Global Metering Pump Market Expected to Reach USD 11.2 Billion by 2033 - IMARC Group

Global Metering Pump Market Statistics, Outlook and Regional Analysis 2025-2033

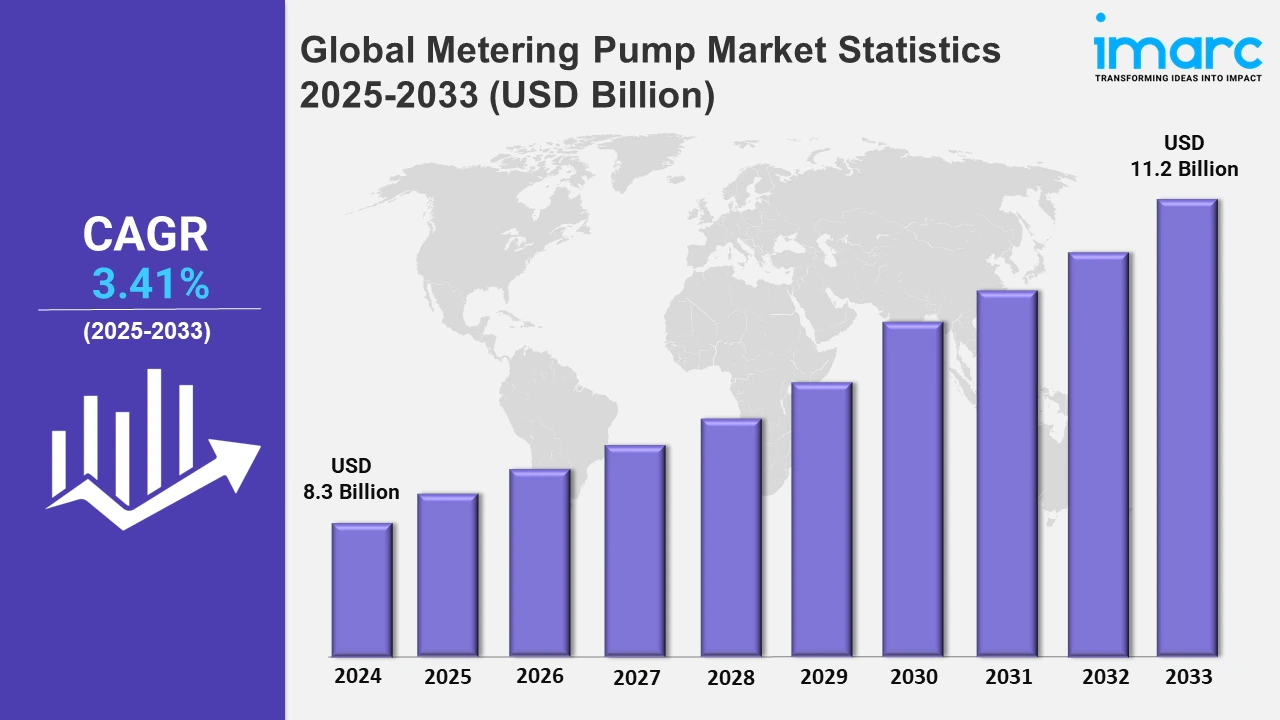

The global metering pump market size was valued at USD 8.3 Billion in 2024, and it is expected to reach USD 11.2 Billion by 2033, exhibiting a growth rate (CAGR) of 3.41% from 2025 to 2033.

To get more information on this market, Request Sample

The global metering pump market is experiencing robust growth, driven by accelerating demand for precise and efficient fluid handling across industries. The rising emphasis on water treatment solutions due to growing concerns over water scarcity and contamination. Metering pumps are critical in dosing chemicals for water purification which ensures accurate and controlled delivery of disinfectants and coagulants. Governments and organizations worldwide are investing heavily in water infrastructure to meet the needs of rapidly urbanizing populations, creating a steady demand for metering pumps in municipal and industrial water treatment facilities. Moreover, stringent environmental regulations are motivating industries to adopt technologies that minimize wastage and environmental harm, positioning metering pumps as essential components for achieving compliance in wastewater management processes. For instance, in December 2024, Valmet's Flowrox FXM metering pumps redefine wastewater treatment with advanced fieldbus connectivity with the precise 5,000:1 turndown ratio, multilingual controls, and robust safety features, ensuring efficiency and adaptability in industrial applications. Furthermore, this demand is particularly pronounced in regions with high industrial activity, where the need to treat effluents and maintain ecological balance is critical.

Additionally, the expansion of the chemical, pharmaceutical, and oil and gas industries are another key driver propelling the market expansion. In the chemical sector, metering pumps are widely used for accurate dosing of aggressive or hazardous chemicals in various manufacturing processes, ensuring operational safety and efficiency. The pharmaceutical industry also relies on metering pumps for precise formulation and delivery of active ingredients, which is crucial for maintaining product quality and compliance with stringent health regulations. Furthermore, the oil and gas sector requires reliable dosing systems for injecting corrosion inhibitors, demulsifiers, and other essential chemicals to optimize production and protect infrastructure. For example, in March 2024, Milton Roy launched the Primeroyal™ Q series, a high-performance chemical metering pump featuring a maximum flow rate of 8,657 l/h and discharge pressure of 1,035 bar, ideal for oil, gas, petrochemical, and power generation industries. Moreover, innovation in metering pump technologies, like digital and smart pumps, is being fueled by the expansion of these industries along with the growing use of automation and advanced control systems. These developments align with the global push for Industry 4.0 by providing improved accuracy, energy efficiency, and remote monitoring capabilities. As industries increasingly prioritize sustainability, efficiency, and technological innovation, metering pumps are set to play an even more vital role across various applications.

Global Metering Pump Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of rapid industrialization, rising population, and increasing environmental awareness.

North America Metering Pump Market Trends:

North America dominates the metering pump market due to its advanced industrial base and strict environmental regulations. Significant demand stems from water and wastewater treatment applications, supported by aging infrastructure upgrades and sustainable water management initiatives. The chemical and pharmaceutical industries support growth through the use of precise dosing technologies and efficiency. Increasing adoption of digital and smart metering pumps aligns with the region’s focus on automation and energy-efficient industrial practices.

Asia-Pacific Metering Pump Market Trends:

The Asia-Pacific metering pump market is witnessing significant growth, driven by rapid industrialization and urbanization in countries like China, India, and Southeast Asia. Increasing investments in water treatment infrastructure to address rising concerns over water scarcity and contamination are key factors propelling demand. The region’s expanding chemical and petrochemical industries are also fueling the need for precise dosing systems to enhance operational efficiency and ensure compliance with environmental regulations and sustainability. For example, Grundfos achieved a 9% reduction in CO2 emissions and a 7% decrease in water consumption in 2023, advancing its net-zero commitment validated by the Science-Based Targets initiative and promoting lifecycle sustainability across its product portfolio. Additionally, the pharmaceutical sector is growing rapidly, with metering pumps playing a critical role in maintaining accuracy during drug formulation. The adoption of advanced technologies, such as digital metering pumps, is gaining traction as industries prioritize energy efficiency and automation, further boosting the market's expansion in this dynamic region.

Europe Metering Pump Market Trends:

Strict environmental regulations and sustainability initiatives, mainly in wastewater management and industrial effluent treatment, drive the Europe metering pump market. These pumps are applied in the pharmaceutical and chemical industries for precision dosing in the strict safety standards. High-tech manufacturing technologies and growing adoption of digital and smart pump systems boost market growth, especially in industrial locations such as Germany, France, and the United Kingdom.

Latin America Metering Pump Market Trends:

Growing investments in water treatment infrastructure and industrial expansion, especially oil and gas and chemical segments, contribute to the expansion of the Latin America metering pump market. Countries such as Brazil and Mexico are concerned with proper management of waste waters, which is seen as an increasing environmental problem. Metering pumps are utilized in agriculture for the appropriate dosing of chemicals in the irrigation systems for effective resource usage.

Middle East and Africa Metering Pump Market Trends:

The Middle East and Africa metering pump market is propelled by the growing need for water desalination and treatment in arid regions, along with infrastructure development in oil-rich economies. The oil and gas sector remains a significant driver, requiring metering pumps for chemical injection and maintenance processes. Industrial growth and increasing adoption of advanced technologies for water reuse and treatment further contribute to market expansion across the region.

Top Companies Leading in the Metering Pump Industry

Some of the leading metering pump market companies include Grundfos Pumps India Private Ltd., IDEX Corporation, LEWA GmbH (Atlas Copco), McFarland Pumps, Milton Roy Company (Ingersoll Rand Inc.), Nikkiso Co., Ltd., ProMinent Group, Seko S.P.A, SPX FLOW, Inc., Verder Liquids, Watson-Marlow Fluid Technology Solutions (Spirax Group plc), Yamada Corporation, among many others.

- In 2024, Swelore Engineering continued to expand its leadership in the metering pump industry. Offering both diaphragm and plunger pumps, the company caters to diverse sectors with customized solutions, ensuring high-quality and reliable performance across oil & gas, petrochemicals, water treatment, and more.

- In 2024 Seeped has introduced Intelligent Metering Pumps (IMP). These pumps incorporate a programmable vector drive and an Electronic Programming Module (EPM) memory chip, enabling precise and customizable operations. The design supports easy parameter changes by simply replacing the EPM chip. The IMP is noted for its compact design, valveless flow control, and high durability.

Global Metering Pump Market Segmentation Coverage

- On the basis of the type, the market has been categorized into diaphragm pumps, piston pumps, and others, wherein diaphragm pumps represent the leading segment. Diaphragm pumps are leading the market due to their effectiveness, durability, and ability to work on abrasive and corrosive fluids. The diaphragm pump operates in a wide range of pressures and flow rates that make it ideal for several applications, such as chemicals, oil & gas, and water treatment.

- Based on the application, the market is classified into water & wastewater treatment, oil & gas chemical processes, pharmaceuticals, food & beverages, paper & pulp, and others, amongst which water & wastewater treatment dominates the market. The industry is led by water and wastewater treatment due to growing concerns about environmental restrictions, contamination, and water scarcity. In order to precisely dose chemicals and disinfectants and guarantee efficient water purification, metering pumps are essential

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 8.3 Billion |

| Market Forecast in 2033 | USD 11.2 Billion |

| Market Growth Rate 2025-2033 | 3.41% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Diaphragm Pumps, Piston Pumps, Others |

| Applications Covered | Water & Wastewater Treatment, Oil & Gas, Chemical Processes, Pharmaceuticals, Food & Beverages, Paper & Pulp, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Grundfos Pumps India Private Ltd., IDEX Corporation, LEWA GmbH (Atlas Copco), McFarland Pumps, Milton Roy Company (Ingersoll Rand Inc.), Nikkiso Co., Ltd., ProMinent Group, Seko S.P.A, SPX FLOW, Inc., Verder Liquids, Watson-Marlow Fluid Technology Solutions (Spirax Group plc), Yamada Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)