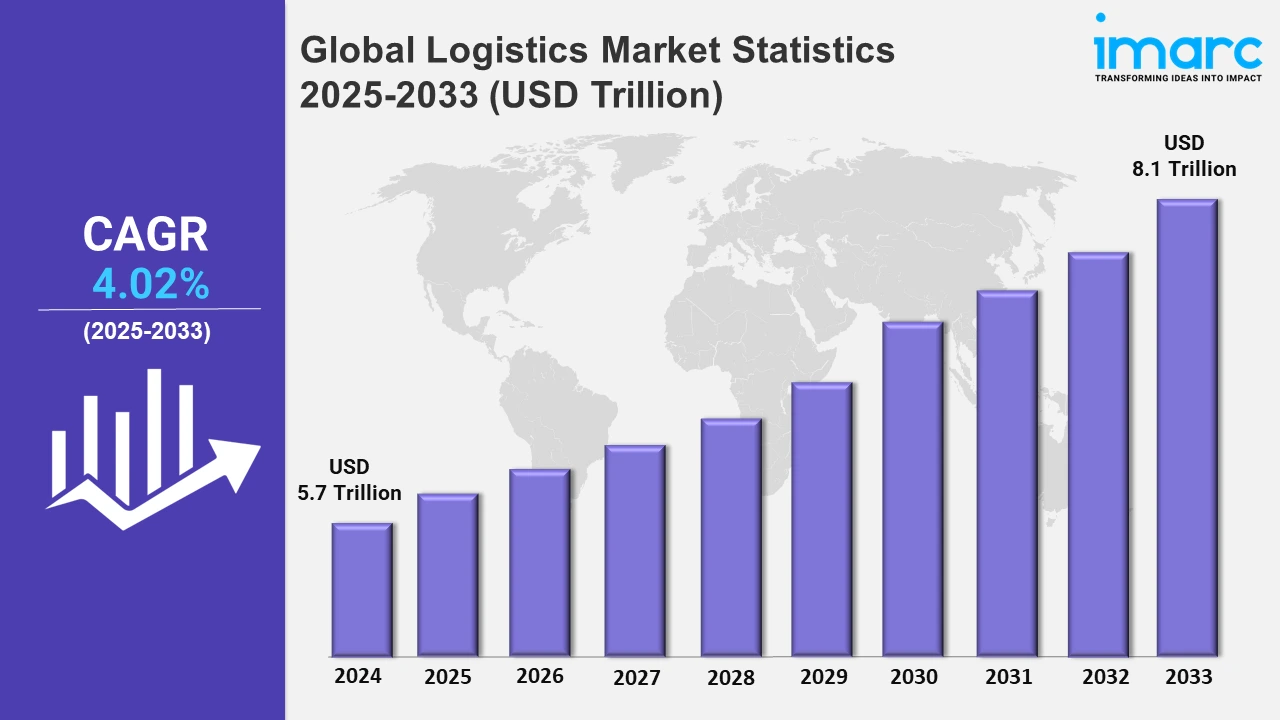

Global Logistics Market to Grow at 4.02% During 2025-2033, Reaching USD 8.1 Trillion by 2033

Global Logistics Market Statistics, Outlook and Regional Analysis 2025-2033

The global logistics market size was valued at USD 5.7 Trillion in 2024, and it is expected to reach USD 8.1 Trillion by 2033, exhibiting a growth rate (CAGR) of 4.02% from 2025 to 2033.

To get more information on this market, Request Sample

The rapid growth in the e-commerce sector is one of the major factors driving the logistics market growth. The industry for e-commerce is anticipated to reach US$ 183.8 trillion by 2032. This increase in online shopping is boosting a growing need for logistical services, especially in last-mile deliveries. Moreover, the convenience of online platforms that fuel consumer expectations for rapid and reliable delivery options, prompting logistics companies to adopt digital integration and automation, is favoring the market growth. Apart from this, the introduction of technologies such as real-time tracking, advanced route planning, and automated warehousing to meet customer demands efficiently is fueling the market growth. Besides this, the rising pace of globalization that led to increased cross-border trade agreements, international partnerships, and the expansion of multinational businesses, creating the need for efficient global logistics solutions is enhancing the market growth. For instance, India’s export of the top six commodities in the 2023, including engineering goods, petroleum products, gems and jewellery, organic and inorganic chemicals, drugs and pharmaceuticals reached an impressive US$ 295.21 billion mark. This hike is encouraging companies to enhance their international freight services, consolidating supply chains, and partnering with regional operators for smoother operations.

The rising innovations in autonomous vehicles, drones, and robotics as operational tools that streamline logistical processes is acting as a growth-inducing factor. For instance, the market for logistics robots is growing rapidly at a rate of 19.7% annually and is anticipated to reach US$ 98.9 billion by 2032. Automated warehouses equipped with robots can handle sorting, picking, and packaging tasks faster and more accurately than traditional labor, reducing operational costs and errors. Additionally, the introduction of advanced software systems powered by artificial intelligence (AI) that support predictive analytics for better route planning and resource allocation, which minimizes fuel consumption and improves delivery times, is favoring the market growth. Furthermore, the increasing environmental concerns and regulatory pressures, boosting the shift towards sustainability is catalyzing the market growth. Along with this, the heightened focus of companies on adopting green practices to reduce their carbon footprint, such as investing in electric or hybrid fleets to optimize delivery routes to lower emissions, and utilize eco-friendly packaging, is enhancing the market growth.

Global Logistics Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, Latin America, and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of the emergence of the e-commerce sector, increasing manufacturing sector, and rising disposable income.

Asia-Pacific Logistics Market Trends:

Asia Pacific represented the largest region in the logistics market, fueled by rapid industrialization, economic growth, and the rise of e-commerce giants. Moreover, the region's booming manufacturing sector and strategic trade routes are contributing to the market growth. Along with this, the increasing investments in infrastructure, such as ports, railways, and highways, that bolster logistics capabilities are fueling the market growth. For instance, In June 2022, the Indian Minister of Road Transport and Highways opened 15 national highway projects worth Rs. 13,585 crore (US$ 1.7 billion) in Patna and Hajipur, Bihar. Along with this, the growing focus of governments on enhancing policies to support efficient transport systems and cross-border trade is accelerating the market growth.

North America Logistics Market Trends:

The North America logistics market is driven by a highly developed infrastructure, strong e-commerce penetration, and technological advancements. Along with this, the expansive network of roadways, railways, and air cargo facilities that support efficient goods movement is fueling the market growth.

Europe Logistics Market Trends:

Europe is a significant logistics hub known for its extensive transport networks and strategic position connecting various global markets. Additionally, the robust trade across the European Union (EU) nations, facilitated by unified customs regulations and efficient cross-border movement, is creating a positive outlook for the market.

Latin America Logistics Market Trends:

Latin America’s logistics market has been expanding, supported by economic improvements, investments in infrastructure, and a growing e-commerce sector. Moreover, the extensive efforts to modernize port facilities, enhance transportation networks, and adopt digital logistics platforms are anticipated to drive the market growth.

Middle East and Africa Logistics Market Trends:

The Middle East and Africa region is marked by a mix of developing and mature logistics markets. Moreover, the increasing investments in logistics infrastructure are fueling the market growth. Along with this, the rising economic development, foreign investments, and the expansion of digital technologies that facilitate better supply chain management are fostering the market growth.

Top Companies Leading in the Logistics Industry

Some of the leading logistics market companies include J.B. Hunt Transport Services, C.H. Robinson Worldwide, Inc., Ceva Holdings LLC, FedEx Corp., United Parcel Service, Inc., Expeditors International of Washington Inc., XPO Logistics Inc., Kenco Group, Deutsche Post DHL Group, Americold Logistics, LLC, and DSV Air & Sea Inc., among many others.

In October 2024, J.B. Hunt Transport Inc. and UP.Labs announced their collaboration in the establishment of the Logistics Venture Lab (LVL). This logistics and freight-focused lab will aim to launch six startups over the next three years to solve core strategic challenges within the industry. The startups are inspired by opportunities to drive efficiency and solve common problems faced by providers in the logistics and freight transportation space.

Global Logistics Market Segmentation Coverage

- On the basis of the model type, the market has been categorized into 2 PL, 3 PL, and 4 PL, wherein 3 PL represent the leading segment, due to the increasing trend among companies to outsource logistics operations to reduce costs and improve efficiency. Moreover, the expertise and comprehensive services provided by 3 PL providers help businesses focus on core operations while ensuring efficient supply chain management.

- Based on the transportation mode, the market is classified into roadways, seaways, railways, and airways, amongst which roadways dominates the market. They dominate the segment due to their flexibility in reaching urban and remote areas, making them crucial for last-mile deliveries. Furthermore, the well-established infrastructure and lower operational costs for road transport is contributing to its widespread use in logistics.

- On the basis of the end use, the market has been divided into manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others. Among these, manufacturing accounts for the majority of the market share, as it relies on efficient logistics for the transport of raw materials and finished products. Besides this, the rise of industrial production and global supply chains is amplifying the demand for seamless logistics support in this sector.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 5.7 Trillion |

| Market Forecast in 2033 | USD 8.1 Trillion |

| Market Growth Rate 2025-2033 | 4.02% |

| Units | Trillion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | J.B. Hunt Transport Services, C.H. Robinson Worldwide, Inc., Ceva Holdings LLC, FedEx Corp., United Parcel Service, Inc., Expeditors International of Washington Inc., XPO Logistics Inc., Kenco Group, Deutsche Post DHL Group, Americold Logistics, LLC, DSV Air & Sea Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Logistics Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)