Global Mobile Wallet Market Expected to Reach USD 701.0 Billion by 2033 - IMARC Group

Global Mobile Wallet Market Statistics, Outlook and Regional Analysis 2025-2033

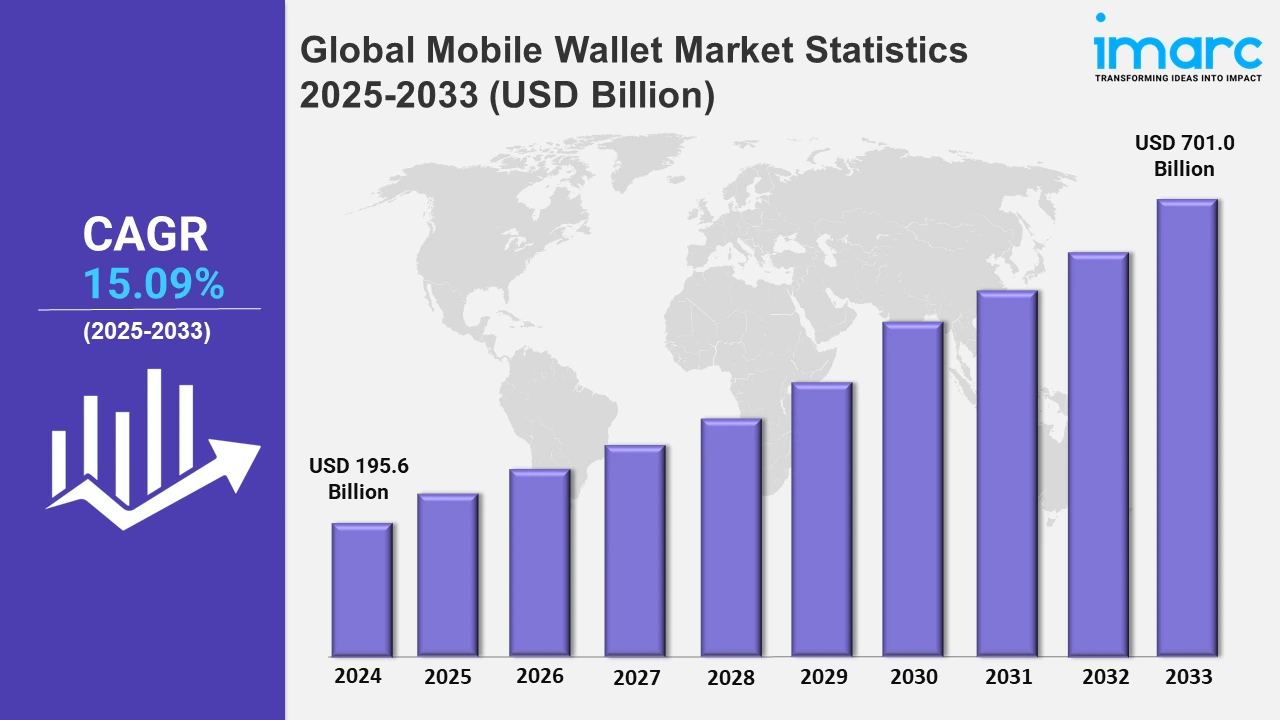

The global mobile wallet market size was valued at USD 195.6 Billion in 2024, and it is expected to reach USD 701.0 Billion by 2033, exhibiting a growth rate (CAGR) of 15.09% from 2025 to 2033.

To get more information on this market, Request Sample

The rising number of smartphone users is indeed one of the key drivers of growth in the mobile wallet market. For instance, according to Statista, between 2024 and 2029, the global number of smartphone users is expected to increase by 1.7 billion. After the sixteenth consecutive year of growth, the smartphone user base is expected to reach 6.2 billion users, marking a new high in 2029. As more people across the world adopt smartphones, particularly in emerging markets, there is a larger potential user base for mobile wallets. Smartphones are the primary device for accessing digital financial services, including mobile payments, digital banking, and financial apps.

Moreover, mobile wallets increasingly use advanced security features like biometric authentication (fingerprint or facial recognition), tokenization, and end-to-end encryption, which improve the security of digital payments. For instance, in November 2024, Mastercard launched the payment passkey service, a biometric authentication system that eliminates one-time passwords (OTPs) by utilizing device-native biometrics for online payment verification. The service complies with the EMVCo Secure Remote Commerce standard and FIDO Alliance protocols for password less authentication, ensuring interoperability across devices and platforms. Tokenized payment credentials and biometric data are saved locally on users' devices, adhering to a decentralized method that protects privacy by keeping sensitive data off external servers. As consumers become more aware of the security advantages over traditional card-based payments, trust in mobile wallets is rising. Besides this, the booming e-commerce sector is driving the adoption of mobile wallets. For instance, the global e-commerce market size reached USD 26.8 Trillion in 2024. Looking forward, IMARC Group expects the market to reach USD 214.5 Trillion by 2033, exhibiting a growth rate (CAGR) of 25.83% during 2025-2033. Consumers prefer the ease of paying via their mobile devices when shopping online or in-app, leading to an increase in mobile wallet use.

Global Mobile Wallet Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest market share on account of the increasing adoption of smartphones among the masses.

North America Mobile Wallet Market Trends:

The increasing preference for contactless payments during everyday transactions is a key factor driving mobile wallet growth. For instance, Apple Pay and Google Pay have continued to gain traction in the U.S. and Canada. According to Statista, Apple Pay use for in-store payments in the United States increased in 2024 compared to early 2020, indicating more consumer use.

Europe Mobile Wallet Market Trends:

The rapid rise in smartphone usage is one of the fundamental drivers of mobile wallet growth in Europe. For instance, according to Statista, the number of smartphone users in Germany has increased dramatically, with nearly 62.6 million in 2021. In 2009, the figure was 6.3 million. As more consumers adopt smartphones, particularly in countries with high mobile penetration, the use of mobile wallets as an alternative to traditional payment methods like cash or cards is becoming more widespread.

Asia-Pacific Mobile Wallet Market Trends:

Asia-Pacific accounted for the largest market share due to the increasing number of smartphone users. For instance, according to Statista, the number of smartphone users in India is expected to exceed one billion by 2023. It is anticipated that by 2040, India will have 1.55 billion smartphone users. In addition, the rising demand for mobile wallets for shopping purposes among individuals is impelling the market growth. Besides this, the growing demand for mobile wallets, as they reduce cash dependency and enhance transparency, is offering a positive market outlook. Furthermore, governing agencies in the region are promoting digital payments, which is supporting the market growth.

Latin America Mobile Wallet Market Trends:

In countries like Brazil, Mexico, and Argentina, smartphone ownership has increased, leading to more users adopting mobile wallets. Brazil, in particular, has seen a surge in mobile wallet usage through platforms like PicPay and MercadoPago, both of which enable users to make peer-to-peer payments, pay bills, and shop online.

Middle East and Africa Mobile Wallet Market Trends:

The UAE has seen rapid adoption of mobile wallets, particularly in cities like Dubai, where people are embracing digital payments for everything from grocery shopping to transportation. Popular wallets like Apple Pay, Samsung Pay, and Google Pay are widely used.

Top Companies Leading in the Mobile Wallet Industry

Some of the leading mobile wallet market companies include Alipay.com (Alibaba Group Holding Limited), Amazon Web Services Inc. (Amazon.com Inc), American Express Company, Apple Inc., Google LLC (Alphabet Inc.), Mastercard Incorporated, Paypal Holdings Inc., Samsung Electronics Co. Ltd., Squareup Pte. Ltd., and Visa Inc., among many others. For instance, in September 2023, Alipay.com (Alibaba Group Holding Limited), Ant Group's cross-border payments solution, expanded into South Korea in conjunction with Korea Easy Payment Foundation, which operates the local electronic wallet ZeroPay. People can also pay at businesses and restaurants in South Korea by scanning ZeroPay quick-response (QR) codes at the checkout.

Global Mobile Wallet Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into proximity and remote, wherein remote represented the largest segment. Remote mobile wallets are digital payment solutions that enable users to make transactions without physically interacting with the payment terminal or device, further propelling the market’s growth.

- Based on the application, the market is categorized into retail, hospitality and transportation, telecommunication, healthcare, and others, amongst which retail represented the largest segment. Mobile wallets enhance the overall shopping experience by offering speed, convenience, and security, further escalating the growth of the segment.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 195.6 Billion |

| Market Forecast in 2033 | USD 701.0 Billion |

| Market Growth Rate 2025-2033 | 15.09% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Proximity, Remote |

| Applications Covered | Retail, Hospitality and Transportation, Telecommunication, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alipay.com (Alibaba Group Holding Limited), Amazon Web Services Inc. (Amazon.com Inc), American Express Company, Apple Inc., Google LLC (Alphabet Inc.), Mastercard Incorporated, Paypal Holdings Inc., Samsung Electronics Co. Ltd., Squareup Pte. Ltd., Visa Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Mobile Wallet Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)