Global Low Voltage Switchgear Market Expected to Reach USD 94.8 Billion by 2033 - IMARC Group

Global Low Voltage Switchgear Market Statistics, Outlook and Regional Analysis 2025-2033

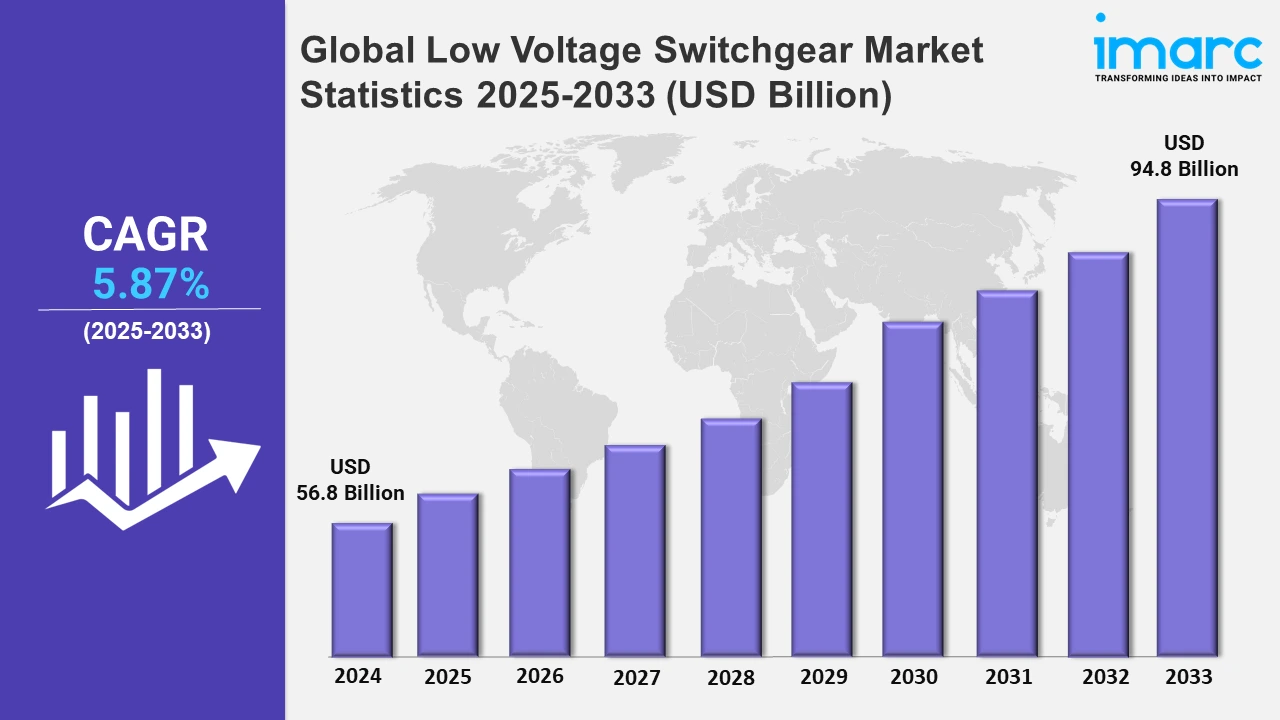

The global low voltage switchgear market size was valued at USD 56.8 Billion in 2024, and it is expected to reach USD 94.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.87% from 2025 to 2033.

To get more information on this market, Request Sample

The escalating consumption of electricity is a significant driver of growth in the low-voltage switchgear market. For instance, according to Statista, the global consumption of electricity has steadily increased, and it is expected to reach roughly 27,000 terawatt-hours in 2023. As global energy demands rise, there's an increased need for efficient and reliable electrical distribution systems, which in turn boosts the adoption of low-voltage switchgear. Moreover, the shift towards renewable energy sources necessitates advanced switchgear capable of managing variable power inputs and integrating distributed energy resources. Countries like Germany and China, with substantial renewable projects, are driving demand for such solutions. For instance, in November 2024, Tencent, a Chinese multinational technology corporation, launched a renewable-powered hybrid microgrid project at its data center in Huailai County, Hebei Province, China. The project's total installation capacity is 10.99MW, with an annual generation capacity of 14 million kWh. To power a nearby data center, the project will combine onsite wind power, solar PV, and battery energy storage (BESS) in a microgrid solution. The project has a total installed solar capacity of 10.54MW, generating 12 million kWh of electricity per year.

Besides this, the integration of automation and smart grid technologies enhances energy efficiency and reliability. LV switchgear equipped with intelligent controls and monitoring systems supports these advancements, leading to increased adoption. For instance, in November 2024, Eaton, an intelligent power management firm, launched its new xEnergy Elite low voltage motor control and power distribution center, which can handle loads up to 7500 A at 690 VAC. It improves uptime and flexibility for business-critical applications in oil and gas, mining, and other industrial sectors while lowering maintenance costs. The xEnergy Elite motor control centre (MCC) meets the appropriate International Electrotechnical Commission (IEC) requirements and is designed to provide optimal power availability while also protecting operating and maintenance people. It integrates advanced motor control and protection technologies that improve performance while safeguarding persons and equipment, such as reducing the dangers associated with an arc flash occurrence beyond the limits of IEC TR 61641.

Global Low Voltage Switchgear Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific was the largest market for low voltage switchgear, owing to the increasing infrastructure development projects, various technological advancements, and growing electricity demand in the region.

North America Low Voltage Switchgear Market Trends:

In North America, the low voltage switchgear market is driven by smart grid developments. Utilities are deploying advanced switchgear for grid modernization and real-time monitoring. For instance, the U.S. Department of Energy supports smart grid projects under programs like the Smart Grid Investment Grant (SGIG). Rising demand for renewable energy integration and reliability is fueling adoption, reflecting North America's emphasis on digital energy systems.

Europe Low Voltage Switchgear Market Trends:

Europe's low voltage switchgear market is heavily influenced by the region's renewable energy transition. Countries like Germany and Denmark are leading in wind and solar power installations, requiring advanced switchgear for efficient energy distribution. The EU’s Green Deal and energy efficiency regulations have spurred investments in switchgear, showcasing Europe’s focus on achieving climate-neutral energy systems by 2050.

Asia-Pacific Low Voltage Switchgear Market Trends:

Asia Pacific dominates the low voltage switchgear market due to rapid industrialization and urban expansion. Countries like China and India are investing in infrastructure development, driving demand for reliable power distribution. For example, China’s Belt and Road Initiative promotes large-scale industrial projects that rely on modern switchgear, highlighting Asia Pacific’s surge in construction and industrial electrification.

Latin America Low Voltage Switchgear Market Trends:

In Latin America, the low voltage switchgear market is shaped by expanding distributed energy resources (DER). Countries like Brazil and Chile are integrating decentralized solar power systems in rural and urban areas. For instance, Brazil's ProGD program encourages solar panel installations, boosting demand for advanced switchgear for microgrids and underlining Latin America’s focus on local energy solutions.

Middle East and Africa Low Voltage Switchgear Market Trends:

The low voltage switchgear market in the Middle East and Africa is driven by investments in utility-scale projects and oil & gas operations. For example, Saudi Arabia’s Vision 2030 includes significant energy infrastructure upgrades, such as NEOM. These projects require robust switchgear solutions for reliable power distribution, demonstrating the region's focus on energy sector transformation.

Top Companies Leading in the Low Voltage Switchgear Industry

Some of the leading low voltage switchgear market companies include ABB Ltd, Alfanar Group, Chint Group Co. Ltd., Eaton Corporation plc, Fuji Electric Co. Ltd., General Electric Company, Hyosung Corporation, Larsen & Toubro Ltd, Mitsubishi Electric Corporation, Rittal GmbH & Co. KG, Schneider Electric SE, Siemens AG, Terasaki Electric Co. Ltd., among many others. For instance, in August 2024, ABB expanded its PQF (Power Quality Filter) series of microprocessor-controlled active filters with the introduction of the PQFS compact wall-mounting device, which is intended to alleviate harmonic and neutral current issues in commercial buildings and small industrial applications. Also, in May 2024, Alfanar Projects and the Royal Commission for Jubail and Yanbu signed an agreement to construct the SS-2B 132/13.8kV Substation in Jazan City for Primary and Downstream Industries (JCPDI).

Global Low Voltage Switchgear Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into fixed mounting, plug-in, and withdrawable unit, wherein fixed mounting represented the largest segment attributed to their robust design, reliability, and suitability for applications where components remain stationary, such as in industrial and commercial settings.

- Based on the voltage rating, the market is categorized into less than 250V, 250V to 750V, and 751V to 1000V. Less than 250V is primarily used in residential and light commercial settings. This range is suitable for standard household appliances, lighting systems, and small office equipment. Moreover, 250V to 750V is commonly found in industrial and larger commercial environments. This range supports machinery, HVAC systems, and other equipment requiring higher power levels. Furthermore, 751V to 1000V is utilized in specialized industrial applications and certain utility operations. This range is essential for heavy machinery, large-scale manufacturing processes, and specific utility equipment.

- On the basis of the installation, the market has been divided into indoor and outdoor. The integration of smart technologies in residential settings has led to the adoption of advanced indoor LVSG. Moreover, the shift towards renewable energy sources, such as solar power, has increased the deployment of outdoor LVSG.

- Based on the application, the market is bifurcated into substation, distribution, power factor correction, sub-distribution, and motor control. LVSG in substations manages the distribution of electrical power from high-voltage transmission systems to lower-voltage distribution networks, facilitating safe and reliable power delivery to end-users. Moreover, in distribution networks, LVSG controls and protects electrical circuits, ensuring efficient power flow from substations to consumers, encompassing residential, commercial, and industrial sectors.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 56.8 Billion |

| Market Forecast in 2033 | USD 94.8 Billion |

| Market Growth Rate 2025-2033 | 5.87% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Fixed Mounting, Plug-In, Withdrawable Unit |

| Voltage Ratings Covered | Less than 250V, 250V to 750V, 751V to 1000V |

| Installations Covered | Indoor, Outdoor |

| Applications Covered | Substation, Distribution, Power Factor Correction, Sub-Distribution, Motor Control |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd, Alfanar Group, Chint Group Co. Ltd., Eaton Corporation plc, Fuji Electric Co. Ltd., General Electric Company, Hyosung Corporation, Larsen & Toubro Ltd, Mitsubishi Electric Corporation, Rittal GmbH & Co. KG, Schneider Electric SE, Siemens AG, Terasaki Electric Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)