Global Metal Recycling Market Expected to Reach USD 356.0 Billion by 2033 - IMARC Group

Global Metal Recycling Market Statistics, Outlook and Regional Analysis 2025-2033

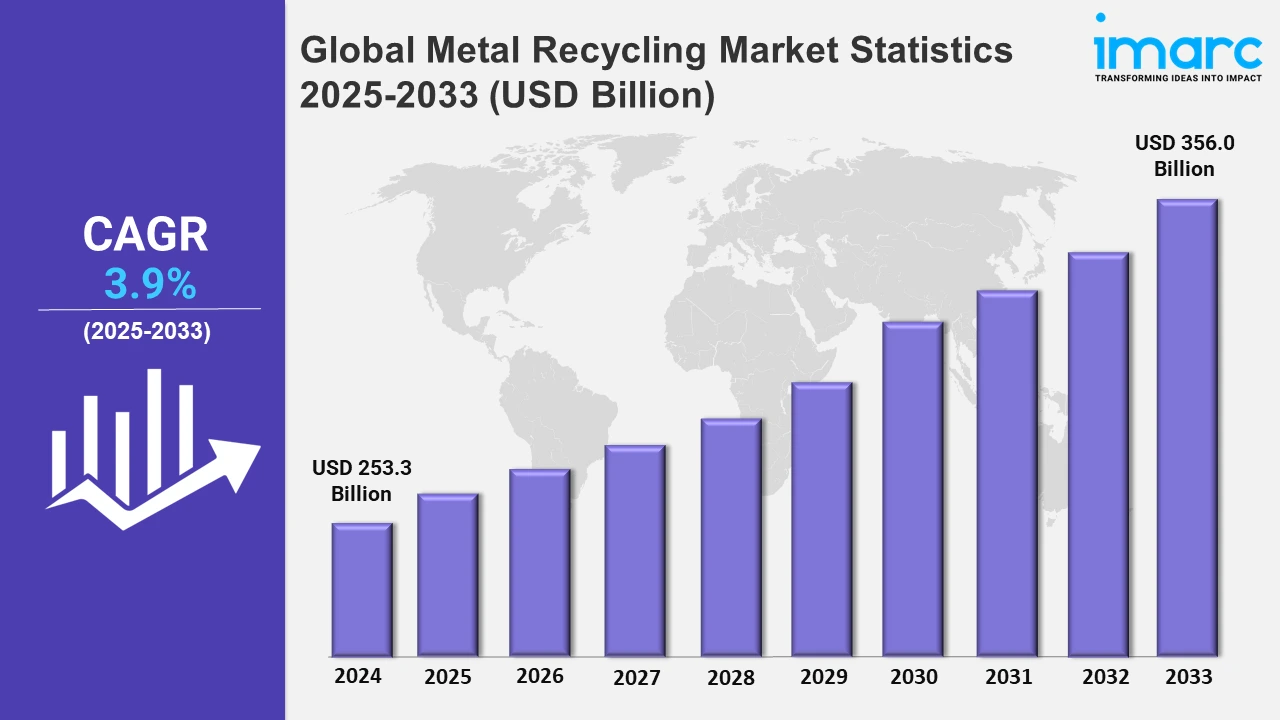

The global metal recycling market size was valued at USD 253.3 Billion in 2024, and it is expected to reach USD 356.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.9% from 2025 to 2033.

To get more information on this market, Request Sample

The growth in the global metal recycling market can be largely attributed to the utilization of electric arc furnaces (EAFs) for steel production. As per the data provided by the Global Steel Plant Tracker (GSPT), annual volume produced using EAFs, which use scrap metal as the main feedstock, reached 151 million tons in China as of January 2024. This transition primarily indicates an increasing emphasis on steel production methods that are less harmful on the environment, since constructing and operating an EAF is much more efficient in terms of power usage and greenhouse gas emissions than the construction and use of a blast furnace. As the world shifts towards cleaner means of production, there is a growing usage of EAFs which recycle metals. Moreover, EAFs are being employed, where possible, as a response to government policies geared towards the reduction of industrial carbon emissions and achievement of other sustainability objectives. On account of the improvements in the recycling tech and the growing focus on the circular economy in the metals industry, this creates a consistent increase in metal recycling, further stimulating the market growth.

One of the major factors propelling the market growth is the expected acceleration in global construction spending which is expected to be $14.5 trillion and $15.7 trillion in 2024 and 2025 respectively according to a 2024 report by S&P Global Rating. Following this rise in the levels of construction activity, particularly in the nonresidential and residential industries, the demand for metals increases and, hence, the need for recycled products. As of 2023, 64% of total world construction expenditure was used for non-residential and 36% for residential construction spending. Due to the expanding construction sector, the consumption of different metals such as steel, aluminum, and copper in infrastructural works is escalating, thus expanding the metal recycling industry. In addressing this demand, where the emphasis is on energy-efficient building construction, recycled metals serve as an environmentally responsible alternative to primary raw materials. This trend is further reinforced by the implementation of stringent regulations and sustainability objectives that advocate for an increased utilization of recycled materials within the industry.

Global Metal Recycling Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest metal recycling market share, driven by the region’s leading steel production in China, rapid industrialization and urbanization, increasing government initiatives promoting sustainability, growing demand from construction and automotive industries, and advancements in recycling technologies.

Asia Pacific Metal Recycling Market Trends:

Asia Pacific dominates the metal recycling market, driven by robust industrial growth and expanding construction activities. China, the world's largest crude steel producer, recorded 67.4 million metric tons in December 2023, per Statista, reinforcing its position as a key contributor to recycled metal demand. The region’s focus on sustainable practices, increasing urbanization, and government initiatives promoting recycling further boost the market growth. Countries like India and Japan are also adopting advanced recycling technologies, fostering a dynamic market environment in Asia Pacific.

North America Metal Recycling Market Trends:

The North American metal recycling market is largely influenced by factors such as environmental rules and a rising consciousness of green practices. The region boasts a strong industrial base, especially in automotive and construction, which has oodles of metal scrap produced with regard to recycling. Furthermore, technological progress in the recycling processes and the government’s stimuli directed towards green practices have facilitated the expansion. Large companies are looking to enhance capacity and efficiency to meet the expected demand growth along with heavy industries aiming at minimizing the environmental impact and protecting natural resources.

Europe Metal Recycling Market Trends:

As part of its support for a circular economy, there are stringent European Union policies that encourage the recycling of metal thus expanding the market in Europe. Countries such as Germany and the UK are the most prominent in the region, due to developed infrastructure for recycling activities and industrial activities of high level. The rising integration of electric arc furnaces in steel manufacture has increased the need for recycled metals. In addition, rising investments in new recycling technologies and strategic partnerships for new innovation development are majorly influencing the regional market dynamics.

Latin America Metal Recycling Market Trends:

In Latin America, there is a growing demand for metal recycling due to rapid industrialization and urbanization. For instance, countries like Brazil and Mexico are key contributors, due to the automotive and construction industries. Recycling efforts are on the rise as pollution control policies are enacted to curb harmful emissions. In addition, the increasing outflow of recyclable metals from the region to the world markets is further enhancing its growth along with operative plans directed toward designing sophisticated processing units for efficiency.

Middle East and Africa Metal Recycling Market Trends:

The Middle East and Africa market is expanding, due to the increased construction activities and the development of infrastructure projects. In addition, regional authorities are promoting recycling as a tool for resource conservation and waste management. Countries such as the UAE and South Africa are constructing recycling facilities to cut down on landfill sites and the environmental risks created by landfill waste. Besides, the growing demand for recycled metals and the use of new recycling techniques help to sustain the growth of the market.

Top Companies Leading in the Metal Recycling Industry

Some of the leading Metal recycling market companies include ArcelorMittal, Aurubis AG, Commercial Metals Company, Dowa Holdings Co. Ltd., European Metal Recycling Ltd (Ausurus Group Ltd), Nucor Corporation, OmniSource LLC (Steel Dynamics Inc.), Schnitzer Steel Industries Inc., Sims Limited and Tata Steel Limited. On February 21, 2024, Tata Steel and ArcelorMittal Nippon Steel (AM/NS) India announced that they are increasing their focus on scrap-based steel production. AM/NS India is working on setting up steel scrap processing centers nationwide, while Tata Steel is establishing recycling plants utilizing electric arc furnace (EAF) technology. This strategic shift toward scrap-based production supports the metal recycling market by bolstering demand for recycled materials, promoting sustainable practices, and reducing reliance on traditional raw materials. These initiatives drive growth and enhance resource efficiency within the global metal recycling sector.

Global Metal Recycling Market Segmentation Coverage

- On the basis of the metal type, the market has been bifurcated into steel, aluminum, copper, and others, wherein steel represents the most preferred segment. This dominance is primarily as steel recycling requires less energy compared to primary steel production, significantly reducing greenhouse gas emissions. Moreover, steel is widely used across industries such as construction, automotive, and manufacturing, ensuring continuous demand for recycled materials. Advancements in steel recycling technologies have further streamlined processes, increased efficiency and reducing operational costs, thus driving its dominance in the market.

- Based on the type, the market is categorized into ferrous metal and non-ferrous metal, amongst which ferrous metal dominates the market. Ferrous metal is the most preferred choice due to the extensive use of ferrous metals in critical sectors like construction, automotive, and heavy machinery. Ferrous metals such as iron and steel are easily recyclable and constitute a significant portion of scrap metal collected globally. Rising investments in recycling infrastructure and stringent regulations promoting sustainable practices further bolster the dominance of ferrous metals in the recycling market.

- On the basis of the end use industry, the market has been divided into building and construction, packaging, automotive, industrial machinery, electronics and electrical equipment, shipbuilding, and others. Among these, building and construction dominates the market due to the extensive use of recycled metals in structural components, reinforcing bars, and roofing materials. The increasing focus on sustainable building practices and green certifications has encouraged developers to incorporate recycled materials, further driving the demand for recycled metals in this sector.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 253.3 Billion |

| Market Forecast in 2033 | USD 356.0 Billion |

| Market Growth Rate 2025-2033 | 3.9% |

| Units | Billion USD |

| Segment Coverage | Metal Type, Type, End Use Industry, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ArcelorMittal, Aurubis AG, Commercial Metals Company, Dowa Holdings Co. Ltd., European Metal Recycling Ltd (Ausurus Group Ltd), Nucor Corporation, OmniSource LLC (Steel Dynamics Inc.), Schnitzer Steel Industries Inc., Sims Limited and Tata Steel Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Metal Recycling Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)