAb), had received Priority Review from the U.S. FDA. The BLA is intended to treat patients with relapsed or refractory multiple myeloma.

Key information covered in the report

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the multiple myeloma market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the multiple myeloma market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report offers a comprehensive analysis of current multiple myeloma marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. Across the six major continents and 100+ countries, we work alongside our business partners as one team with a common ambition to achieve unparallelled results, gain a competitive edge, and transform industries. IMARC Group excels in understanding its clients’ business priorities and delivering tailored solutions that drive meaningful outcomes. Our client base spans over 3,000 organizations in the private, public, and social sectors, ranging from high-growth startups to Fortune 500 companies.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)