Global Metal Cans Market Expected to Reach USD 81.7 Billion by 2033 - IMARC Group

Global Metal Cans Market Statistics, Outlook and Regional Analysis 2025-2033

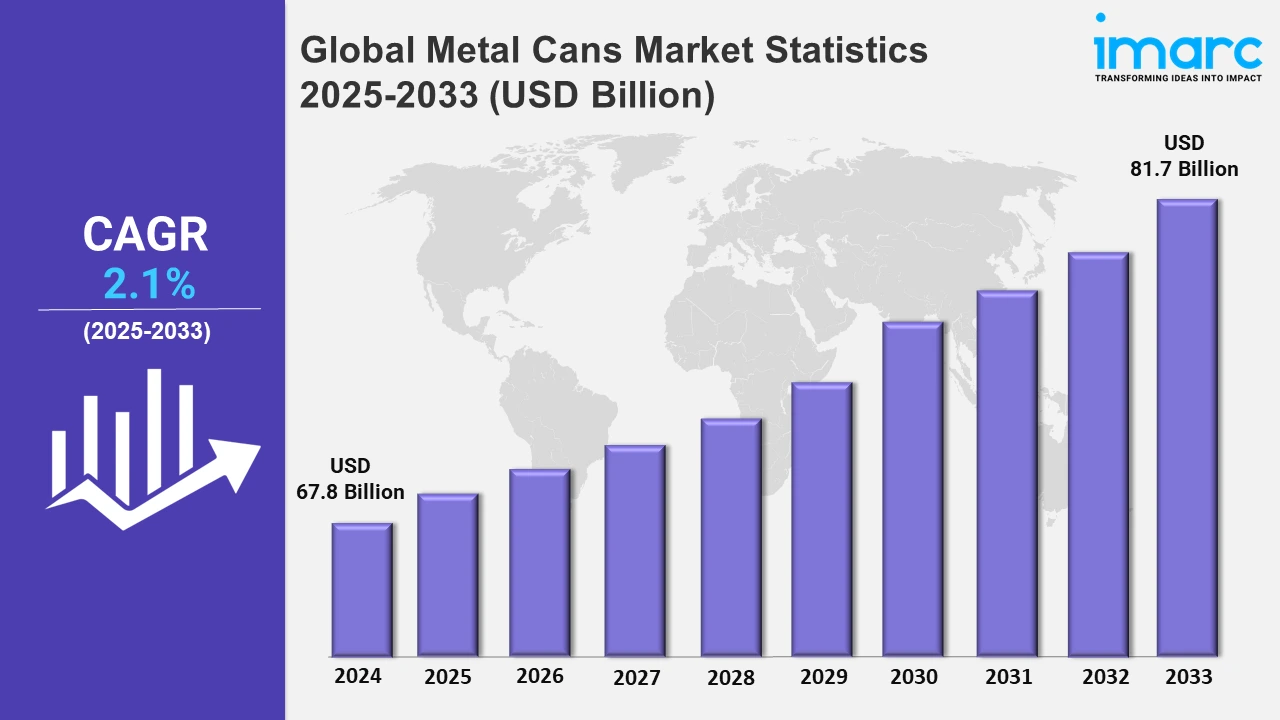

The global metal cans market size was valued at USD 67.8 Billion in 2024, and it is expected to reach USD 81.7 Billion by 2033, exhibiting a growth rate (CAGR) of 2.1% from 2025 to 2033.

To get more information on this market, Request Sample

The global metal cans market is witnessing a rising trend due to the escalating demand for sustainable and recyclable packaging solutions across various industries. They are highly recyclable as well as reusable, gaining amplified focus with heightening environmental concern with regulatory bodies, enforcing strict guidelines to minimize plastic usage. Moreover, the consumers become intensely conscious regarding the implications of their choices on the environment, which forces brands towards metal packaging as an alternative towards sustainability. The integration of government initiatives across the world on industries to utilize recyclable material is further boosting the metal can market. Metal cans also offer improved protection from light, air, and contaminants, which are ensuring extended shelf lives for packaged goods. For example, Ball Corporation in 2024 has partnered with CavinKare to launch retort two-piece aluminum cans for milkshakes, ensuring flavor, nutrient preservation, and sustainability. These cans cater to India's growing ready-to-drink (RTD) dairy segment and on-the-go lifestyles. Furthermore, this has been particularly advantageous for the food and beverage (F&B) industry, where the requirement for the long-lasting packaging solutions is important for preserving the quality and safety of products.

Convenience-oriented and portable packaging demand is driving the metal cans market. The new lifestyle pattern of people is characterized by urbanization and hectic schedules which is spurring the consumption of ready-to-eat (RTE) foods, beverages, and on-the-go meal solutions, highly dependent on metal cans for packaging. For example, in October 2024, Nespresso launched its first ready-to-drink canned coffee, the Master Origins Colombia, packaged in recyclable aluminum cans. The Nespresso product fits within this sustainability commitment and growing market for convenient, on-the-go beverages, such as coffee. Also, aluminum cans are lightweight and yet strong, ideal for use in storage and shipment. They also provide flexibility as other designs have been introduced to make it possible for the convenience of the consumer to increase without losing the integrity of the product, such as the resealable top and lightweight construction. The printing and labeling technologies are offering businesses the opportunity to brand differentiate in a very competitive marketplace by producing attractive, customizable packaging. This growth is also aided by the increase in the popularity of canned pet food, as well as the booming pet ownership market around the world. All these factors, along with further investments in technological progress and innovative manufacturing methods, are favoring the global expansion of the market.

Global Metal Cans Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of high beverage consumption and advanced recycling infrastructure.

North America Metal Cans Market Trends:

North America dominates the market share of metal cans, primarily due to high demand from the F&B sectors. The reason behind this is the demand for canned beverages, such as soda, energy drinks, and craft beers. In January 2023, Ardagh Metal Packaging announced its first U.S.-manufactured 19.2 oz. an aluminum can of beverage that integrates sustainability along with retail differentiation and higher volumes of single-serve varieties, produced in the group's facility at Huron, Ohio. Finally, increased demand for easy to consume, strong and 'sustainable' packaging propels the usage of a metal can. Apart from this, the pet food industry also significantly contributes to this, as metal cans are highly preferred as a packaging choice for wet pet food. Technological innovations, such as lightweight and resealable can designs, alongside bolstering demand for RTE and long-shelf-life foods are amplifying the market growth.

Asia-Pacific Metal Cans Market Trends:

Growing urbanization, rising disposable incomes, and amplifying demand for packaged goods and beverages are the key factors which are propelling the Asia-Pacific market's expansion. High consumption of RTD beverages is fueled by heightened populations in nations like China and India. Furthermore, the region's adoption of recyclable metal cans is bolstered by growing environmental consciousness and a move toward sustainable packaging solutions.

Europe Metal Cans Market Trends:

Strict environmental laws that encourage the usage of recyclable materials along with a strong recycling infrastructure boost the European market. Premium beverages, as well as superior packaging, are in high demand, and this is particularly so for France, Germany, and the United Kingdom. Acceptance in the market increases further with the rising consumer consciousness about environmentally friendly and sustainable packaging options, especially regarding beverages and canned foods.

Latin America Metal Cans Market Trends:

The market expansion in Latin America is a result of amplifying utilization of portable and robust packaging as well as higher intake of canned beverages, particularly beer. Moreover, three major factors are the growing F&B sectors in Argentina, Mexico, and Brazil. Furthermore, the region's requirement for metal cans has grown through shifting customer preferences and lifestyles, favoring long-lasting products.

Middle East and Africa Metal Cans Market Trends:

The rising consumption of convenience meals and non-alcoholic beverages in the Middle East and Africa is propelling the demand for metal cans. Market expansion is determined by urbanization and a stronger emphasis on long-lasting, lightweight, and environmental packaging. Demand in the region is also supported by growing F&B industries and new recycling programs.

Top Companies Leading in the Metal Cans Industry

Some of the leading metal cans market companies include Allied Cans Limited, Ardagh Group, Ball Corporation, Berlin Packaging, Envases Group, Hindustan Tin Works Ltd., Independent Can Company, Kaira Can Company Limited, Kian Joo Can Factory Berhad, Mauser Packaging Solutions, SKS Bottle & Packaging, Inc., and The Cary Company, among many others.

- In October 2024, Ball Corporation, a world leader in aluminum packaging, became a partner to Del Monte Foods in supporting India's vision of net-zero emissions target by 2070. Del Monte shifted from a traditional tin can to two-piece infinitely recyclable aluminium beverage cans for its fruit juices. The change reduced material usage, improved efficiency in transport, and lower carbon emissions.

Global Metal Cans Market Segmentation Coverage

- On the basis of the material type, the market has been categorized into aluminium, steel, and tin., wherein aluminium represent the leading segment. Aluminum leads the market due to it is lightweight, corrosion-resistant, and highly recyclable properties. It is used widely in packaging beverages and food, with a growing demand for sustainable materials, making it dominate the market. The preservation of product quality and shelf life through aluminum cans increases their preference across industries, especially in the beverage sector.

- Based on the fabrication, the market is bifurcated into two-piece metal can and three piece metal can, amongst which two piece metal can dominates the market. Two-piece metal cans are widely used cans in the market as they are seamless, giving better strength and leak resistance. They are also efficient in terms of manufacturing, requiring fewer materials and processes than three-piece cans. The cans are widely used in the beverage industry for cost-effective and durable packaging.

- On the basis of the can type, the market has been divided into food (vegetable, fruits, pet food and others), beverages (alcoholic beverage and non-alcoholic beverage), aerosols (paints and varnishes, cosmetic and personal care, pharmaceuticals, and others), and others. Among these, beverages accounts for the majority of the market share. The largest market share is beverage, driven by their high demand for packaging both alcoholic and non-alcoholic drinks. Metal cans are perfectly suited to this segment on account of their convenience, portability, and recyclability. Heightening the preference of consumers for ready-to-drink beverages further pushes the growth of beverage cans in the packaging market.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 67.8 Billion |

| Market Forecast in 2033 | USD 81.7 Billion |

| Market Growth Rate 2025-2033 | 2.1% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Aluminium, Steel, Tin |

| Fabrications Covered | Two Piece Metal Can, Three Piece Metal Can |

| Can Types Covered | Food (Vegetable, Fruits, Pet Food, Others), Beverages (Alcoholic Beverage, Non-Alcoholic Beverage), Aerosols (Paints and Varnishes, Cosmetic and Personal Care, Pharmaceuticals, Others), Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allied Cans Limited, Ardagh Group, Ball Corporation, Berlin Packaging, Envases Group, Hindustan Tin Works Ltd., Independent Can Company, Kaira Can Company Limited, Kian Joo Can Factory Berhad, Mauser Packaging Solutions, SKS Bottle & Packaging, Inc., The Cary Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)