Metal Cleaning Chemicals Market Size, Share, Trends and Forecast by Type, Metal Type, Ingredient, End Use, and Region, 2025-2033

Metal Cleaning Chemicals Market 2024, Size and Trends:

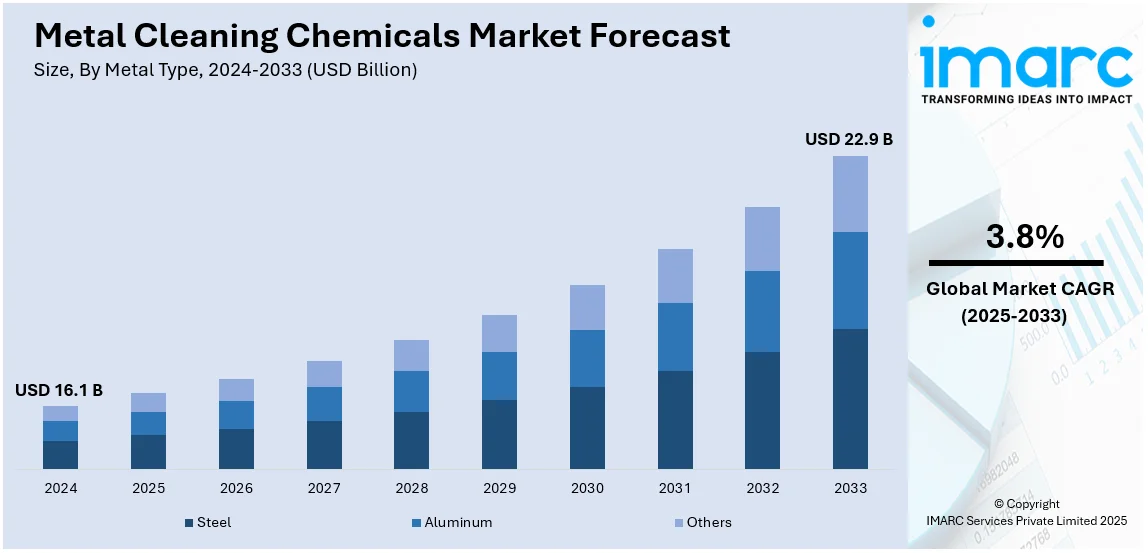

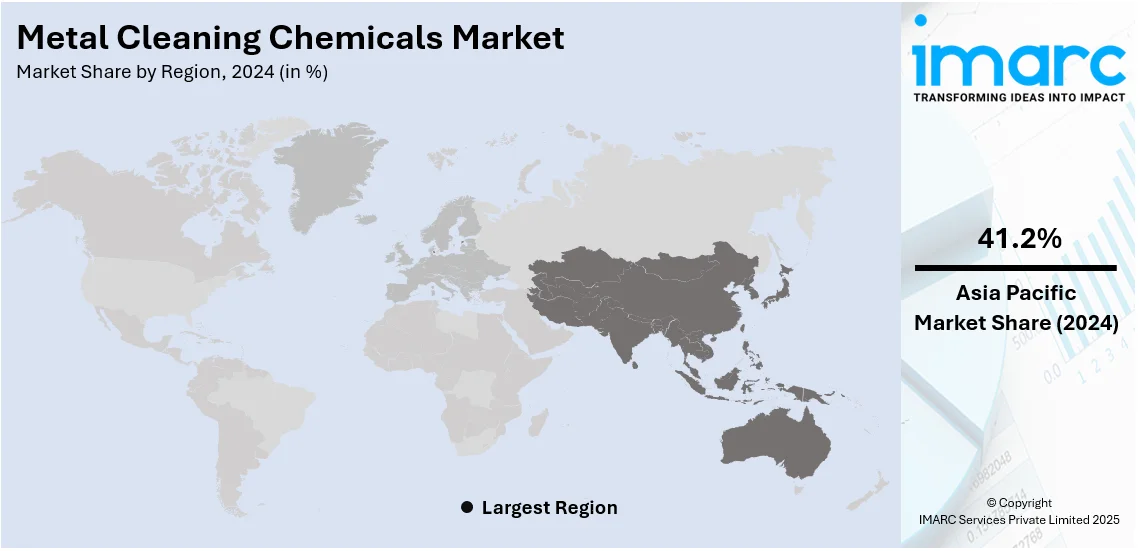

The global metal cleaning chemicals market size was valued at USD 16.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 22.9 Billion by 2033, exhibiting a CAGR of 3.8% during 2025-2033. Asia-Pacific currently dominates the market in 2024, holding 41.2% of the market share. The rapidly expanding automotive and construction industries are key drivers for the growing use of metal cleaning chemicals. In automotive manufacturing, these chemicals are vital for cleaning vehicle body parts, ensuring high-quality finishing. With global vehicle production rising, demand for these cleaners has significantly increased. In construction, metal cleaning chemicals are essential for removing metallic scale and corrosion, maintaining structural integrity, and achieving superior finishes in architectural applications like decorative metalwork. The shift towards aqueous-based cleaners further supports the metal cleaning chemicals market share, aligning with environmental regulations and industry needs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 16.1 Billion |

|

Market Forecast in 2033

|

USD 22.9 Billion |

| Market Growth Rate 2025-2033 | 3.8% |

The global metal cleaning chemicals are driven by numerous factors such as increasing focus on preserving equipment effectiveness and durability in production facilities. The growth of the automotive industry, especially in developing countries, increases the need for metal cleaning chemicals utilized in engine components, gears, and various parts. Additionally, the advancement of eco-friendly and safe cleaning products supports sustainability objectives, appealing to a wider range of consumers. Improvements in formulations through technological advancements to enhance performance and decrease energy usage are also key factors. Moreover, raising awareness regarding corrosion prevention and the advantages of metal cleaning chemicals in improving product quality enhances their use in diverse industries worldwide.

The United States stands out as a key market disruptor, driven by the robust presence of industries such as automotive, aerospace, and manufacturing, which need high-performance cleaning solutions to maintain operational efficiency and product quality. Regulatory standards are now becoming more stringent, as laid down by the Environmental Protection Agency (EPA), to promote the use of eco-friendly and non-toxic formulations. Increasing emphasis on industrial hygiene and corrosion prevention will also help the market grow further. Specialized cleaning chemicals for batteries and precision components are becoming a necessity, especially with the increasing automotive industry, which heavily focuses on electric vehicles. Another factor propelling the metal cleaning chemical market growth is technological advancements, through which cost-effective and energy-efficient cleaning solutions that cater to particular industrial needs are developed.

Metal Cleaning Chemicals Market Trends:

Rapid expansion of the electronics industry

One of the primary factors driving the metal cleaning chemical market share is the rapid growth in the electronics industry to clean and prepare metal surfaces for electronic component assembly. For instance, as of March 2023, the electronics market in India was valued at USD 101 Billion, with an ambitious target of reaching USD 300 Billion by 2025-26. The purpose of these chemicals is cleaning and preparing the surfaces made from metal used in the assembly of electronic components to assure high accuracy and reliability in their performance. It involves removal of various contaminants like grease, oil, dust, and oxide layers which might reduce the efficiency of such electronic components, for instance circuit boards, semiconductors, and connectors. The need for impeccable surface preparation is more pronounced with the miniaturization of electronic devices and the rising adoption of high-performance technologies such as 5G, artificial intelligence, and IoT. Moreover, the increasing production of consumer electronics and renewable energy devices, including solar panels and electric vehicle batteries, demands high-quality metal cleaning solutions. This trend is supported by innovations in environmentally friendly formulations, which respond to the needs of the industry and regulatory compliance, further fueling market growth.

Maintenance of equipment and machinery

The growing awareness regarding the importance of maintaining equipment and machinery to prevent downtime and ensure operational efficiency is creating a positive market outlook. Automotive, aerospace, and manufacturing companies heavily depend on consistent performance from equipment and machinery in order to fulfill production requirements and quality. Dirty, greasy, corroded, or contaminated unplanned downtime could lead to tremendous financial loss, missed deadlines, and reduced quality of products. As a result, the company is inclined towards preventive maintenance activities, among which is the repeated use of metal cleaning chemicals to clean, degrease, and protect critical parts. These chemicals contribute greatly to ensuring equipment longevity as they reduce wear and tear, minimize corrosion, and maintain performance at its peak. Another trend is the increase in investments of industries in sustainable, eco-friendly, and versatile cleaning solutions for various metal types, due to sustainability objectives and compliance with regulatory requirements.

Increasing product adoption in the construction industry

Moreover, the wide product employment in the construction industry for the removal of metallic scale and corrosion products is boosting the metal cleaning chemicals market demand. For instance, construction sector has seen highest FDI investment of approximately USD 7.39 Billion in fiscal 2021. Metal structures such as beams, reinforcements, and panels must be completely cleaned to remove contaminants such as rust, grease, and welding residues before fabrication, coating, or assembly. Cleaning enhances the adhesion of protective coatings and diminishes the probability of corrosion on metal components, thereby prolonging their service life. Steel and aluminum, with all the strength and sustainability that modern construction requires, also mean a stronger demand for specific cleaning chemicals on these materials. Stricter building codes and standards also highlight structural integrity and safety as key factors for the use of advanced cleaning solutions.

Metal Cleaning Chemicals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global metal cleaning chemicals market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, metal type, ingredient, and end use.

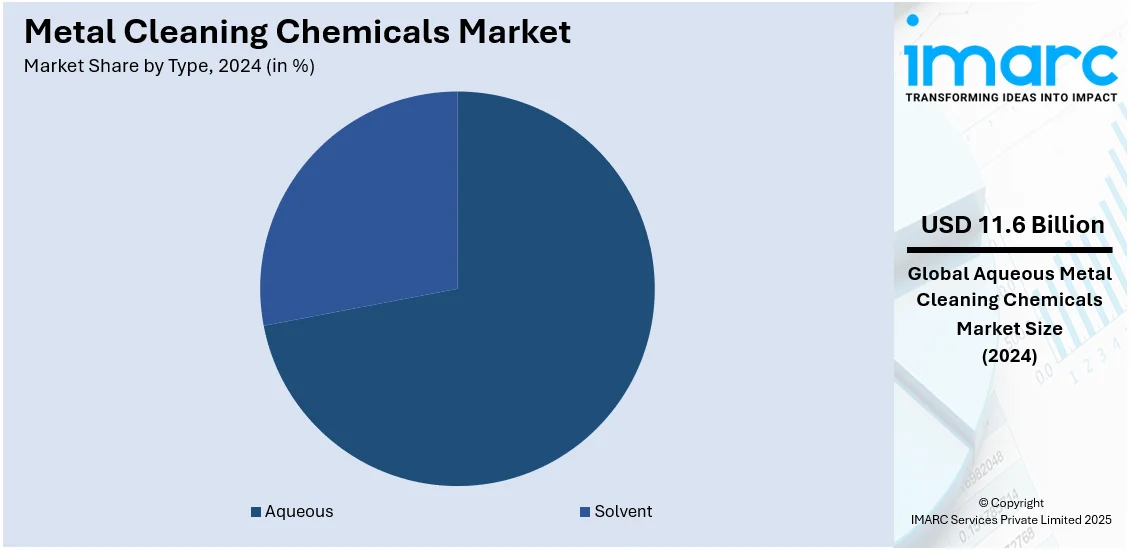

Analysis by Type:

- Aqueous

- Solvent

According to the metal cleaning chemical market forecast, aqueous stands as the largest component in 2024, holding 71.8% of the market share. Aqueous solutions lead the metal cleaning chemical market on account of their environmentally friendly properties, safety, and effectiveness in eliminating contaminants such as oils, dirt, and grease from metal surfaces. Being water-based, they pose lower risks than solvent-based options, complying with strict environmental regulations and sustainability objectives. Moreover, water-based cleaners are adaptable, serving multiple sectors like automotive, aerospace, and manufacturing, where efficient and safe cleaning is crucial. Their capacity to deliver reliable outcomes, along with improvements in biodegradable and low-toxicity products, fuels their extensive use as the favored cleaning option.

Analysis by Metal type:

- Steel

- Aluminum

- Others

Based on the metal cleaning chemical market trends, steel leads the market in 2024, due to its widespread application in sectors such as construction, automotive, and manufacturing. Its durability, adaptability, and affordability render it a favored material for numerous uses, necessitating routine cleaning to uphold quality and avert corrosion. The extensive application of steel in construction projects, equipment, and transport boosts the need for cleaning solutions. Furthermore, steel's vulnerability to impurities such as rust and grease requires effective cleaning solutions, reinforcing its leadership in the market.

Analysis by Ingredients:

- Surfactant

- Chelating agent

- Solvent

- Others

Chelating agent leads the market in 2024, on account of its efficiency in eliminating metal ions, scale, and various impurities from surfaces. Its adaptability renders them appropriate for various sectors, such as automotive, construction, and manufacturing. Chelating agent improves the stability and effectiveness of cleaning products, guaranteeing complete elimination of contaminants while avoiding re-deposition. Moreover, its compatibility with sustainable and biodegradable cleaning solutions corresponds with rising environmental regulations.

Analysis by End use:

- Manufacturing

- Automotive

- Aerospace

- Others

According to the metal cleaning chemical market outlook, the manufacturing sector leads the industry in 2024, on account of its significant dependence on these chemicals for upkeep of machinery, tools, and product parts. Sectors such as automotive, aerospace, and electronics utilize metal cleaning agents for degreasing, surface preparation, and corrosion prevention to guarantee high-quality results and operational effectiveness. Furthermore, the increasing focus on precision manufacturing and the implementation of advanced production technologies require effective cleaning solutions, which further strengthens the manufacturing sector's dominance in the market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 41.2%, due to its swift industrial growth, increasing manufacturing capabilities, and booming automotive and construction industries in nations such as China, India, and Japan. The area's strong infrastructure growth and heightened output of steel, aluminum, and various metals stimulate the need for cleaning solutions. Moreover, increased environmental consciousness and tougher regulations are driving the use of environmentally friendly chemicals. The presence of affordable raw materials and labor additionally bolsters the market's expansion, positioning Asia Pacific as the largest regional sector.

Key Regional Takeaways:

United States Metal Cleaning Chemicals Market Analysis

In 2024, the United States accounts for over 81.20% of the metal cleaning chemicals market in North America. The adoption of metal cleaning chemicals in the United States is driven by the expanding aerospace sector. According to reports, there are approximately 1,509 aircraft, engine & parts manufacturing businesses in the US as of 2023. As the demand for advanced aircraft and aerospace components increases, manufacturers face the challenge of maintaining stringent cleanliness standards to ensure precision and safety in critical components. Metal cleaning chemicals are essential in removing oils, dust, and contaminants from metal parts, thus enabling the production of high-performance, corrosion-resistant components. The aerospace industry's rapid growth, particularly in commercial aircraft production and defense applications, has created a demand for specialized cleaning solutions that meet the sector's rigorous standards. This increased focus on manufacturing efficiency and quality control is fueling the rise in metal cleaning chemical adoption, ensuring the smooth operation of complex machinery and systems. The need for enhanced productivity in aerospace manufacturing further strengthens the reliance on advanced cleaning chemicals, helping streamline operations and meet tight regulatory requirements for safety and durability.

Asia Pacific Metal Cleaning Chemicals Market Analysis

The growing electronics industry in Asia-Pacific is another driving force behind the increasing adoption of metal cleaning chemicals. According to India Brand Equity Foundation, India is a popular manufacturing hub. India's domestic electronics production has grown from USD 29 Billion in 2014-15 to USD 101 Billion in 2022-23. With a surge in the production of electronic devices such as semiconductors, smartphones, and consumer electronics, the need for precise and contamination-free components has become more crucial. Metal cleaning chemicals play a pivotal role in removing microscopic impurities and residues from metallic surfaces, ensuring the high-quality performance of electronic products. As the electronics sector rapidly expands, particularly in countries with significant production hubs, the demand for efficient cleaning solutions continues to rise. Metal cleaning chemicals help manufacturers maintain the integrity of electronic components, ensuring optimal functionality and reducing the risk of product failures. The rise in consumer demand for advanced electronics, combined with the industry's ongoing technological advancements, drives the need for better cleaning solutions in the Asia-Pacific region.

Europe Metal Cleaning Chemicals Market Analysis

In Europe, the increased adoption of metal cleaning chemicals is fuelled by the growing production and manufacturing sector. According to reports, the EU's industrial production in 2021 is increased by 8.5% compared with 2020. It continued to go up in the year 2022 with 0.4% rise with 2021. Industries across automotive, aerospace, and heavy machinery production are embracing advanced cleaning technologies to enhance production processes and maintain strict standards of component cleanliness. As manufacturers strive for efficiency and precision, the demand for effective cleaning agents to ensure that metal surfaces are free of contamination has surged. Metal cleaning chemicals are vital in ensuring the quality, durability, and safety of components used in high-performance machinery. In particular, the growing trend toward environmentally friendly solutions in the European market has led to innovations in metal cleaning chemicals, offering safe and sustainable alternatives that align with the region’s environmental regulations. The need for enhanced productivity and compliance with stringent quality standards is further accelerating the adoption of these chemicals, allowing industries to meet the rising demand for high-quality, clean metal components.

Latin America Metal Cleaning Chemicals Market Analysis

In Latin America, the growing automotive industry is driving the adoption of metal cleaning chemicals. Stellantis announced a significant investment of USD 6.03 billion in South America, marking the largest financial commitment ever made in the region's automotive sector. As this industry grows, the requirements for metal parts cleaning solutions by manufacturers increase while ensuring cost-effective methods for cleaning in the automotive production process. These chemicals are used for cleansing parts and components to ensure that they meet specified quality standards, including engine components, frames, and transmission systems. This demand is fueled by the increase in vehicle production and assembly operations across the region. The growth in the automotive industry has highlighted the importance of maintaining high cleanliness standards to ensure the functionality and durability of critical parts. Metal cleaning chemicals play a vital role in removing impurities and contaminants that can affect the quality and safety of automotive components. With the rise of automotive manufacturing in Latin America, the demand for these chemicals is expected to continue growing.

Middle East and Africa Metal Cleaning Chemicals Market Analysis

The construction sector is boosting the Middle East and Africa's expanding market for metal cleaning chemicals. According to a report, the construction sector has positively impacted the market in Saudi Arabia, with more than 8,200 active projects totaling over USD 819 Billion. Such projects will continue to be essential for the country's future construction boom, and they will affect most sectors such as residential building projects, commercial real estate projects, industrial facilities development, and hotels and resorts construction. The demand for effective and clean metal materials has increased in activities related to large-scale infrastructure projects as well as commercial building. These chemicals are required for the preparation of metal parts of construction tools, machinery, or similarly structural parts to meet the high quality standards. The cleaning procedure serves to remove impurities that might weaken or compromise the productivity of metals in the long run. Huge investments in construction and infrastructure developments require the need of cleaning technologies to meet the increasing needs of any construction material processes. Consequently, this trend will mainly influence the consumer market of metal cleaning chemicals for the optimization of construction projects throughout the region.

Competitive Landscape:

Leading companies in the metal cleaning chemicals sector are promoting growth through strategic initiatives centered on global expansion, sustainability, and innovation. In response to growing environmental concerns and legal requirements, companies are heavily spending in research and development (R&D) to create novel formulations, such as non-toxic and environmentally friendly cleaning solutions. The introduction of water-based and low-volatile organic compounds (VOC) substitutes also demonstrates their commitment to eco-friendly practices. To enhance their market presence and expand their range of products, many companies are entering into strategic partnerships and acquiring smaller firms. Another key focus is on customizing goods to meet the particular needs of industries including construction, automotive, and aerospace.

The report provides a comprehensive analysis of the competitive landscape in the metal cleaning chemicals market with detailed profiles of all major companies, including:

- Chautauqua Chemical Company.

- Crest Industrial Chemicals Inc.

- Delstar Metal Finishing Inc.

- Hubbard-Hall Inc.

- Kyzen Corporation.

- Lincoln Chemical Corporation.

- Luster-On Products Inc.

- PCC Rokita SA.

- Quaker Houghton.

- Stepan Company

- Zavenir Daubert India Private Limited

Latest News and Developments:

- September 2024: BASF Coatings has introduced its first ChemCycling® products in the automotive refinish market at Automechanika 2024. Leveraging advanced ChemCycling technology under BASF’s mass balance approach, the new premium clearcoats are made from recycled waste tires. These products, under Glasurit® Eco Balance and R-M® eSense brands, enhance body shop efficiency, contribute to the circular economy, and reduce CO2 emissions. The innovation supports sustainability in the refinish industry.

- July 2024: Chemitek Solar has introduced a Metal Oxides Removal Agent designed to remove rust and other metal oxides effectively and safely from solar panels and tiles. The biodegradable formula reacts with metal oxide particles, ensuring their removal without damaging the panels. This eco-friendly solution eliminates the need for abrasive cleaning methods, offering a safer and more sustainable option for solar maintenance.

- June 2024: Henkel Adhesive Technologies introduces a cleaner and coater technology that streamlines metal pretreatment, cutting process steps in half. This innovation saves energy and water, aligning with Henkel's sustainability initiative, "Respect the Planet, Rethink Design." The technology ensures better corrosion protection and paint adhesion while addressing environmental challenges in industries like household appliances and machinery. Manufacturers can reduce CO2 emissions and process costs with this efficient solution.

- April 2024: Stepan Company introduced STEPANATE SCS-40A, a versatile solution serving as a solubilizer, coupling agent, and cloud point depressant. This product is designed for use in heavy-duty cleaners, wax strippers, and dishwashing detergents, along with applications in oilfield operations and metalworking processes. STEPANATE SCS-40A is manufactured and marketed for usage in the Asia-Pacific area.

-

April 2024: ProXL has introduced a new water-based Rust Remover designed for the automotive repair sector, offering an eco-friendly solution for corrosion removal. After three years of research, the product eliminates rust without dismantling, scrubbing, or sanding vehicle panels. The versatile formula is ideal for various applications, particularly in bodyshops. This innovative product ensures efficient rust removal while minimizing environmental impact.

- February 2024: Jelmar, LLC, known for its CLR Brands™, CLR PRO®, and Tarn-X®, has launched the CLR PRO MAX™ Industrial Descaler. This new cleaning solution is designed for faster, more effective removal of scale and rust buildup from industrial equipment. It targets drains and equipment that heat and cool liquids, ensuring advanced results in metal cleaning. The product promises enhanced performance for industrial maintenance.

- February 2024: Chemetall, the surface treatment division of BASF's coatings segment, inaugurated its Aluminum Competence Center in Giussano, Italy. This state-of-the-art facility aims to strengthen Chemetall's global leadership in providing advanced solutions for the surface treatment of aluminum substrates.

Metal Cleaning Chemicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Aqueous, Solvent |

| Metal Types Covered | Steel, Aluminum, Others |

| Ingredients Covered | Surfactant, Chelating agent, Solvent, Others |

| End uses Covered | Manufacturing, Automotive, Aerospace, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Chautauqua Chemical Company., Crest Industrial Chemicals Inc., Delstar Metal Finishing Inc., Hubbard-Hall Inc., Kyzen Corporation., Lincoln Chemical Corporation., Luster-On Products Inc., PCC Rokita SA., Quaker Houghton., Stepan Company., Zavenir Daubert India Private Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the metal cleaning chemicals market from 2019-2033.

- The metal cleaning chemicals market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the metal cleaning chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Metal cleaning chemicals are used to remove contaminants such as oils, greases, rust, and dirt from metal surfaces to ensure proper functionality, enhance product quality, and prevent corrosion.

The metal cleaning chemicals market was valued at USD 16.1 Billion in 2024.

IMARC Group estimates the metal cleaning chemicals market to reach USD 22.9 Billion by 2033, exhibiting a CAGR of 3.8% during 2025-2033.

The global metal cleaning chemicals market is driven by increasing industrialization, stringent environmental regulations, the demand for corrosion prevention, and the growing adoption of eco-friendly and efficient cleaning solutions across sectors like automotive, aerospace, and construction.

According to the report, solvents represented the largest segment by type, driven by their effective ability to dissolve oils, grease, and other contaminants, making them widely used in industries such as automotive, manufacturing, and aerospace.

Steel leads the market by metal type due to its widespread use in industries such as automotive, construction, and manufacturing, where it requires regular cleaning to maintain quality, prevent corrosion, and ensure longevity.

Chelating agent represents the largest segment due to their ability to effectively remove metal ions, improve cleaning efficiency, and prevent scaling and corrosion in various industrial applications.

Manufacturing holds the maximum number of shares due to the high demand for cleaning solutions in the production of metal parts and components used in industries like automotive, aerospace, and machinery, which require regular maintenance to ensure efficiency and quality.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global metal cleaning chemicals market include Chautauqua Chemical Company, Crest Industrial Chemicals Inc., Delstar Metal Finishing Inc., Hubbard-Hall Inc., Kyzen Corporation, Lincoln Chemical Corporation, Luster-On Products Inc., PCC Rokita SA, Quaker Houghton, Stepan Company, and Zavenir Daubert India Private Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)