Global Medical Flexible Packaging Market Expected to Reach USD 50.0 Billion by 2033 - IMARC Group

Global Medical Flexible Packaging Market Statistics, Outlook and Regional Analysis 2025-2033

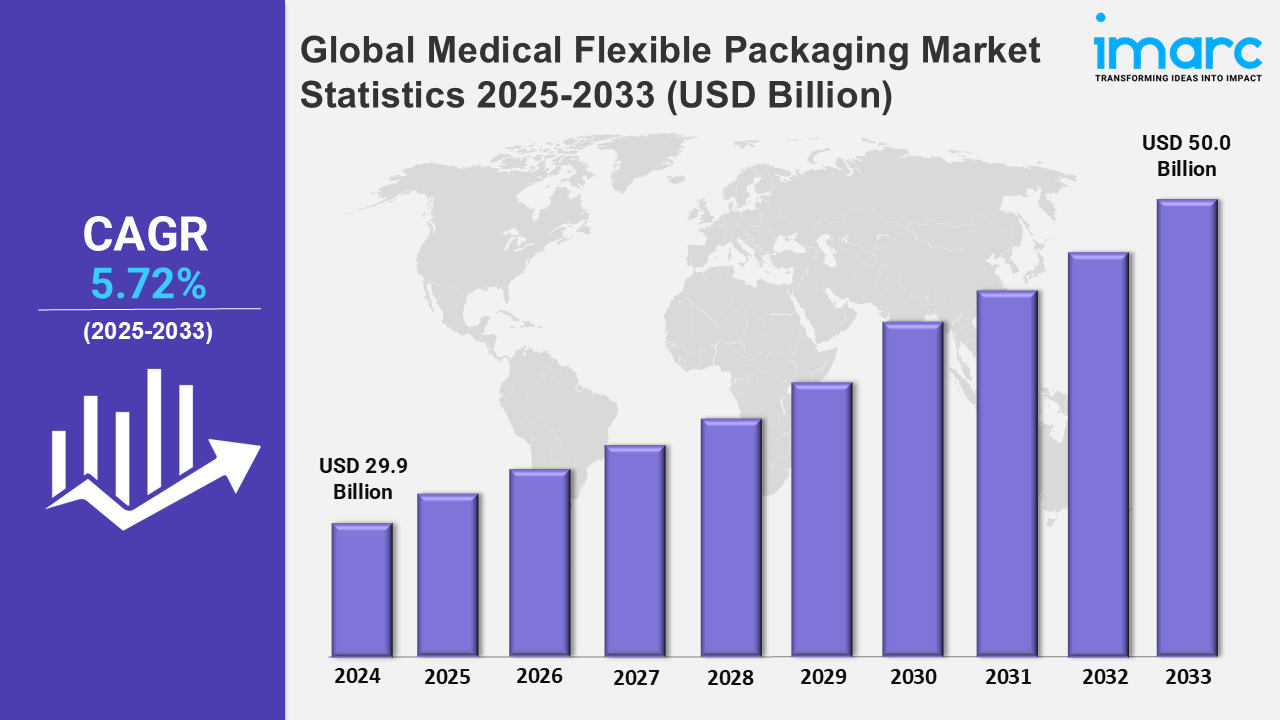

The global medical flexible packaging market size was valued at USD 29.9 Billion in 2024, and it is expected to reach USD 50.0 Billion by 2033, exhibiting a growth rate (CAGR) of 5.72% from 2025 to 2033.

To get more information on this market, Request Sample

The marketplace is increasing because of the growing older populace. For example, the WHO predicts that by 2030, one in six human beings might be 60 years of age or older. In addition, the global population of people 60 and older is predicted to double to 2.1 billion by way of 2050, whilst the wide variety of people eighty and older is expected to triple between 2020 and 2050. The use of pharmaceuticals and scientific supplies rises dramatically with an older population, boosting the need for packaging that ensures product safety, sterility, and usability.

Moreover, the growing incidence of cardiovascular disorders, diabetes, and cancers is notably propelling the demand for clinical packaging. These illnesses include ongoing medical treatment, driving demand for secure, long-lasting, and user-friendly packaging solutions. Medical flexible packaging promises to protect and integrate medicines, equipment, and clinical tools. In addition, its light, cost-effective, and environmentally friendly functions make it an excellent choice for health professionals. Demand for innovative, flexible packaging is increasing with the growing acceptance of health services at home and self-pasteurized means, which supports the market's demand. In addition, authorities and regulatory agencies implement strict environmental regulations and encourage health professionals to use ecological packaging materials. Biodegradable packing reduces environmental effects. For example, in June 2024, Bayer partnered with PAPACKS to devise biodegradable, fiber-based packaging for client wellness products, inclusive of Bepanthen, Claritin, and Aspirin, as a part of their aim of utilizing 100% recyclable packaging by 2030.

Global Medical Flexible Packaging Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific holds the biggest market segment, owing to ongoing technological innovations.

North America Medical Flexible Packaging Market Trends:

Six out of ten grownups in the United States suffer from a chronic ailment, according to a disease control center. The demand for robust and secure packaging for medications and medical equipment rises as a result. For instance, diabetic drugs like insulin pens and test strips are frequently packed in flexible blister packs and pouches.

Europe Medical Flexible Packaging Market Trends:

Europe has one of the oldest populations in the world. In 2022, more than 20% of people in the EU were 65 or older. This shift in age increases the need for medications and medical devices. As a result, the demand for flexible packaging, like sachets and blister packs, is growing. Also, the EU Medical Device Regulation (MDR), which started in May 2021, requires medical packaging to follow strict safety and traceability rules. This makes the need for flexible packaging even higher.

Asia-Pacific Medical Flexible Packaging Market Trends:

Asia-Pacific represents the biggest market because of fast population growth and better access to healthcare. Countries like India and China are important markets. For example, in January 2021, Huhtamaki, a company that makes sustainable packaging, opened a new production facility in Malaysia.

Latin America Medical Flexible Packaging Market Trends:

The growth in the region is driven by more people needing healthcare. This is because the population is getting older, and there are more chronic diseases. For example, Brazil and Mexico, the crucial markets in the region, are spending more on healthcare. The OECD says that Brazil's healthcare spending will increase to 12.6% of its GDP by 2040. This is due to an aging population and the need to treat chronic diseases, which also increases the demand for flexible packaging.

Middle East and Africa Medical Flexible Packaging Market Trends:

Middle East and Africa is investing more in new medical packaging technology. Countries like the UAE and South Africa are using smart packaging, like RFID-enabled and temperature-sensitive packaging. For example, Gulf Printing and Packaging has developed new ways to protect temperature-sensitive medicines in hot climates.

Top Companies Leading in the Medical Flexible Packaging Industry

Some key medical flexible packaging market companies Amcor plc, Berry Global Inc, Borealis GmbH, Catalent, Inc, Constantia Flexibles, Coveris, Eagle Flexible Packaging, Huhtamaki Oyj, Nelipak, Sealed Air, Sonoco Products Company, and Winpak Ltd, among many others. For instance, packaging giant Berry Global merged its existing M&H and PET Power divisions in August 2023 to form a newfound Europe-wide venture. Also, Becton, Dickinson, and Company (BD) signed a contract in June 2023 to trade their surgical instrumentation channel to STERIS for USD 540 Million.

Global Medical Flexible Packaging Market Segmentation Coverage

- Based on the material, the market has been bifurcated into plastics (polyvinyl chloride, polypropylene, polyethylene terephthalate, polyethylene, and others), paper, aluminum, and bioplastics, wherein plastics represented the largest segment due to their versatility and adaptability, which enable the production of personalized packing techniques for specialized medical items.

- Based on the product, the market is categorized into pouches and bags, seals, high barrier films, wraps, lids and labels, and others, amongst which pouches and bags represented the largest segment owing to the surging need for sustainable packaging alternatives made with eco-friendly resources.

- Based on the end user, the market has been split into pharmaceutical manufacturing, medical device manufacturing, implant manufacturing, contract packaging, and others. Precision and sterility in packing are critical in pharmaceutical manufacturing to ensure product integrity. In medical device manufacturing, specific covering ensures device performance and purity while following industry rules. Implant manufacturing depends on packing that maintains biocompatibility, integrity, and physical security.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 29.9 Billion |

| Market Forecast in 2033 | USD 50.0 Billion |

| Market Growth Rate 2025-2033 | 5.72% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Materials Covered | Plastics (Polyvinyl Chloride, Polypropylene, Polyethylene Terephthalate, Polyethylene, Others), Paper, Aluminum, Bioplastics |

| Products Covered | Pouches and Bags, Seals, High Barrier Films, Wraps, Lids and Labels, Others |

| End Users Covered | Pharmaceutical Manufacturing, Medical Device Manufacturing, Implant Manufacturing, Contract Packaging, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amcor plc, Berry Global Inc, Borealis GmbH, Catalent, Inc, Constantia Flexibles, Coveris, Eagle Flexible Packaging, Huhtamaki Oyj, Nelipak, Sealed Air, Sonoco Products Company, Winpak Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)