Global Mobile TV Market Expected to Reach USD 26.9 Billion by 2033 - IMARC Group

Global Mobile TV Market Statistics, Outlook and Regional Analysis 2025-2033

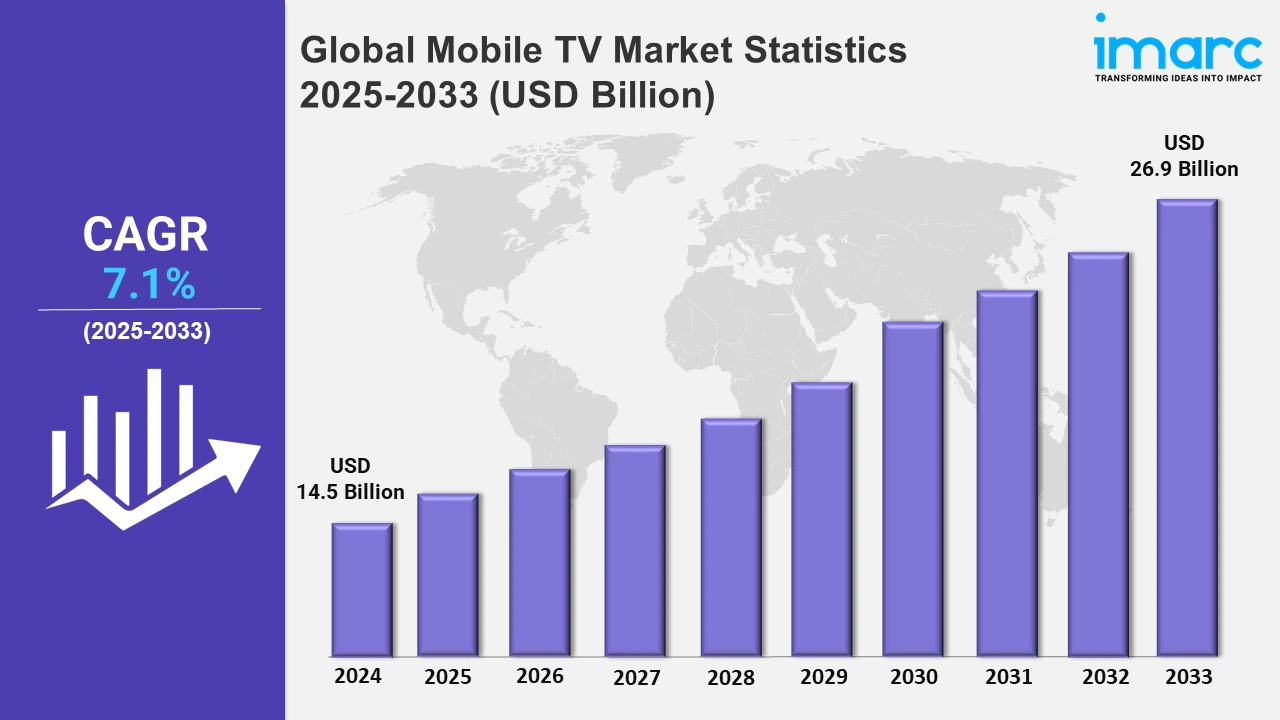

The global mobile TV market size was valued at USD 14.5 Billion in 2024, and it is expected to reach USD 26.9 Billion by 2033, exhibiting a growth rate (CAGR) of 7.1% from 2025 to 2033.

To get more information on this market, Request Sample

In the mobile TV industry, the market is substantially growing due to factors such as upgraded mobile network systems, the rising affordability of smartphones, and high-speed connection, which enables high-quality video streaming. Apart from this, in November 2023, as per the Global Mobile Suppliers Association, in 170 countries, nearly more than 570 operators invested in 5G technology. Meanwhile, around 100 countries and almost 280 operators have begun operating services that are compatible with 3GPP. Additionally, the convenience of having access to entertainment at any time and from any location is accelerating the market growth. Furthermore, over-the-top (OTT) services provide a wide variety of content, such as movies, series, documentaries, and unique original programming, i.e., easily accessible on mobile devices. This direct-to-consumer approach delivers users unmatched ease by enabling them to access and view content via apps on their tablets and smartphones. For example, Dish TV provided Dish TV Smart+, merging OTT services with standard TV subscriptions in April 2024. This allowed D2H and Dish TV consumers to watch TV and OTT content on all screens for no extra cost.

Apart from this, telecommunications firms are seeking to deliver lower-cost and higher-volume data plans, thereby making it more reasonable for individuals to view films on their mobile. This greater affordability encourages new users to join, particularly in developing areas where price awareness is more important. Individuals are encouraged to adopt mobile streaming by combining packages that include mobile data plans and mobile TV subscriptions. The trend of more generous and cost-effective data plans is increasing access to mobile TV services, allowing a wider spectrum of viewers to enjoy flawless streaming experiences. Correspondingly, the democratization of mobile data helps in market expansion by encouraging a more inclusive digital ecosystem. For example, Vodafone Idea (Vi) disclosed Vi One's joint service in July 2024, which merged OTT subscriptions like Disney+ Hotstar and ZEE5 with fiber internet and prepaid mobile.

Global Mobile TV Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for mobile TV owing to the surging investment in 5G infrastructure.

North America Mobile TV Market Trends:

The North America mobile TV market is growing on account of the proliferation of smartphones, which have made streaming more accessible, and advancements in 4G and 5G networks, enabling high-quality and low-latency streaming. The OTT platforms like Netflix and Hulu have also fueled demand, offering diverse content for mobile viewers. Affordable data plans from telecom providers further enhance accessibility. For instance, in June 2024, CTV Inc. and Bell Canada launched mobile video news services, providing exclusive updates to Bell mobility users.

Europe Mobile TV Market Trends:

In Europe, the development of 5G networks, the proliferation of smartphones, and the emergence of free ad-supported streaming TV (FAST) channels are all contributing to the region's growth. In addition to this, countries like Germany and the UK are leading the way in this trend, with major telecom companies expanding their mobile TV capabilities. In Germany, for example, Deutsche Telekom's Magenta TV reached about 4.7 million members in early 2024 after adding 72,000 new users, which is acting as a growth-inducing factor.

Asia Pacific Mobile TV Market Trends:

Asia Pacific led the overall market owing to affordable smartphones, localized content, and the prevalence of regional streaming services. Platforms like Hotstar in India and WeTV in China dominate with region-specific programming, such as Bollywood films and C-dramas, as well as exclusive sports like cricket and esports. For example, the Indian Premier League (IPL) broke global streaming records, with millions tuning in via mobile devices.

Latin America Mobile TV Market Trends:

Latin America's mobile TV market is growing due to the increasing smartphone penetration and localized entertainment options. Platforms like Globoplay in Brazil and Claro Video across the region cater to viewers with popular genres like telenovelas, sports, and family programming. Partnerships between telecom providers and streaming services ensure affordability, enabling widespread access. For instance, Copa América matches saw high mobile viewership in countries like Argentina and Mexico.

Middle East and Africa Mobile TV Market Trends:

In the Middle East and Africa, mobile TV adoption is driven by social media integration, localized content, and telecom partnerships. Shahid, a leading platform in the Middle East, offers Arabic content tailored to regional tastes, while Showmax in Africa leverages partnerships with telecom operators for affordable bundles. For example, Showmax’s mobile-first strategy and zero-data options in countries like South Africa make streaming accessible even in data-restricted regions.

Top Companies Leading in the Mobile TV Industry

Some of the leading mobile TV market companies include Asianet Satellite, AT&T Inc., Bell Canada (BCE Inc.), Bharti Airtel Limited, Charter Communications Inc., Comcast Corporation, Consolidated Communications, Cox Communications Inc., MobiTV Inc., SPB TV AG, Tata Sky Ltd. (TOF), United States Cellular (Telephone and Data Systems), Verizon Communications Inc, among many others. For instance, in July 2024, Bell Canada, Canada's communications, technology, and digital media leader, teamed with ServiceNow to expedite Bell's transformation in response to increasing customer demand for technological services and digital media. Also, in December 2024, Comcast Business acquired Nitel, a managed services company based in Chicago, from international private equity firm Cinven.

Global Mobile TV Market Segmentation Coverage

- On the basis of the content type, the market has been bifurcated into video-on-demand, online video, and live streaming. Video-on-demand enables users to choose and view video content whenever they prefer instead of being limited to a set broadcast schedule. Moreover, online video includes content produced by influencers and independent creators. This segment is renowned for its wide range and fast usage rate, typically accessed through platforms that encourage user interaction and participation. Furthermore, live streaming involves broadcasting real-time events, including sports, concerts, news, and other live performances.

- Based on the technology, the market is categorized into IPTV, OTT, satellite, and others, amongst which OTT accounted for the largest market share. The dominance of this segment is driven by the increasing availability of high-speed internet and the growing use of smart devices, enabling easy and flexible access to OTT content.

- On the basis of the service type, the market has been divided into free-to-air services and pay TV services. Among these, pay TV services represented the largest segment as people seek more tailored and high-quality viewing experiences.

- Based on the application, the market is bifurcated into commercial and personal, wherein personal accounted for the largest market share due to the extensive use of mobile devices for individual entertainment purposes.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 26.9 Billion |

| Market Growth Rate 2025-2033 | 7.1% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Content Types Covered | Video-on-Demand, Online Video, Live Streaming |

| Technologies Covered | IPTV, OTT, Satellite, Others |

| Service Types Covered | Free-to-Air Services, Pay TV Services |

| Applications Covered | Commercial, Personal |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asianet Satellite, AT&T Inc., Bell Canada (BCE Inc.), Bharti Airtel Limited, Charter Communications Inc., Comcast Corporation, Consolidated Communications, Cox Communications Inc., MobiTV Inc., SPB TV AG, Tata Sky Ltd. (TOF), United States Cellular (Telephone and Data Systems), Verizon Communications Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)