Global Liquid Detergent Market Size Anticipated to Reach USD 54.8 Billion by 2033 - IMARC Group

Global Liquid Detergent Market Statistics, Outlook and Regional Analysis 2025-2033

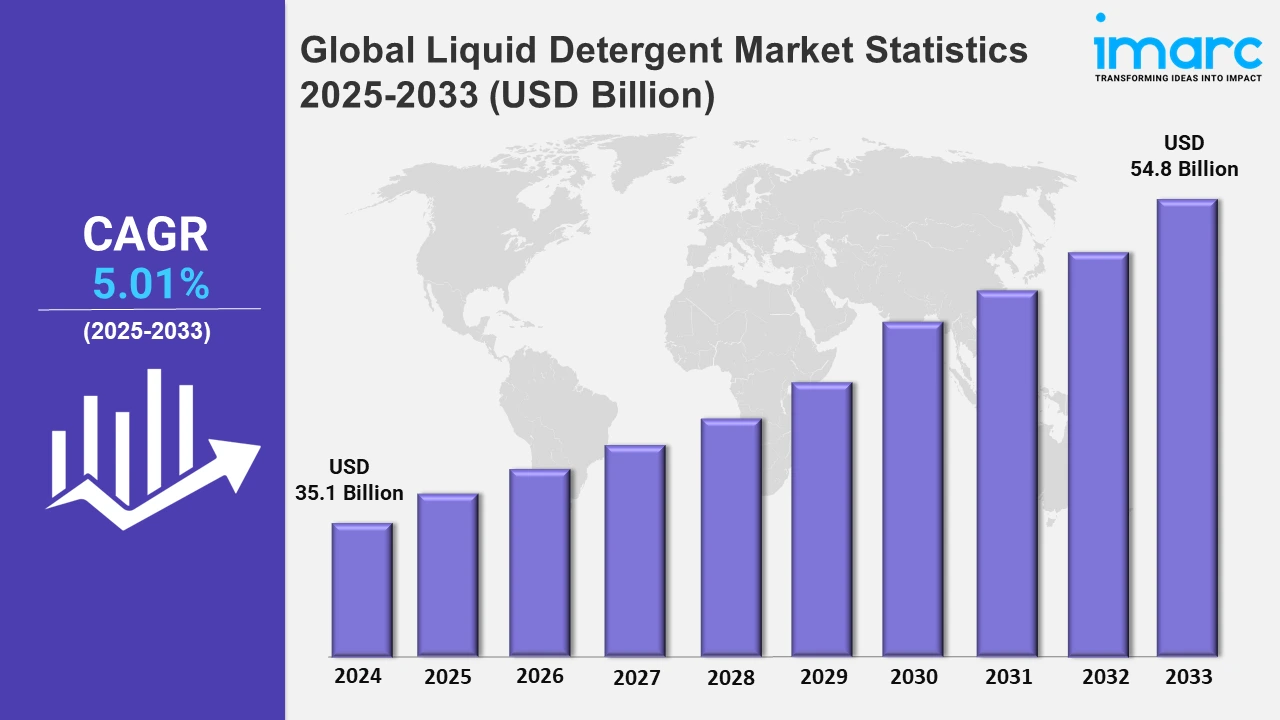

The global liquid detergent market size was valued at USD 35.1 Billion in 2024, and it is expected to reach USD 54.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.01% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing demand for convenience and ease of use is one of the major drivers boosting the liquid detergent market share. Along with this, the growing product popularity as they dissolve more effectively in water, which ensures better performance in cold washes, is favoring the market growth. Besides this, the rising awareness about hygiene and cleanliness is fostering the market growth. Consumers are now more conscientious about the cleanliness of their clothing, bedding, and household textiles. For instance, as per an industry report, it has been found that 92% of American citizens say that maintaining good hygiene is a top priority. Along with this, 88% of women and 78% of men said they prefer to change their undergarments every day, and 73% of women and 63% of men advocate changing their clothes every day. This creates the need for effective cleaning solutions, such as liquid detergents, as they are seen as more effective in eliminating dirt, stains, and germs due to their superior ability to dissolve in water and target stains directly at the molecular level.

The rapid expansion of e-commerce and online shopping platforms is another major factor driving the growth of the liquid detergent market. For example, in the year 2023, the total e-commerce turnover in Europe saw a modest growth of 3%, increasing from €864 billion to €887 billion. The convenience of online shopping, coupled with the rise of digital platforms that offer a wide variety of home and personal care products, is positively influencing consumer purchasing behaviors. Moreover, these online marketplaces make it easier for consumers to access a broad range of liquid detergent brands and formulations without leaving their homes. Furthermore, the increasing disposable income, particularly in emerging economies, is also bolstering the market growth. The per capita disposable income of Indian citizens grew 8% in the year 2024 and 13.3% in the year 2023. This hike in income encourages consumers to invest in higher-quality and premium household products, including liquid detergents. Along with this, the rising urbanization and the growth of the middle class, which led to changing consumption patterns as more households opt for liquid detergents over traditional powder-based products, is favoring the market growth.

Global Liquid Detergent Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. According to the report, North America accounted for the largest market share on account of increasing disposable income of consumers and rising need for hygiene in daily lives.

North America Liquid Detergent Market Trends:

The North American liquid detergent market accounted for the majority share due to its strong consumer preferences for convenience and hygiene products, supported by the well-established retail sector and significant purchasing power. As per industry reports, earnings of US households have increased by 3.3 percent at an annual rate. Additionally, retail sales in the country surged 0.4% in September 2024, highlighting the growing utilization of premium liquid detergents. Along with this, the increasing awareness regarding eco-friendly and high-efficiency products is fueling the market growth. Apart from this, the burgeoning demand for premium liquid detergents that offer advanced features, such as stain removal and hypoallergenic properties, is propelling the market growth.

Asia-Pacific Liquid Detergent Market Trends:

In the Asia Pacific, the liquid detergent market is experiencing rapid growth due to increasing urbanization, rising disposable incomes, and greater consumer awareness. Moreover, the availability of a variety of product types at competitive prices is stimulating the market growth. Besides this, the rising innovations tailored to regional needs, such as detergents for cold water and local scent preferences, are boosting the market growth.

Europe Liquid Detergent Market Trends:

Europe holds a significant share of the liquid detergent market, driven by a strong focus on sustainability and eco-friendly products. Moreover, the rising preference among consumers for detergents that offer effective cleaning while meeting strict environmental regulations is bolstering the market growth.

Latin America Liquid Detergent Market Trends:

Latin America’s steady growth in the liquid detergent market is propelled by urbanization and an increasing middle-class population that seeks convenience and efficiency in household chores. Along with this, the rising demand for affordable liquid detergents, which drives local production and innovation, is fueling the market growth.

Middle East and Africa Liquid Detergent Market Trends:

The Middle East and Africa region displays gradual expansion in the liquid detergent market, supported by a growing population and improving economic conditions in several countries. Besides this, the rising urbanization and the ongoing shift in consumer behavior toward more convenient and effective laundry solutions are contributing to the market growth.

Top Companies Leading in the Liquid Detergent Industry

Some of the leading liquid detergent market companies include Amway Corporation, Church & Dwight Co., Inc., Godrej Consumer Products Limited, Henkel AG & Co. KGaA, Kao Corporation, Lion Corporation, Reckitt Benckiser Group PLC, S. C. Johnson & Son, Inc., The Procter & Gamble Company, and Unilever Plc, among many others.

In November 2024, Henkel signed a deal with the Colgate-Palmolive Company to acquire its full range of laundry detergents and pre-wash brands in New Zealand and Australia. It included Colgate’s powder and liquid detergents, along with pre-wash brands including Cold Power, Dynamo, Fab, and Sard.

Global Liquid Detergent Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into inorganic liquid detergent and organic liquid detergent, wherein inorganic liquid detergent represents the leading segment. This is due to the cost-effectiveness and strong cleaning power. Additionally, they are widely available and marketed for their ability to handle tough stains, thus appealing to households with heavy-duty cleaning needs.

- Based on the end-use, the market is classified into residential and commercial, amongst which residential dominates the market. Residential users form the bulk of the market as households frequently purchase liquid detergents for daily laundry needs. Moreover, the convenience, variety of formulations, and marketing strategies targeted at home users drive consistent demand in this segment.

- On the basis of the distribution channel, the market has been divided into supermarkets and hypermarkets, convenience stores, departmental stores, online stores, and others. Among these, supermarkets and hypermarkets account for the majority of the market share, as they offer a wide variety of products in one place, encouraging bulk purchasing and convenience for shoppers. Furthermore, their extensive reach and strategic locations make them highly accessible, further solidifying their position as the leading distribution channel.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 35.1 Billion |

| Market Forecast in 2033 | USD 54.8 Billion |

| Market Growth Rate 2025-2033 | 5.01% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Inorganic Liquid Detergent, Organic liquid Detergent |

| End Uses Covered | Residential, Commercial |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Departmental Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Amway Corporation, Church & Dwight Co., Inc., Godrej Consumer Products Limited, Henkel AG & Co. KGaA, Kao Corporation, Lion Corporation, Reckitt Benckiser Group PLC, S. C. Johnson & Son, Inc., The Procter & Gamble Company, Unilever Plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)